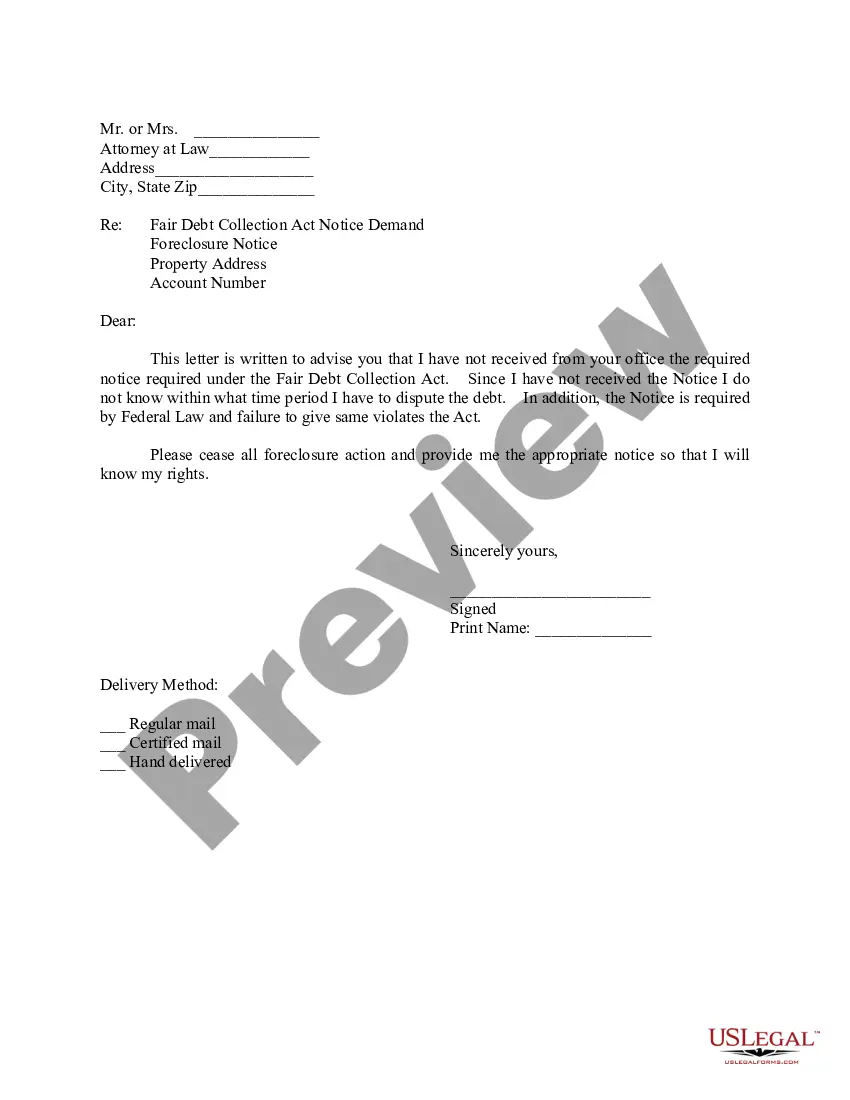

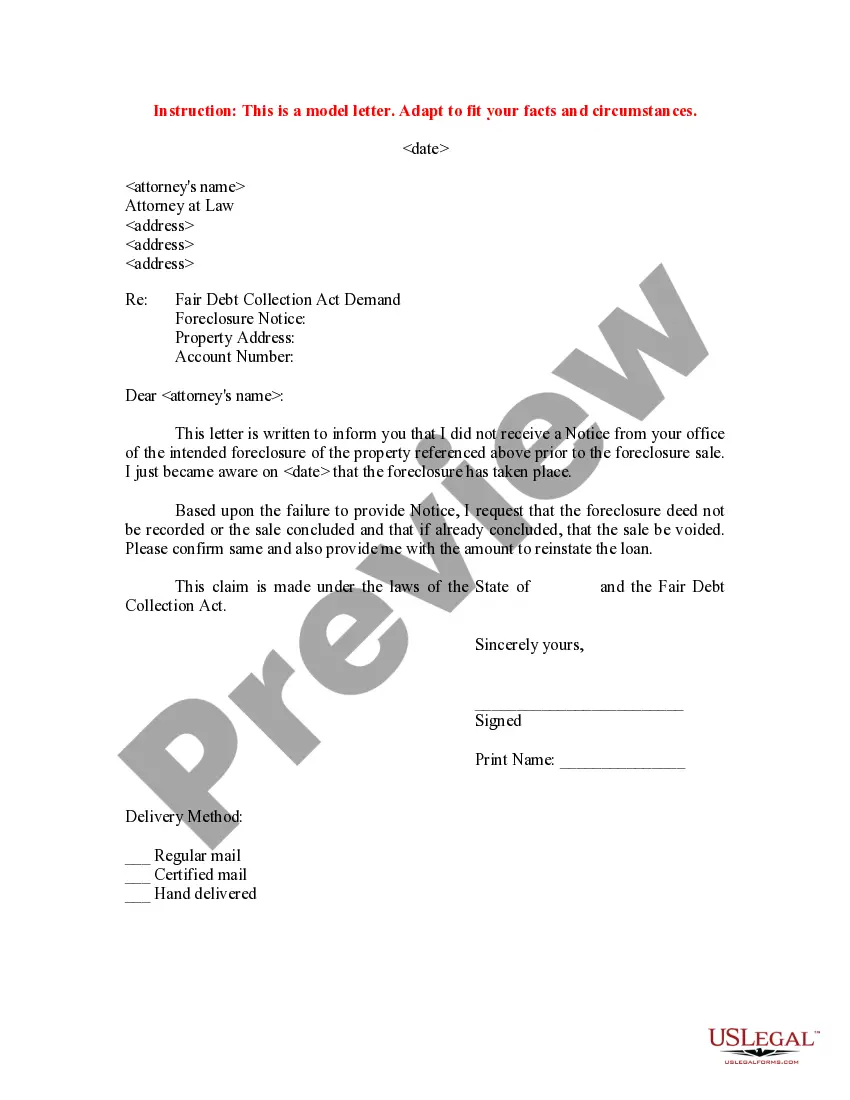

Minnesota Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice of

Description

How to fill out Letter To Foreclosure Attorney - After Foreclosure - Did Not Receive Notice Of?

Are you currently in the situation the place you will need files for either organization or personal reasons almost every working day? There are plenty of authorized record themes accessible on the Internet, but finding types you can rely on isn`t effortless. US Legal Forms gives a large number of develop themes, just like the Minnesota Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice of, which can be composed in order to meet state and federal needs.

If you are presently informed about US Legal Forms web site and have an account, basically log in. Following that, you are able to download the Minnesota Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice of template.

If you do not offer an account and need to begin to use US Legal Forms, follow these steps:

- Discover the develop you will need and make sure it is for the appropriate city/region.

- Use the Review option to check the shape.

- See the explanation to actually have selected the correct develop.

- In the event the develop isn`t what you`re seeking, utilize the Look for discipline to discover the develop that suits you and needs.

- When you find the appropriate develop, click on Get now.

- Pick the rates strategy you desire, fill out the required info to make your money, and buy an order utilizing your PayPal or charge card.

- Choose a convenient paper structure and download your backup.

Locate all of the record themes you possess purchased in the My Forms food selection. You may get a more backup of Minnesota Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice of at any time, if required. Just select the necessary develop to download or printing the record template.

Use US Legal Forms, by far the most considerable variety of authorized forms, to conserve some time and steer clear of blunders. The support gives skillfully made authorized record themes which you can use for a variety of reasons. Make an account on US Legal Forms and commence producing your daily life easier.

Form popularity

FAQ

In most cases, this is 6 months. However, some Mortgage Foreclosures are subject to federal regulations, in which case there is no redemption period. A Certificate of Redemption can be obtained from the Sheriff's Office of the county in which the foreclosure occurred or from the Mortgagee (lending institution).

The mortgage foreclosure process in Canada If you miss too many mortgage payments for an extended period, your mortgage lender can sue you. If the court rules in their favour, they'll be able to gain control of the title to your property, meaning they now legally own your home.

How To Obtain a Loan Foreclosure Letter From Bank? Firstly, write a foreclosure letter to the bank. ... Once the bank receives your letter, they will calculate the amount you still need to pay. The bank will inform you the amount and then you will have to make payment via NEFT, RTGS, or cheque.

If the owner in default does not pay off the default within a certain time frame, the trustee can schedule a public sale of the property. Foreclosures in California are primarily administered out of court, although court foreclosures are allowed. Out-of-court foreclosures take about four months.

One way to find such a property is to contact a realtor who works in the area where you wish to purchase a foreclosure home. Real estate agents know the market and can potentially tell you if there are any foreclosure properties available in the market.

Notice of Default ? Foreclosure starts when your lender records a Notice of Default against your property with the Registrar Recorder's office. The Notice of Default tells you the total amount you owe including missed payments and foreclosure fees.

The sale is followed by a redemption period, which is usually six months. ingly, assuming there is no bankruptcy filing, a typical foreclosure by advertisement (including the typical six month redemption period) generally takes around eight to nine months.