Minnesota Business Management Consulting or Consultant Services Agreement - Self-Employed

Description

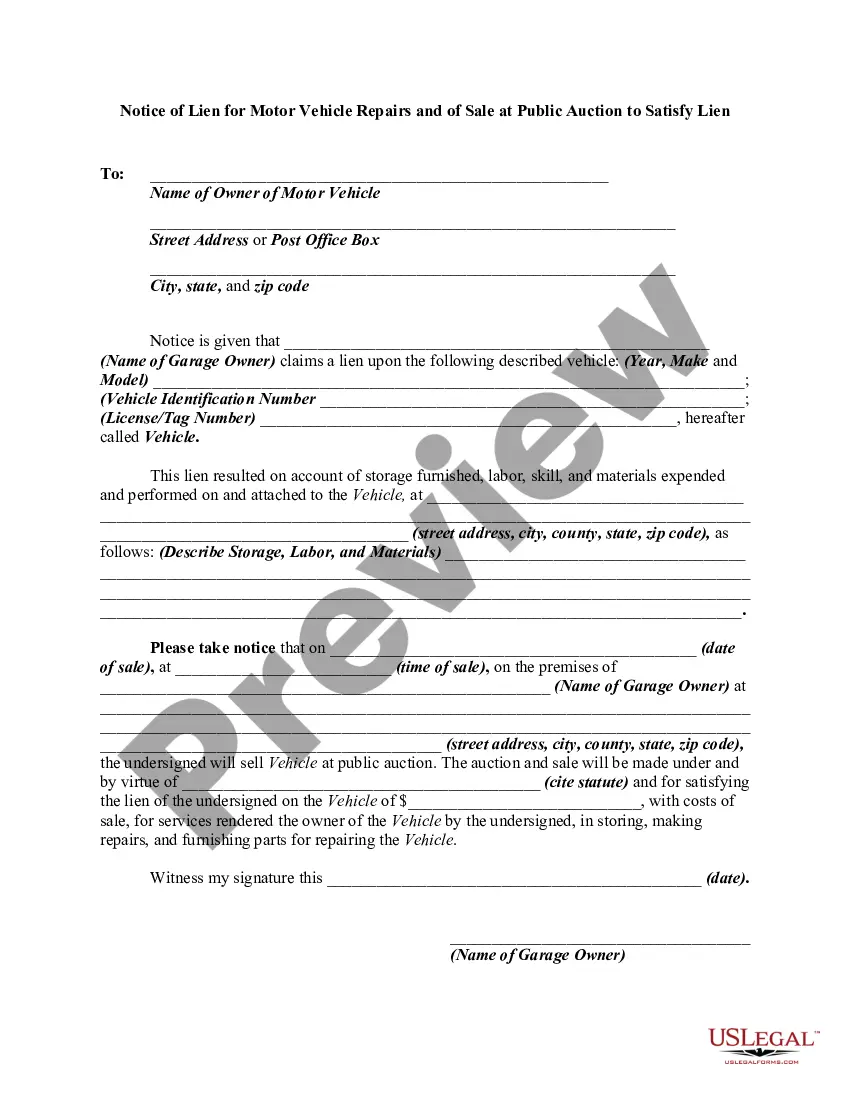

How to fill out Business Management Consulting Or Consultant Services Agreement - Self-Employed?

You can spend hours online searching for the valid document template that fulfills the federal and state requirements you need.

US Legal Forms offers a wide array of valid forms that have been reviewed by professionals.

It is easy to download or print the Minnesota Business Management Consulting or Consultant Services Agreement - Self-Employed from our platform.

If available, use the Review option to browse through the document template as well. If you wish to find another version of your form, utilize the Search field to locate the template that meets your requirements.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, modify, print, or sign the Minnesota Business Management Consulting or Consultant Services Agreement - Self-Employed.

- Every valid document template you purchase is yours indefinitely.

- To obtain another copy of any purchased form, go to the My documents tab and select the appropriate option.

- If you are accessing the US Legal Forms website for the first time, follow the simple directions outlined below.

- First, ensure that you have chosen the correct document template for the state/city of your preference.

- Review the form description to confirm you have selected the right form.

Form popularity

FAQ

Most consultants operate as self-employed individuals, which allows them to run their own businesses and set their own terms. Being self-employed as a consultant means managing your projects, schedules, and clients independently. Utilizing Minnesota Business Management Consulting resources helps clarify your status and responsibilities while promoting successful client relationships.

Yes, a consultant can be classified as a W-2 employee in some situations. This may occur if a consultant works primarily for one company and is subject to that company's control and direction. However, this setup may limit the flexibility that typically comes with being self-employed, particularly within a Consultant Services Agreement - Self-Employed.

A consultant typically operates as a service-based business. They provide expertise or specialized knowledge to help other businesses improve their performance. Engaging in Minnesota Business Management Consulting allows you to offer personalized services tailored to clients' needs, making it an attractive option for many self-employed professionals.

Yes, having a contract is essential as a consultant. A clear agreement outlines the services you will provide, payment terms, and the expectations of both parties. This clarity not only protects your interests but also reinforces professionalism; using a Consultant Services Agreement - Self-Employed from uslegalforms can guide you through the process.

Self-employed individuals run their own businesses and earn income directly from clients or customers. To be considered self-employed, one must not rely on an employer for a paycheck and should manage their tax obligations independently. Understanding the nuances of Minnesota Business Management Consulting or a Consultant Services Agreement - Self-Employed makes it easier to navigate your responsibilities.

Writing a simple consulting agreement involves several key components. Start by defining the scope of work, specifying the services provided under Minnesota Business Management Consulting or Consultant Services Agreement - Self-Employed. Include details about payment terms, timelines, and confidentiality. You might want to consider using uslegalforms, which offers templates that simplify the process of drafting effective consulting agreements, ensuring you cover all necessary aspects.

Yes, a consultant is often considered self-employed. This means they run their own business and provide expert advice or services to clients. In the context of Minnesota Business Management Consulting or Consultant Services Agreements, self-employed consultants operate under contracts that outline their duties, payment terms, and the duration of their engagement. It's crucial to have a clear agreement to define the working relationship and expectations.

An independent contractor can act as an agent of a company, though this role must be specified in the agreement. The Minnesota Business Management Consulting or Consultant Services Agreement - Self-Employed should outline the contractor's authority to represent the company. Clearly defining these parameters can lead to effective collaboration and mutual understanding.

Yes, an independent contractor can manage company employees, provided this is clearly outlined in the Minnesota Business Management Consulting or Consultant Services Agreement - Self-Employed. This arrangement can benefit businesses by leveraging outside expertise for team management. However, it is important to ensure that the contractor’s authority is well-defined to prevent misunderstandings.

A management consulting agreement is a formal contract that details the consulting services provided, payment terms, and other responsibilities. This agreement serves as a framework for the working relationship between businesses and consultants. Using a Minnesota Business Management Consulting or Consultant Services Agreement - Self-Employed helps ensure clarity and protects both parties involved.