Minnesota Financing Statement

Description

How to fill out Financing Statement?

Finding the appropriate legal document template can be a challenge. Clearly, there are numerous templates accessible online, but how do you get the legal form you require.

Use the US Legal Forms website. The service offers thousands of templates, including the Minnesota Financing Statement, which can be utilized for business and personal needs.

All forms are verified by experts and comply with state and federal regulations.

If the form does not meet your requirements, use the Search field to find the appropriate form. Once you are sure the form is correct, select the Get now button to acquire the form. Choose the pricing plan you prefer and enter the necessary information. Create your account and pay for the order using your PayPal account or credit card. Select the document format and download the legal document template to your device. Complete, modify, print, and sign the acquired Minnesota Financing Statement. US Legal Forms is the largest collection of legal forms where you can find a variety of document templates. Utilize the service to obtain professionally crafted documents that comply with state regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Minnesota Financing Statement.

- Use your account to review the legal forms you have previously purchased.

- Go to the My documents section of your account and download another copy of the file you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, ensure you have selected the correct form for your area/location.

- You can view the form using the Preview option and read the form description to confirm it is suitable for you.

Form popularity

FAQ

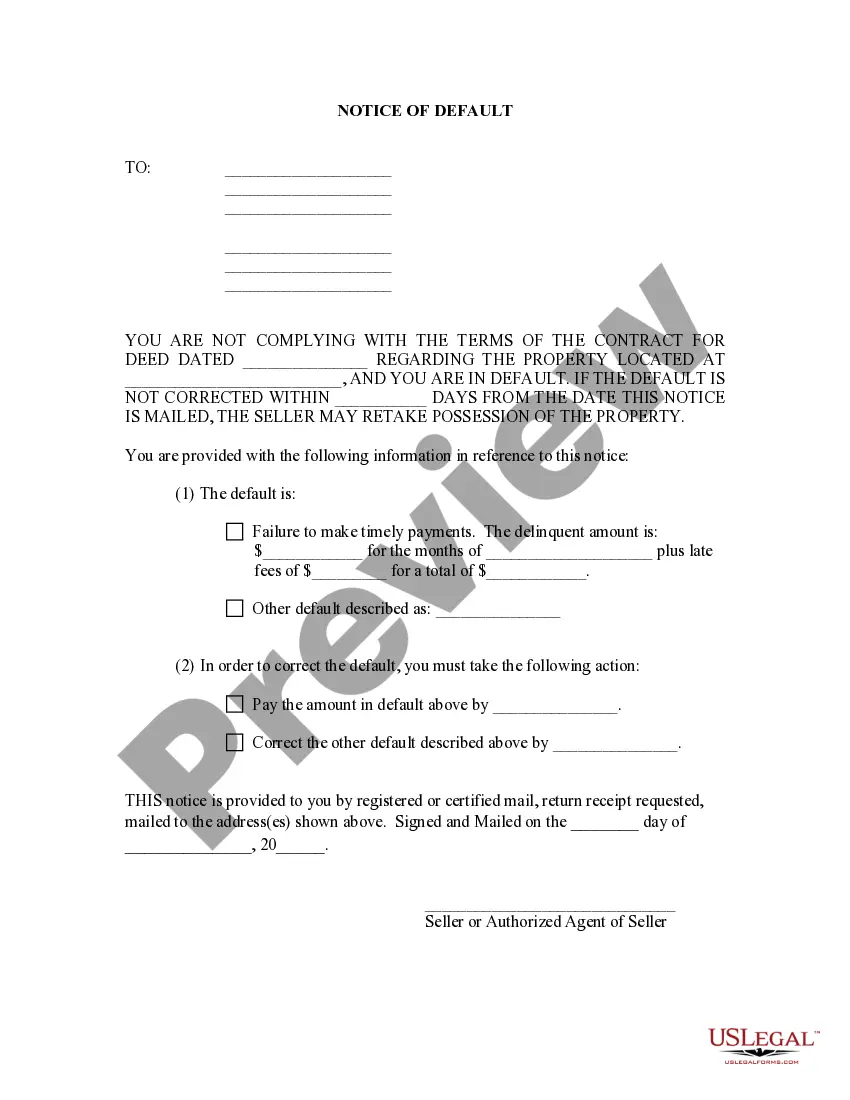

The primary purpose of a Minnesota Financing Statement is to publicly declare the secured party's interest in collateral. This process helps ensure that the lender's rights are recognized, especially in case of disputes or bankruptcy. Moreover, it deters fraud by informing other parties about existing security interests. Uslegalforms can facilitate the filing process, making it straightforward and efficient.

A financial statement in real estate typically includes details about income, expenses, assets, and liabilities related to a property. It provides an overview of the property's financial health and plays a crucial role in transactions. Understanding these details is vital for making informed decisions. For further clarity, you can utilize uslegalforms to access tools and templates related to financial statements.

Filing a UCC, or Uniform Commercial Code statement, is essential for establishing a legal claim to collateral in Minnesota. It protects the lender's interests in case the borrower defaults. By filing a Minnesota Financing Statement, the lender solidifies their priority over other creditors. Uslegalforms offers valuable resources to ensure your UCC filing is completed correctly.

You should file a Minnesota Financing Statement in Minnesota, especially if the collateral is located there. Each state has specific requirements for filing, so it's crucial to understand local regulations. Filing in the correct jurisdiction protects your rights as a secured party. Uslegalforms can guide you on where and how to file effectively.

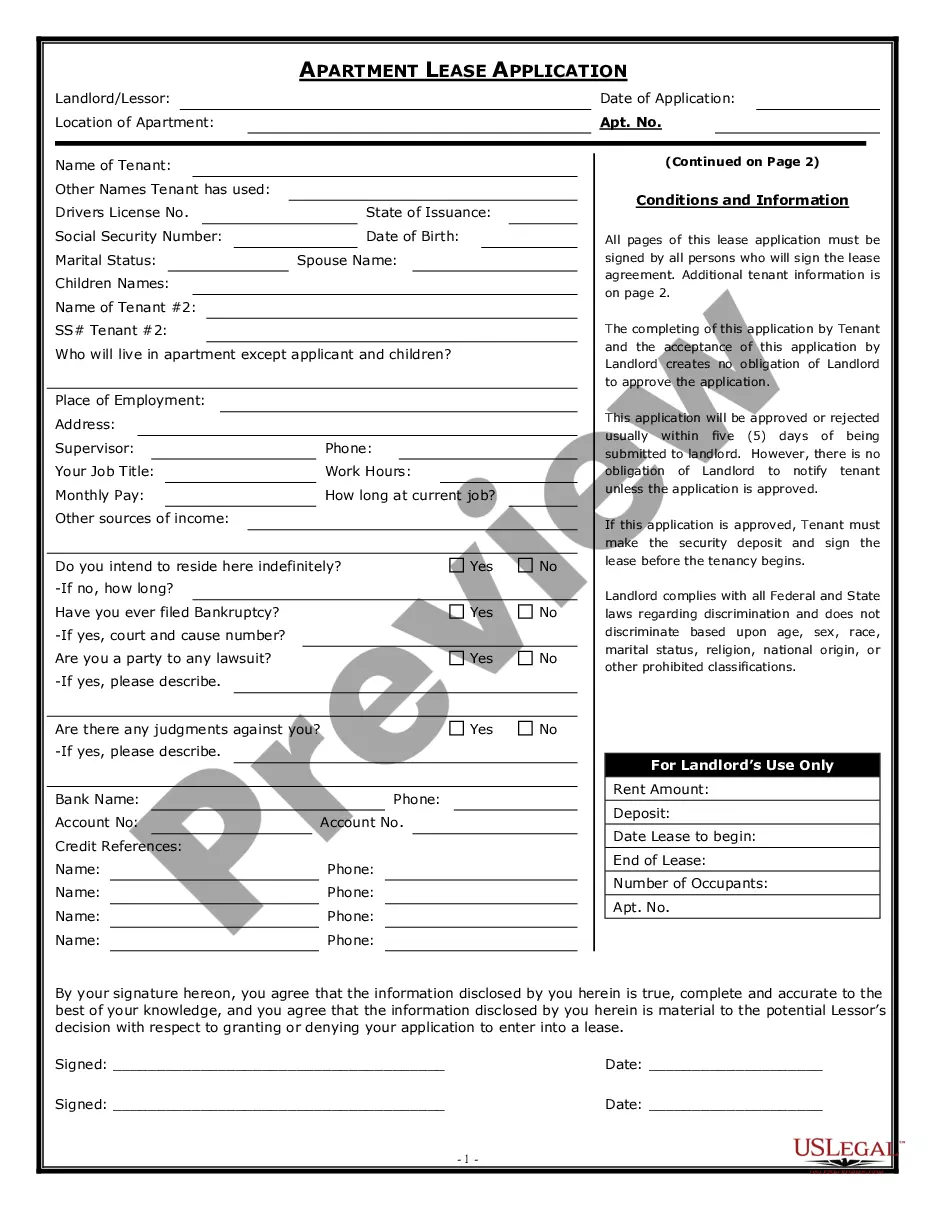

A Minnesota Financing Statement typically contains basic information about the debtor and the secured party, including names and addresses. It also includes a description of the collateral involved in the secured transaction. This document is often filed electronically, making it easily accessible. By using uslegalforms, you can obtain templates to ensure your financing statement meets all legal requirements.

A financing statement becomes part of the public records after it is filed with the Secretary of State. You can access these records online or in person at the Secretary of State's office in Minnesota. By obtaining a copy of the Minnesota Financing Statement, you gain valuable insight into the security interests that may affect any property.

To file a lien on property in Minnesota, begin by preparing your Minnesota Financing Statement and gathering relevant information regarding the property. You then need to submit this statement to the Secretary of State or the county recorder's office, depending on the type of lien. Make sure to follow all required procedures to correctly establish the lien.

Yes, a financing statement generally requires a signature for it to be valid. The signature serves to confirm the authenticity of the document and the intent of the parties involved. When completing a Minnesota Financing Statement, ensure you include the necessary signatures to avoid any complications.

You should file a UCC financing statement in the state where the debtor is located. For individuals, this is typically the state of their residence; for businesses, it’s where they are registered. For Minnesota Financing Statements, you must follow Minnesota's regulations and guidelines.

To file a financing statement in Minnesota, you will go to the Secretary of State’s office or their online filing portal. It’s essential to follow the specific guidelines they set for submitting the Minnesota Financing Statement correctly. This ensures your document is processed efficiently and is legally recognized.