Minnesota Triple Net Lease for Commercial Real Estate

Description

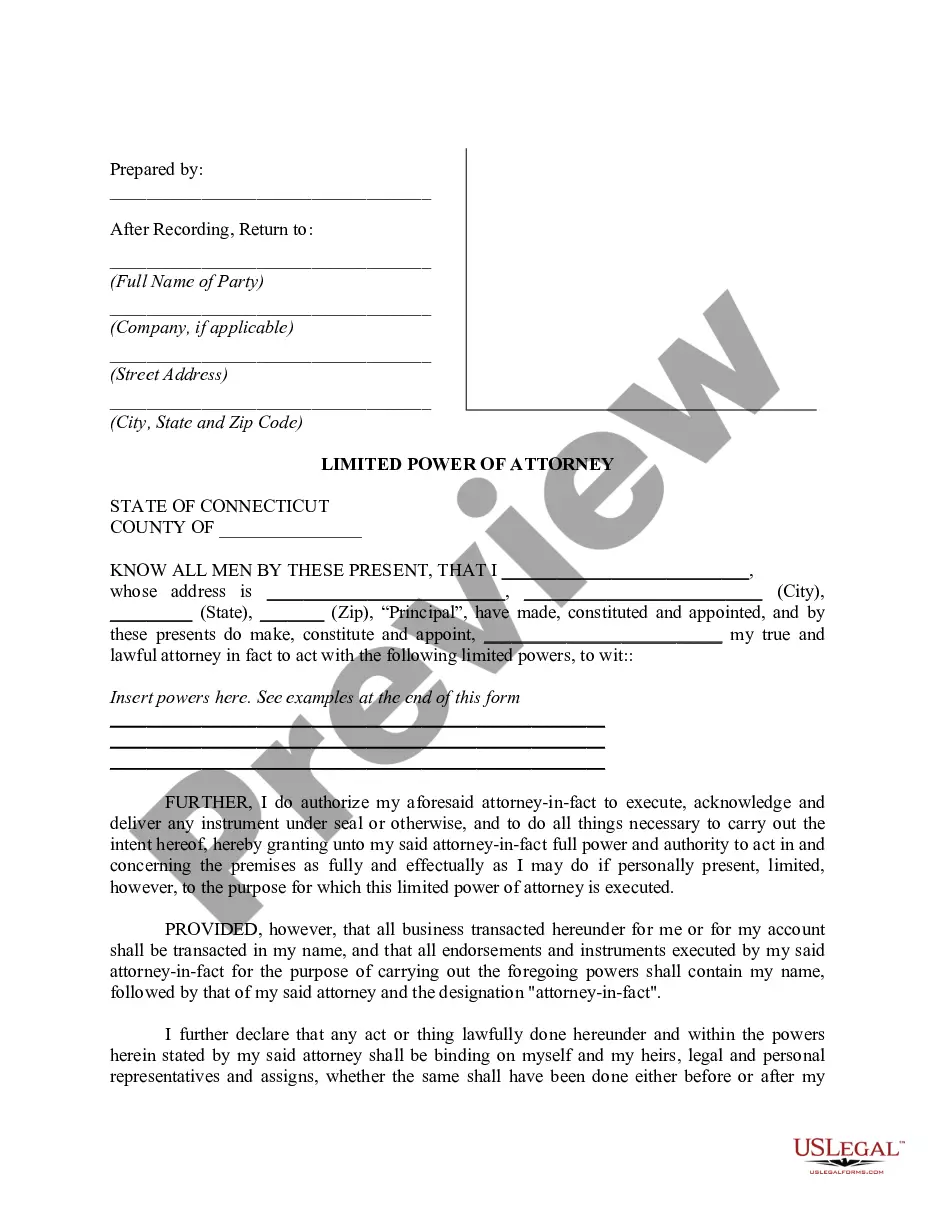

How to fill out Triple Net Lease For Commercial Real Estate?

Are you presently in a scenario where you require documentation for potentially business or particular purposes nearly every day.

There are numerous legal document templates available online, but finding forms you can trust is challenging.

US Legal Forms offers a vast array of document templates, such as the Minnesota Triple Net Lease for Commercial Real Estate, which are designed to comply with federal and state regulations.

Choose a convenient document format and download your copy.

You can find all the document templates you have purchased in the My documents section. You can acquire another copy of the Minnesota Triple Net Lease for Commercial Real Estate whenever needed. Just click on the necessary form to download or print the format.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Minnesota Triple Net Lease for Commercial Real Estate template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- 1. Locate the form you need and ensure it is for the correct city/region.

- 2. Utilize the Preview feature to view the document.

- 3. Read the description to confirm that you have chosen the correct form.

- 4. If the form is not what you're looking for, use the Search option to find the document that suits your requirements.

- 5. Once you find the appropriate form, click Acquire now.

- 6. Select the pricing plan you prefer, enter the necessary information to create your account, and pay for your order using your PayPal or credit card.

Form popularity

FAQ

To calculate a Minnesota Triple Net Lease for Commercial Real Estate, you need to determine the base rent and add the additional costs for property taxes, insurance, and maintenance. Each of these expenses is usually expressed on a per square foot basis and then multiplied by the total area of the leased space. By breaking down these costs, you can gain a clear understanding of your total financial commitment.

Finding a Minnesota Triple Net Lease for Commercial Real Estate involves exploring various online listings and consulting with real estate professionals. Online platforms often list properties suited for NNN leases; filter your search based on location and property type. Attending real estate investment groups or network events can also lead to potential opportunities.

To secure a Minnesota Triple Net Lease for Commercial Real Estate, start by researching available properties that offer this lease type. Collaborate with a real estate agent who specializes in commercial properties; they can guide you through the process. Once you identify a suitable property, negotiate lease terms that align with your business needs and financial capabilities.

To qualify for a Minnesota Triple Net Lease for Commercial Real Estate, you typically need to provide financial statements, credit history, and possibly personal guarantees. Landlords look for tenants with stable income and a solid business plan to ensure they can cover the lease expenses. It helps if you have a track record in managing similar properties, as this can strengthen your application.

Calculating commercial net involves deducting expenses related to the property from total income generated by the lease. To find your net income, subtract your operating expenses, such as property taxes, insurance, and maintenance, from the gross rental income. When you are evaluating a Minnesota Triple Net Lease for Commercial Real Estate, having accurate calculations allows for better investment decisions. For assistance with these calculations, consider using platforms like uslegalforms, which provides ample resources for landlords and tenants alike.

To calculate commercial rent under a triple net lease, you start with the base rent per square foot and then add the estimated annual costs for property taxes, insurance, and maintenance. For instance, if your base rent is $20.00 per square foot and the estimated costs are $5.00 per square foot, your total rent would be $25.00 per square foot. When considering a Minnesota Triple Net Lease for Commercial Real Estate, be sure to clarify these calculations with your landlord. This approach helps in making informed financial decisions.

Yes, many commercial leases are structured as triple net leases, especially in Minnesota. A Minnesota Triple Net Lease for Commercial Real Estate typically requires tenants to cover property taxes, insurance, and maintenance costs. This lease type benefits landlords by providing a steady income while minimizing their responsibilities. If you’re considering a commercial lease, ensure you fully understand the terms to make the best decision.

To get approved for a Minnesota Triple Net Lease for Commercial Real Estate, you should first gather all necessary financial documents, including tax returns and bank statements. Then, prepare a solid business plan that outlines your operations and goals. Lenders and landlords will look for reliable income and your ability to maintain the property. Utilizing platforms like UsLegalForms can help you understand the requirements and streamline the approval process.

A NNN lease, or triple net lease, in commercial real estate means that the tenant takes on the responsibility for property taxes, insurance, and maintenance on top of the base rent. This type of lease structure benefits landlords by providing stable income while reducing their operational liabilities. When considering a Minnesota Triple Net Lease for Commercial Real Estate, it's important to evaluate the tenant's ability to handle these responsibilities. Overall, this arrangement often leads to a more predictable financial outcome for property owners.

To structure a Minnesota Triple Net Lease for Commercial Real Estate, you start by specifying the base rent and the additional expenses that the tenant will be responsible for. Commonly, these expenses include property taxes, insurance, and maintenance costs. It's crucial to outline who pays for what to avoid misunderstandings. By clearly defining these aspects in the lease agreement, both parties can have a smoother experience.