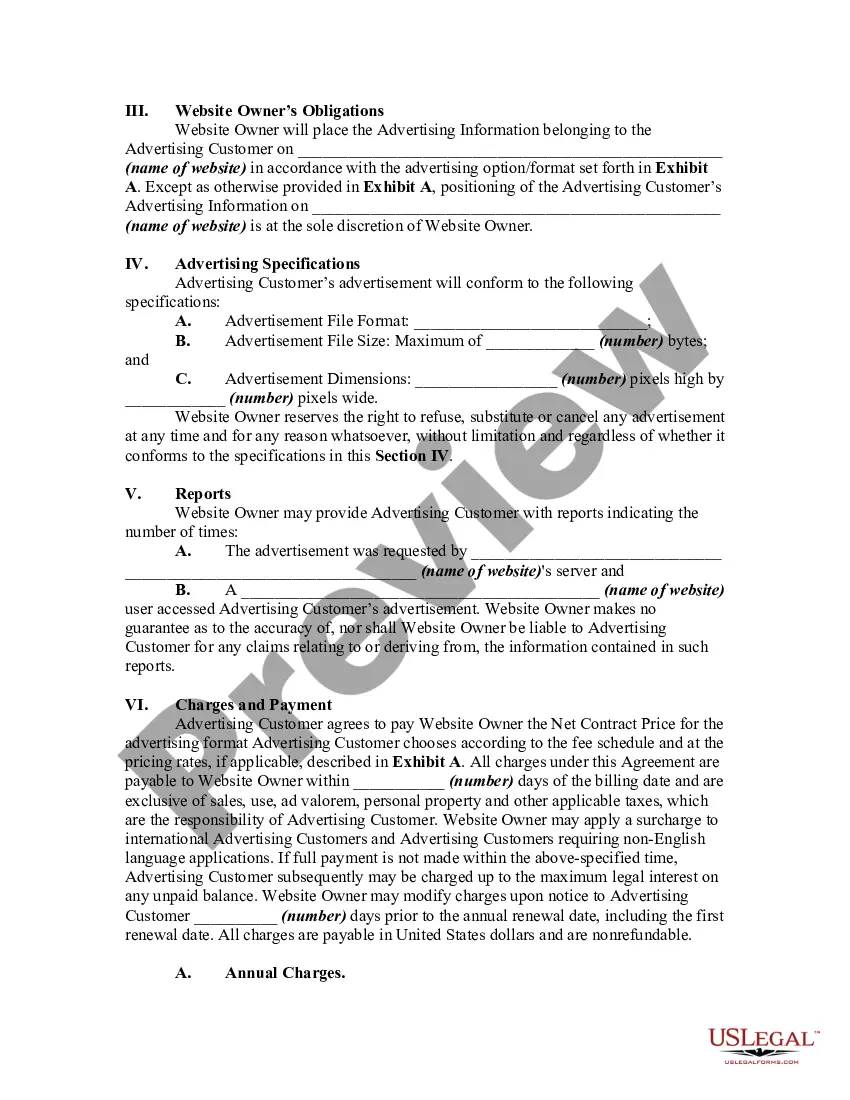

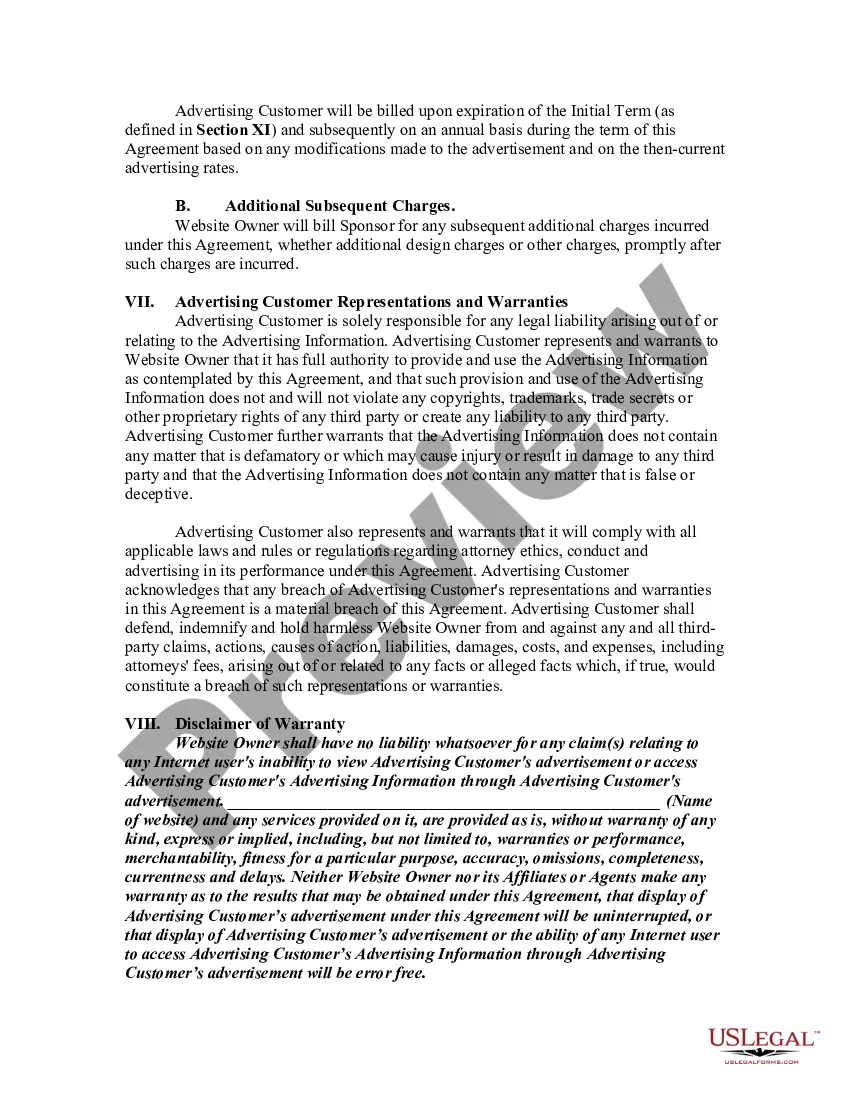

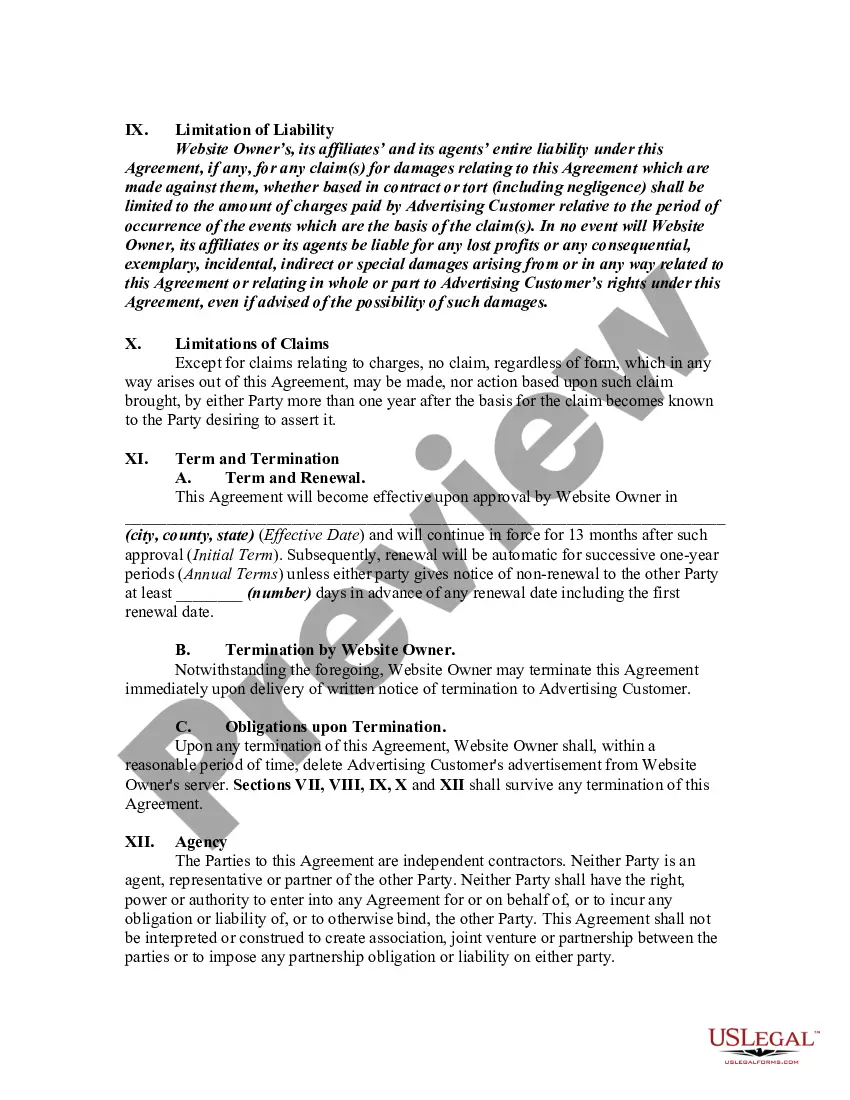

This Website Advertising Agreement form is an agreement between a website owner and an advertising customer whereby the owner will place an advertisement of the advertising customer on its website according to advertising specifications, formats and a fee schedule, if applicable.

Minnesota Website Advertising Agreement

Description

How to fill out Website Advertising Agreement?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal document templates that you can obtain or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms like the Minnesota Website Advertising Agreement in just a few moments.

If you already hold a subscription, Log In and obtain the Minnesota Website Advertising Agreement from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously saved forms from the My documents section of your account.

Complete the purchase. Utilize your Visa or Mastercard or PayPal account to finalize the transaction.

Select the format and download the form to your device. Make modifications. Fill out, edit, and print and sign the saved Minnesota Website Advertising Agreement.

Each template you saved in your account does not expire and belongs to you indefinitely. Thus, if you wish to obtain or print another copy, simply visit the My documents section and click on the form you want.

Access the Minnesota Website Advertising Agreement with US Legal Forms, the most extensive library of legal document templates. Utilize a multitude of professional and state-specific templates that meet your business or personal requirements and needs.

- Make sure you have chosen the correct form for your area/county.

- Click on the Preview button to review the form’s details.

- Examine the form details to ensure you have picked the right form.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase Now button.

- Then, select the pricing plan you prefer and provide your information to register for an account.

Form popularity

FAQ

Yes, Minnesota sales tax exemption certificates can expire. Generally, these certificates remain valid as long as the purchaser continues to qualify for the exemption. Businesses that enter into a Minnesota Website Advertising Agreement should maintain up-to-date records to ensure they comply with tax regulations and take advantage of any possible exemptions.

Nexus refers to the connection between a business and the state, which establishes the obligation to collect sales tax. In Minnesota, factors such as having a physical presence or significant online sales can create nexus. If you're entering into a Minnesota Website Advertising Agreement, it’s important to understand your nexus status to manage tax responsibilities effectively.

Yes, advertising can be taxable in Minnesota, depending on the type and format of the service provided. This means you should be prepared to account for potential taxes when forming your Minnesota Website Advertising Agreement. Consulting with a tax professional can help clarify your specific liabilities.

Many services, including those related to advertising, are taxed in Minnesota. This category can include promotional services that involve tangible advertising deliverables. As you draft your Minnesota Website Advertising Agreement, it's important to understand the tax obligations to budget effectively.

In Minnesota, services such as consulting or specific education programs may be exempt from sales tax. However, advertising services often fall within taxable categories. When entering a Minnesota Website Advertising Agreement, be sure to identify which elements are tax-exempt to optimize your budgeting.

Obtaining an advertising contract typically involves identifying your advertising needs and negotiating terms with a provider. You can draft a Minnesota Website Advertising Agreement using templates available online or by utilizing platforms like USLegalForms. These resources can help guide you through the process, ensuring all crucial details are covered.

Generally, advertising can be taxed, particularly when it involves tangible goods or certain services in Minnesota. This tax can apply to promotional materials, billboards, and more. To navigate the tax implications of your Minnesota Website Advertising Agreement accurately, consider referencing local tax regulations or seeking guidance.

Yes, in Minnesota, certain types of advertising services can be subject to sales tax. However, it depends on the nature of the advertisement and the medium used. To determine specifics related to your Minnesota Website Advertising Agreement, consulting a tax professional or legal expert may be beneficial.

An advertising agreement outlines the terms between parties who want to engage in advertising services. This document typically includes details regarding payment, duration, and the specific advertising deliverables. When creating a Minnesota Website Advertising Agreement, both parties can ensure a clear understanding of expectations and responsibilities.