An accounting by a fiduciary usually involves an inventory of assets, debts, income, expenditures, and other items, which is submitted to a court. Such an accounting is used in various contexts, such as administration of a trust, estate, guardianship or conservatorship. Generally, a prior demand by an appropriate party for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting.

Minnesota Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian

Description

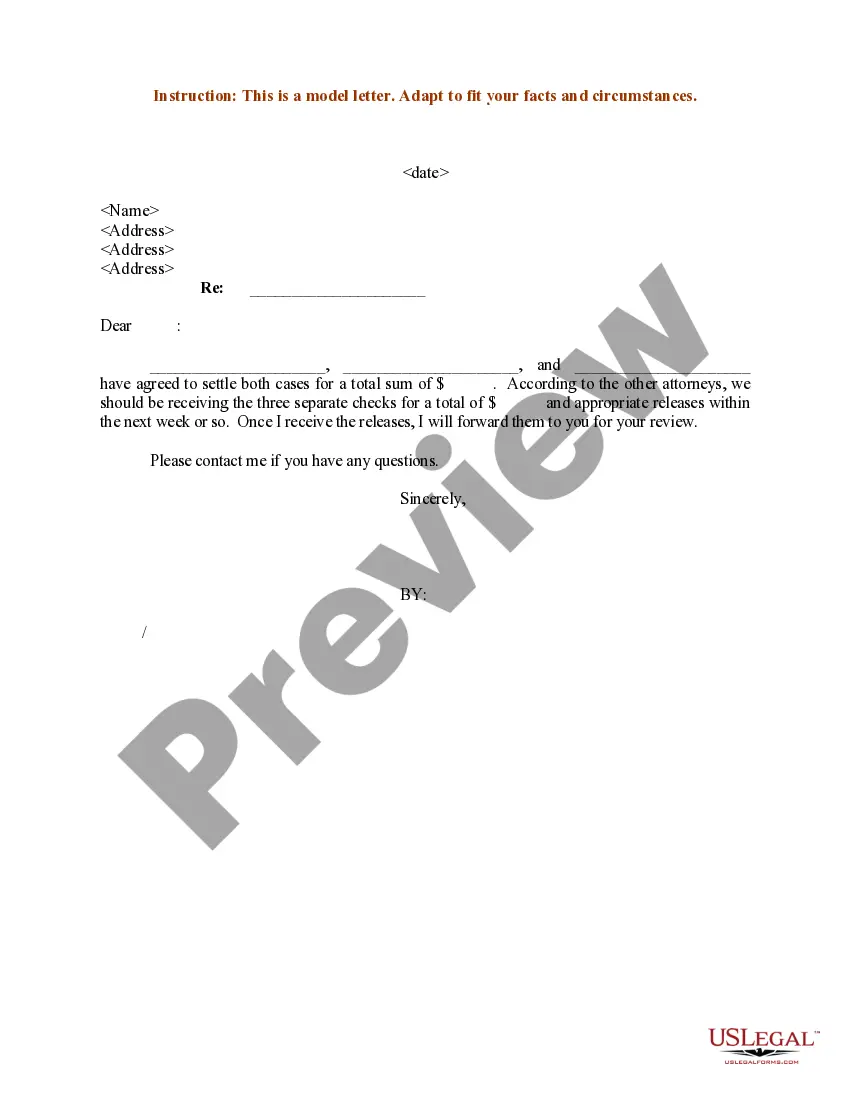

How to fill out Demand For Accounting From A Fiduciary Such As An Executor, Conservator, Trustee Or Legal Guardian?

If you wish to finalize, download, or create authentic document templates, utilize US Legal Forms, the most extensive collection of legal documents available on the internet.

Employ the site's straightforward and user-friendly search to find the documents you need.

Numerous templates for business and individual purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Select the pricing plan you prefer and enter your information to register for an account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Use US Legal Forms to locate the Minnesota Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee, or Legal Guardian in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Minnesota Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee, or Legal Guardian.

- You can also access documents you previously saved within the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have chosen the form for your specific city/state.

- Step 2. Use the Review option to examine the form's content. Don't forget to read the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal document template.

Form popularity

FAQ

Minnesota Statute 144.3431 relates to the responsibilities of guardians, particularly regarding health care decisions. It provides guidelines for ensuring that individuals under guardianship receive appropriate medical care while respecting their autonomy. If you suspect that a guardian is not fulfilling their duties, a Minnesota Demand for Accounting from a Fiduciary can be an essential step in addressing your concerns.

Statute 471.61 addresses the financial management responsibilities of public officials, including fiduciaries. This statute is significant as it outlines the expectations for fiscal accountability and proper reporting. If you are concerned about a financial issue with a fiduciary, understanding this statute can be beneficial. Pursuing a Minnesota Demand for Accounting from a Fiduciary can leverage this information to ensure responsible management of funds.

Minnesota's guardianship statutes provide a framework for establishing and overseeing guardianships. These laws ensure that the rights of those under guardianship are protected while empowering guardians to make necessary decisions for their well-being. If you're dealing with a guardian and need clarity on their actions, a Minnesota Demand for Accounting from a Fiduciary can help ensure transparency.

A legal guardian is appointed through a court process, giving them authority over another person, often a minor or incapacitated individual. The term 'guardian' can sometimes refer more broadly to individuals who provide care, but it typically lacks the legal connotation of formal responsibilities. In situations requiring a Minnesota Demand for Accounting from a Fiduciary, understanding the distinctions between these roles is essential for accountability.

Statute 356A in Minnesota pertains to the authorities and permissions granted to fiduciaries. It serves to clarify the powers of agents in managing assets while balancing the rights of those they represent. If you're seeking accountability from a fiduciary such as an executor or trustee, this statute may be a crucial reference. A Minnesota Demand for Accounting from a Fiduciary leverages these legal guidelines to ensure you receive the necessary information.

Minnesota Statute 524.2 404 outlines the duties and responsibilities of fiduciaries. This statute emphasizes the obligation to act in good faith and require reasonable care when managing another individual's assets. If you are facing issues related to fiduciary responsibilities, understanding these statutes can be vital. When pursuing a Minnesota Demand for Accounting from a Fiduciary, this knowledge can guide your actions.

Yes, trustees are always considered fiduciaries. They have a legal obligation to act in the best interests of the beneficiaries under their care. This responsibility is central to their role and extends to transparent accounting practices. In cases involving a Minnesota Demand for Accounting from a Fiduciary such as a trustee, beneficiaries can request documentation to ensure proper management of trust assets.

In Minnesota, the statute of limitations for a breach of fiduciary duty is typically six years. This period begins when the breach occurs or when the injured party becomes aware of the breach. If you feel a fiduciary, such as an executor, conservator, trustee, or legal guardian, has wronged you, it is essential to act promptly. Understanding your rights in a Minnesota Demand for Accounting from a Fiduciary can help you navigate this process effectively.

Yes, beneficiaries can request to see the deceased's bank statements, but access may depend on the executor's policies and local laws. Engaging in a Minnesota Demand for Accounting from a Fiduciary process can make it easier for beneficiaries to obtain this information. Online banking often provides a convenient way to access historical statements with the appropriate permissions. Opening a dialogue with the executor is crucial for ensuring beneficiaries receive the information they need.

In Minnesota, the timeframe for an executor to distribute assets typically ranges from six months to a year after the will is probated. The specific timeframe can vary based on the complexity of the estate and any potential disputes among beneficiaries. Promptly fulfilling the Minnesota Demand for Accounting from a Fiduciary can help streamline this process. Overall, communication and cooperation among all parties involved facilitate timely asset distribution.