Agency is a relationship based on an agreement authorizing one person, the agent, to act for another, the principal. For example an agent may negotiate and make contracts with third persons on behalf of the principal. Actions of an agent can obligate the principal to third persons. Actions of an agent may also give a principal rights against third persons. It is important to be able to distinguish agencies from other relationships that are similar. Control and authority are key factors in distinguishing ordinary employees and independent contractors from agents.

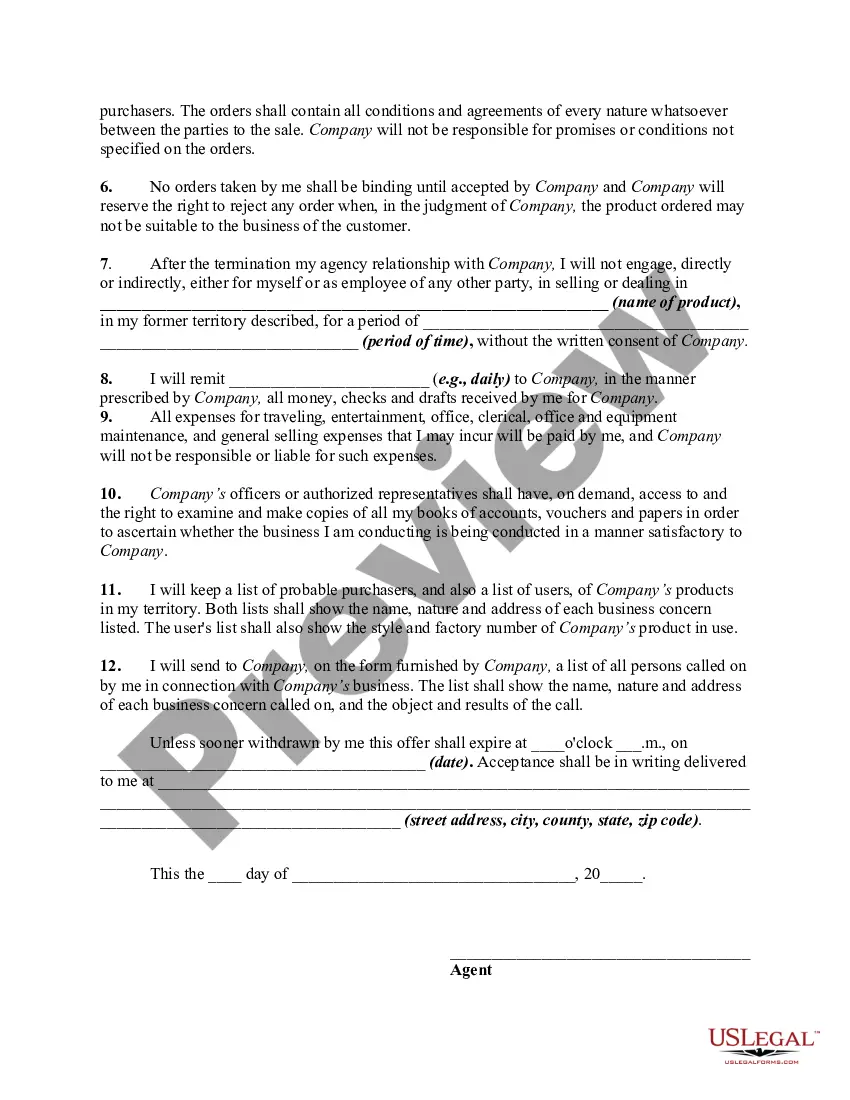

Minnesota Business Letter Offering Representation as General Sales Agent

Description

How to fill out Business Letter Offering Representation As General Sales Agent?

US Legal Forms - one of the largest collections of legal templates in the USA - offers a range of legal document formats that you can download or print.

By using the website, you can access thousands of forms for both business and personal purposes, organized by categories, states, or keywords. You can acquire the latest versions of forms such as the Minnesota Business Letter Offering Representation as General Sales Agent in just a few minutes.

If you currently hold a monthly subscription, Log In and download the Minnesota Business Letter Offering Representation as General Sales Agent from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously downloaded forms from the My documents tab of your account.

Process the payment. Use your Visa, MasterCard, or PayPal account to complete the transaction.

Choose the format and download the form to your device. Make modifications. Complete, edit, print, and sign the downloaded Minnesota Business Letter Offering Representation as General Sales Agent. Each design you add to your account does not expire and belongs to you indefinitely. Thus, if you wish to download or print another copy, simply go to the My documents section and click on the form you desire. Access the Minnesota Business Letter Offering Representation as General Sales Agent with US Legal Forms, the most extensive collection of legal document formats. Utilize thousands of professional and state-specific templates that cater to your business or personal needs and requirements.

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to review the form’s details.

- Check the form description to confirm that you have chosen the right document.

- If the form does not meet your needs, utilize the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, select the payment plan you prefer and provide your details to create an account.

Form popularity

FAQ

The processing time for obtaining a Minnesota tax ID number typically takes around 7 to 10 business days, depending on the volume of applications. Once your application is approved, you will receive documentation confirming your tax ID. Timely acquisition of your tax ID is essential for your operations under any Minnesota Business Letter Offering Representation as General Sales Agent.

To obtain a MN sales tax ID number, you must complete the application process through the Minnesota Department of Revenue. This usually involves submitting necessary documentation regarding your business operations. Ensuring you have this ID is critical for engaging in business under a Minnesota Business Letter Offering Representation as General Sales Agent.

The Minnesota Department of Revenue administers the collection of taxes and ensures compliance with state laws. They provide resources and assistance to taxpayers regarding tax filings and obligations. Understanding their role is vital when dealing with any Minnesota Business Letter Offering Representation as General Sales Agent.

You may receive a check from the MN Department of Revenue due to a tax refund or a correction of an overpayment. It is important to review the accompanying documentation to understand the reason for the payment. If you are unsure, consider consulting with a professional who specializes in Minnesota Business Letter Offering Representation as General Sales Agent.

To close your MN sales tax account, you must formally notify the Minnesota Department of Revenue in writing. Include your business details and the reason for closing the account. Completing this process accurately will ensure that you have no remaining liabilities associated with your Minnesota Business Letter Offering Representation as General Sales Agent.

Receiving a letter from the MN Department of Revenue may indicate that they require more information from you or that there is a change in your tax status. It might also serve as a notification of an audit or discrepancy in your filings. Understanding these communications will help you effectively manage your obligations under the Minnesota Business Letter Offering Representation as General Sales Agent.

To determine how much you owe, you can visit the Minnesota Department of Revenue's website or contact them directly. They provide resources that outline your tax liabilities and any outstanding balances. Utilizing these resources is essential for maintaining compliance, especially if you have received a Minnesota Business Letter Offering Representation as General Sales Agent.

Minnesota Revenue may send you a letter to clarify your tax obligations or to notify you of an issue with your filings. This letter serves as a means of communication regarding your responsibilities as a taxpayer. Responding promptly to the letter is crucial to avoid potential penalties or complications related to your Minnesota Business Letter Offering Representation as General Sales Agent.

Minnesota does not impose a gross receipts tax, but businesses may need to comply with other tax requirements. This distinguishes Minnesota’s tax structure from some other states. When creating a Minnesota Business Letter Offering Representation as General Sales Agent, it's crucial to understand the local tax regulations to provide accurate information and maintain legal compliance.

Minnesota statute 481.02 governs the practice of law and provides definitions regarding who can engage in legal representation. This statute emphasizes that only licensed attorneys can represent clients in legal matters. When drafting a Minnesota Business Letter Offering Representation as General Sales Agent, understanding this statute ensures compliance and protects your interests.