This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Minnesota General Form of Claim or Notice of Lien By General Contractor

Description

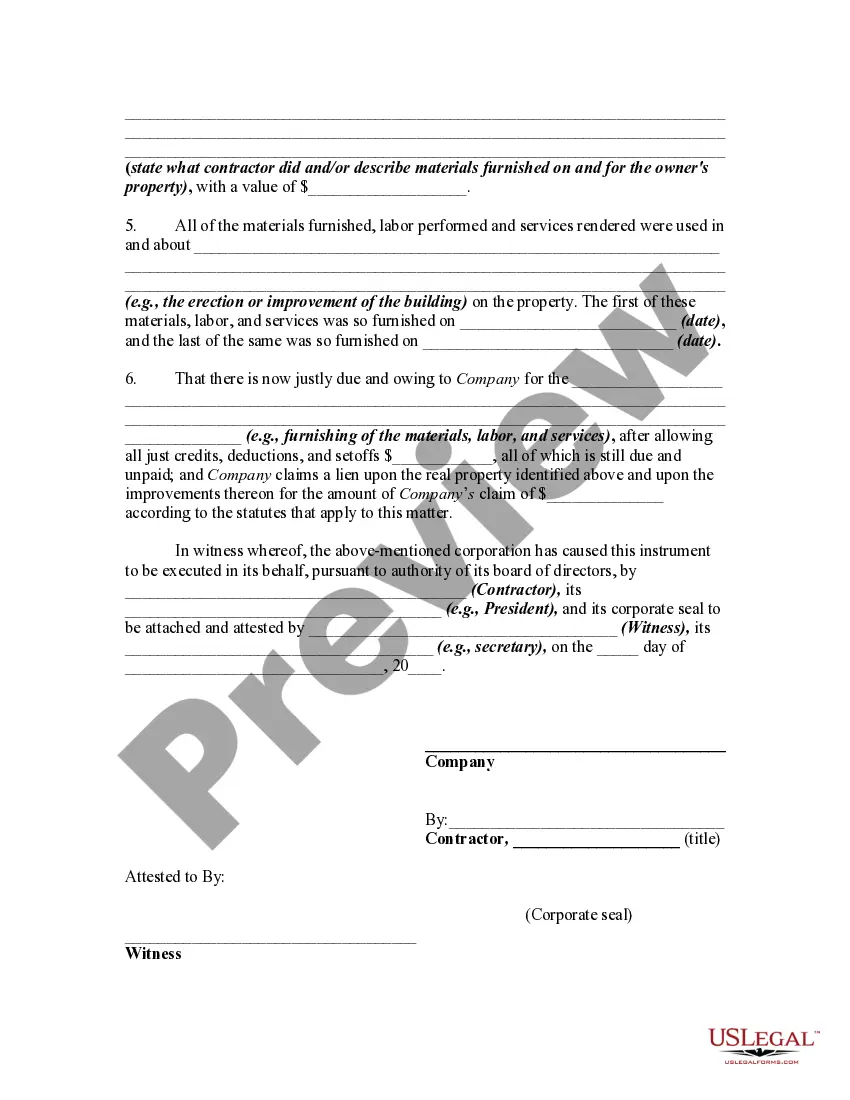

How to fill out General Form Of Claim Or Notice Of Lien By General Contractor?

US Legal Forms - one of the largest compilations of legal documents in the USA - offers a variety of legal document templates that you can download or print.

By using the website, you can access thousands of documents for commercial and personal use, organized by types, claims, or keywords.

You can obtain the latest documents such as the Minnesota General Form of Claim or Notice of Lien By General Contractor in just seconds.

Review the form description to ensure you have picked the right document.

If the document does not meet your needs, utilize the Search box at the top of the screen to find one that does.

- If you already have a subscription, sign in and download the Minnesota General Form of Claim or Notice of Lien By General Contractor from the US Legal Forms collection.

- The Download button appears on every document you view.

- You have access to all previously downloaded documents from the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple steps to get you started.

- Ensure you have chosen the correct document for your city/county.

- Select the Review button to check the form's details.

Form popularity

FAQ

Statute 514.10 in Minnesota addresses the rights of contractors regarding mechanics’ liens. It outlines how contractors can secure payment for labor or materials provided to a property. When navigating this legal landscape, understanding the Minnesota General Form of Claim or Notice of Lien By General Contractor can be instrumental in securing your rights and ensuring compliance with the law.

Obtaining a lien release in Minnesota requires you to settle any outstanding debts with the contractor. Once payment is made, the contractor must sign a lien release form, which can often be drafted based on the Minnesota General Form of Claim or Notice of Lien By General Contractor. This document serves as proof that the debt has been satisfied and the lien is no longer enforceable against the property.

Minnesota has specific rules that govern the filing and enforcement of liens. Contractors must provide a notice to the property owner and file the claim with the county recorder. Using the Minnesota General Form of Claim or Notice of Lien By General Contractor can simplify this process, ensuring that all necessary details are correctly documented and submitted.

In Minnesota, a contractor has 120 days from the completion of the work to file a lien against a property. If you are seeking to ensure your rights, it's important to understand the processes outlined in the Minnesota General Form of Claim or Notice of Lien By General Contractor. This timeframe encourages prompt action to secure your payment for services rendered.

In Minnesota, you can perform minor home repairs or maintenance work without a contractor's license, but there are limitations. If the value of the project exceeds $15,000, you must have a license to comply with state regulations. Always ensure that any work you undertake aligns with the Minnesota General Form of Claim or Notice of Lien By General Contractor. It’s essential to understand the rules before you start any work.

Yes, an unlicensed contractor can file a lien in Minnesota, but specific conditions must be met. The contractor must have a valid contract and must have provided services or materials that benefit the property. Be cautious, as a problematic project may complicate the process. Consulting with legal professionals or platforms like uslegalforms can provide clarity on your rights and procedures.

In Minnesota, you generally have 120 days from the last day you provided labor or materials to file a lien. However, for a residential property, the deadline may be 45 days if you are a subcontractor or supplier. Avoid missed deadlines by carefully tracking your project dates. Using the Minnesota General Form of Claim or Notice of Lien By General Contractor can help ensure timely and accurate submissions.

Filing a lien in Minnesota involves submitting the Minnesota General Form of Claim or Notice of Lien By General Contractor to the appropriate local county office. First, gather the necessary documentation that supports your claim, including contracts and invoices. It is important to adhere to state-specific regulations and deadlines. Consider utilizing uslegalforms for a streamlined filing process and access to valuable resources.

Yes, Minnesota is considered a tax lien state. This means that if property taxes remain unpaid, the county can place a tax lien on your property. This lien can lead to foreclosure if the taxes are not settled. Understanding the implications of tax liens is crucial for homeowners, and resources like uslegalforms can help clarify this process.

To file a contractor's lien in Minnesota, you need to complete the Minnesota General Form of Claim or Notice of Lien By General Contractor. This form must be submitted to the county recorder's office in the county where the property is located. Ensure that you file within the required timeframe, as this can affect your rights. For assistance, consider using the uslegalforms platform, which provides templates and guidance for filing.