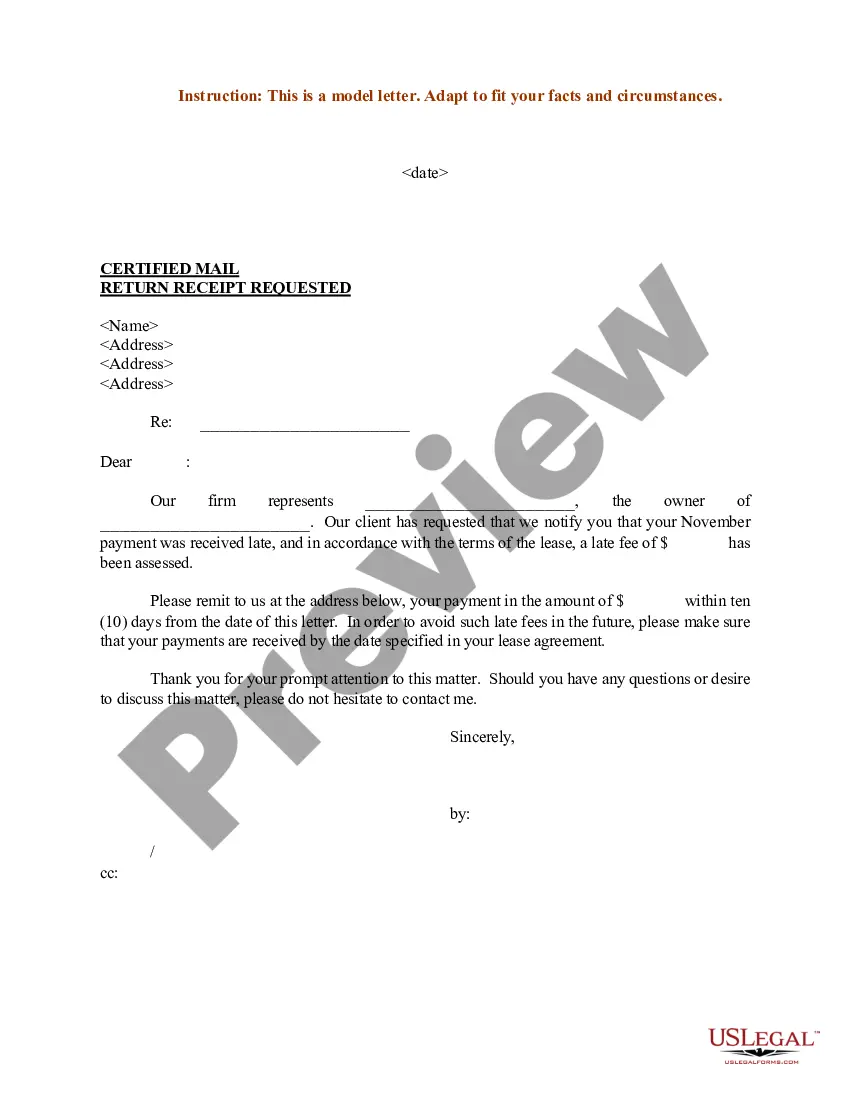

Minnesota Sample Letter for Remittance of Late Fee

Description

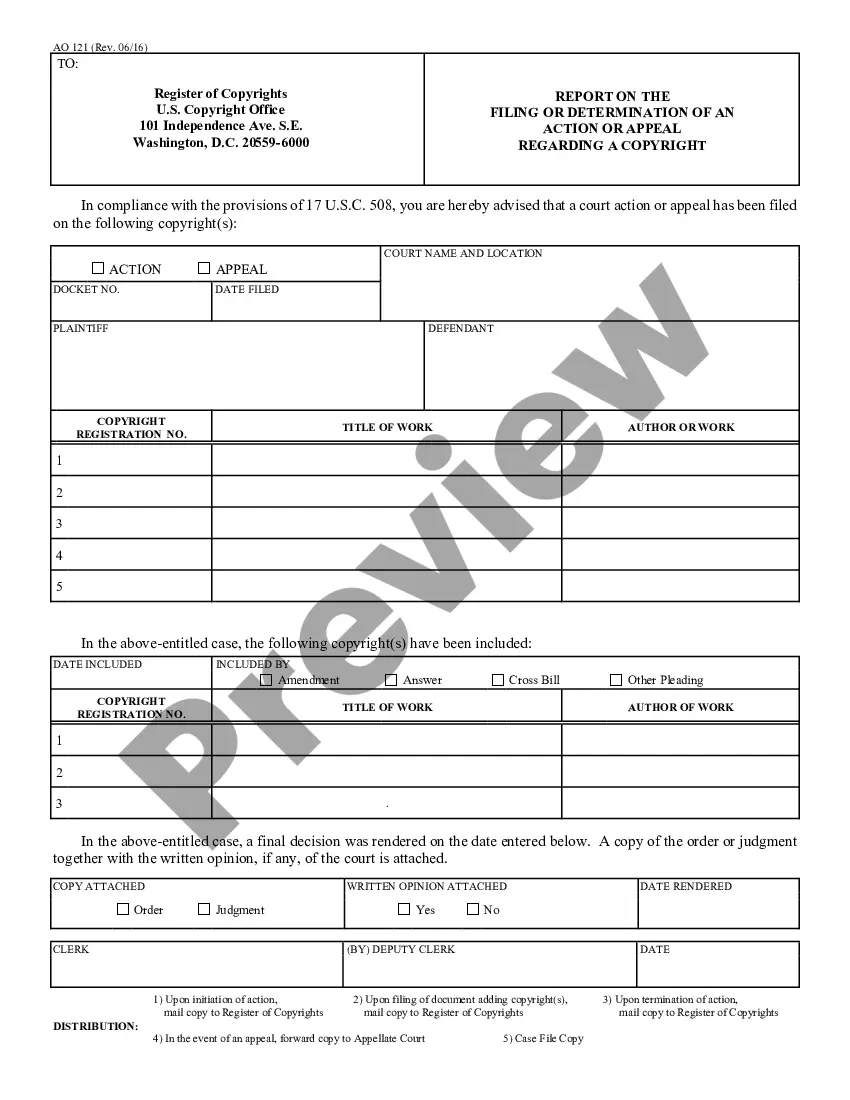

How to fill out Sample Letter For Remittance Of Late Fee?

If you want to comprehensive, acquire, or produce lawful record layouts, use US Legal Forms, the biggest selection of lawful forms, that can be found on-line. Utilize the site`s easy and convenient research to discover the files you need. Different layouts for business and individual functions are sorted by types and suggests, or keywords. Use US Legal Forms to discover the Minnesota Sample Letter for Remittance of Late Fee in a few clicks.

When you are already a US Legal Forms client, log in to the profile and click on the Obtain button to find the Minnesota Sample Letter for Remittance of Late Fee. You may also gain access to forms you earlier downloaded from the My Forms tab of your profile.

If you work with US Legal Forms the first time, follow the instructions under:

- Step 1. Be sure you have chosen the shape for your correct area/region.

- Step 2. Make use of the Review solution to look over the form`s articles. Never forget about to read the information.

- Step 3. When you are unsatisfied with all the type, utilize the Search discipline on top of the display screen to find other types in the lawful type template.

- Step 4. Once you have discovered the shape you need, go through the Buy now button. Pick the costs strategy you choose and include your qualifications to sign up for the profile.

- Step 5. Method the transaction. You should use your charge card or PayPal profile to accomplish the transaction.

- Step 6. Pick the structure in the lawful type and acquire it on your own gadget.

- Step 7. Total, edit and produce or indication the Minnesota Sample Letter for Remittance of Late Fee.

Each lawful record template you acquire is your own property permanently. You possess acces to every type you downloaded inside your acccount. Click on the My Forms section and choose a type to produce or acquire once more.

Compete and acquire, and produce the Minnesota Sample Letter for Remittance of Late Fee with US Legal Forms. There are thousands of skilled and state-specific forms you can utilize for your business or individual requirements.

Form popularity

FAQ

Time Abatement can be requested verbally or in writing. You may file FTB 2918 or call 8006894776 to request that we cancel a penalty based on onetime abatement. We will begin to accept onetime penalty abatement requests on April 17, 2023.

You may qualify for penalty relief if you demonstrate that you exercised ordinary care and prudence and were nevertheless unable to file your return or pay your taxes on time. Examples of valid reasons for failing to file or pay on time may include: Fires, natural disasters or civil disturbances.

Taxpayers may apply for first-time penalty abatement online, in writing, or over the phone. In some cases, if you qualify, the IRS removes the penalties on the spot.

A good written late rent notice should include the following information: Date of the late rent notice; Name of all tenants on the lease; Name of the landlord or property manager; Property address; Amount of rent past due; Grace period (if any); Late fee amount if the rent is not paid in full by the grace period;

To Whom It May Concern: We respectfully request that the [failure-to-file/failure-to-pay/failure-to-deposit] penalty be abated based on the IRS's First Time Abate administrative waiver procedures, as discussed in IRM 20.1. 1.3. 6.1, First Time Abate (FTA).

Minnesota Sales Tax Penalties Payments received between 31 and 60 days after the original due date will be subject to a 10% penalty, and payments that are more than 60 days late will incur a 15% penalty.

How to Write a Penalty Abatement Request Letter Record Your Information and the Penalty Information. ... State an Explicit Request for an IRS Penalty Abatement and Appeal. ... Explain the Facts. ... Cite any Applicable Laws. ... Apply the Law to the Facts. ... Request for Next Action. ... Include Signature, Attestations, and Attachments.

IRS Penalty Abatement Request Letter State the type of penalty you want removed. Include an explanation of the events and specific facts and circumstances of your situation, and explain how these events were outside of your control. Attach documents that will prove your case.