Minnesota Agreement and Release for Working at a Novelty Store - Self-Employed

Description

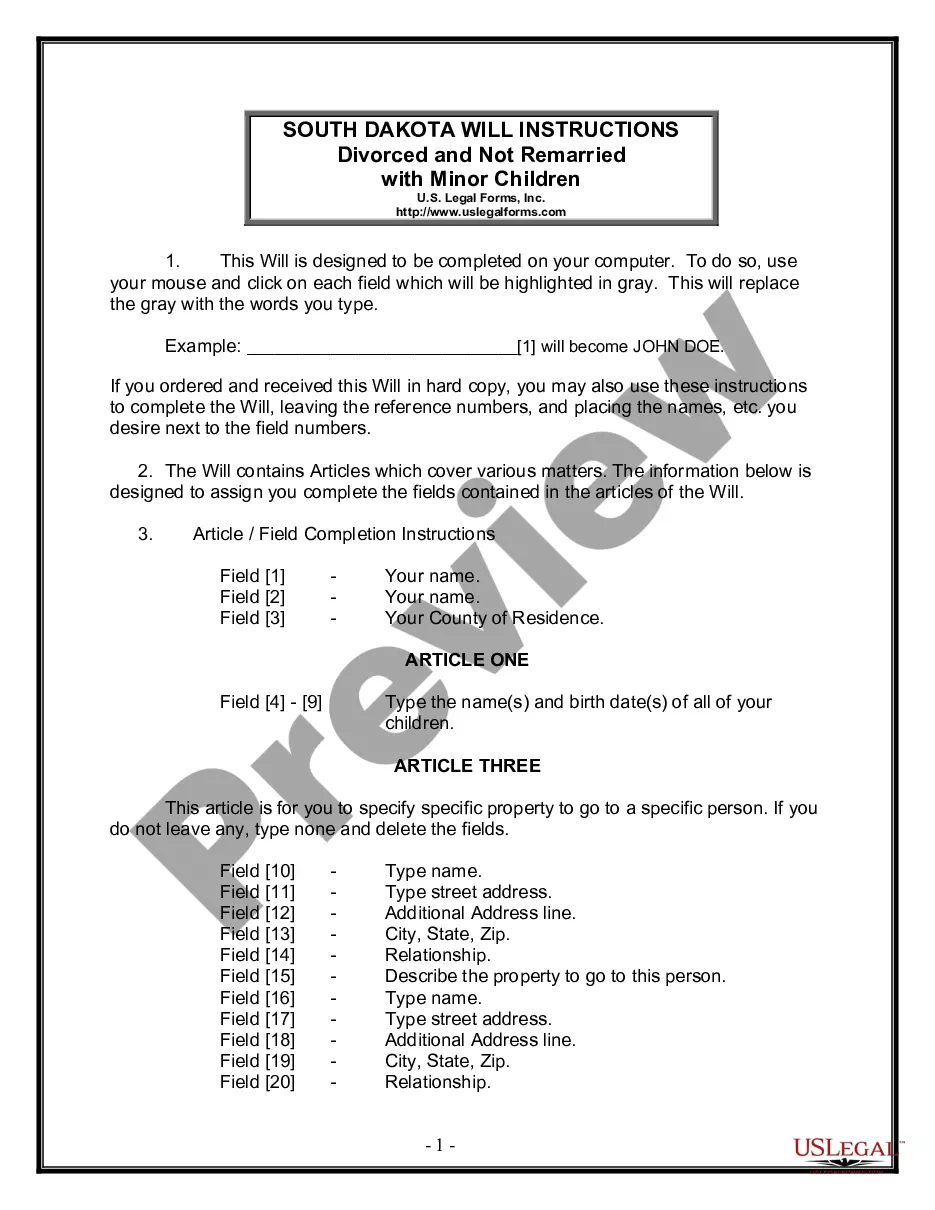

How to fill out Agreement And Release For Working At A Novelty Store - Self-Employed?

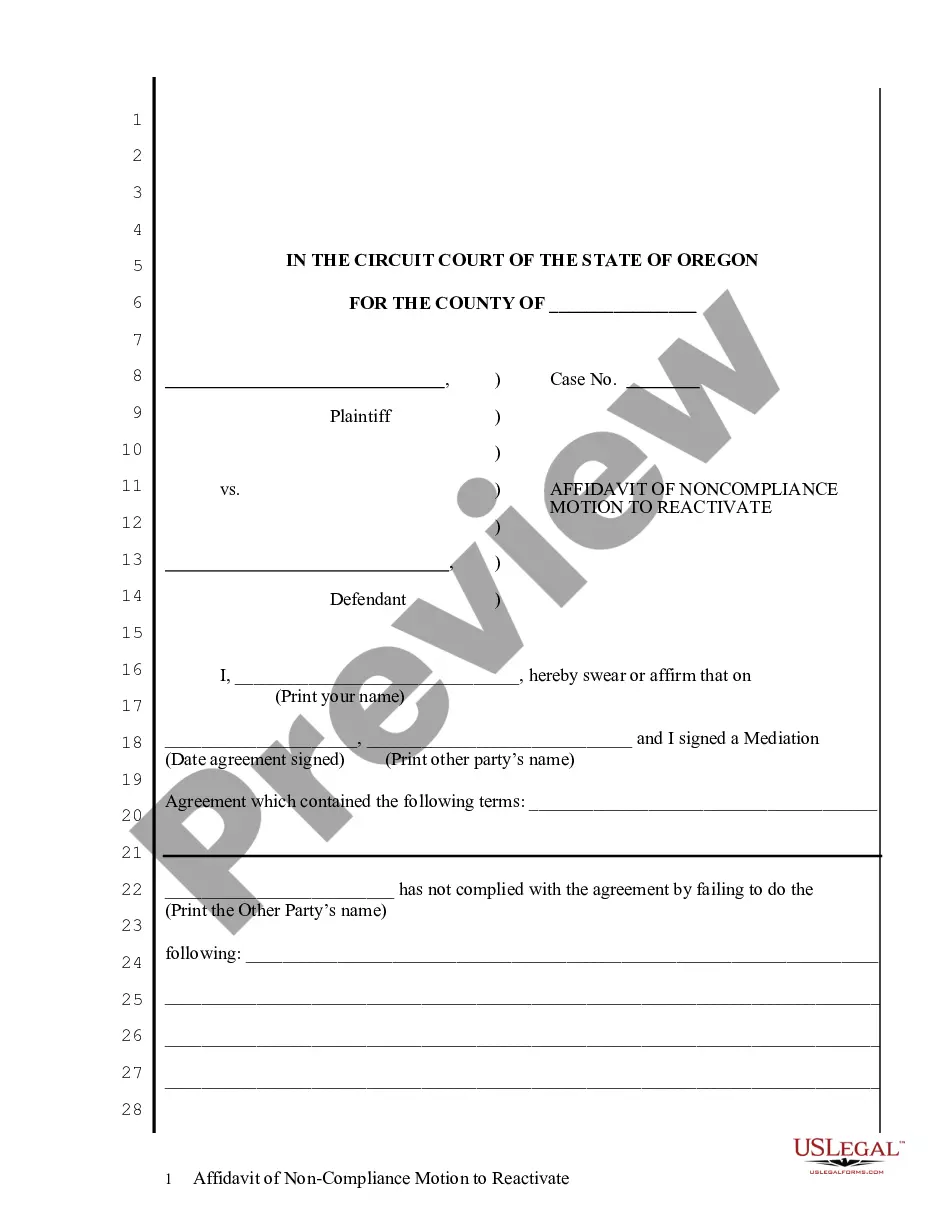

You can spend countless hours online searching for the legal document format that meets the federal and state requirements you desire. US Legal Forms provides a wide assortment of legal templates that are evaluated by professionals.

You can obtain or create the Minnesota Agreement and Release for Working at a Novelty Store - Self-Employed from our platform.

If you already have a US Legal Forms account, you can sign in and then click the Download button. After that, you can complete, edit, print, or sign the Minnesota Agreement and Release for Working at a Novelty Store - Self-Employed. Every legal document template you purchase is yours indefinitely.

Complete the payment. You can use your Visa or Mastercard or PayPal account to pay for the legal form. Choose the format of your document and download it to your device. Make modifications to your document if necessary. You can fill out, edit, sign and print the Minnesota Agreement and Release for Working at a Novelty Store - Self-Employed. Download and print a vast array of document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- To get another copy of a purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the right document template for the area/city of your preference. Review the form details to confirm that you have selected the correct one.

- If available, utilize the Review button to browse through the document template as well.

- If you want to find another version of your form, use the Search field to locate the format that meets your needs and requirements.

- Once you have found the template you desire, click on Buy now to proceed.

- Select the pricing plan you wish, enter your information, and create an account on US Legal Forms.

Form popularity

FAQ

Examples of comments from a former employer might include statements about your teamwork skills or your ability to meet deadlines. They could also reference specific accomplishments you achieved while employed. When crafting a Minnesota Agreement and Release for Working at a Novelty Store - Self-Employed, understanding these potential comments can help you present your professional history positively.

In Minnesota, a background check can typically cover up to seven years of your criminal history. Employers must adhere to federal regulations and cannot consider convictions that have been expunged or sealed. Being aware of these guidelines can help you prepare relevant documents, like the Minnesota Agreement and Release for Working at a Novelty Store - Self-Employed, that reflect your current standing.

A former employer might mention issues related to your work performance or punctuality if those were documented during your employment. However, they must stick to facts and avoid speculative commentary. This situation highlights the importance of maintaining accurate records, especially when preparing a Minnesota Agreement and Release for Working at a Novelty Store - Self-Employed.

Yes, a previous employer can disclose the reasons for your termination in Minnesota, provided the information is accurate and truthful. They cannot, however, share information that is defamatory or misleading, which can affect your future employment opportunities. Understanding this aspect becomes vital when engaging with the Minnesota Agreement and Release for Working at a Novelty Store - Self-Employed for clarity on your professional history.

In Minnesota, a former employer can discuss factual information about your employment, such as your job title, the duration of your employment, and the reason for your leaving. However, they must refrain from sharing misleading statements or opinions that could harm your reputation. It's crucial to be aware of how these factors can intertwine with the Minnesota Agreement and Release for Working at a Novelty Store - Self-Employed, ensuring your current status is clear.

The self-employment tax in Minnesota is the combined rate of Social Security and Medicare taxes for self-employed individuals. Generally, this rate is 15.3%, which includes 12.4% for Social Security and 2.9% for Medicare. If you earn above a certain threshold, you may also be subject to an additional 0.9% Medicare tax. Understanding these obligations is essential when considering the Minnesota Agreement and Release for Working at a Novelty Store - Self-Employed.

Non-compete agreements can be enforceable in Minnesota in 2024, but they must meet specific criteria. To be valid, they need to be supported by legitimate business interests and reasonable in scope and duration. Navigating the complexities of a Minnesota Agreement and Release for Working at a Novelty Store - Self-Employed can be challenging, so using a service like uslegalforms can help ensure your agreements are lawful and effective.

Yes, Minnesota does allow non-solicitation agreements, which prevent employees from soliciting clients or employees after leaving a job. These agreements must be reasonable in scope and duration to be enforceable. If you are formulating a Minnesota Agreement and Release for Working at a Novelty Store - Self-Employed, consider including a non-solicitation clause to protect your clientele and team.

As of 2024, Minnesota has introduced several employment laws affecting employee rights and benefits. These changes focus on fair wages, workplace safety, and anti-discrimination measures. For those involved in a Minnesota Agreement and Release for Working at a Novelty Store - Self-Employed, staying updated on these laws is crucial to ensure compliance and protect both employer and employee interests.

Non-disclosure agreements (NDAs) are not illegal in Minnesota; they are, in fact, commonly used to protect sensitive information. However, NDAs must be reasonable and not overly restrictive to be enforceable. If you are considering a Minnesota Agreement and Release for Working at a Novelty Store - Self-Employed, incorporating an NDA can safeguard your business's confidential details.