Minnesota Revocable Living Trust for Real Estate

Description

How to fill out Revocable Living Trust For Real Estate?

Have you ever been in a situation where you require documents for either business or personal purposes almost every day.

There are numerous legal document templates available online, but finding ones that you can trust is not easy.

US Legal Forms offers a vast array of form templates, including the Minnesota Revocable Living Trust for Real Estate, which can be tailored to fulfill state and federal requirements.

Once you find the appropriate form, click Buy now.

Select the pricing plan you prefer, provide the required information to set up your account, and pay for the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Minnesota Revocable Living Trust for Real Estate template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

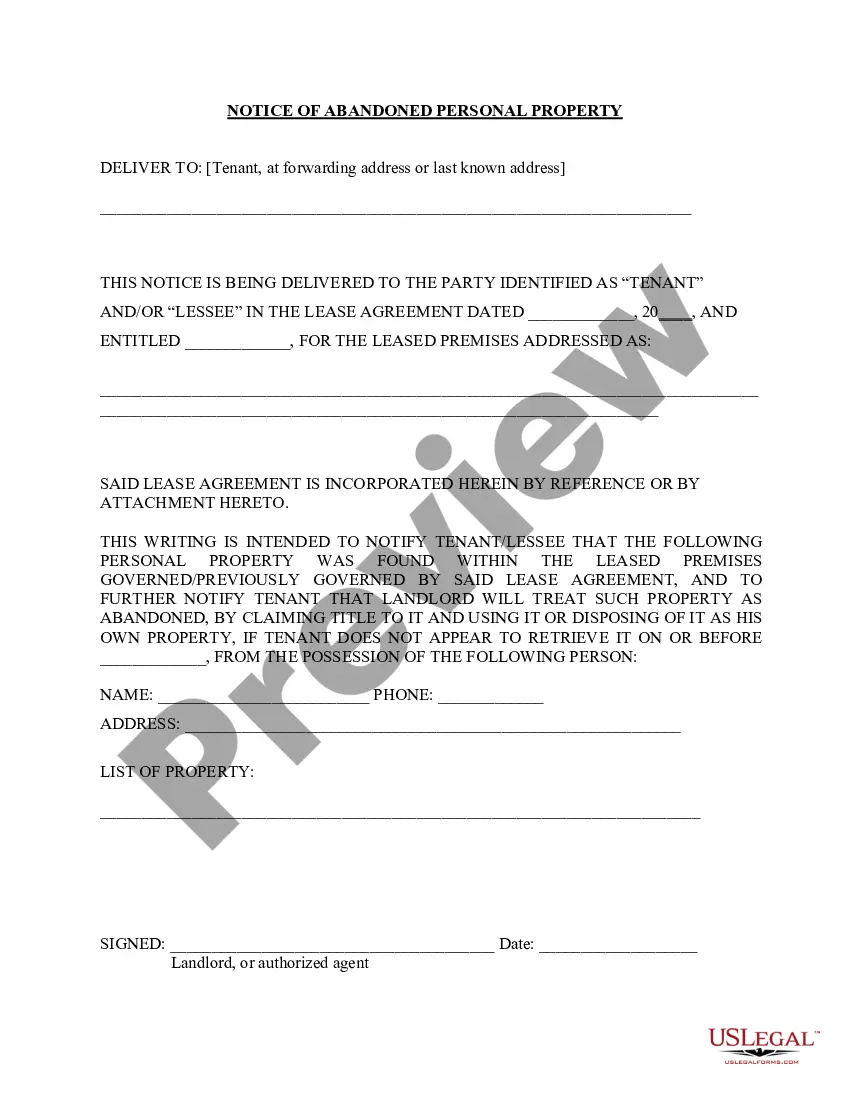

- Use the Preview function to examine the document.

- Review the description to confirm you have chosen the correct form.

- If the form is not what you are looking for, use the Search area to find a form that meets your needs.

Form popularity

FAQ

A revocable trust in Minnesota is a legal document that allows you to manage your assets while you are alive and dictate how they will be distributed after your death. Specifically, a Minnesota Revocable Living Trust for Real Estate enables you to place real estate properties into the trust, ensuring a seamless transition for your heirs. You can modify or revoke the trust at any point, providing flexibility as your needs change. This approach simplifies estate planning and helps protect your assets.

For managing real estate, a Minnesota Revocable Living Trust for Real Estate is often considered the best option. This type of trust allows for flexibility during your lifetime, enabling you to make changes as needed. It also simplifies the transfer of property upon your passing, preventing the challenges of probate. Choosing the right trust can significantly streamline your estate planning process.

While a Minnesota Revocable Living Trust for Real Estate offers many benefits, it also has some disadvantages. One key drawback is that assets placed in this trust still remain part of your taxable estate. Additionally, a revocable trust does not provide protection from creditors, which could leave your real estate vulnerable. Understanding these aspects can help you make informed decisions about your estate planning.

While a revocable trust offers many benefits, it does come with some drawbacks. One significant downside is that assets in a Minnesota Revocable Living Trust for Real Estate do not provide tax benefits during your lifetime. Additionally, because you retain control of the assets, they are still subject to creditors. It's essential to weigh these considerations against the advantages of avoiding probate and maintaining privacy.

To establish a living trust, you begin by determining the assets you wish to include, particularly your real estate holdings. Then, draft the trust document that outlines your wishes, or use platforms like USLegalForms for assistance. After creating the trust, remember to transfer ownership of your assets into the trust. This transition is essential to ensure your Minnesota Revocable Living Trust for Real Estate operates effectively and according to your wishes.

To record a certificate of trust in Minnesota, you typically need to file it with the county where the real estate is located. This involves providing the necessary documentation and paying any applicable fees. When managing a Minnesota Revocable Living Trust for Real Estate, consider this step to ensure that the trust's authority is recognized by relevant entities.

Trusts themselves are generally not recorded in Minnesota, making them private documents. This means details of the trust remain confidential and are only disclosed as needed. If you establish a Minnesota Revocable Living Trust for Real Estate, this privacy can help shield your assets from public scrutiny.

In Minnesota, a certificate of trust does not typically need to be recorded with public authorities. However, it is important to present it to the institutions or parties involved, such as banks or title companies, when dealing with trust assets. Utilizing a Minnesota Revocable Living Trust for Real Estate can streamline asset management, making handling financial matters simpler.

A trust is a legal entity created to hold and manage your assets, including real estate, for the benefit of designated beneficiaries. In contrast, a certificate of trust is a document that summarizes the trust's existence, details, and authority of the trustee without exposing the entire trust document. When considering a Minnesota Revocable Living Trust for Real Estate, understanding this difference helps in determining how to manage and protect your assets.