Minnesota Sample Letter for Agreement to Extend Debt Payment

Description

How to fill out Sample Letter For Agreement To Extend Debt Payment?

If you want to finish, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms, accessible online.

Leverage the site’s straightforward and convenient search to find the documents you need.

A variety of templates for business and personal purposes are sorted by categories and states, or keywords.

Every legal document template you obtain is yours permanently. You have access to every form you downloaded with your account. Click on the My documents section and choose a form to print or download again.

Complete and download, and print the Minnesota Sample Letter for Agreement to Extend Debt Payment with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Use US Legal Forms to acquire the Minnesota Sample Letter for Agreement to Extend Debt Payment with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to get the Minnesota Sample Letter for Agreement to Extend Debt Payment.

- You can also access forms you previously downloaded from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

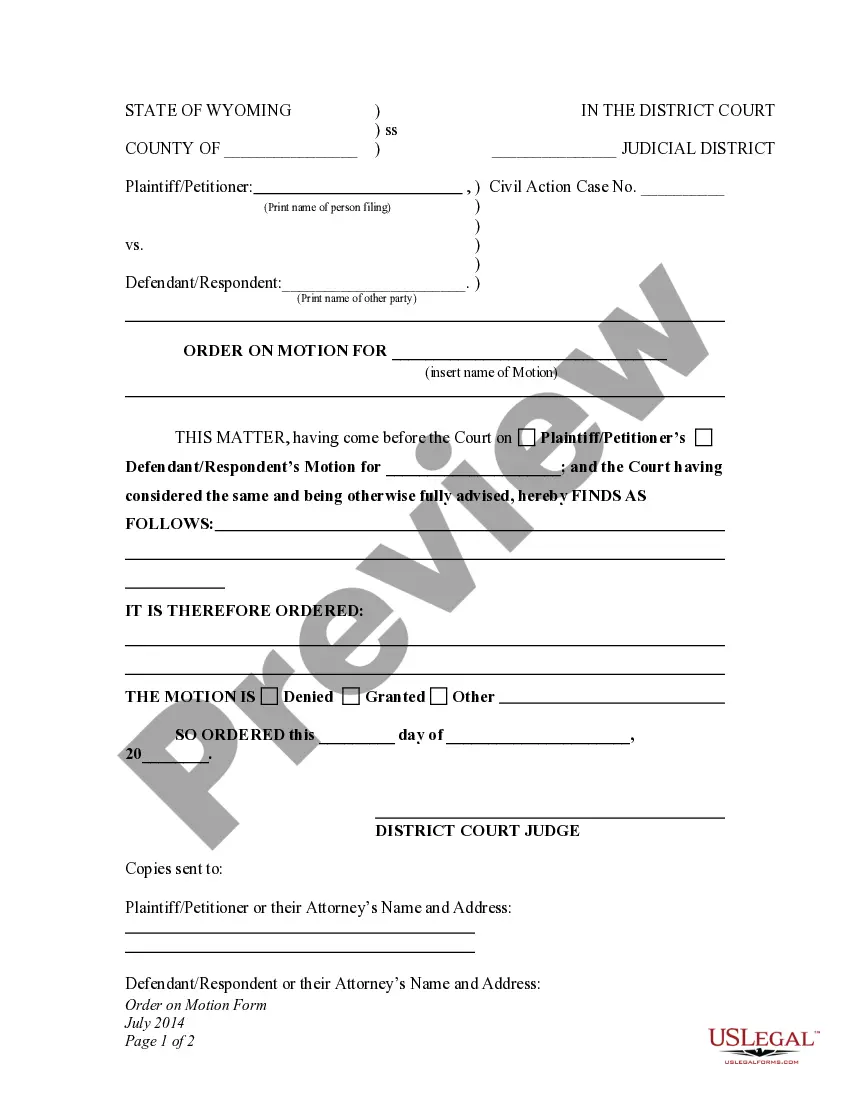

- Step 1. Ensure you have selected the form for the correct region/state.

- Step 2. Use the Review option to browse the form’s details. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Lookup field at the top of the screen to find alternative versions of the legal form template.

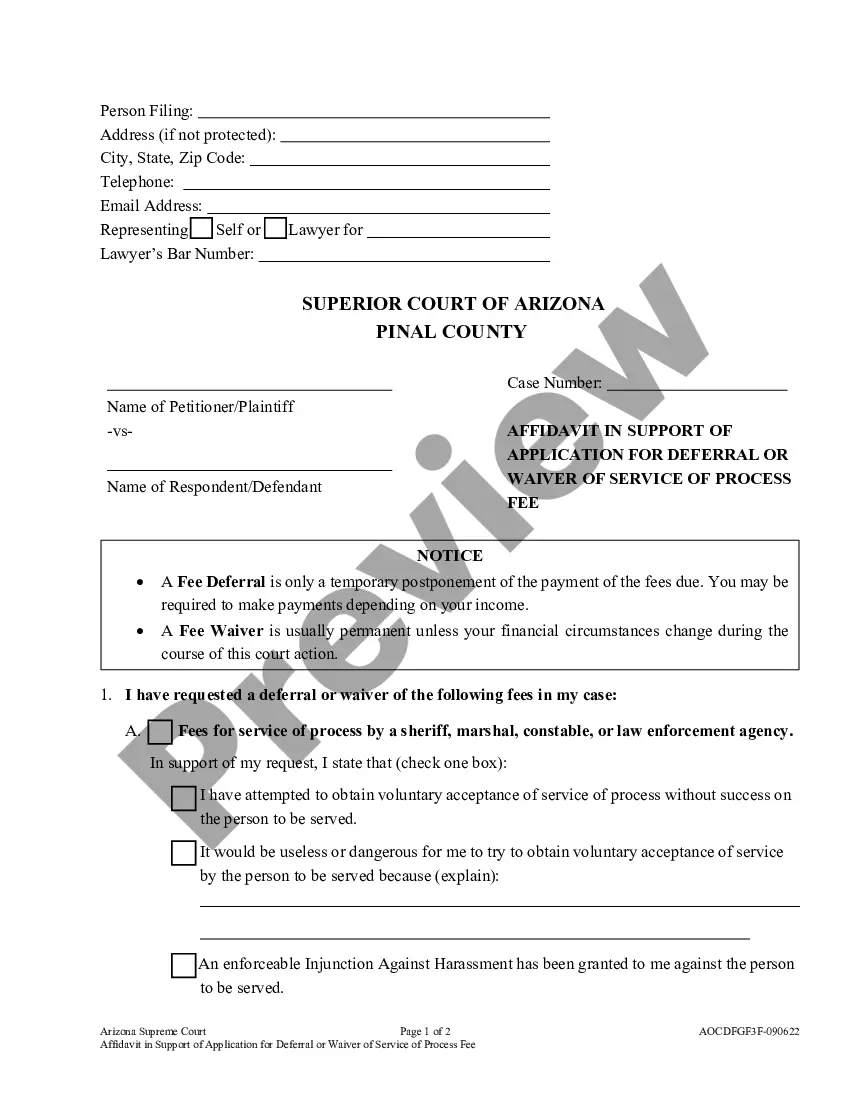

- Step 4. After locating the form you want, click the Purchase now button. Choose the pricing plan you prefer and provide your information to register for the account.

- Step 5. Process the payment. You may use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of your legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Minnesota Sample Letter for Agreement to Extend Debt Payment.

Form popularity

FAQ

A good debt settlement letter should be concise and clear, stating your intention to settle your debt and the proposed amount. Ensure you include your account details and a suitable explanation of your financial situation. For additional inspiration, use the Minnesota Sample Letter for Agreement to Extend Debt Payment as a reference.

When writing a letter for payment relief, start by introducing yourself and explaining your financial hardship. Clearly state your request for reduced payments or a temporary halt. A Minnesota Sample Letter for Agreement to Extend Debt Payment can be an excellent template to follow.

To write a debt settlement agreement, include the total debt amount, the reduced settlement figure, and the payment schedule. Both parties should sign the document to ensure mutual consent. You may refer to a Minnesota Sample Letter for Agreement to Extend Debt Payment for clarity.

Typically, a settlement offer ranges from 30% to 70% of the total debt, depending on your financial situation and the creditor’s policies. It's wise to start with a lower percentage and negotiate up if needed. For tailored advice, consider the Minnesota Sample Letter for Agreement to Extend Debt Payment.

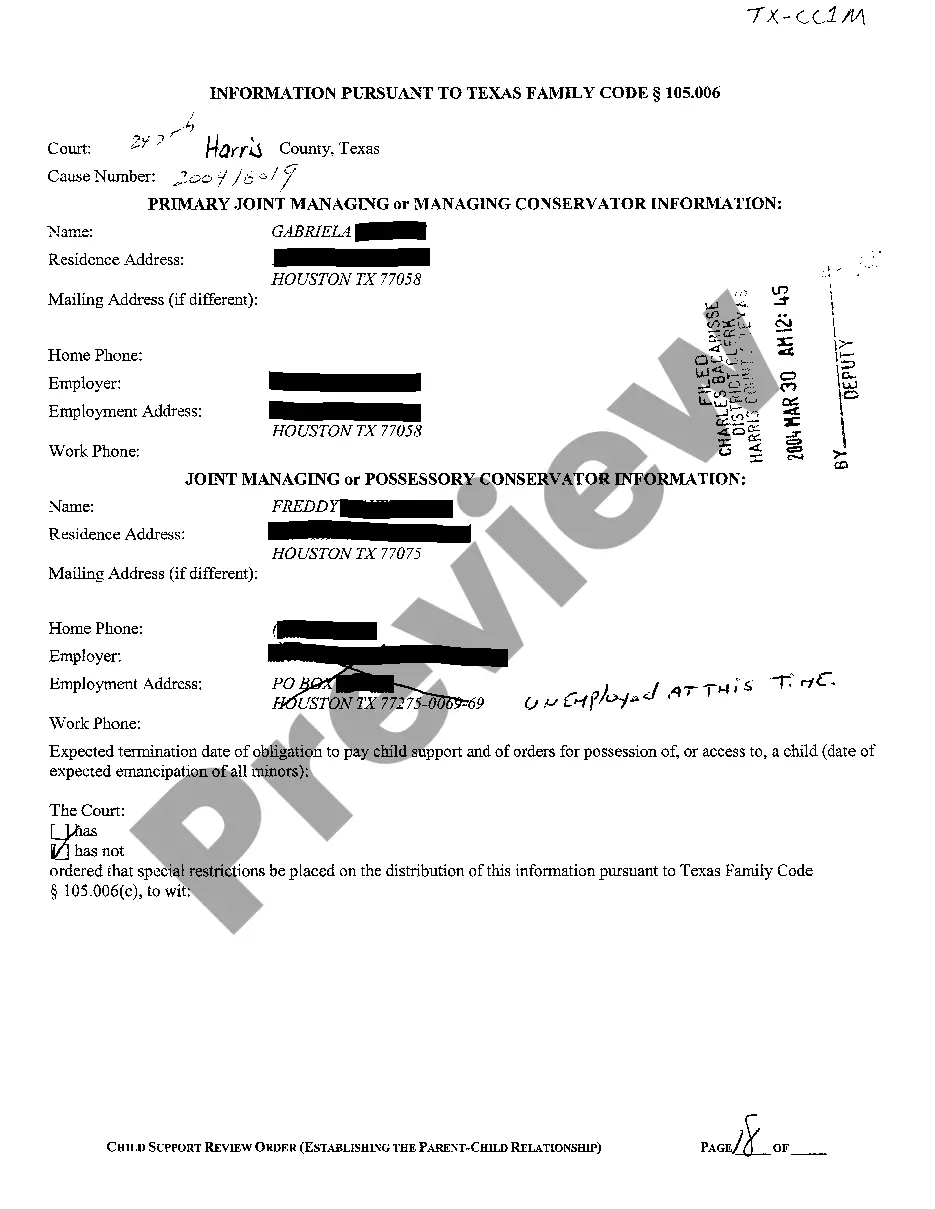

A debt agreement should clearly outline the terms of repayment, including amounts and deadlines. Make sure to include both parties' contact information and signatures. For format and content guidance, the Minnesota Sample Letter for Agreement to Extend Debt Payment can serve as a valuable resource.

A good settlement offer should be realistic and reasonable, aiming for a win-win scenario. Begin by detailing the debt and your current financial position. It may be helpful to use the Minnesota Sample Letter for Agreement to Extend Debt Payment as a guideline.

Writing a settlement agreement involves clearly stating the terms and conditions to resolve a debt. Start with the parties involved, outline the debt amount, and specify the agreed-upon payment plan. For a clear example, you can refer to a Minnesota Sample Letter for Agreement to Extend Debt Payment.

Begin your letter by clearly stating your intention to request a payment arrangement. Include details like your account number and a brief explanation of your current situation. To strengthen your request, consider incorporating a Minnesota Sample Letter for Agreement to Extend Debt Payment as a reference.

Writing a payment plan agreement involves outlining the total amount owed, payment schedule, and any conditions tied to the agreement. Be clear and concise while stating the responsibilities of both parties, which helps avoid misunderstandings. Including a practical template can streamline the process, making it easier to adhere to the agreed terms. For this purpose, a Minnesota Sample Letter for Agreement to Extend Debt Payment serves as a valuable resource.

A debt agreement can be a beneficial option if you find yourself unable to meet your payment obligations. By formally extending your payment terms, you can manage your financial situation more effectively. It allows you to negotiate with creditors for a plan that you can afford, reducing stress. Using a Minnesota Sample Letter for Agreement to Extend Debt Payment can simplify this process.