Minnesota Guaranty of Open Account - Alternate Form

Description

How to fill out Guaranty Of Open Account - Alternate Form?

Are you currently in a location where you need paperwork for either business or personal reasons almost all the time.

There are numerous legal document templates available online, but finding ones you can trust isn't straightforward.

US Legal Forms offers a vast collection of form templates, such as the Minnesota Guaranty of Open Account - Alternate Form, designed to meet state and federal regulations.

When you find the correct form, click on Buy Now.

Choose the pricing plan you want, enter the required information to create your account, and complete the purchase with your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Minnesota Guaranty of Open Account - Alternate Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your correct area/region.

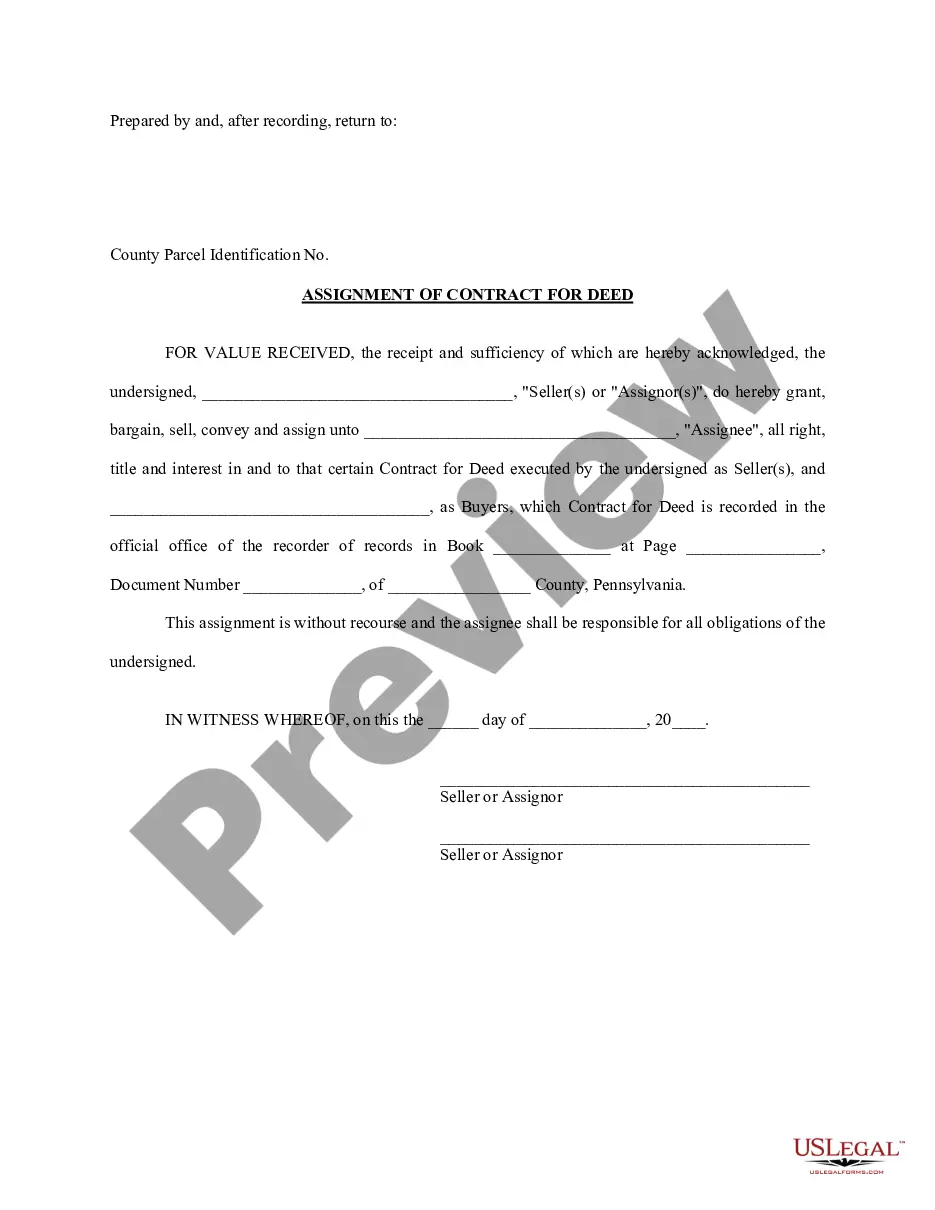

- Utilize the Preview feature to examine the form.

- Read the description to confirm that you have selected the right form.

- In case the form isn't what you require, use the Search section to find the form that suits you and your needs.

Form popularity

FAQ

In West Virginia, all licensed insurance companies must participate in the West Virginia insurance guaranty association. This requirement ensures that policyholders receive protection in case an insurer becomes insolvent. By participating, companies help maintain trust and stability within the insurance market. If you are exploring coverage options like the Minnesota Guaranty of Open Account - Alternate Form, consider how local regulations can affect your choices.

Originally, the funding for insurance guaranty associations stemmed from assessments on insurance companies and any surplus from previous years. This system allows the Minnesota Guaranty of Open Account - Alternate Form to maintain its operational capabilities. Over the years, these funding methods have evolved to ensure adequate coverage for policyholders. Understanding this structure can help you appreciate the safety provided by such associations.

Guardianship in Minnesota provides support to adults with mental illness who cannot make decisions regarding their care and finances. The Minnesota Guaranty of Open Account - Alternate Form can play a role when financial decisions intersect with insurance matters. This legal arrangement ensures that individuals receive necessary assistance while protecting their rights. If you're navigating these issues, seeking guidance on the insurance angle is essential.

The Minnesota Guaranty of Open Account - Alternate Form primarily receives its funding through assessments on licensed insurance companies. This funding helps cover claims when an insurance company becomes insolvent. As policyholders, you can trust that these funds are in place to protect your interests. Additionally, the structure of the funding ensures stability for the association.

An insurer can promote its membership in the Minnesota Insurance Guaranty Association once it has been officially recognized as a member. This advertisement can help build trust and reassure potential clients that the insurer is reputable and backed by a protective system like the Minnesota Guaranty of Open Account - Alternate Form. Transparency in these advertisements enhances consumer confidence and highlights the insurer’s commitment to stability.

The Minnesota Insurance Guaranty Association acts as a safety net for policyholders, ensuring they do not suffer losses when their insurers go bankrupt. MIGA covers various types of insurance, including liability and property policies. By offering the Minnesota Guaranty of Open Account - Alternate Form, MIGA plays a crucial role in maintaining stability within the insurance market, protecting both consumers and businesses alike.

The Minnesota Insurance Guarantee Association (MIGA) offers protection to policyholders in the event that their insurance company becomes insolvent. This means that if your insurer cannot fulfill its obligations, MIGA ensures you receive the benefits promised in your policy, including the Minnesota Guaranty of Open Account - Alternate Form. This valuable service safeguards consumers from unexpected losses and provides peace of mind.

The purpose of the Minnesota Life and Health Insurance Guaranty Association is to protect policyholders by providing benefits in the event that a member insurance company becomes insolvent. This protection encompasses life, health, and annuity policies, ensuring that individuals are not left without coverage. By utilizing resources like the Minnesota Guaranty of Open Account - Alternate Form, consumers can understand their rights and options when it comes to insurance security.

The Life and Health Insurance Guaranty Association was funded through a series of assessments imposed on licensed life and health insurance companies in Minnesota. This structure allows the association to generate sufficient resources to cover claims from insolvent insurers. Understanding the funding process, such as that outlined in the Minnesota Guaranty of Open Account - Alternate Form, can empower consumers to make informed insurance choices.

The Minnesota Insurance Guaranty Association obtains its funding from contributions made by licensed insurance carriers within the state. These contributions help create a financial safety net that protects policyholders when their insurance provider cannot meet its obligations. In relation to the Minnesota Guaranty of Open Account - Alternate Form, this funding structure is designed to provide peace of mind and support to consumers.