Minnesota Corporate Resolution for EIDL Loan

Description

How to fill out Corporate Resolution For EIDL Loan?

You might spend hours online looking for the legal document template that suits the state and federal requirements you need.

US Legal Forms provides thousands of legal templates that have been reviewed by professionals.

You can obtain or print the Minnesota Corporate Resolution for EIDL Loan from the platform.

If available, use the Preview button to view the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- Subsequently, you can fill out, modify, print, or sign the Minnesota Corporate Resolution for EIDL Loan.

- Every legal document template you purchase is yours forever.

- To get another copy of a purchased form, go to the My documents section and click the relevant button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, make sure you have chosen the correct document template for your county/city of preference.

- Examine the form description to ensure you have selected the right form.

Form popularity

FAQ

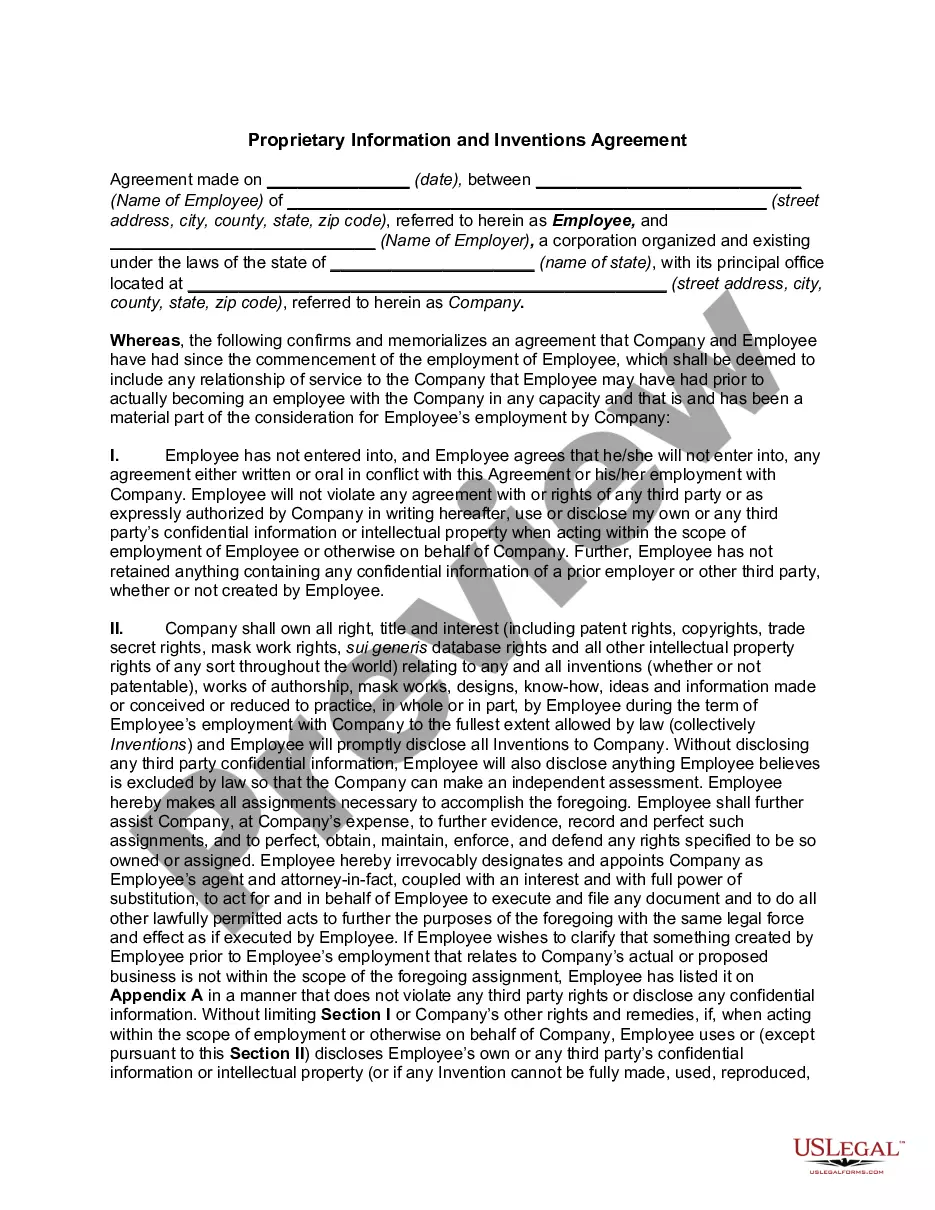

The EIDL documents require a Board Resolution to be submitted within 6 months of loan disbursement. Proof of Hazard insurance is due within 1 year of loan disbursement.

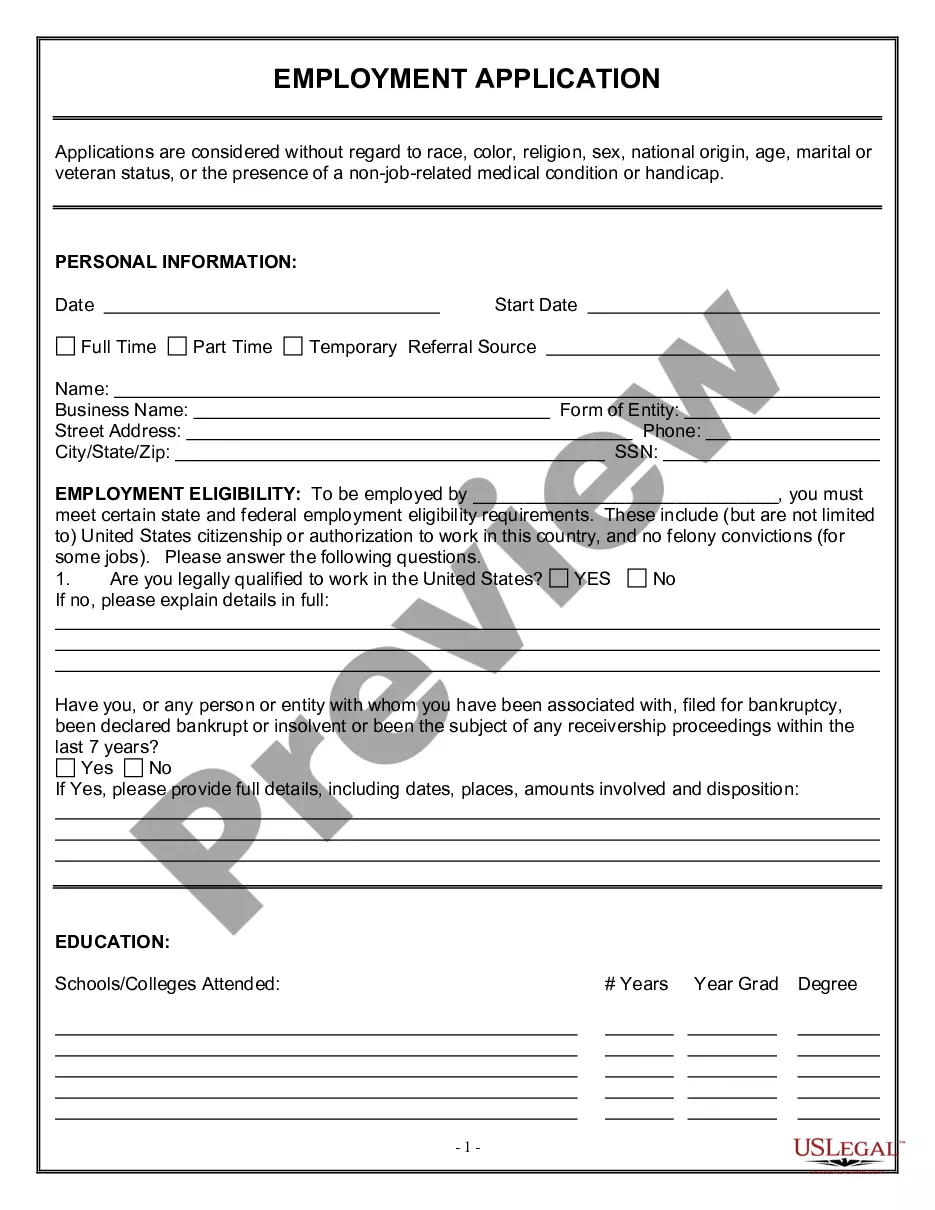

EIDL Filing RequirementsElectronic Loan Application (SBA Form 5C) Sole Proprietorship Only 3. Tax Authorization (IRS Form 4506-T) 20% Owners/GP/50% Affiliate 4. Most recent 3 Years of Business Tax Return(s) 5. Personal Financial Statement (SBA Form 413) 20% Owners/GP 6.

Do You Need an Audit on Your COVID Small Business Loan? But if you got an EIDL (Economic Impact Disaster Loan) the answer is yes. The answer is yes only if your loan is equal or greater than $750,000.

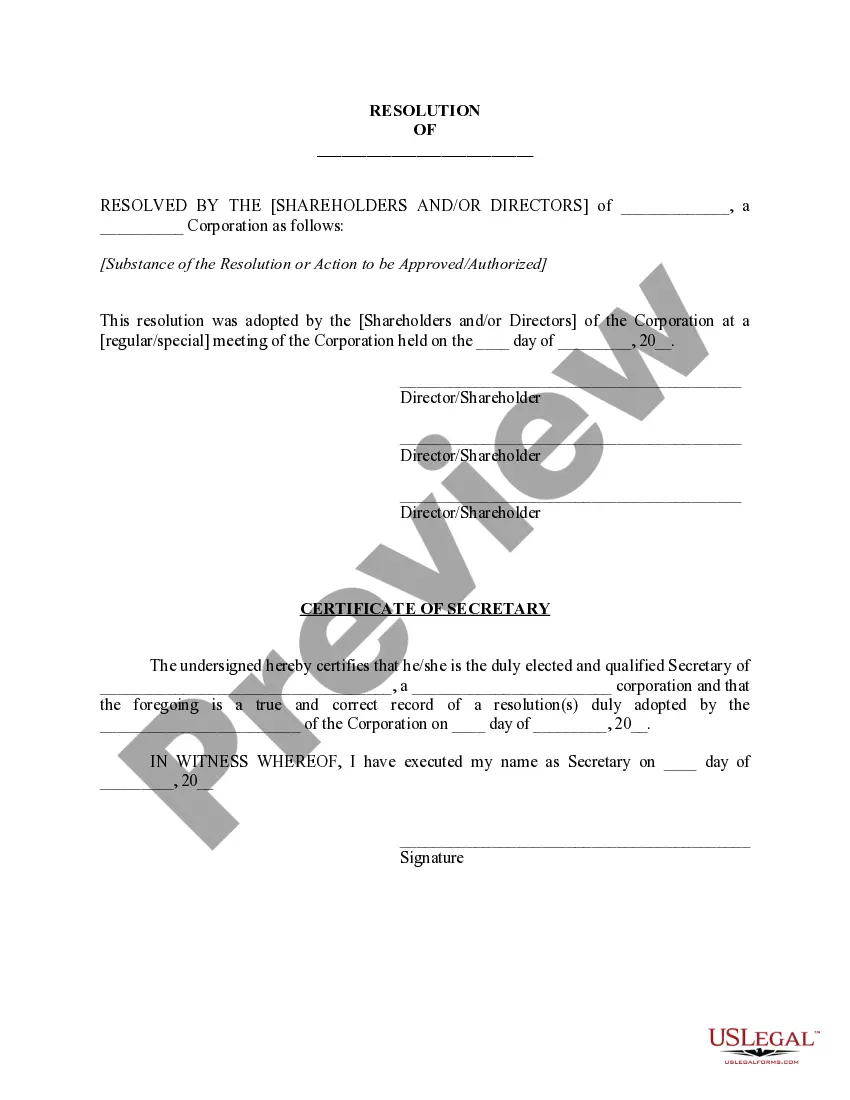

A certified board resolution is a written document that provides an explanation of the actions of a company's board of directors that has been verified by the secretary of the organization and approved by the board's president.

Remember, EIDL loans cannot for forgiven. EIDL grants are automatically forgiven, provided you use the funds on approved expenses.

EIDL Filing RequirementsElectronic Loan Application (SBA Form 5C) Sole Proprietorship Only 3. Tax Authorization (IRS Form 4506-T) 20% Owners/GP/50% Affiliate 4. Most recent 3 Years of Business Tax Return(s) 5. Personal Financial Statement (SBA Form 413) 20% Owners/GP 6.

SBA Form 160, Resolution of Board of Directors is a form issued by the Small Business Administration (SBA) and filed with SBA Business Expansion loans - including Direct, Guaranteed, or Participation loans.

The US Small Business Administration (SBA) has extended the deferment period for COVID-19 Economic Injury Disaster Loan (EIDL) payments for the third time in 12 months.

The SBA imposes strict record-keeping requirements on EIDL borrowers. They must keep itemized receipts showing how they spend the loan funds. A full set of financial statements are required to be furnished to the SBA each year.

EIDL Loan Forgiveness. EIDL loans cannot be forgiven. EIDL loans do have a deferment period, however. Loans made during the 2020 calendar year have a 24-month deferment window from the date of the note.