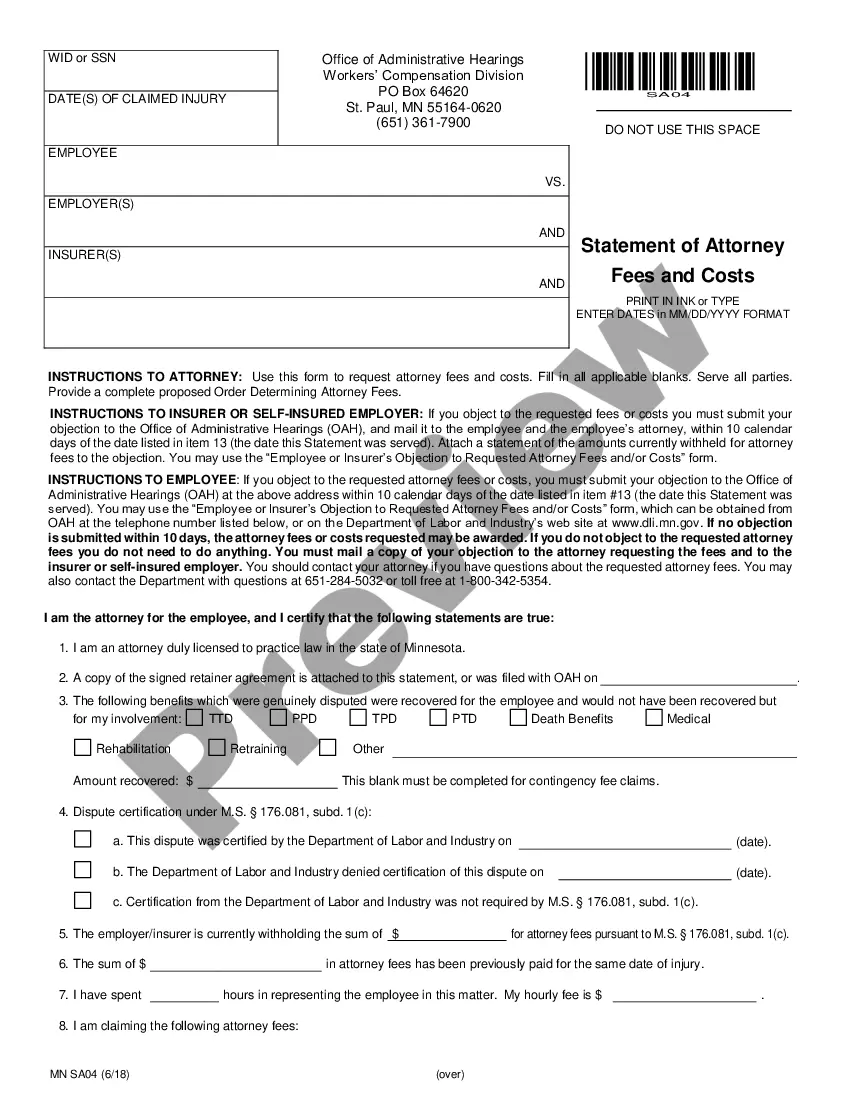

The Minnesota Statement of Attorney Fees and Costs is a document used by attorneys to provide a detailed record of the fees and costs associated with a legal case. This document is required by the Minnesota Rules of Professional Conduct when attorneys enter into a fee arrangement with a client. It must be signed by both the lawyer and the client and is used to track the attorney’s expenses, including court costs, filing fees, research costs, and other related expenses. It also outlines the attorney’s fee and how it will be paid. The Minnesota Statement of Attorney Fees and Costs can come in two forms: a fixed fee arrangement or an hourly fee arrangement. In a fixed fee arrangement, the attorney charges a one-time fee for their services, and in an hourly fee arrangement, the attorney charges an hourly rate for their services. In either case, the attorney must include a detailed breakdown of their fees and costs in the Minnesota Statement of Attorney Fees and Costs.

Minnesota Statement of Attorney Fees and Costs

Description

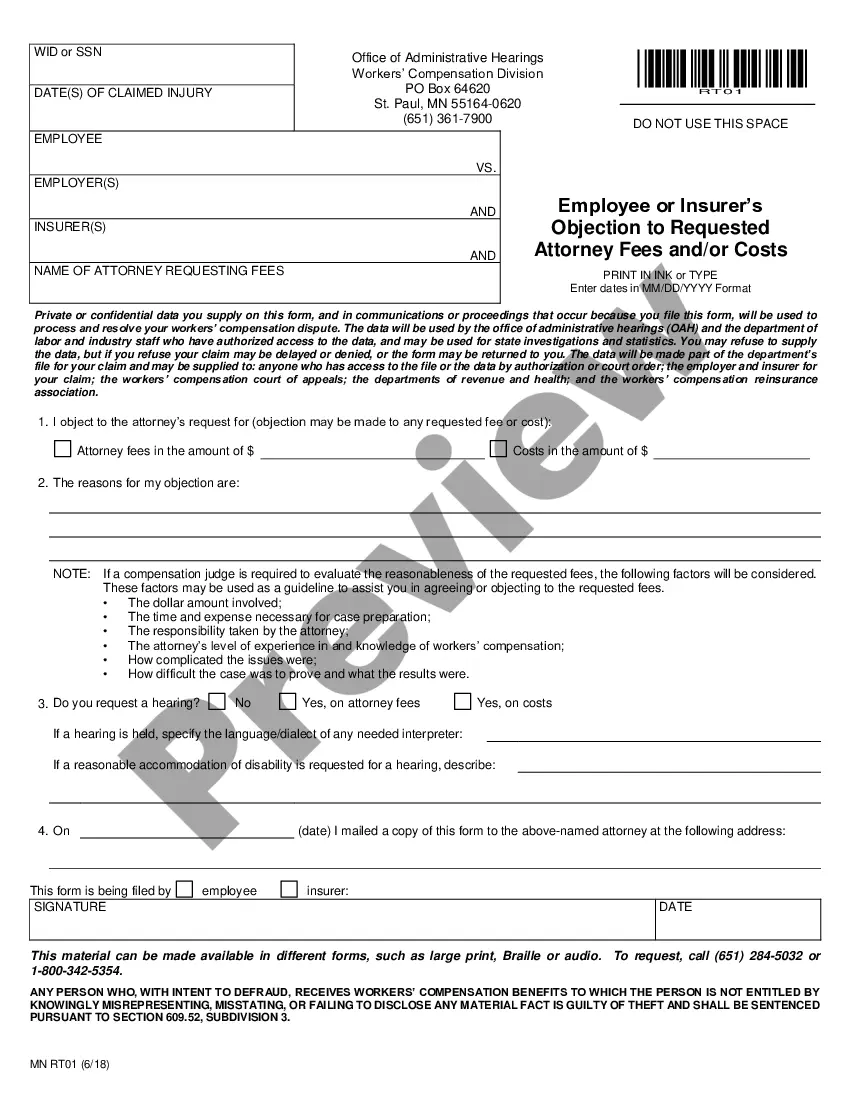

How to fill out Minnesota Statement Of Attorney Fees And Costs?

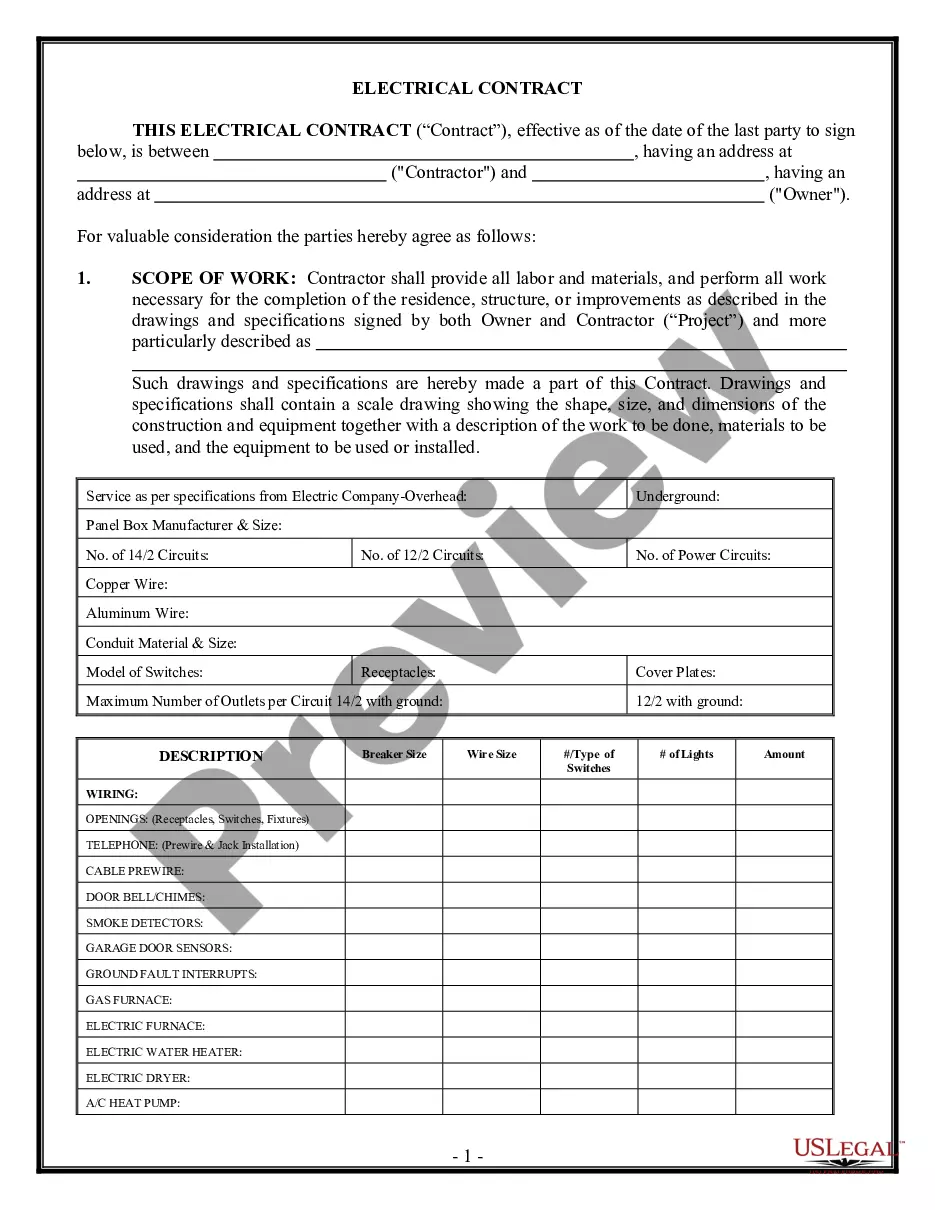

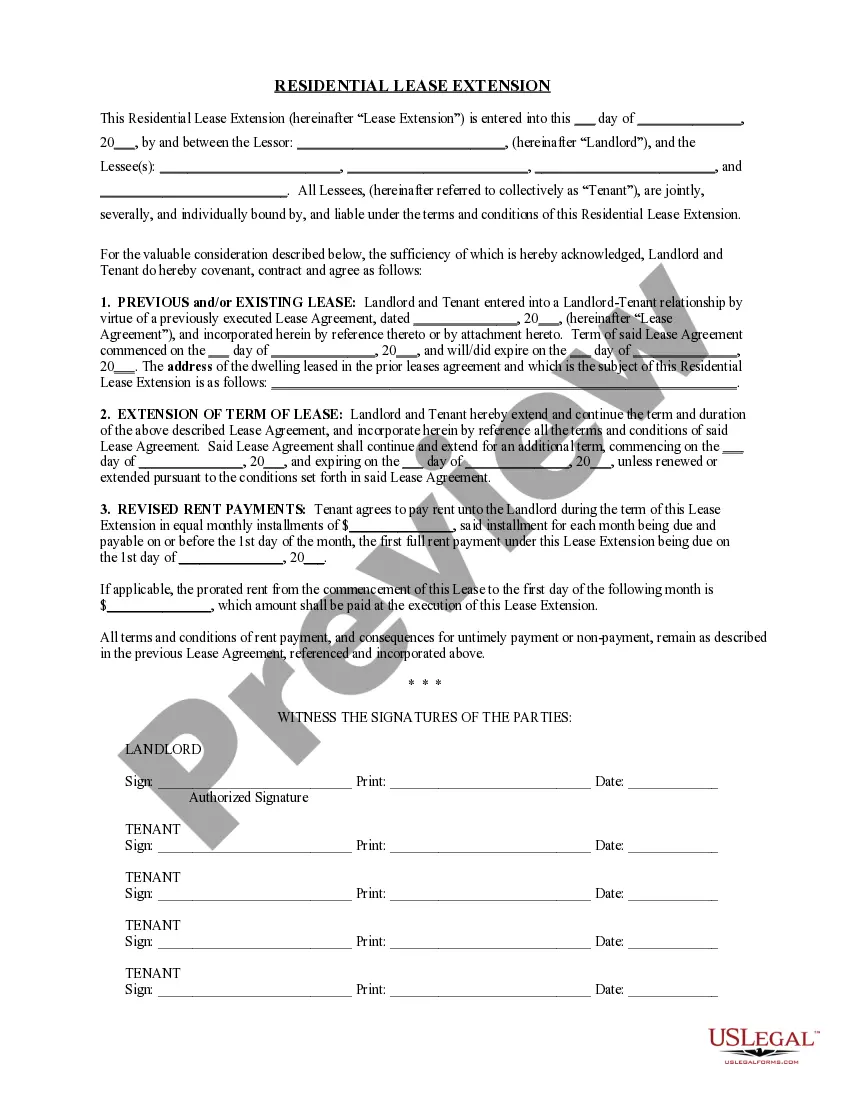

How much duration and resources do you typically allocate for creating formal documents.

There’s a better approach to obtaining such forms than employing legal professionals or squandering hours browsing the internet for an appropriate template.

Click Buy now once you identify the correct document. Choose the subscription plan that suits you best to access our library’s full capabilities.

Create an account and settle your subscription fee. You can process a payment with your credit card or via PayPal - our service is entirely secure for that.

- US Legal Forms is the premier online library that provides expertly crafted and validated state-specific legal papers for any purpose, such as the Minnesota Statement of Attorney Fees and Costs.

- To obtain and fill out a suitable Minnesota Statement of Attorney Fees and Costs template, follow these simple steps.

- Review the form content to ensure it aligns with your state regulations. To do this, read the form description or utilize the Preview option.

- If your legal template does not fulfill your requirements, seek a different one using the search tab at the top of the page.

- If you already possess an account with us, Log In and download the Minnesota Statement of Attorney Fees and Costs.

- If not, proceed to the subsequent steps.

Form popularity

FAQ

When inquiring about attorney fees, it’s best to be direct and clear about your concerns. Start by asking for a breakdown of the costs and what services those fees cover. You can also request a Minnesota Statement of Attorney Fees and Costs to better understand any potential expenses. Many attorneys, including those associated with uslegalforms, are happy to provide this information to ensure you feel informed and comfortable.

Attorney fees refer to the payments made for the legal services provided by an attorney, while costs encompass additional expenses incurred during the legal process, such as filing fees and court costs. Understanding the distinction between these two components is crucial for clients, as both are documented in the Minnesota Statement of Attorney Fees and Costs. This clarity helps clients manage their legal expenses more effectively.

An affidavit for attorney fees is a sworn statement that outlines the fees charged by an attorney for legal services rendered. This document is often required in court cases to justify the attorney's costs and provide a formal record of expenses. Utilizing a Minnesota Statement of Attorney Fees and Costs helps in preparing this affidavit, ensuring all necessary details are accurately reflected.

Rule 119.05 in Minnesota establishes guidelines for the documentation of attorney fees and costs in legal proceedings. This rule requires attorneys to provide a Minnesota Statement of Attorney Fees and Costs, detailing the charges incurred during a case. By adhering to these guidelines, clients receive clear insights into the financial aspects of their legal representation, ensuring transparency and accountability.

Yes, you can write off attorney and court fees in certain situations. If these costs relate to a business or income-producing activity, they may be deductible. However, personal legal fees generally do not qualify for a deduction. For specific guidance, consider reviewing the Minnesota Statement of Attorney Fees and Costs to understand your options.

The rule allows the court to require additional materials in any case where appropriate. This rule is not intended to limit the court's discretion, but is intended to encourage streamlined handling of fee applications and to facilitate filing of appropriate support to permit consideration of the issues.

It may be as low as $500 or as high as $5,000 or more. Some attorneys base retainer fees on their hourly rate multiplied by the number of hours that they anticipate your case will take. Once your attorney begins work on your case, he or she subtracts the time that he or she put into the case from your retainer.

In the United States, the general rule, which derives from common law, is that each side in a legal proceeding pays for its own attorney. There are many exceptions, however, in which federal courts, and occasionally federal agencies, may order the losing party to pay the attorneys' fees of the prevailing party.

The ?American Rule? requires each party to bear its own attorney's fees in litigation absent a statutory or contractual exception. i Fee-shifting provisions are the exceptions to that general rule.

The hourly fee attorneys charge could range from as low as $50 or $100 per hour to as high as several thousand dollars per hour for specialized legal work performed by a top professional. ing to the Clio 2022 Legal Trends Report, the average attorney hourly rate was $313.00 in 2022.