Minnesota Nonprofit Articles of Organization For Limited Liability Company is a document that is required by law to be filed in order to form a Minnesota nonprofit limited liability company (LLC). This document outlines the purpose of the organization, names of the registered agents, and the names and addresses of the members. It also provides information regarding the management of the LLC, including the number of members, the rights and duties of the members, and the power of the LLC to enter into contracts. Additionally, the Articles of Organization must be submitted to the Minnesota Secretary of State in order to be legally recognized. There are two types of Minnesota Nonprofit Articles of Organization For Limited Liability Company: Articles of Organization for Nonprofit Corporation and Articles of Organization for Nonprofit Limited Liability Company.

Minnesota Nonprofit Articles of Organization For Limited Liability Company

Description

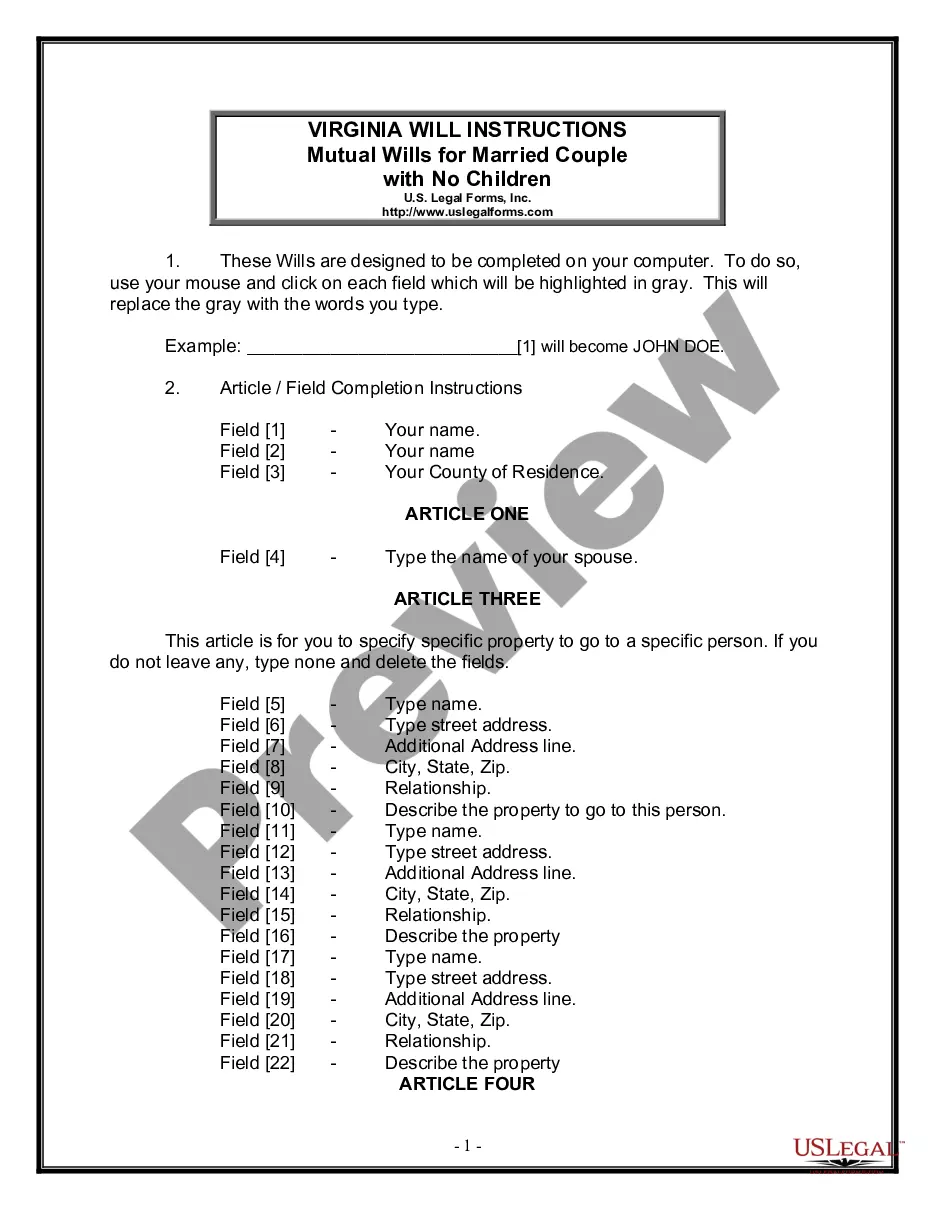

How to fill out Minnesota Nonprofit Articles Of Organization For Limited Liability Company?

If you’re looking for a way to appropriately prepare the Minnesota Nonprofit Articles of Organization For Limited Liability Company without hiring a lawyer, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reputable library of official templates for every individual and business scenario. Every piece of documentation you find on our online service is created in accordance with nationwide and state regulations, so you can be certain that your documents are in order.

Adhere to these simple guidelines on how to acquire the ready-to-use Minnesota Nonprofit Articles of Organization For Limited Liability Company:

- Make sure the document you see on the page meets your legal situation and state regulations by examining its text description or looking through the Preview mode.

- Type in the document title in the Search tab on the top of the page and choose your state from the dropdown to locate an alternative template if there are any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Create an account with the service and select the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The blank will be available to download right after.

- Decide in what format you want to get your Minnesota Nonprofit Articles of Organization For Limited Liability Company and download it by clicking the appropriate button.

- Upload your template to an online editor to complete and sign it quickly or print it out to prepare your paper copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you purchased - you can find any of your downloaded blanks in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

The LLC operating agreement, also known as an LLC agreement, establishes the rules and structure for the LLC and can help address any issues that arise during business operations. Most states have default provisions that address many of these difficulties, but the operating agreement can override these presumptions.

Minnesota LLC members must pay federal income tax at the 15.3% self-employment rate plus state income tax at a graduated rate. Minnesota collects a state sales tax of 6.875%, and most municipalities also levy a local sales tax.

A Minnesota LLC isn't legally obligated to have an operating agreement. Minnesota Statute § 322C. 0110 outlines what an operating agreement may cover but doesn't state that LLCs must have one.

You can be your own Registered Agent in Minnesota if: you are a resident of Minnesota, and. you have a physical street address in Minnesota.

A limited liability company is a nonprofit limited liability company if it is organized under or governed by this chapter and its articles of organization state that it is a nonprofit limited liability company governed by this section.

To protect the business' limited liability status: Operating agreements give members protection from personal liability to the LLC. Without this specific formality, your LLC can closely resemble a sole proprietorship or partnership, jeopardizing your personal liability.

How to Apply. An organization must apply to the Minnesota Department of Revenue for authorization, known as Nonprofit Exempt Status. For more information, see the Nonprofit Organizations Industry Guide. To apply for Nonprofit Exempt Status, submit Form ST16, Application for Nonprofit Exempt Status ? Sales Tax (PDF).

LLCs are typically created to generate profits, while nonprofits are established to serve a specific public mission, such as charitable, educational, or religious purposes. In terms of teams, LLCs have owners known as members who share in profits and losses, while a board of directors governs nonprofits.