Minnesota Warranty Deed for Husband and Wife Converting Property from Tenants in Common to Joint Tenancy

Description

Key Concepts & Definitions

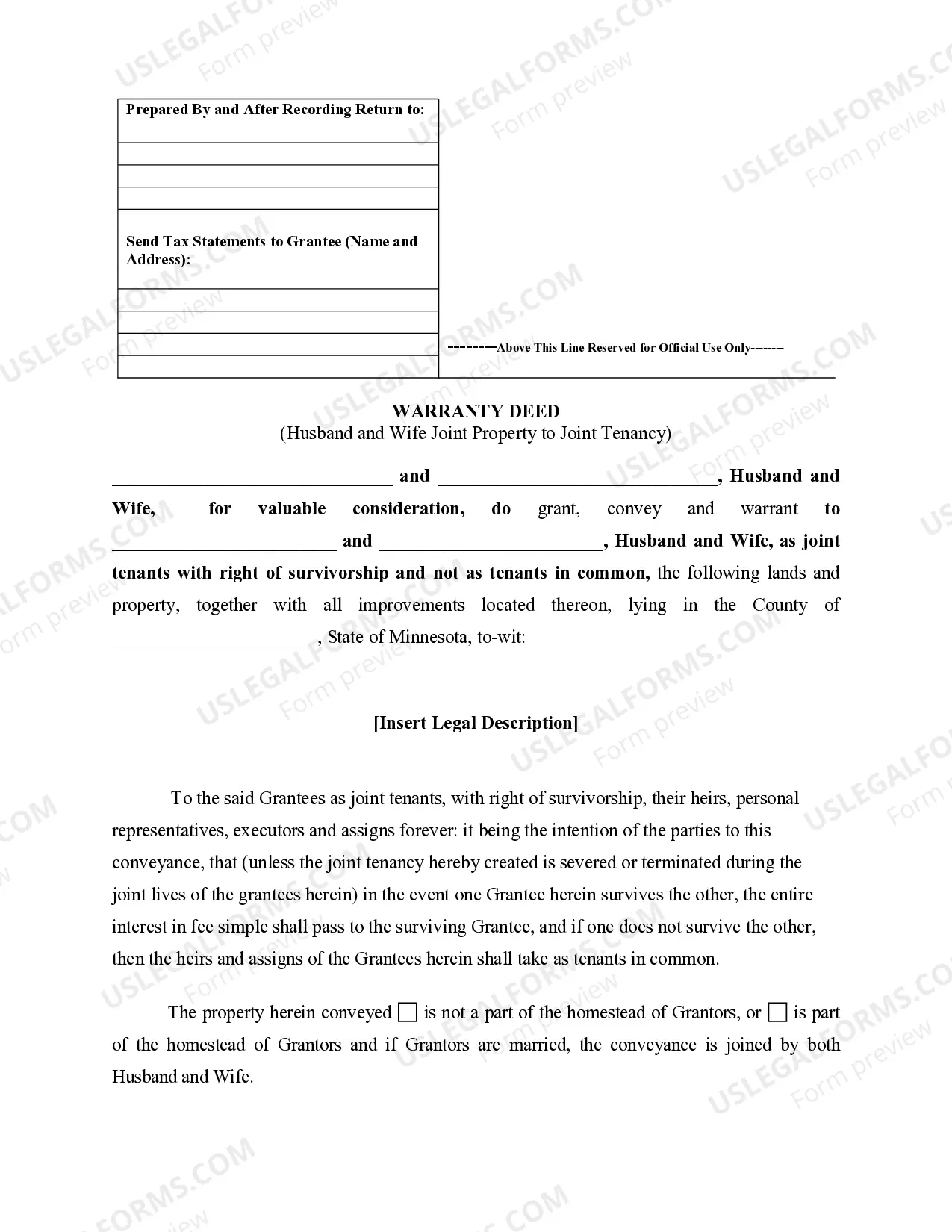

A warranty deed is a legal document that guarantees a clear title to the buyer of real property. Specifically, when discussing a warranty deed for husband and wife converting, this refers to a case where a property owned by one spouse is transformed into jointly owned property, ensuring both husband and wife have equal rights and interests in the property.

Step-by-Step Guide

- Review Current Ownership: Assess who currently holds the title to the property.

- Consult with a Real Estate Attorney: Get professional advice to understand local laws and implications.

- Prepare the Warranty Deed: The deed should include names of both spouses, legal description of the property, and the statement indicating the transfer.

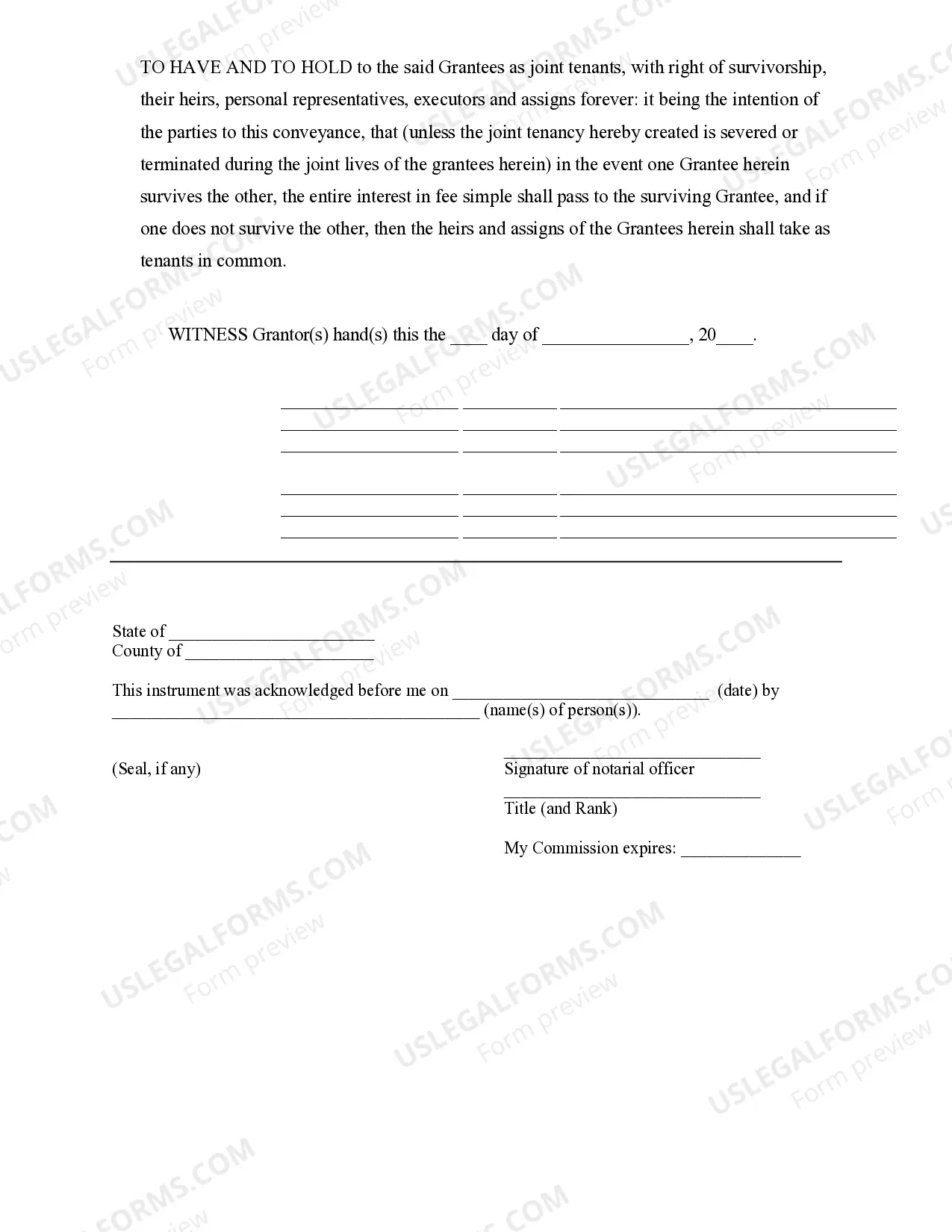

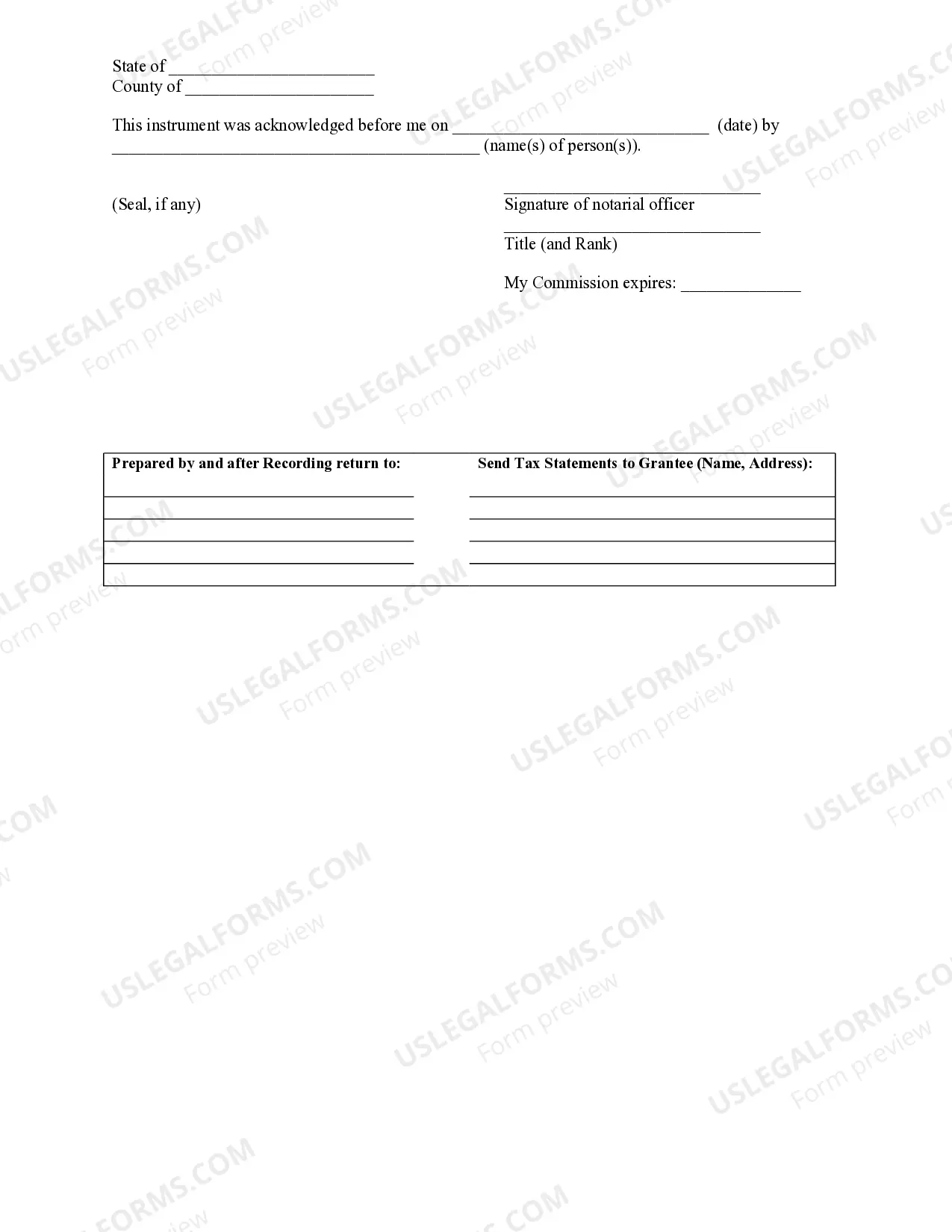

- Signature and Notarization: Both spouses must sign the deed in front of a notary.

- Record the Deed: File the signed deed with the local county recorder's office to make the transfer official and public.

Risk Analysis

Converting to a jointly owned property through a warranty deed involves risks such as potential tax implications, future liability in case of divorce or death, and loss of control over the property for the original owner. Consulting a tax advisor and attorney before proceeding is highly advised.

Pros & Cons

- Pros:

- Enhances spousal rights to property.

- Streamlines estate planning and transfer.

- Cons:

- Potential increase in liability for both spouses.

- Complications in case of relationship dissolution.

Common Mistakes & How to Avoid Them

- Not Consulting Legal Advice: Always consult with a real estate lawyer to tailor the deed according to local laws.

- Ignoring Tax Implications: Consult a tax advisor to understand how the conversion affects your tax situation.

- Inaccuracy in Document Details: Double check all legal descriptions and personal details in the deed to avoid future disputes.

FAQ

- What happens if one spouse dies? With most jointly owned property, the surviving spouse typically receives full ownership, avoiding probate. However, specifics can vary by state.

- Can a warranty deed be revoked? Once a warranty deed is executed and recorded, it cannot be revoked without the consent of both parties.

Summary

Converting property to joint ownership using a warranty deed for husband and wife optimizes estate planning and strengthens spousal entitlements to property. However, it also involves certain risks and complexities that should be navigated with professional advice.

How to fill out Minnesota Warranty Deed For Husband And Wife Converting Property From Tenants In Common To Joint Tenancy?

Among numerous paid and free samples that you’re able to get on the net, you can't be certain about their reliability. For example, who created them or if they are skilled enough to take care of the thing you need those to. Always keep calm and make use of US Legal Forms! Get Minnesota Warranty Deed for Husband and Wife Converting Property from Tenants in Common to Joint Tenancy templates made by skilled legal representatives and prevent the expensive and time-consuming procedure of looking for an attorney and then paying them to draft a document for you that you can find on your own.

If you have a subscription, log in to your account and find the Download button near the form you are seeking. You'll also be able to access all your previously downloaded documents in the My Forms menu.

If you’re utilizing our service for the first time, follow the guidelines listed below to get your Minnesota Warranty Deed for Husband and Wife Converting Property from Tenants in Common to Joint Tenancy easily:

- Make certain that the file you discover applies where you live.

- Review the file by reading the information for using the Preview function.

- Click Buy Now to start the ordering process or look for another template utilizing the Search field in the header.

- Select a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the required format.

Once you have signed up and bought your subscription, you can utilize your Minnesota Warranty Deed for Husband and Wife Converting Property from Tenants in Common to Joint Tenancy as many times as you need or for as long as it remains active in your state. Revise it in your favorite offline or online editor, fill it out, sign it, and print it. Do much more for less with US Legal Forms!

Form popularity

FAQ

Jointly-owned property.There is no need for probate or letters of administration unless there are other assets that are not jointly owned. The property might have a mortgage. However, if the partners are tenants in common, the surviving partner does not automatically inherit the other person's share.

The name and address of the seller (called the grantor) The name and address of the buyer (called the grantee) A legal description of the property (found on the previous deed) A statement that the grantor is transferring the property to the grantee.

Jointly owned propertyProperty owned as joint tenants does not form part of a deceased person's estate on death. But the value of the deceased person's share of jointly owned property is included when calculating the value of the estate for Inheritance Tax purposes.

Serve a written notice of the change (a 'notice of severance') on the other owners - a conveyancer can help you do this. Download and fill in form SEV to register a restriction without the other owners' agreement. Prepare any supporting documents you need to include.

Most jointly owned property is held as joint tenants but you should not assume this.As property held under a joint tenancy will automatically pass to the surviving joint owners it will not form part of the deceased's estate except for the purposes of calculating inheritance tax.

You can apply to court to change your ex-partner's tenancy to your name, or remove their name from a joint tenancy. You can apply for a 'transfer of tenancy' if: your landlord refuses to change your tenancy. your tenancy doesn't allow a transfer.

Joint Tenancy Two or more people, including spouses, may hold title to their jointly owned real estate as joint tenants. There is a so-called right of survivorship, which means that when one dies, the property automatically transfers to the survivor without the necessity of probating the estate.

When one co-owner dies, property that was held in joint tenancy with the right of survivorship automatically belongs to the surviving owner (or owners). The owners are called joint tenants.

Regardless of how the property is owned (and how it will be treated for succession purposes), the deceased's share of jointly owned property will form part of the deceased's estate for inheritance tax (IHT) purposes (although an exemption will, of course, apply where the deceased's share passes to their spouse/civil