Minnesota Forest Products Timber Sale Contract

Description

How to fill out Minnesota Forest Products Timber Sale Contract?

Get any form from 85,000 legal documents including Minnesota Forest Products Timber Sale Contract online with US Legal Forms. Every template is drafted and updated by state-certified attorneys.

If you have a subscription, log in. Once you are on the form’s page, click the Download button and go to My Forms to access it.

In case you haven’t subscribed yet, follow the tips below:

- Check the state-specific requirements for the Minnesota Forest Products Timber Sale Contract you need to use.

- Read through description and preview the sample.

- As soon as you’re sure the sample is what you need, just click Buy Now.

- Choose a subscription plan that works well for your budget.

- Create a personal account.

- Pay in just one of two appropriate ways: by credit card or via PayPal.

- Pick a format to download the document in; two ways are available (PDF or Word).

- Download the file to the My Forms tab.

- As soon as your reusable template is downloaded, print it out or save it to your device.

With US Legal Forms, you will always have immediate access to the proper downloadable template. The platform provides you with access to forms and divides them into groups to simplify your search. Use US Legal Forms to get your Minnesota Forest Products Timber Sale Contract fast and easy.

Form popularity

FAQ

To sell timber on your land, you should first assess the type and quantity of timber you have. Next, consider contacting a professional forester who can help evaluate your timber and guide you through the process. Once you understand your options, you can draft a Minnesota Forest Products Timber Sale Contract to formalize the sale. This contract not only protects you as the seller but also ensures that the buyer understands their obligations regarding the timber.

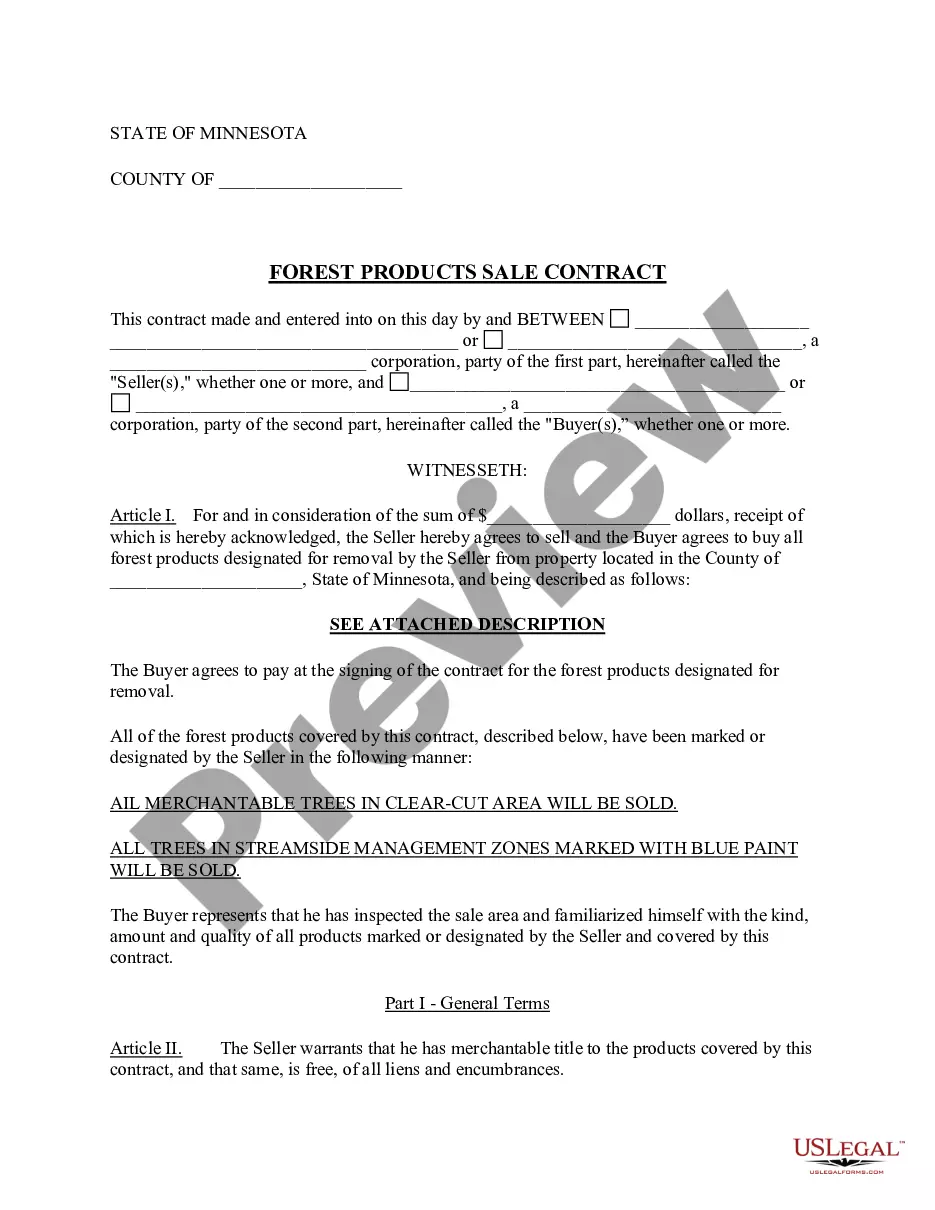

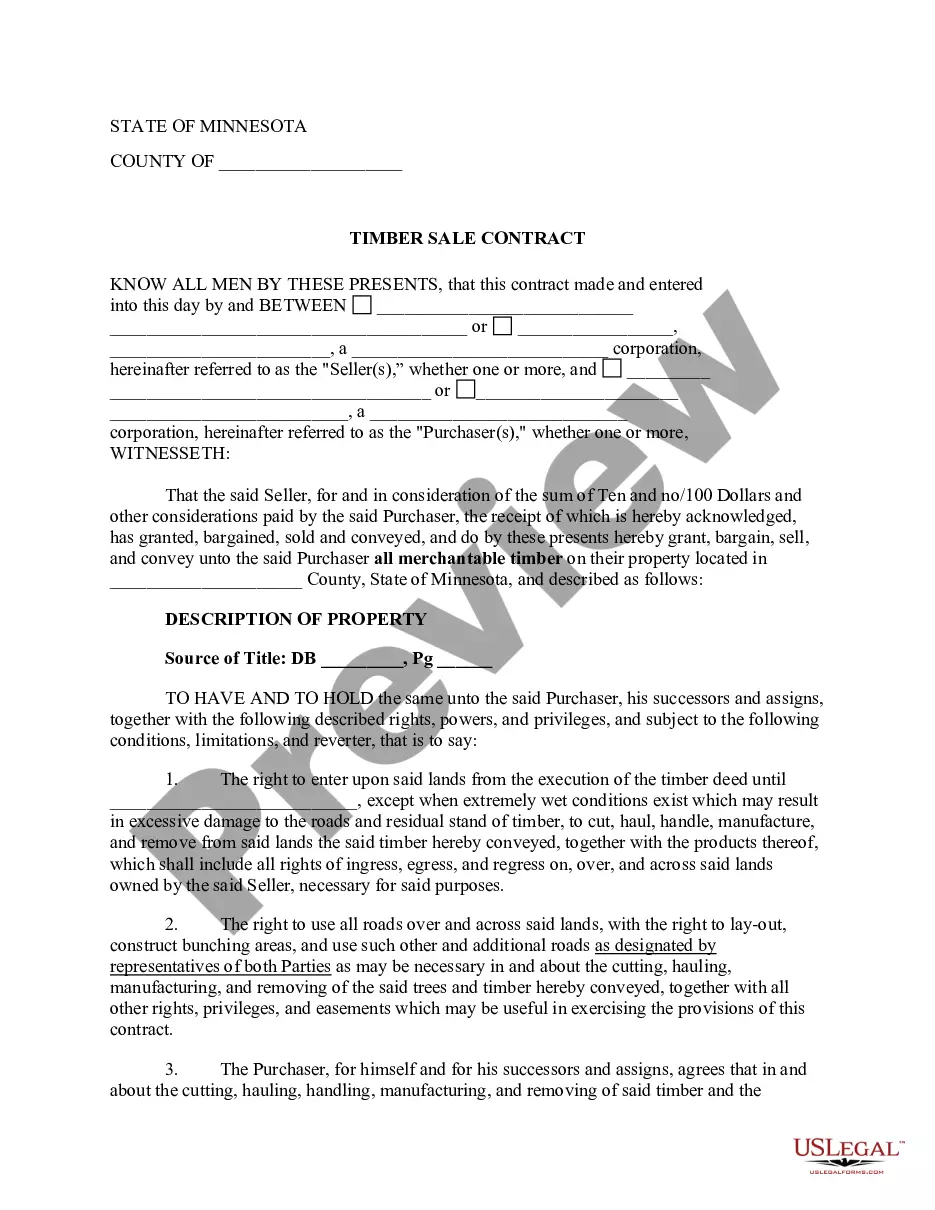

Timber contracts, such as the Minnesota Forest Products Timber Sale Contract, outline the terms under which timber is sold from one party to another. These contracts specify details like payment terms, the quantity of timber, and the rights and responsibilities of both the seller and buyer. Understanding these contracts is crucial for ensuring a smooth transaction and compliance with legal requirements. For drafting or reviewing timber contracts, consider using resources from US Legal Forms to ensure all aspects are covered.

To report timber sales on your tax return, you will need to list the income derived from the sale as specified in your Minnesota Forest Products Timber Sale Contract. You should report this income on your federal tax return, typically on Schedule F or Schedule C. Be sure to include any direct expenses related to the sale, as they can reduce your overall taxable income. Using US Legal Forms can help simplify the process of preparing the necessary documentation.

Yes, timber is generally considered real property, especially when tied to a Minnesota Forest Products Timber Sale Contract. This classification means that timber is part of the land and can affect how it is taxed and transferred. When selling timber, understanding its classification helps in navigating legal and tax implications. Consult with a legal expert or a platform like US Legal Forms for detailed guidance on this matter.

Recording the sale of timber on your taxes involves documenting the sale income and any related expenses from your Minnesota Forest Products Timber Sale Contract. You will need to report this income on Schedule F or Schedule C, depending on your situation. It's essential to keep accurate records of the sale and expenses to substantiate your income and deductions. Consider using platforms like US Legal Forms to assist in managing your timber sale documentation.

To report the sale of timber on your tax return using TurboTax, start by gathering your records related to the Minnesota Forest Products Timber Sale Contract. You will need to input the sale amount as income and specify any associated expenses. TurboTax guides you through the process, ensuring you account for any deductions available for timber sales. This way, you can accurately report your timber income while maximizing potential tax benefits.

The term "timber sale" is used to refer to any significant harvest of wood products involving an exchange of monies. Timber sales may involve sales of trees used to make lumber (sawtimber), fuelwood, whole tree chips, pulp, or any combination of these products.

Logging companies rarely have the specialized equipment, not to mention proper insurances, to remove trees from an Urban setting. But even if they did, the cost associated with hauling equipment to a location and removing the bulk of an entire tree including its top is usually far greater than the value of the tree.

Illegal logging is the cutting down of trees, transporting them, or using their products such as timber for economic gains against the prohibition by law.The excessive extraction of timber beyond the stipulated limits is equally pronounced as illegal logging.

For these reasons, it's not uncommon for a tree grower to net $40,000 to $60,000 per acre every year producing high quality trees that are healthy and bring premium prices in the marketplace.