Minnesota Chapter 13 Plan

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Minnesota Chapter 13 Plan?

Obtain any template from 85,000 legal documents, including the Minnesota Chapter 13 Plan, online with US Legal Forms. Each template is crafted and refreshed by state-approved legal experts.

If you already possess a subscription, Log In. When you navigate to the form’s page, click on the Download button and proceed to My documents to gain access to it.

If you have not subscribed yet, adhere to the instructions below: Check the state-specific criteria for the Minnesota Chapter 13 Plan you wish to utilize. Review the description and examine the sample. Once you’re certain the sample meets your needs, simply click Buy Now. Choose a subscription plan that fits your financial situation. Create a personal account. Make payment in one of two acceptable methods: by credit card or through PayPal. Select a format to download the document in; two options are available (PDF or Word). Download the document to the My documents section. When your reusable template is downloaded, print it out or save it to your device.

- With US Legal Forms, you will consistently have instant access to the appropriate downloadable template.

- The platform will provide you with access to documents and organizes them into categories to simplify your search.

- Utilize US Legal Forms to acquire your Minnesota Chapter 13 Plan quickly and effortlessly.

Form popularity

FAQ

Obtaining a Minnesota Chapter 13 Plan is not necessarily hard, but it does require careful preparation and understanding of your financial situation. You must meet specific eligibility criteria, including a stable income and certain debt limits. Many people find it helpful to use platforms like US Legal Forms to navigate the process, ensuring they complete all necessary paperwork correctly.

The Minnesota Chapter 13 Plan has some downsides to consider. One significant drawback is the repayment period, which typically lasts three to five years. During this time, you must adhere to a strict budget and make regular payments, which can be challenging for some individuals. Additionally, this plan may impact your credit score, as it appears on your credit report.

Yes, you can file a Minnesota Chapter 13 Plan on your own, but it is often advisable to seek assistance. Navigating the legal requirements and paperwork can be complex, and a mistake could lead to delays or denials. By using resources like US Legal Forms, you can access the necessary forms and guidance to ensure you complete your plan accurately. Getting help from a professional could save you time and reduce stress.

You take and complete a credit counseling course. You'll prepare the bankruptcy petition and the proposed Chapter 13 plan. You file your bankruptcy petition, proposed plan, and other required documents. The court appoints a bankruptcy trustee to administer your case. The automatic stay takes effect.

To qualify for Chapter 13 bankruptcy: You must have regular income. Your unsecured debt cannot exceed $394,725, and your secured debt cannot exceed $1,184,200. You must be current on tax filings.

Generally speaking, the funds you have in your bank accounts are safe when you file for Chapter 13 bankruptcy.Chapter 13 also allows debtors to keep bank account funds in excess of the allowable exemption amount provided the excess amounts are worked into the Chapter 13 plan and paid back over the life of the plan.

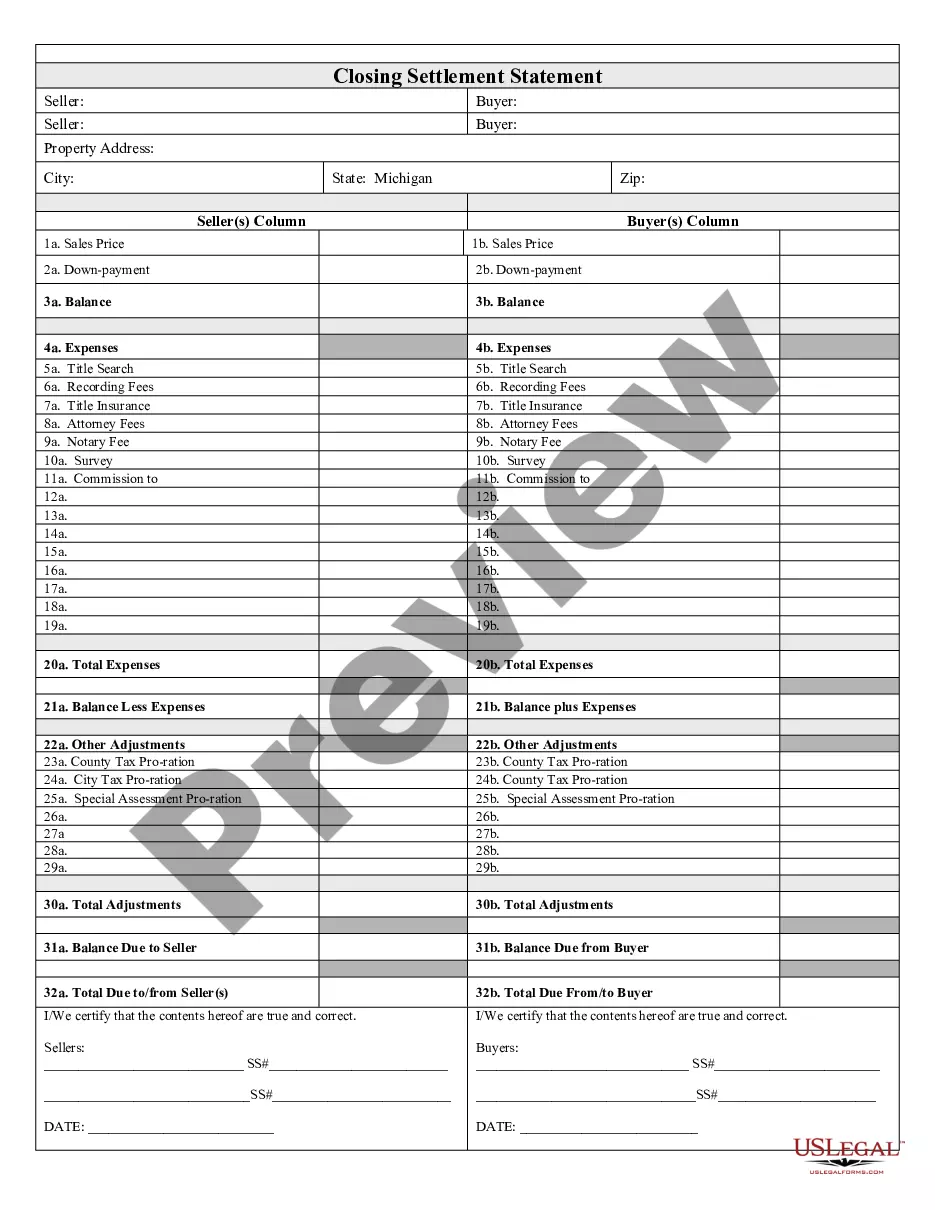

The difference between your income on Schedule I and your expenses on Schedule J will be your Chapter 13 plan payment. Your unsecured creditors will receive a percentage of the disposable income that remains after secured and priority creditors receive payment.

The Overall Chapter 13 Average Payment. The average payment for a Chapter 13 case overall is probably about $500 to $600 per month. This information, however, may not be very helpful for your particular situation.

In Chapter 13 bankruptcy, you pay your unsecured creditors an amount between 0 and 100% of what you owe them. The exact amount is depends on these rules: (1) The minimum amount you must pay is equal to the amount your unsecured creditors would have received had you filed for Chapter 7 bankruptcy.

Debts You Must Pay in Full Through Your Plan. Add up the following debts and divide by the number of months your plan will last. Secured Debt Payments on Property You Want to Keep. Unsecured Debts. Length of Your Repayment Plan.