Minnesota Partial checklist of tasks - steps for opening client file

Understanding this form

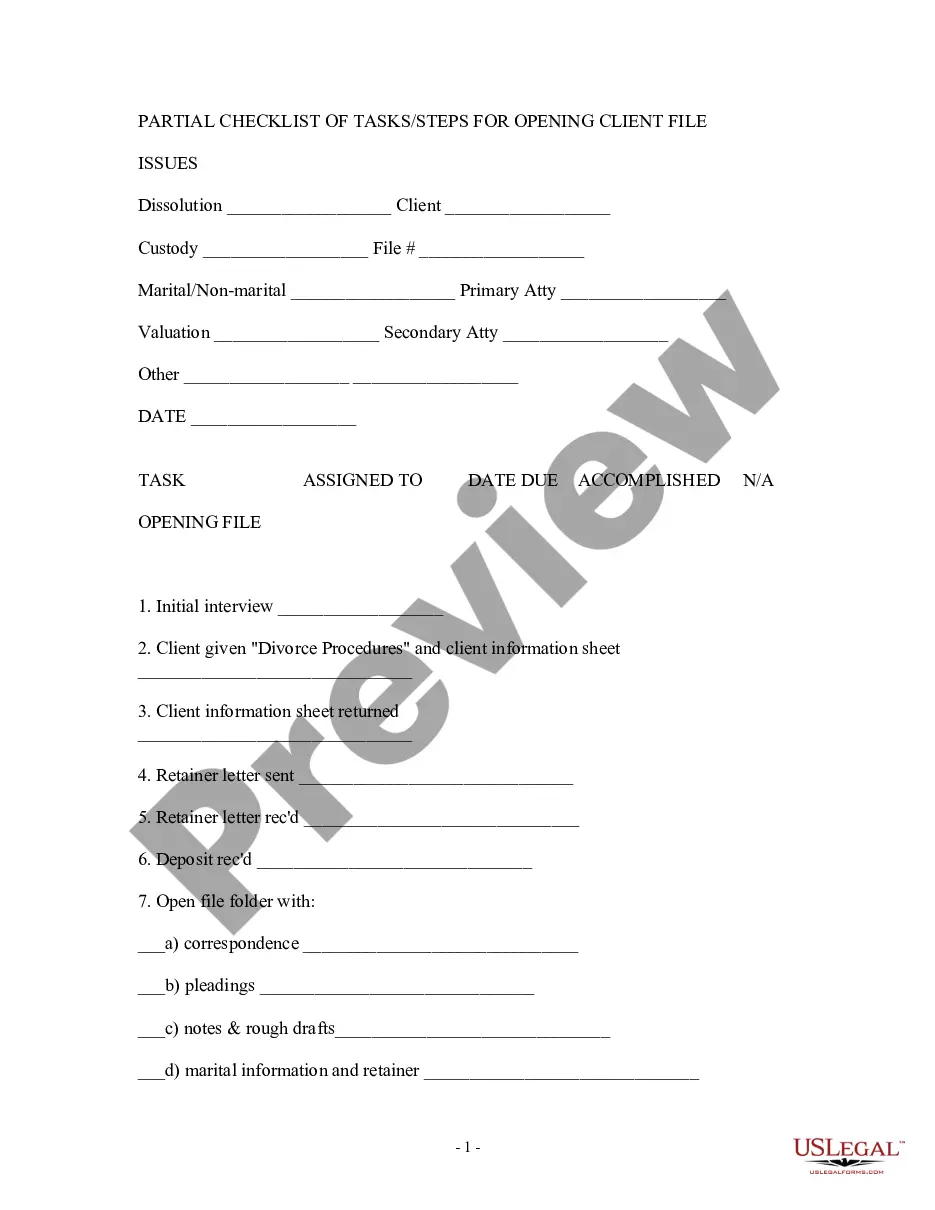

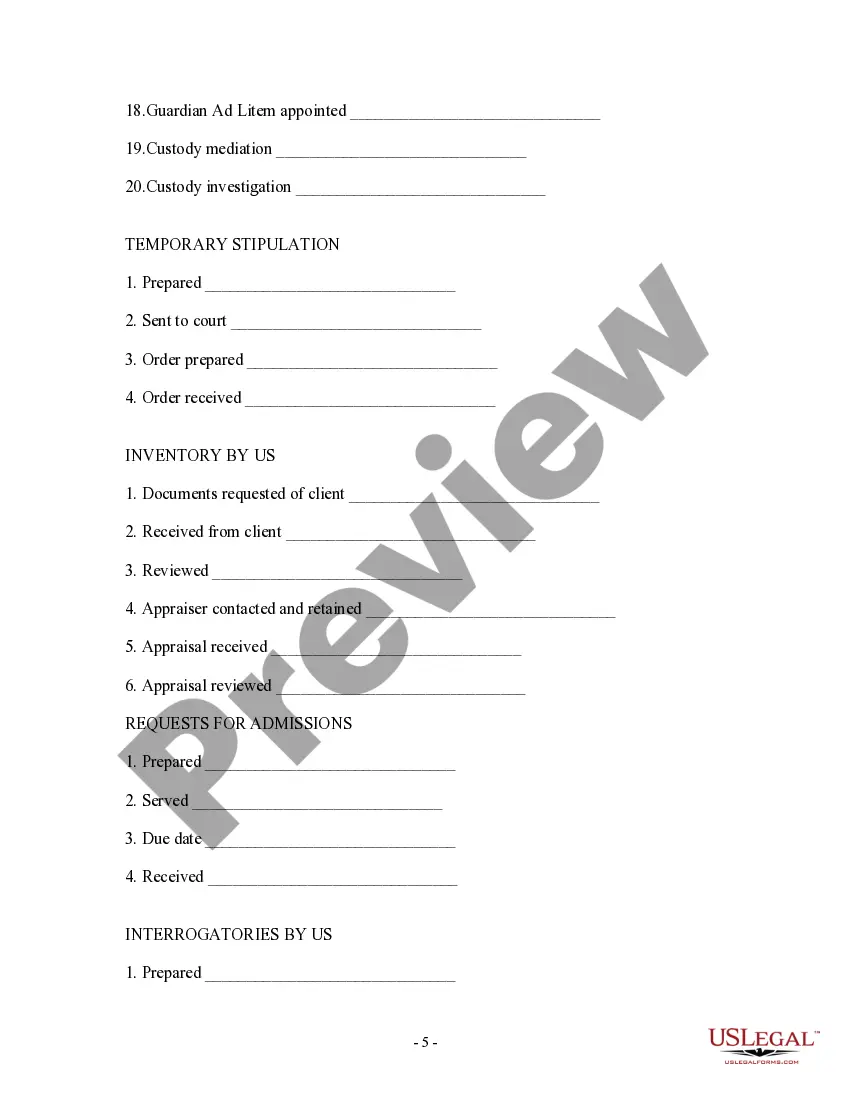

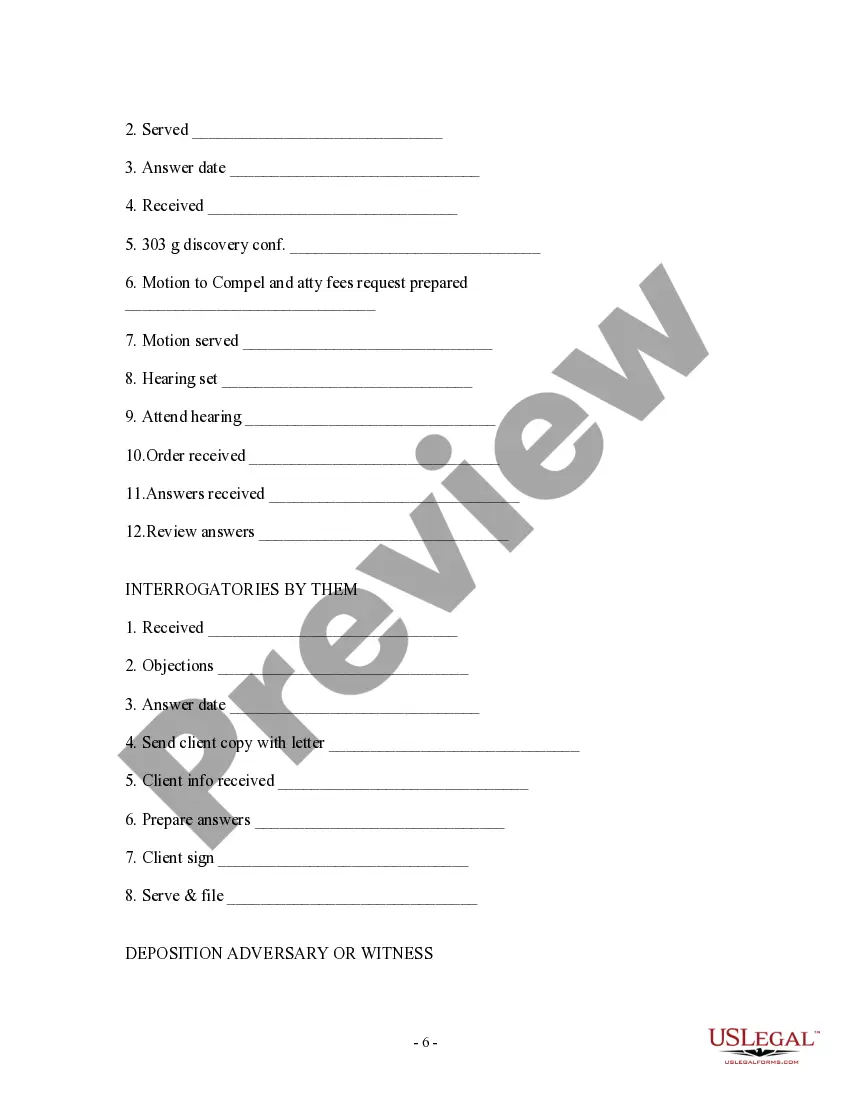

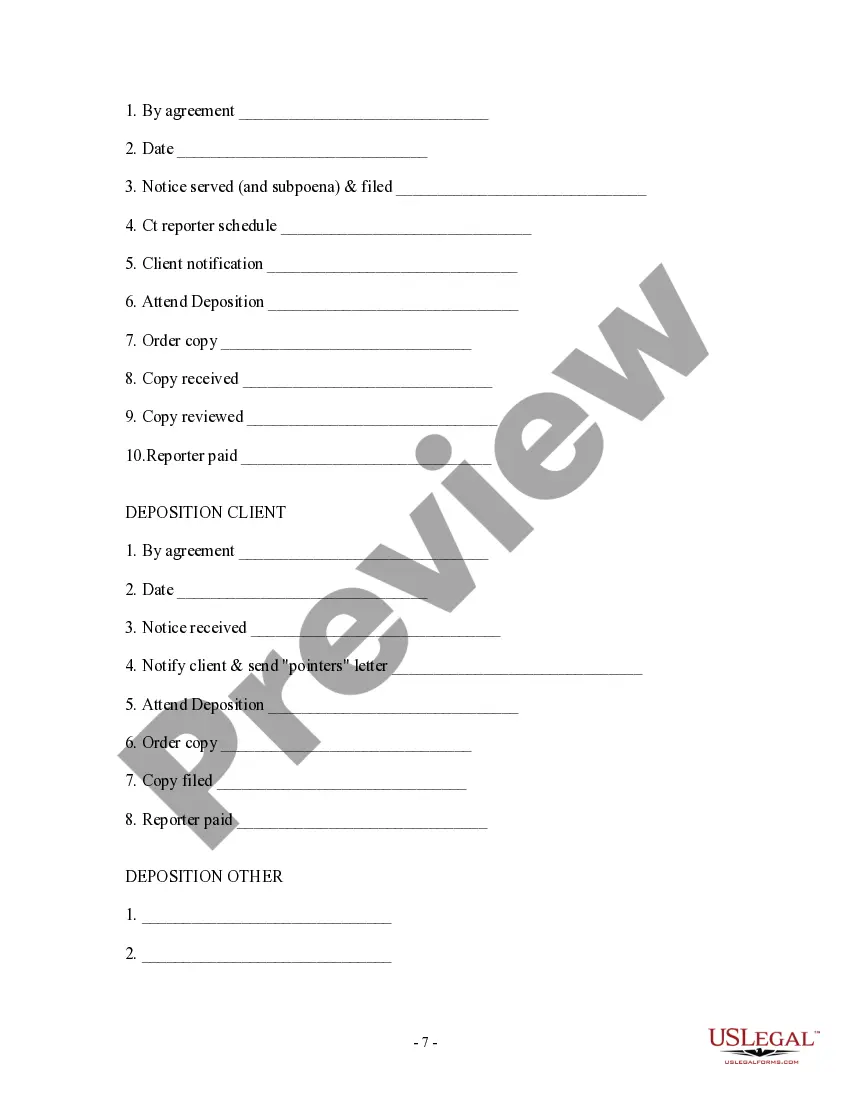

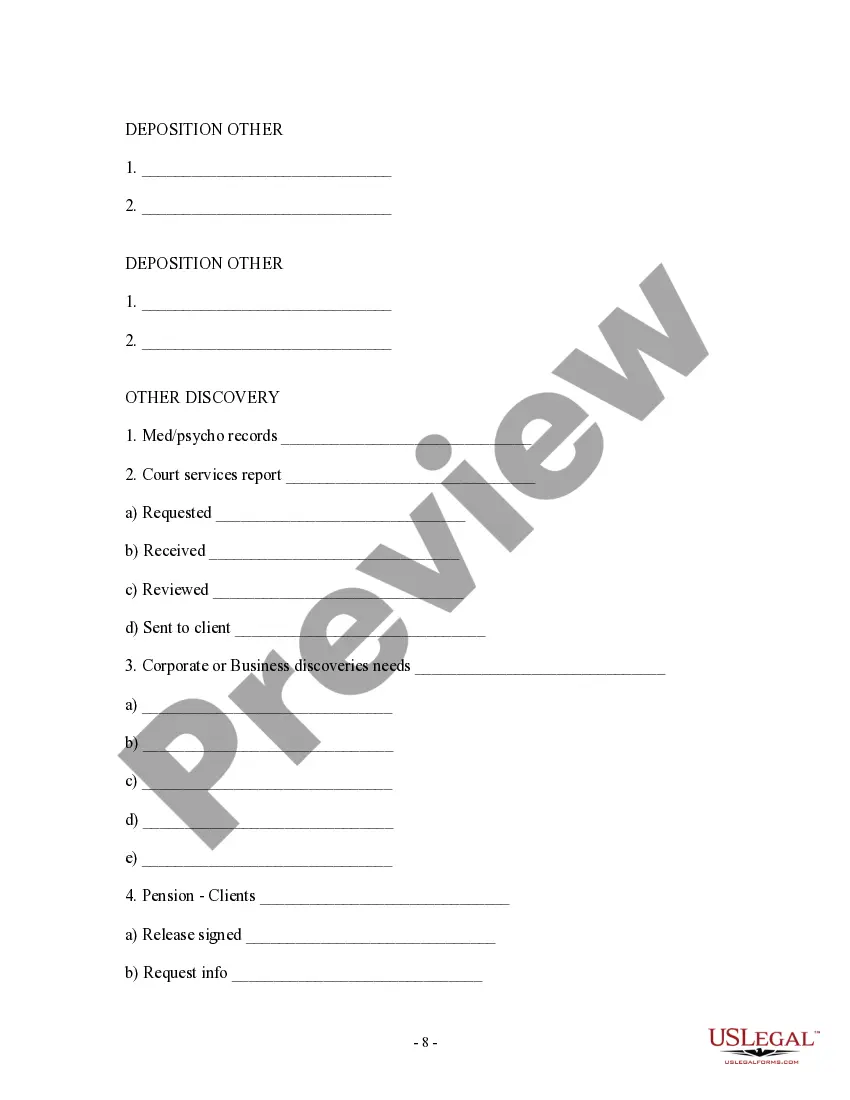

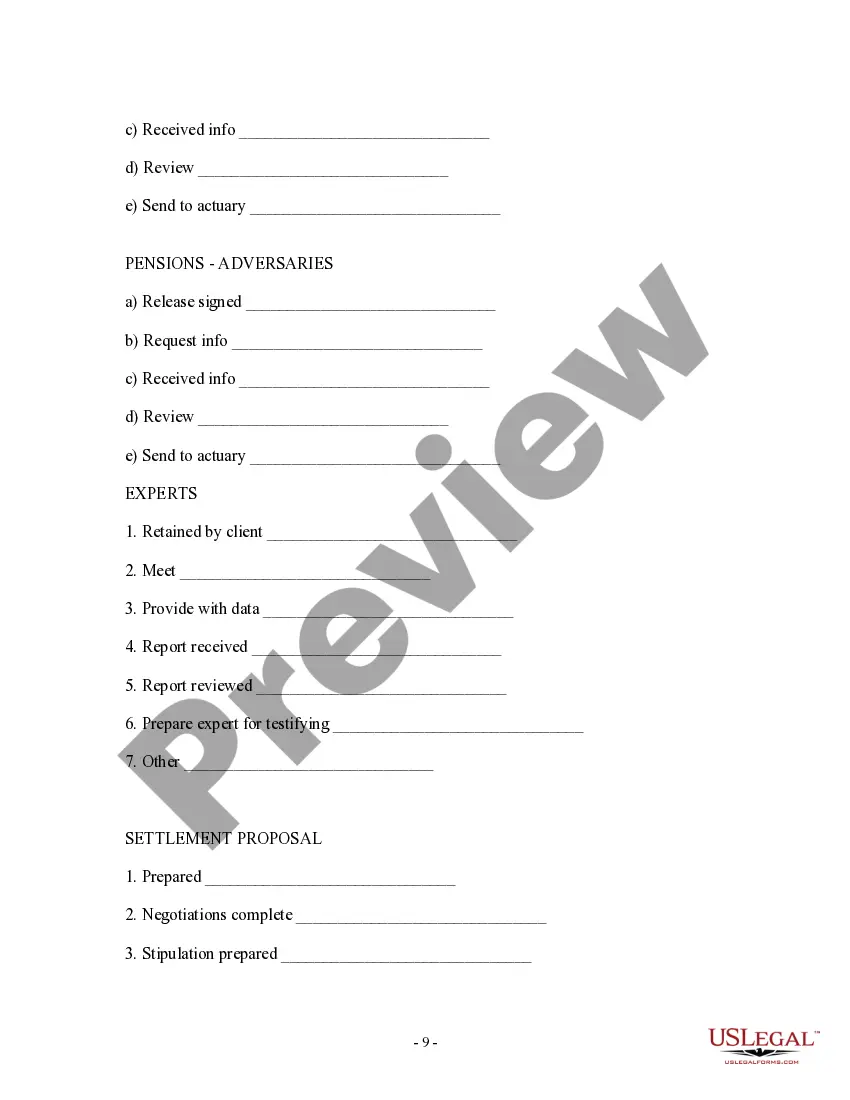

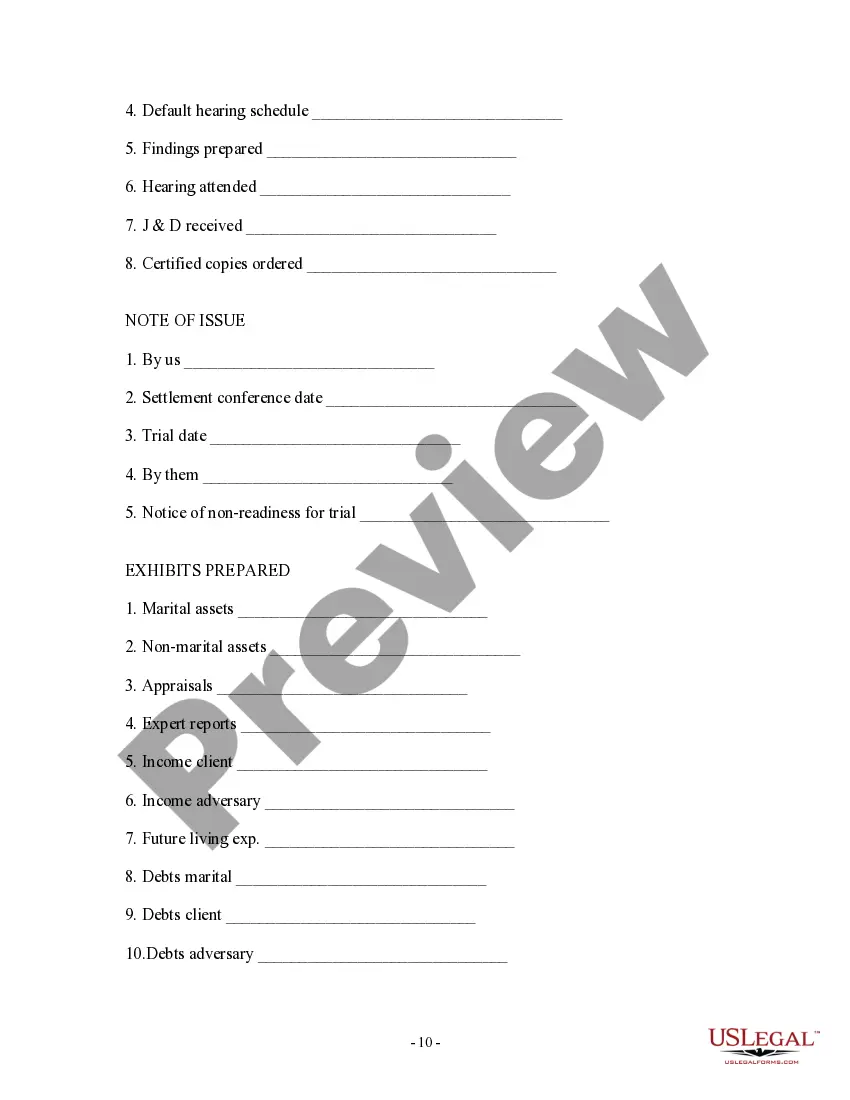

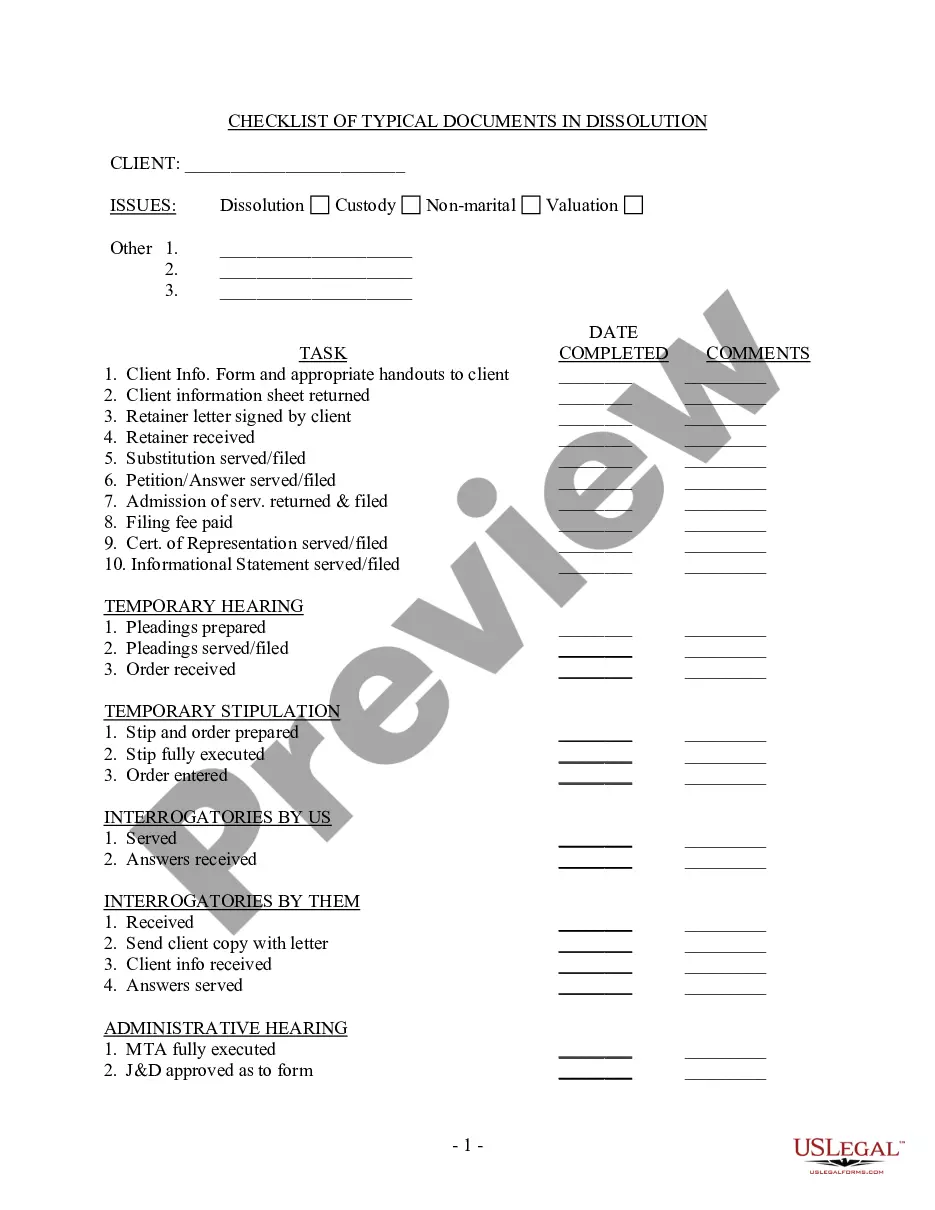

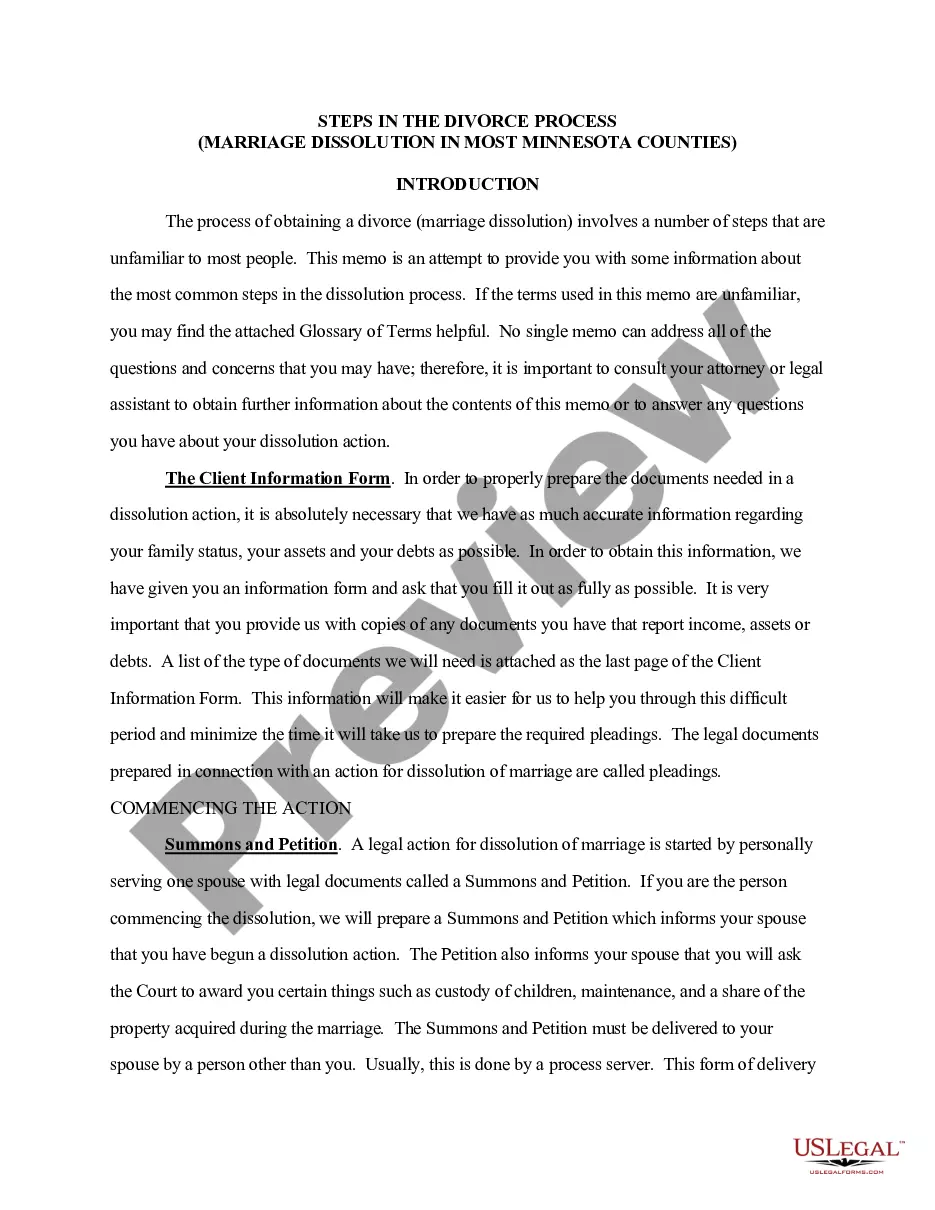

The Partial checklist of tasks for opening client file is a structured guide designed to help legal professionals systematically manage the initial steps in a client's case. This form differs from other legal forms by providing a comprehensive checklist that ensures all necessary tasks are completed when starting a new client file, particularly in dissolution and custody matters. It serves as an essential tool for attorneys to maintain organized records and to ensure nothing is overlooked in the early stages of case management.

Form components explained

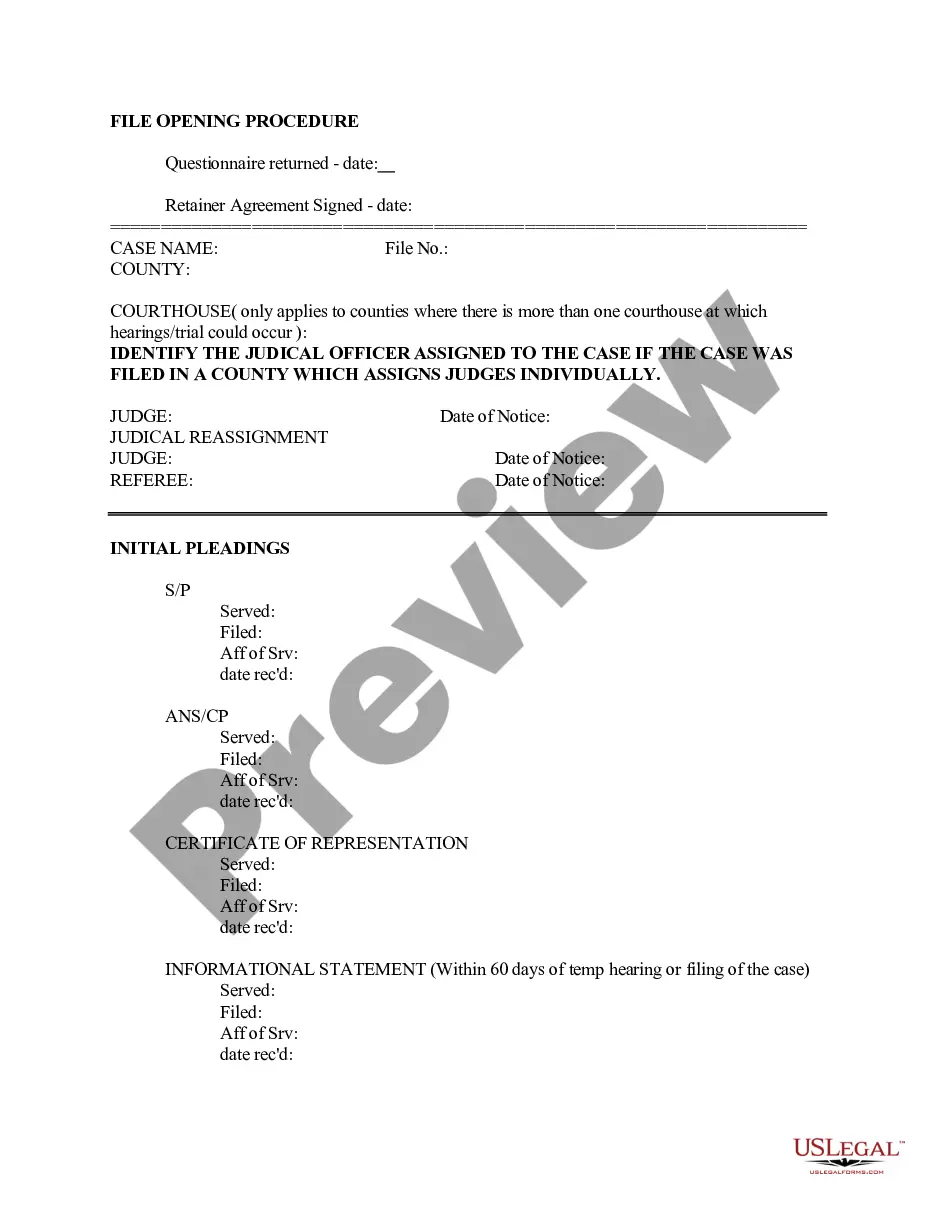

- Client and case information sections for essential details.

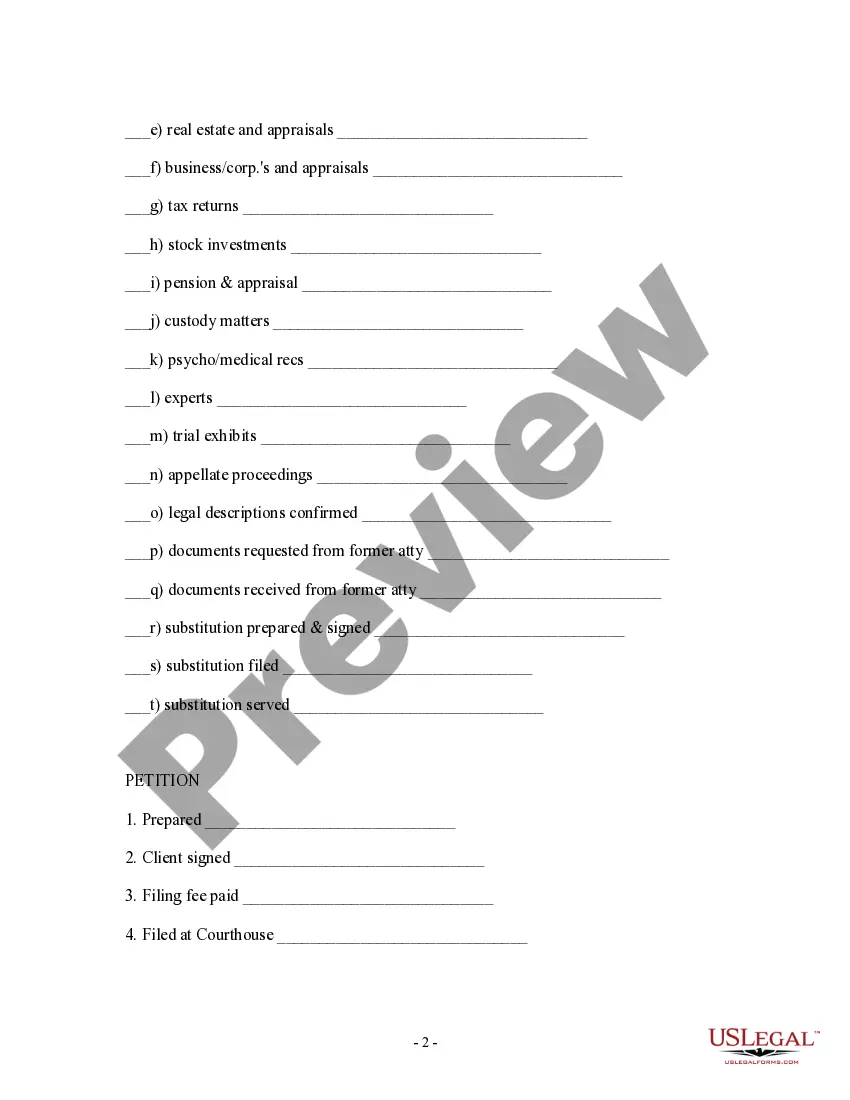

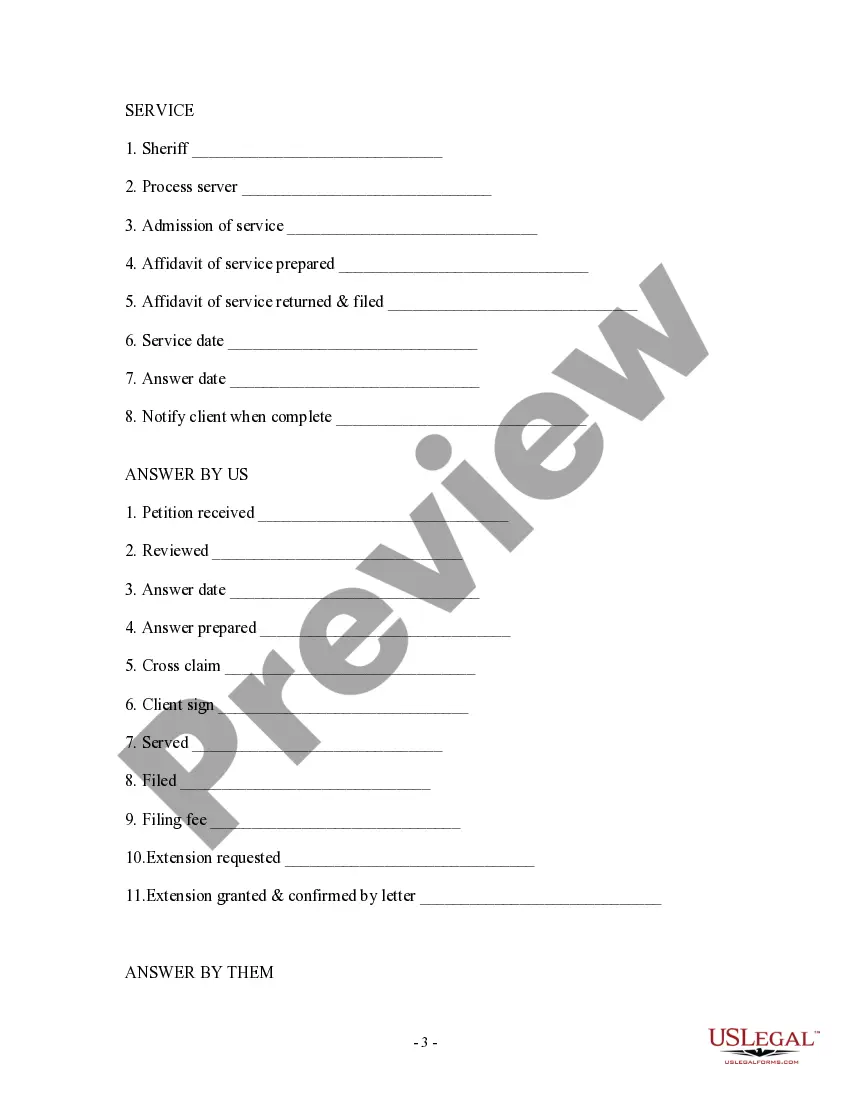

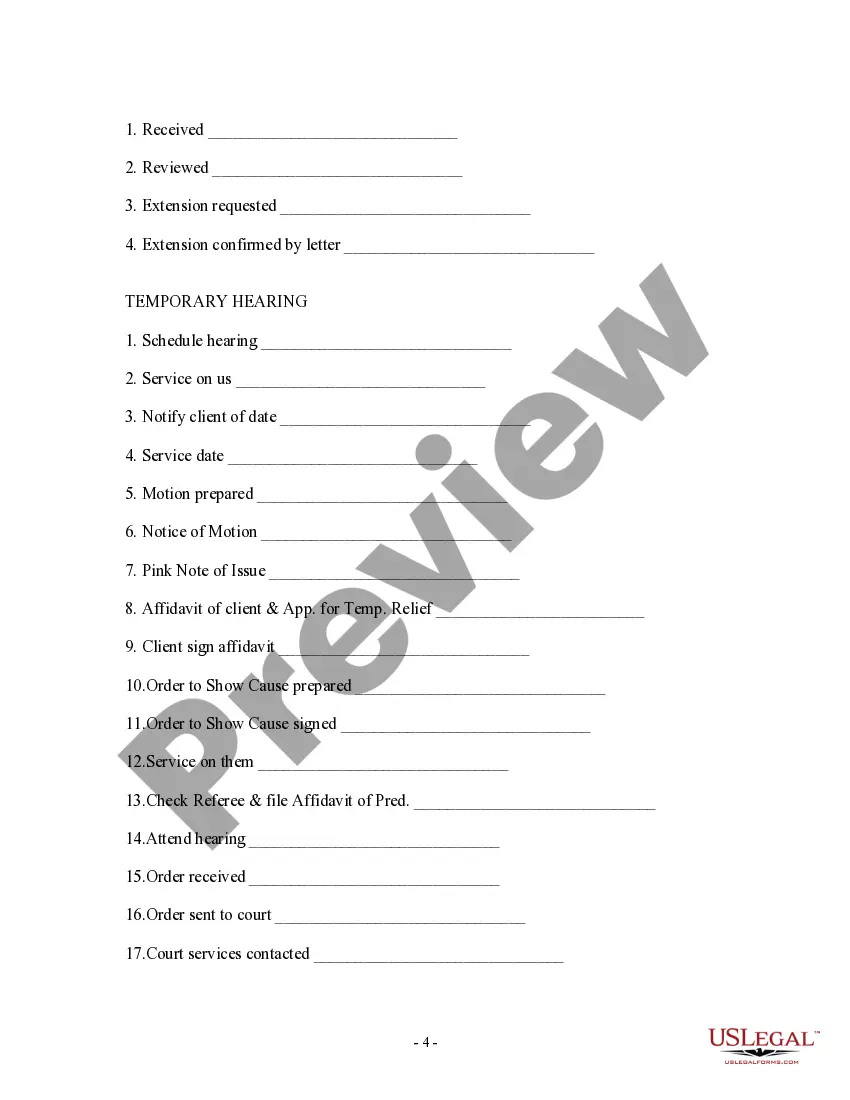

- A comprehensive checklist of tasks for opening and managing the client file.

- Sections for tracking deadlines, such as filing and service dates.

- Segments for documenting communications and records received from previous attorneys.

- Areas for notes and remarks specific to case management.

Common use cases

This form should be used by attorneys and legal staff when initiating a new client case, particularly in divorce or custody situations. It is helpful for ensuring all necessary preliminary tasks are completed thoroughly and timely, including documenting client interactions, managing retainer fees, and organizing case evidence. Using this checklist promotes efficiency and legal compliance throughout the case management process.

Who should use this form

This form is intended for:

- Legal professionals such as attorneys and paralegals involved in family law cases.

- Law firms handling divorce and custody matters requiring organized case management.

- Personnel responsible for client intake and file management in a legal setting.

How to complete this form

- Begin by filling in the client and case details at the top of the checklist.

- Assign tasks to individual team members, specifying deadlines for each task.

- Go through each task in the checklist, making sure to note completion dates and any relevant remarks.

- Maintain a record of all associated documents, including retainer letters and client information sheets.

- Regularly review the checklist to ensure all tasks are on track and completed before advancing in the case.

Does this form need to be notarized?

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

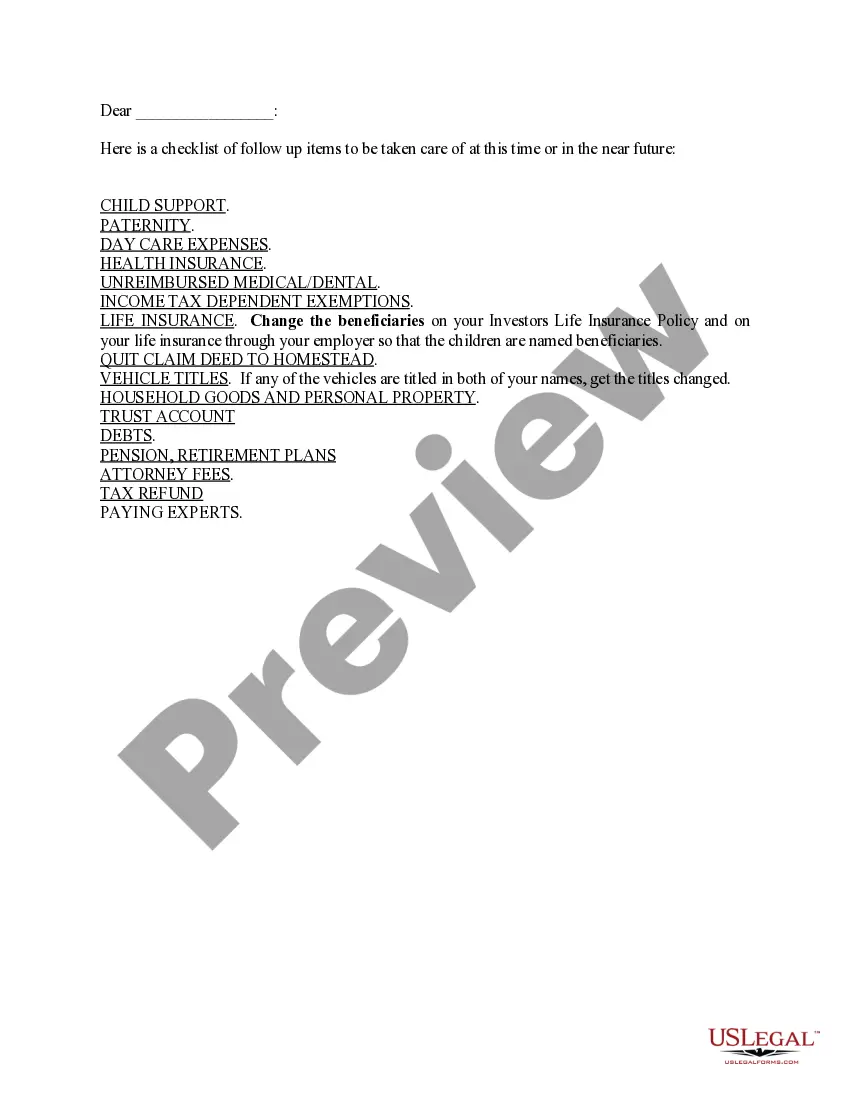

- Failing to complete all sections of the checklist, leading to disorganized files.

- Neglecting to set and monitor deadlines for task completion.

- Omitting critical documents that may be required for court hearings.

- Not assigning tasks to appropriate team members, which can create confusion.

Advantages of online completion

- Convenient access to the checklist from anywhere, making case management easier.

- Editable format allows for real-time updates and modifications as the case progresses.

- Reliable and organized storage of all relevant case information in one place.

- Reduces the risk of overlooking important tasks by providing a clear structure.

Looking for another form?

Form popularity

FAQ

A file opening sheet is a crucial document that helps streamline the process of starting a client file. It serves as an organized checklist, guiding you through the Minnesota Partial checklist of tasks - steps for opening client file. By using a file opening sheet, you can ensure that all necessary information is collected efficiently, reducing the risk of missing essential details. This tool not only enhances your organization but also improves client communication and case management.

The MSP client onboarding process typically involves several key steps, including gathering client information, setting expectations, and creating an efficient workflow. Following a Minnesota Partial checklist of tasks - steps for opening client file ensures that all essential documents are collected and reviewed. Additionally, tools like uslegalforms can simplify this process, offering structured templates to enhance your client onboarding experience.

Attorneys in Minnesota must retain client files for a minimum of six years after the conclusion of a case. This period ensures compliance with legal standards while allowing for potential future inquiries. Implementing a Minnesota Partial checklist of tasks - steps for opening client file can help you manage document retention effectively. Utilizing platforms like uslegalforms can streamline this process and provide you with necessary templates.

To effectively organize a new case file, start with gathering all necessary client information, including contact details and case specifics. Next, create a Minnesota Partial checklist of tasks - steps for opening client file, which may include setting up folders for documents, correspondence, and notes. Additionally, ensure that you label everything clearly to streamline future access. Finally, consider utilizing a platform like USLegalForms, which can provide templates and resources to simplify the process.

The 2020 Minnesota State Income Tax Return forms for Tax Year 2020 (Jan. 1 - Dec. 31, 2020) can be e-Filed together with the IRS Income Tax Return by April 15, 2020 May 17, 2021. However, if you file a tax extension you can e-File your Taxes until October 15, 2021 without a late filing penalty.

Q: Why might my refund be taking longer to process this year than last (or a prior year)? With the increase in scams and stolen personal information, the department is taking the time necessary to make sure the right refund goes to the right taxpayer.

The Minnesota Department of Revenue will provide a link on its website to your free file tax preparation software if you offer free electronic return preparation and filing services for federal and Minnesota tax returns to taxpayers filing 2019 individual income tax returns.

Minnesota is allowing additional time for making 2020 state individual income tax filings and payments to May 17, 2021, without any penalty and interest being applied. This grace period does not include individual estimated tax payments.You do not have to wait until May 17, 2021, to file your return.

You can file your Minnesota Individual Income Tax return electronically or by mail.You may qualify for free electronic filing if your income is $72,000 or less.

If you are waiting for a refund and want to know its status: Use our Where's My Refund? system. Call our automated phone system (available 24/7) at 651-296-4444 or 1-800-657-3676 (toll-free).