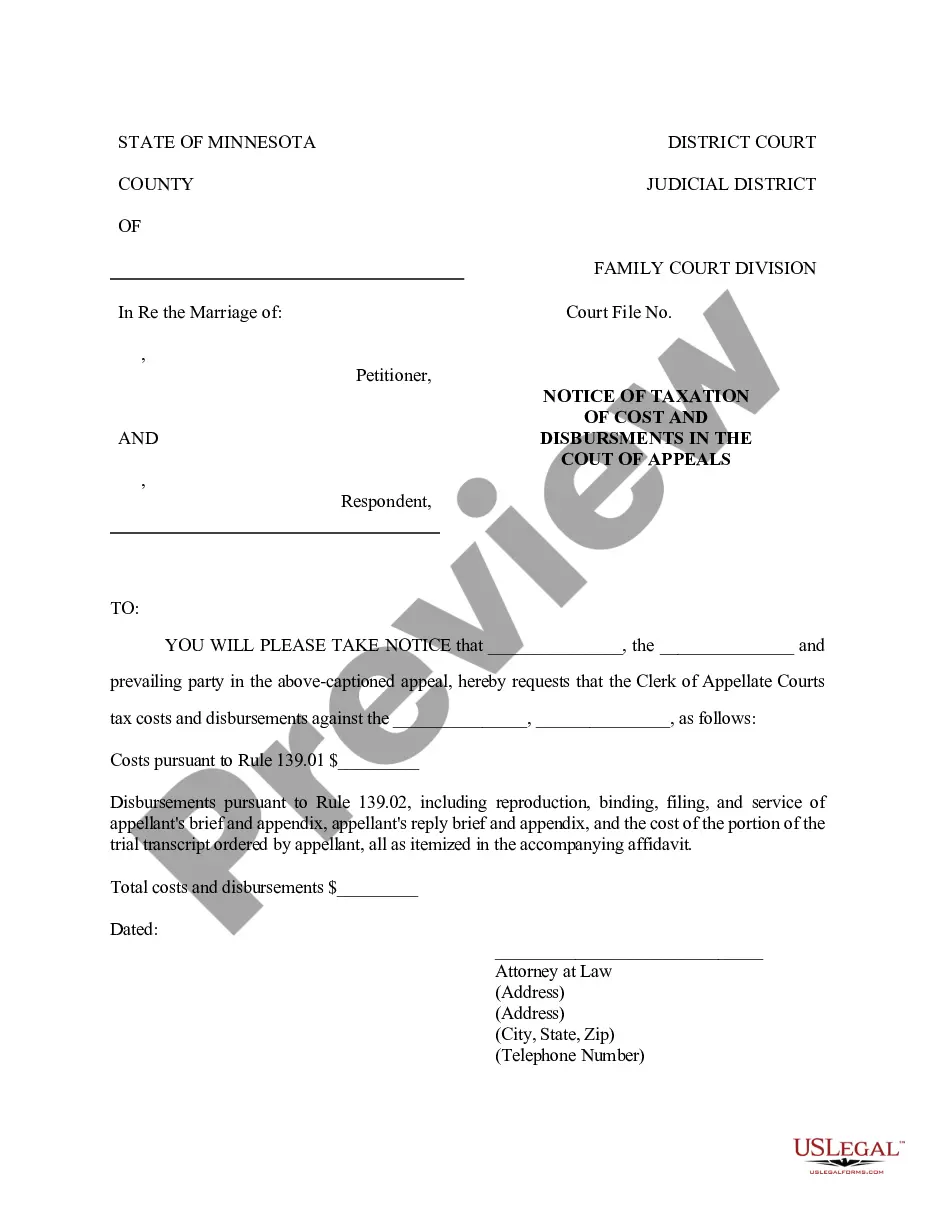

Minnesota Notice of Taxation of Costs and Disbursements on Appeal

Description

How to fill out Minnesota Notice Of Taxation Of Costs And Disbursements On Appeal?

Get any form from 85,000 legal documents such as Minnesota Notice of Taxation of Costs and Disbursements on Appeal online with US Legal Forms. Every template is drafted and updated by state-licensed lawyers.

If you already have a subscription, log in. When you are on the form’s page, click on the Download button and go to My Forms to get access to it.

If you haven’t subscribed yet, follow the steps below:

- Check the state-specific requirements for the Minnesota Notice of Taxation of Costs and Disbursements on Appeal you need to use.

- Read through description and preview the sample.

- As soon as you’re sure the sample is what you need, click Buy Now.

- Select a subscription plan that works well for your budget.

- Create a personal account.

- Pay in just one of two appropriate ways: by bank card or via PayPal.

- Choose a format to download the file in; two ways are available (PDF or Word).

- Download the document to the My Forms tab.

- Once your reusable form is ready, print it out or save it to your device.

With US Legal Forms, you will always have immediate access to the proper downloadable template. The platform provides you with access to documents and divides them into categories to streamline your search. Use US Legal Forms to obtain your Minnesota Notice of Taxation of Costs and Disbursements on Appeal fast and easy.

Form popularity

FAQ

Rule of Practice 521 in Minnesota pertains to the procedures for filing motions and other documents in appellate cases. This rule aims to streamline the process and ensure clarity in submissions. Understanding Rule 521 can help you effectively navigate the appeals process, including the steps necessary for submitting a Minnesota Notice of Taxation of Costs and Disbursements on Appeal.

A motion for taxation of costs is a formal request to the court to recover certain expenses incurred during litigation. This motion is typically filed after a judgment is made, allowing the prevailing party to seek reimbursement for costs outlined in the Minnesota Notice of Taxation of Costs and Disbursements on Appeal. It's important to follow the proper procedures and timelines to ensure your motion is considered by the court.

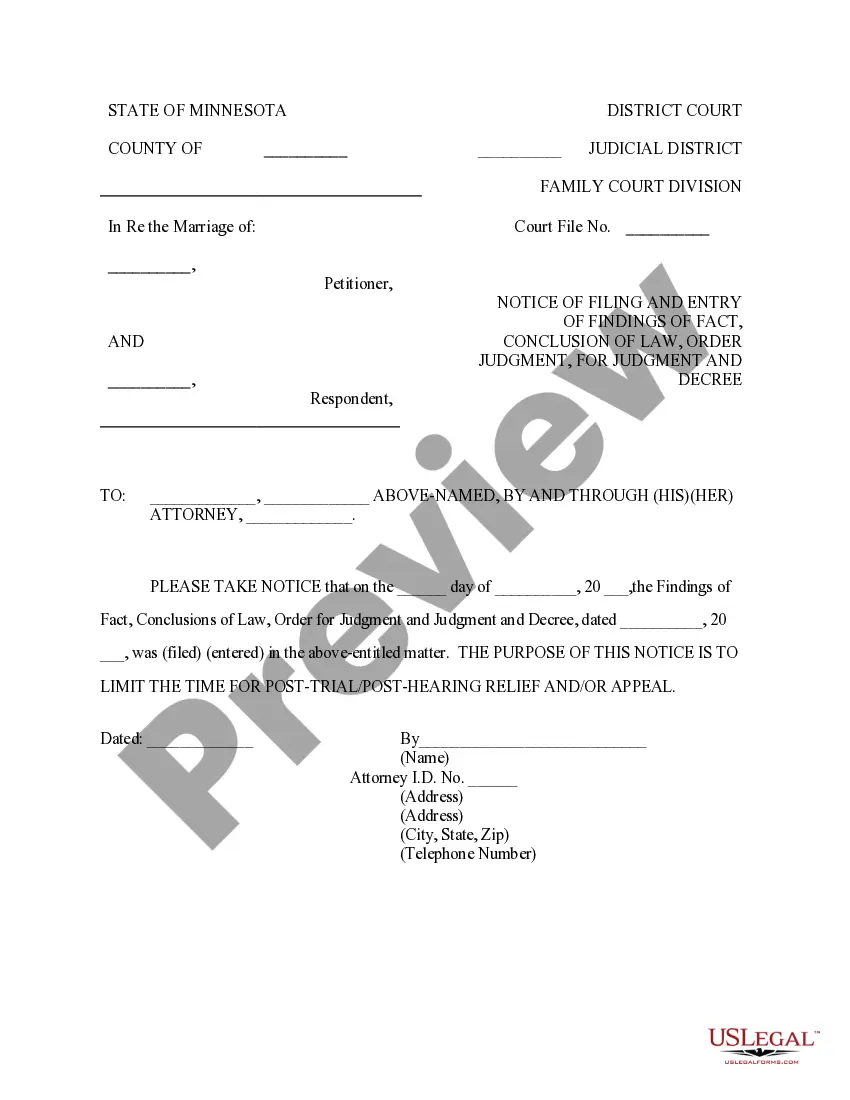

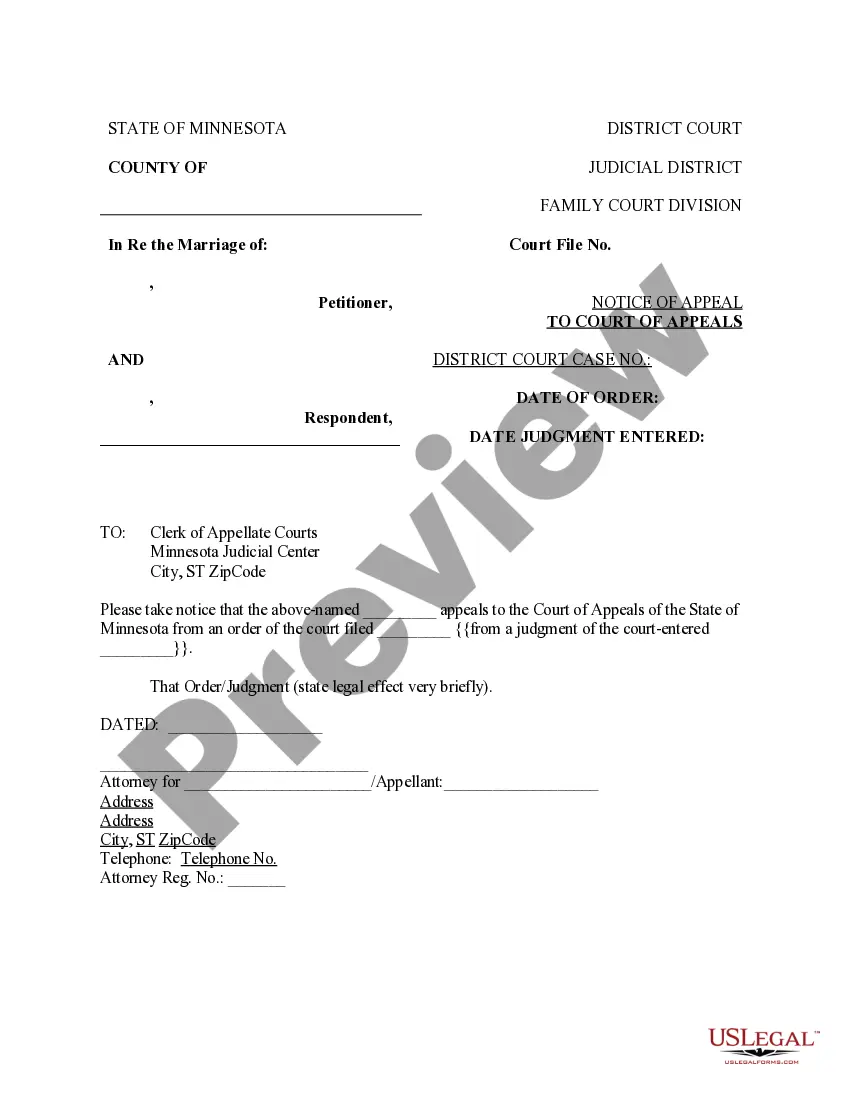

To file an appeal in Minnesota, you must first determine the appropriate court for your case. You then need to prepare a notice of appeal and file it with the court, along with any required fees. After filing, you will also need to serve the other party with the Minnesota Notice of Taxation of Costs and Disbursements on Appeal, ensuring they are aware of your intent to appeal and any associated costs.

Rule 69 in Minnesota governs the taxation of costs and disbursements in civil cases. This rule outlines how parties can recover costs associated with legal proceedings. Specifically, it provides the framework for submitting a Minnesota Notice of Taxation of Costs and Disbursements on Appeal, allowing winning parties to reclaim expenses incurred during the appeal process.