Minnesota Notice to Insurer of Court Order Naming Policy Beneficiary

Description

How to fill out Minnesota Notice To Insurer Of Court Order Naming Policy Beneficiary?

Obtain any version from 85,000 lawful documents including Minnesota Notice to Insurer of Court Order Naming Policy Beneficiary online with US Legal Forms. Each template is crafted and refreshed by state-certified legal experts.

If you already possess a subscription, sign in. Once on the form’s page, click on the Download button and navigate to My documents to retrieve it.

If you haven't subscribed yet, follow the instructions below.

With US Legal Forms, you will always have immediate access to the appropriate downloadable template. The service grants you access to documents and categorizes them to ease your search. Use US Legal Forms to acquire your Minnesota Notice to Insurer of Court Order Naming Policy Beneficiary quickly and effortlessly.

- Verify the state-specific criteria for the Minnesota Notice to Insurer of Court Order Naming Policy Beneficiary you intend to utilize.

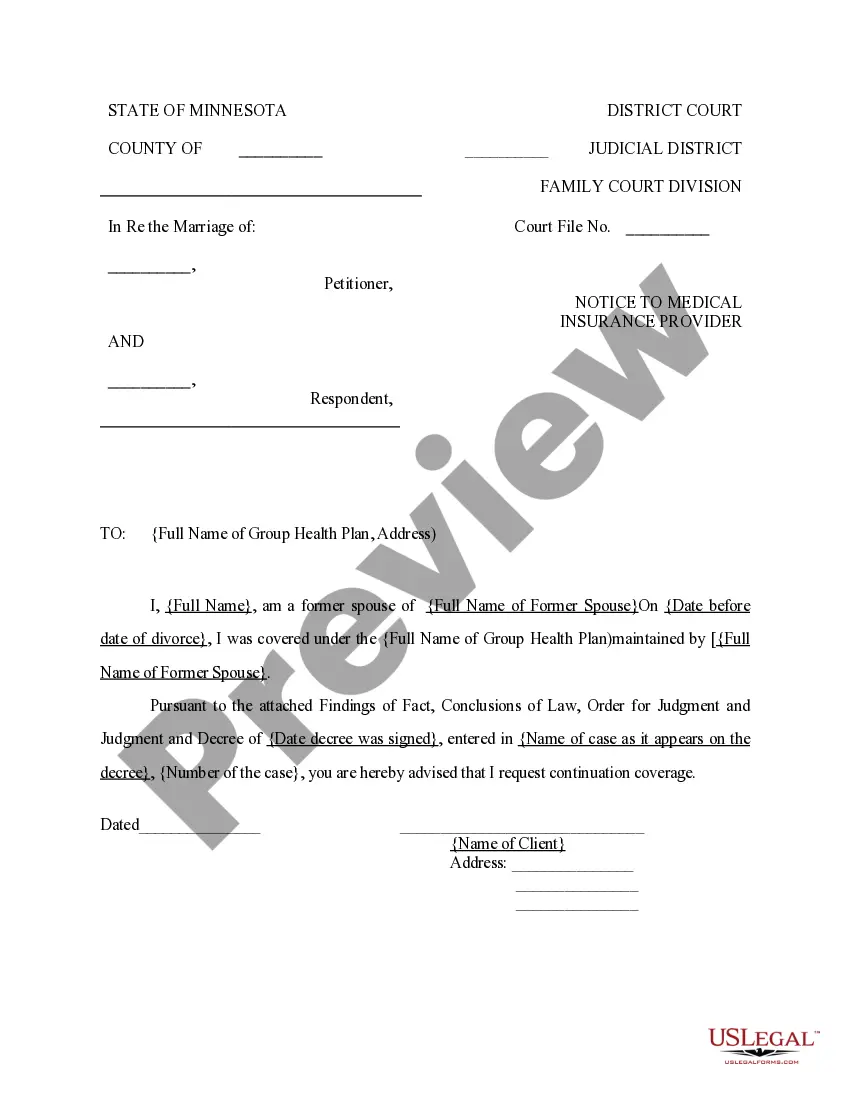

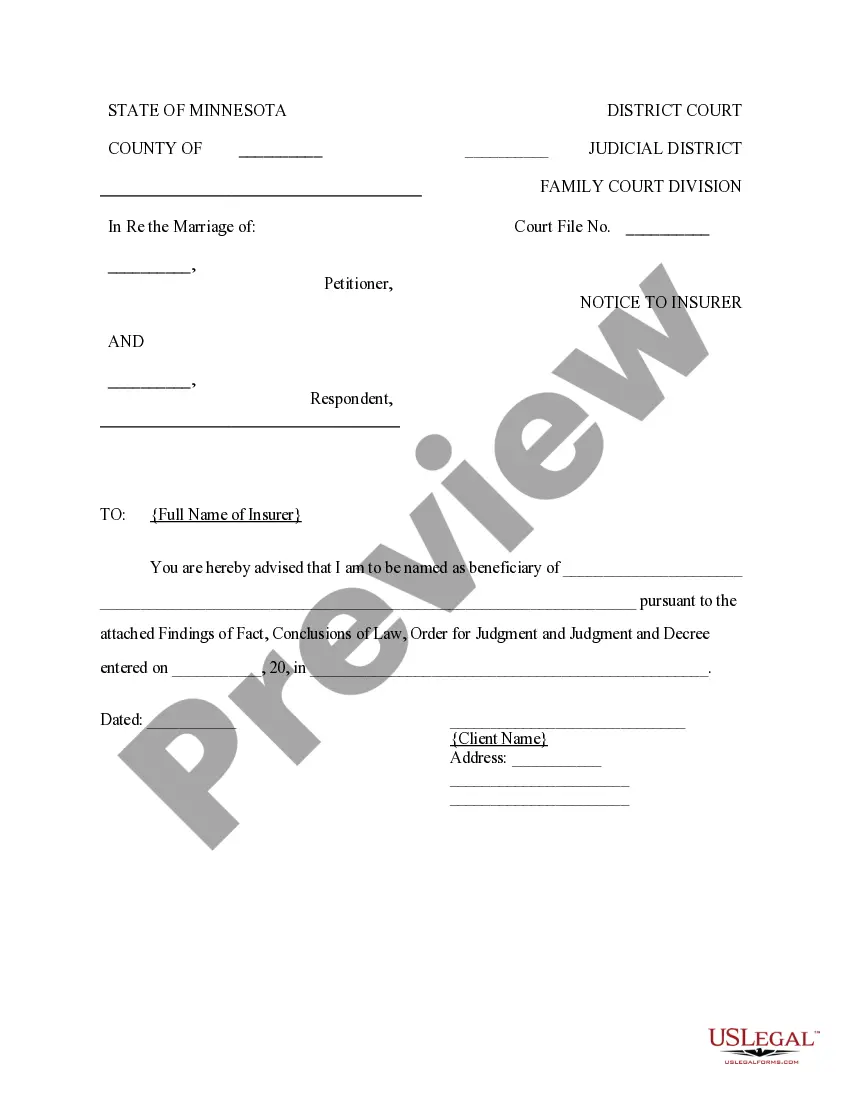

- Review the description and preview the example.

- Once you are certain the example meets your needs, click Buy Now.

- Choose a subscription plan that fits your financial situation.

- Establish a personal account.

- Make a payment through one of two convenient methods: by card or via PayPal.

- Select a format to download the document in; two options are available (PDF or Word).

- Download the document to the My documents section.

- Once your reusable form is downloaded, print it or store it on your device.

Form popularity

FAQ

The statute 524.2 101 in Minnesota covers the general provisions related to wills and estates, including the naming of beneficiaries. This statute is essential as it provides the legal framework for how beneficiaries are designated in life insurance policies and other financial instruments. Knowing this statute empowers you to make informed decisions regarding your estate planning. For specific cases involving the Minnesota Notice to Insurer of Court Order Naming Policy Beneficiary, consulting legal documents can be beneficial.

Life insurance companies typically notify beneficiaries through direct communication, often via mail or electronic notification. When a policyholder passes away, the insurer reviews the policy details and contacts the named beneficiaries to inform them of their entitlement. It is crucial to keep your contact information updated with your insurer for a smooth notification process. If there are any changes, the Minnesota Notice to Insurer of Court Order Naming Policy Beneficiary can also be a helpful resource.

The statute 524.3 204 in Minnesota outlines the requirements for life insurance companies regarding the notification of beneficiaries. This statute mandates that insurers must follow specific procedures when a court order names a policy beneficiary. Understanding this statute can help ensure that beneficiaries receive their rightful benefits without unnecessary delays. For more detailed guidance, you may explore resources on the Minnesota Notice to Insurer of Court Order Naming Policy Beneficiary.

In the event of a divorce, the designation of a life insurance beneficiary naming a spouse typically changes automatically, based on Minnesota law. After divorce, the former spouse may no longer be recognized as the beneficiary unless specifically stated otherwise. It is essential to file a Minnesota Notice to Insurer of Court Order Naming Policy Beneficiary to update the insurance company on these changes. This process helps you ensure that your assets are directed according to your current wishes, so it is wise to consult a legal expert for assistance.

Statute 507.24 in Minnesota addresses the requirements for notifying insurers when a court order names a policy beneficiary. This statute ensures that insurers recognize the designated beneficiary as per the court's direction. Understanding this statute is crucial for anyone involved in the process of changing a life insurance policy, particularly if it involves a Minnesota Notice to Insurer of Court Order Naming Policy Beneficiary. It helps safeguard your interests and ensures correct beneficiary designations.

In Minnesota, a public notice must include specific details to be valid. Typically, it should state the purpose of the notice, the involved parties, and relevant dates. Additionally, for a Minnesota Notice to Insurer of Court Order Naming Policy Beneficiary, it is crucial to ensure that the notice is published in a qualified legal newspaper. This helps ensure that all interested parties are informed, which is essential for legal compliance.

Yes, the authority to name a beneficiary under a life insurance policy lies primarily with the policyholder. However, if there is a court order in place, such as a Minnesota Notice to Insurer of Court Order Naming Policy Beneficiary, this may influence the process. It is essential to ensure that the beneficiary designation aligns with both your intentions and legal requirements.

Beneficiaries must be clearly named in the life insurance policy to ensure they receive the benefits. Furthermore, laws can vary by state, so it's crucial to understand the specific rules applicable in Minnesota. Utilizing a Minnesota Notice to Insurer of Court Order Naming Policy Beneficiary can help clarify and enforce your wishes regarding beneficiaries.

The policyholder typically has the authority to name the beneficiary under a life insurance policy. This means that you can designate who will receive the benefits upon your passing. It is important to follow proper procedures to ensure your designation is legally recognized, particularly when considering a Minnesota Notice to Insurer of Court Order Naming Policy Beneficiary.