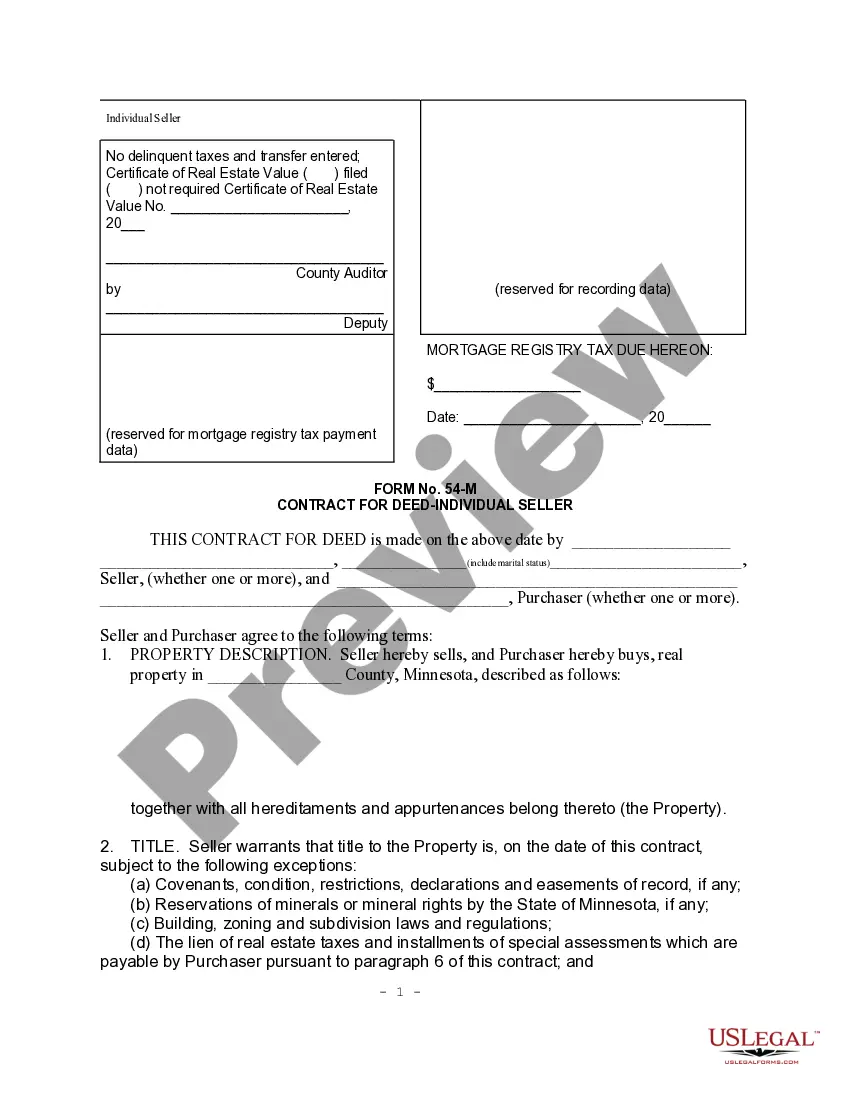

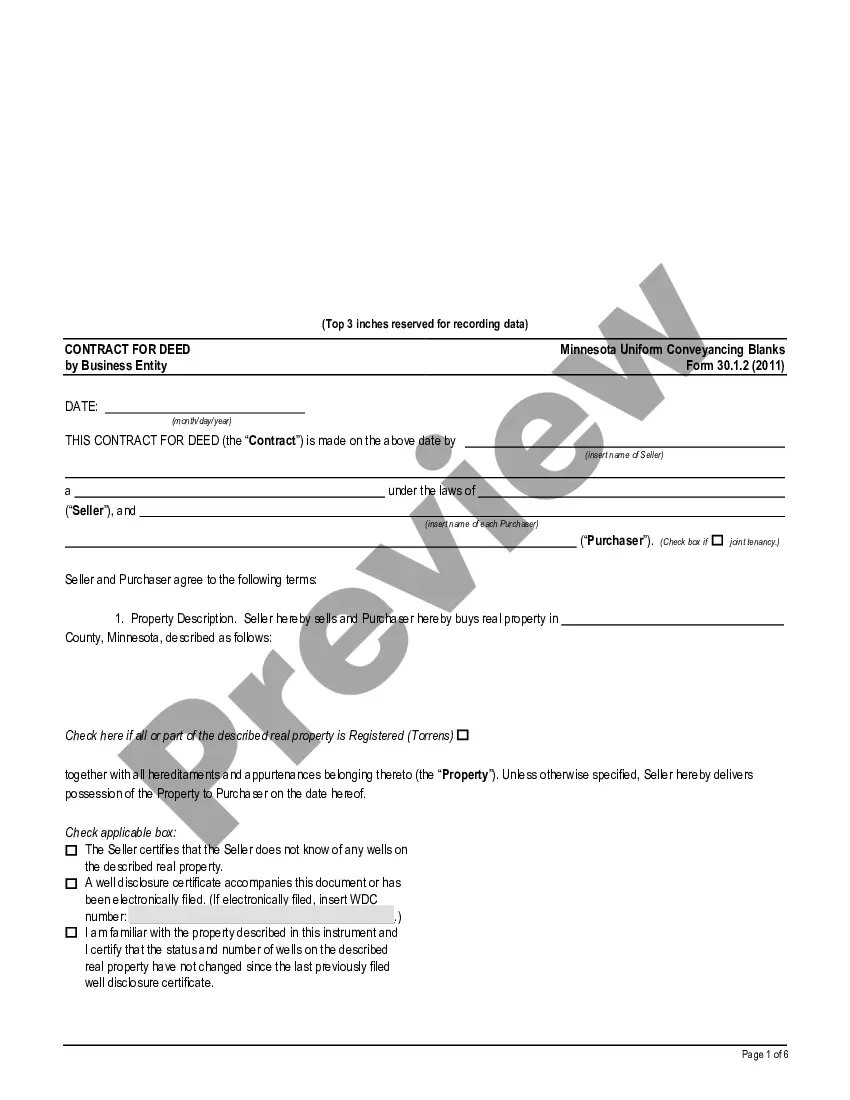

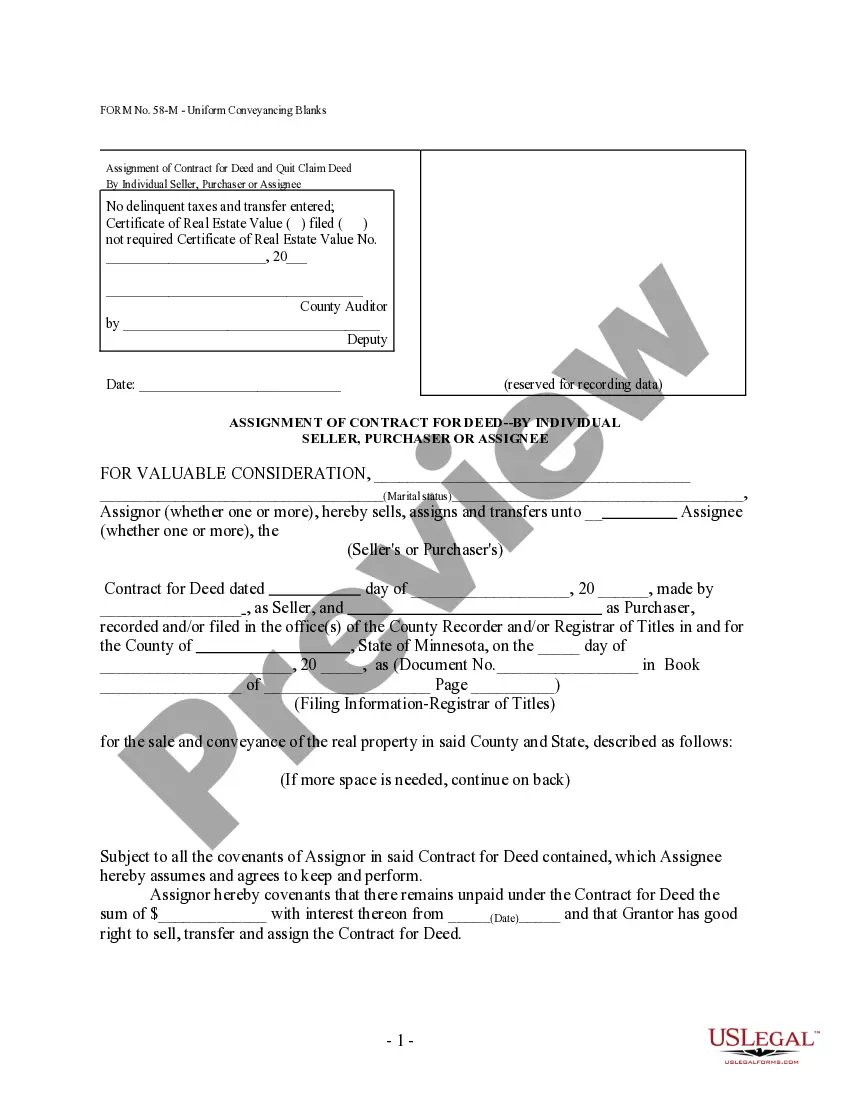

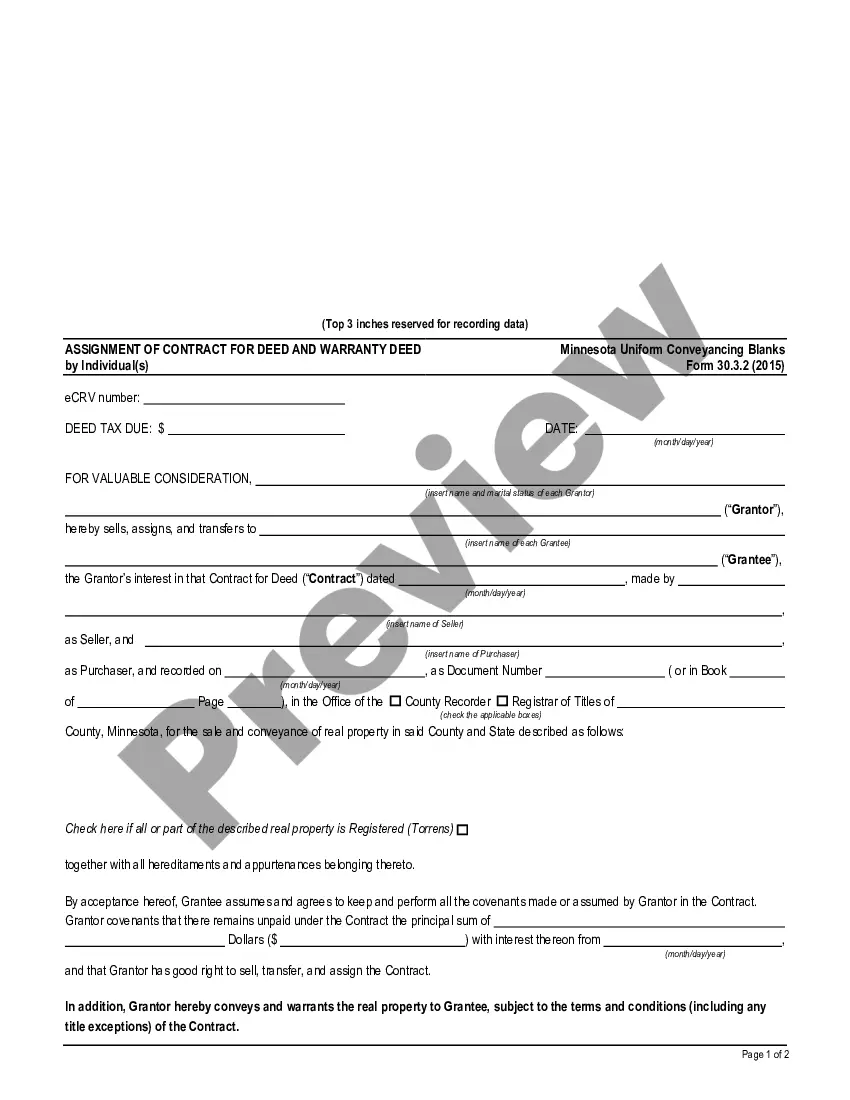

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce. The form is available here in PDF format.

Minnesota Contract for Deed Addendum Form 30.2.1

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

Contract for Deed Addendum Form 30 2 1 refers to a specific legal document that modifies or adds to the terms of an existing contract for deed. A contract for deed, also known as a land contract, is a legal agreement where the seller finances the purchase of the property rather than a bank or other financial institution. The addendum form is used when the parties involved agree to update or change certain conditions within the original agreement.

Step-by-Step Guide

- Review the Original Contract: Before drafting an addendum, thoroughly review the initial agreement to determine which terms need modification or clarification.

- Discuss Changes: Both parties should discuss and agree on the changes to ensure that the addendum meets the needs and expectations of both the buyer and the seller.

- Draft the Addendum: Write the addendum clearly outlining the modifications. It's advisable to use precise language to avoid any potential misunderstandings or disputes.

- Include Reference Details: Clearly mention details that connect the addendum to the original contract, such as date and original contract reference numbers.

- Signatures: Both parties must sign the addendum. These signatures legally bind the parties to the new terms outlined in the document.

- Witnesses or Notary: Depending on state law, the addendum may need to be signed in the presence of witnesses or notarized to be legally enforceable.

- Attach the Addendum to the Original Contract: Once signed, attach the addendum to the original contract, ensuring that it is part of the legal records and is accessible for future reference.

Risk Analysis

- Legal Risks: Improperly drafted addendums can lead to legal disputes or void the original contract if they contradict existing laws or the original terms without proper execution.

- Financial Risks: Changes in terms might inadvertently affect the financial obligations of either party. For example, altering payment plans might impact the buyer's ability to make payments or the sellers financial planning.

- Compliance Risks: Failing to comply with state-specific laws regarding contracts for deed and their addendums can have legal repercussions, including penalties or nullification of the agreement.

Key Takeaways

Attention to Detail: The exactness in preparing and attaching the addendum is crucial for its validity and enforceability.

Legal Consultation: Consulting with a real estate attorney may help to navigate state laws and ensure that all modifications are legally sound.

Clear Communication: Both parties must maintain open and clear communication to effectively manage any changes in the agreement and prevent disputes.

How to fill out Minnesota Contract For Deed Addendum Form 30.2.1?

Access any template from 85,000 legal documents like the Minnesota Contract For Deed - Corporation or Partnership Seller - UCBC Form 30.2.1 available online with US Legal Forms. Each template is drafted and refreshed by state-certified legal experts.

If you possess a subscription, Log In. Once on the form’s page, click the Download button and go to My documents to retrieve it.

If you haven't subscribed yet, follow the instructions outlined below: Check the state-specific prerequisites for the Minnesota Contract For Deed - Corporation or Partnership Seller - UCBC Form 30.2.1 you wish to utilize. Review the description and preview the sample. When you're confident that the template meets your needs, simply click Buy Now. Choose a subscription plan that truly fits your budget. Set up a personal account. Make payment using either of the two suitable methods: by credit card or via PayPal. Select a format for downloading the file; two options are available (PDF or Word). Download the document to the My documents tab. When your reusable template is prepared, print it or save it to your device.

- With US Legal Forms, you will consistently have immediate access to the correct downloadable template.

- The service provides you access to documents and categorizes them to ease your search.

- Utilize US Legal Forms to quickly and easily obtain your Minnesota Contract For Deed - Corporation or Partnership Seller - UCBC Form 30.2.1.

Form popularity

FAQ

In a contract for deed, the responsibility for property taxes can vary based on the terms negotiated between the buyer and seller. Typically, the buyer assumes the tax obligation, but this should be clearly stated in the contract. Utilizing the Minnesota Contract for Deed Addendum Form 30.2.1 can help clarify these terms and ensure both parties understand their responsibilities.

To write an addendum to a real estate contract, begin by clearly labeling it as an addendum and referencing the original contract. Detail the changes or additions you wish to make, using clear and concise language. Finally, have all parties sign the addendum to ensure it is legally enforceable.

Writing a contract for a deed requires careful attention to detail. Start by identifying the parties involved and providing a thorough description of the property. Next, outline the payment terms and include any contingencies. Finally, ensure both parties sign the document to finalize the agreement.

Yes, you can write your own land contract, but it is essential to ensure that it complies with local laws. Using resources like the Minnesota Contract for Deed Addendum Form 30.2.1 can guide you through this process. However, consulting with a legal professional can help you avoid potential pitfalls.

To write a simple legally binding contract, start with a clear title and date. Include the names of the parties, the purpose of the agreement, and the specific terms. Make sure to use straightforward language and include a provision for signatures, as this will help reinforce the agreement's validity.

While it is not strictly necessary to hire a lawyer for a contract for deed, it is highly recommended. An attorney can help you understand the legal implications and ensure that the document, including the Minnesota Contract for Deed Addendum Form 30.2.1, meets all state requirements. This can prevent potential disputes in the future and provide peace of mind.

Filling out a contract for a deed involves several steps. First, ensure you have the correct form, such as the Minnesota Contract for Deed Addendum Form 30.2.1. Next, you will need to include the names of the parties involved, a clear description of the property, and the payment terms. Finally, both parties should sign and date the document to make it legally binding.

The new contract for deed law in Minnesota introduces significant changes to how property transactions are structured. It emphasizes transparency and provides clearer guidelines for both buyers and sellers. This law now requires the use of the Minnesota Contract for Deed Addendum Form 30.2.1, which outlines essential rights and obligations. By using this form, parties can ensure compliance with the updated regulations and protect their interests during the transaction.

The contract for deed addendum is a supplementary document that specifies additional terms related to the contract for deed. This addendum can address unique circumstances or agreements made by the parties involved. By utilizing the Minnesota Contract for Deed Addendum Form 30.2.1, you can create a clear and comprehensive record that protects everyone's interests in the transaction.

In Minnesota, a buyer must record the contract for deed within four months of execution to protect their interest in the property. Failing to do so can lead to complications regarding ownership rights. Using the Minnesota Contract for Deed Addendum Form 30.2.1 can help ensure that all necessary documentation is in order and recorded promptly.