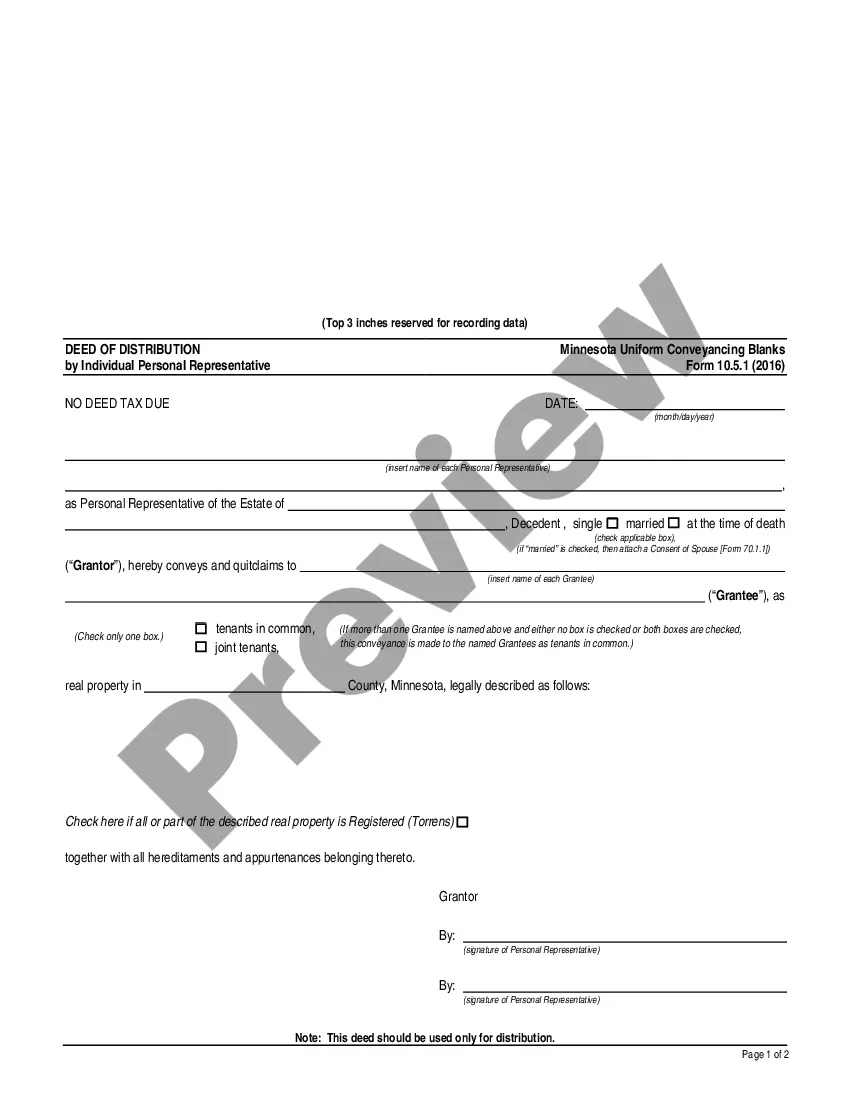

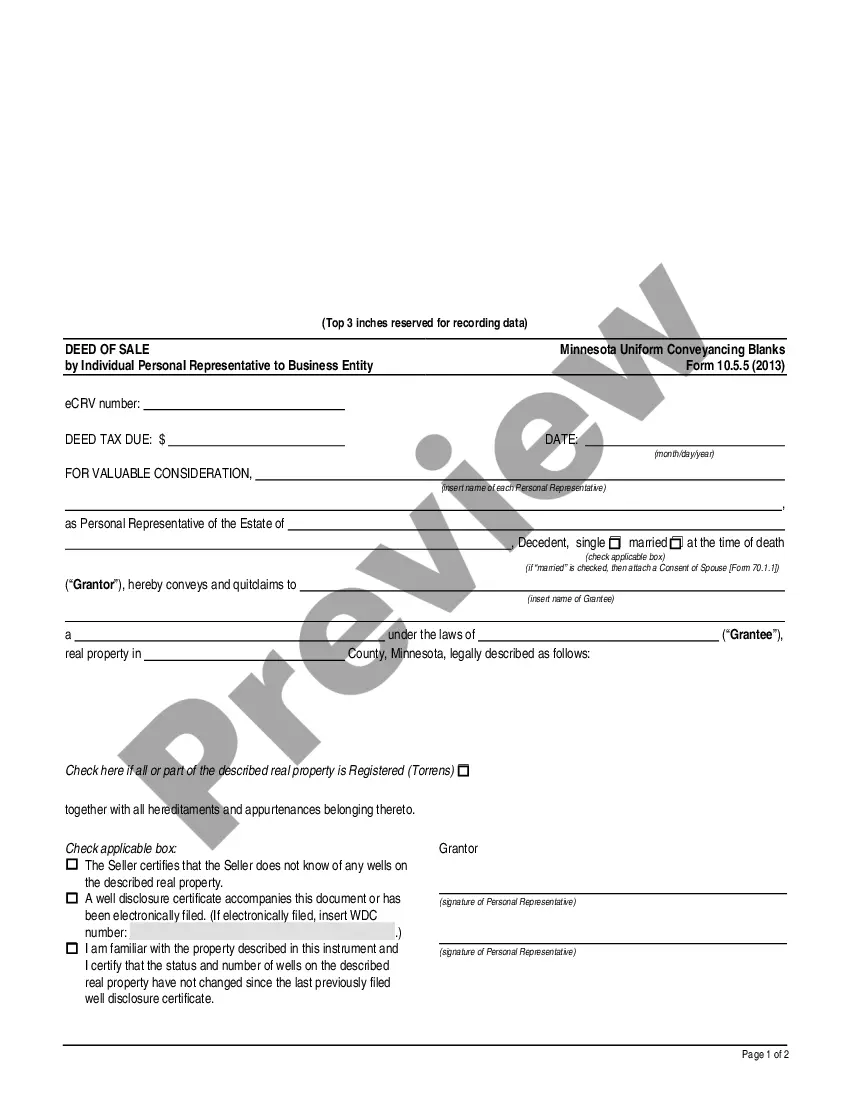

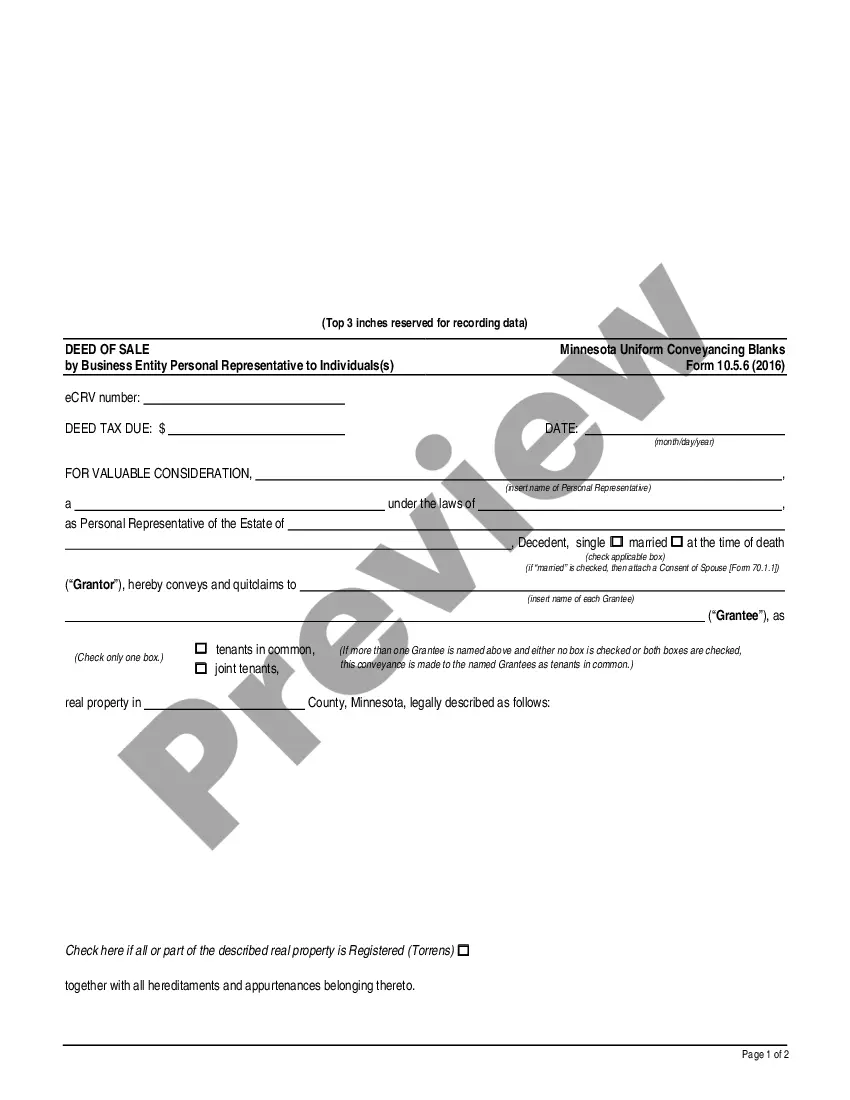

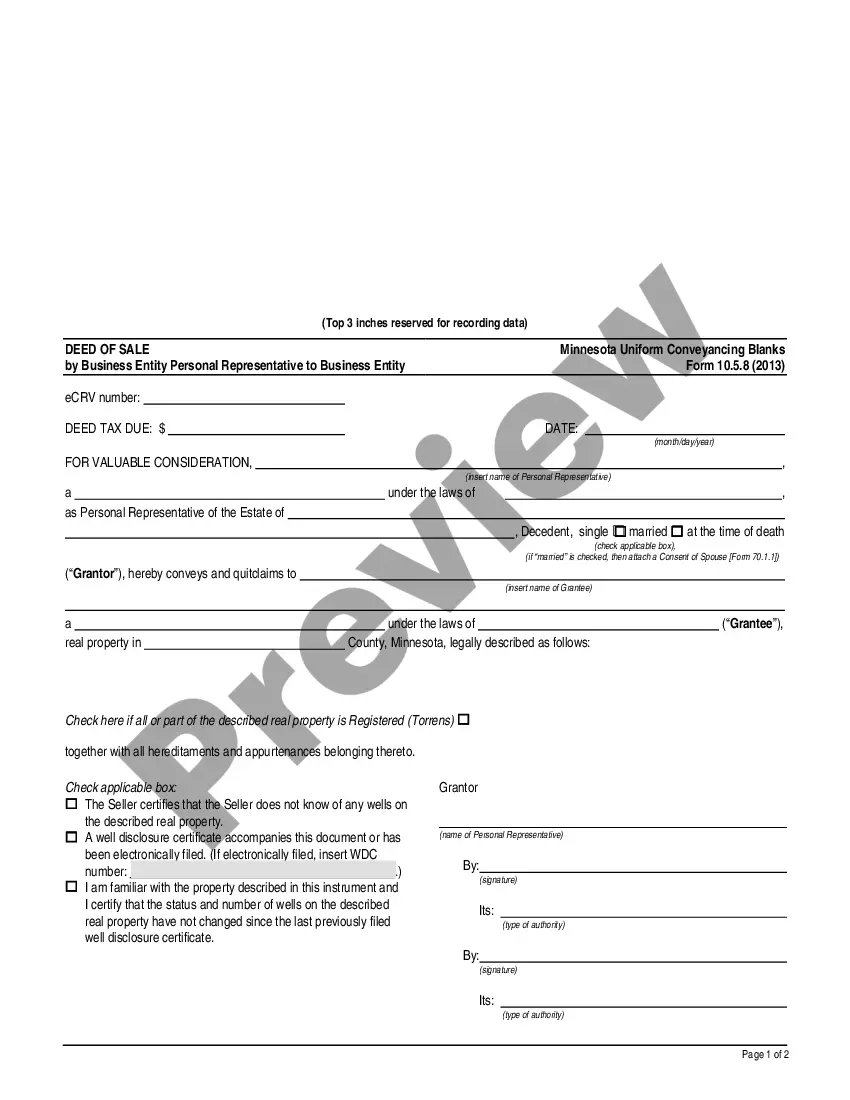

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce. The form is available here in PDF format.

Minnesota Deed of Distribution by Business Entity Personal Representative - UCBC Form 10.5.2

Description

How to fill out Minnesota Deed Of Distribution By Business Entity Personal Representative - UCBC Form 10.5.2?

Obtain any version from 85,000 legal records including Minnesota Deed of Distribution by Business Entity Personal Representative - UCBC Form 10.5.2 online with US Legal Forms. Each template is crafted and refreshed by state-authorized legal experts.

If you possess a subscription, sign in. Once you reach the form’s page, click the Download button and navigate to My documents to access it.

If you haven't subscribed yet, follow the guidelines below.

With US Legal Forms, you will always have immediate access to the appropriate downloadable template. The service provides you with forms and categorizes them to ease your search. Utilize US Legal Forms to swiftly and effortlessly acquire your Minnesota Deed of Distribution by Business Entity Personal Representative - UCBC Form 10.5.2.

- Verify the state-specific criteria for the Minnesota Deed of Distribution by Business Entity Personal Representative - UCBC Form 10.5.2 you wish to use.

- Examine the description and look over the sample.

- When you are sure the template meets your needs, click on Buy Now.

- Select a subscription plan that fits your budget.

- Establish a personal account.

- Make payment in one of two convenient methods: by card or via PayPal.

- Choose a format to download the document in; two options are available (PDF or Word).

- Download the file to the My documents section.

- Once your reusable template is prepared, print it or save it to your device.

Form popularity

FAQ

A personal representative deed in Minnesota is a document executed by an appointed personal representative, authorizing the transfer of property from an estate to its beneficiaries. This deed is crucial for legitimizing the transfer and ensuring that it meets legal requirements. The Minnesota Deed of Distribution by Business Entity Personal Representative - UCBC Form 10.5.2 is specifically designed for business entities acting as personal representatives, streamlining the process and ensuring compliance with Minnesota laws. By using this form, you can simplify the distribution process and protect the rights of all involved.

A personal representative's deed typically provides essential details regarding the distribution of an estate's assets among beneficiaries. It includes information about the deceased individual, the personal representative's authority, and a list of the assets being distributed. Specifically, the Minnesota Deed of Distribution by Business Entity Personal Representative - UCBC Form 10.5.2 includes all necessary legal language to validate the deed and protect the interests of all parties involved. This ensures that the process is transparent and legally binding.

A deed of distribution in Minnesota is a legal document that outlines the distribution of assets from an estate to the beneficiaries. This document is particularly relevant when a business entity acts as a personal representative. In the context of the Minnesota Deed of Distribution by Business Entity Personal Representative - UCBC Form 10.5.2, it serves to formalize the transfer of property and ensure compliance with state laws. Utilizing this deed helps clarify ownership and provides a clear record of asset distribution.

Filling out a Minnesota quit claim deed requires careful attention to detail. Begin by clearly stating the names of the grantor and grantee, as well as the legal description of the property. Ensure you include the statement of consideration, which indicates the value exchanged for the property. For a smooth process, consider using the Minnesota Deed of Distribution by Business Entity Personal Representative - UCBC Form 10.5.2 available on USLegalForms. This form simplifies the process, ensuring you meet all legal requirements.

A Minnesota Deed of Distribution by Business Entity Personal Representative - UCBC Form 10.5.2 allows a personal representative to transfer property from an estate to beneficiaries. This legal document records the distribution of assets, ensuring that all parties receive their rightful share. When properly executed, it provides a clear and official record of the distribution process. You can utilize our platform at US Legal Forms to easily access and complete this form, ensuring compliance with Minnesota laws.

Q: How Long Does an Executor Have to Distribute Assets From a Will? A: Dear Waiting: In most states, a will must be executed within three years of a person's death.

Used to transfer property rights from a deceased person's estate. Involves Probate Court. Like a Quit Claim deed, there are no warranties. Generally, the Personal Representative is unwilling to warrant or promise anything relating to property that he/she has never personally owned.

Executor Fees in Minnesota For example, if in the last year, executor fees were typically 1.5%, then 1.5% would be considered reasonable and 3% may be unreasonable. But the court can take into account other factors such as how complicated the estate is to administer and may increase or decrease the amount from there.

A personal representative deed and warranty deed are the same only in that they both convey ownership of land. The types of title assurance that the different deeds provide to the new owner are very different.

A Minnesota Quit Claim Deed is a legal document that is used to convey property from one person to the next within the state. This type of transfer comes with no guarantee as to whether or not the title is clear, and doesn't reveal whether or not the seller has the legal right or authority to sell the property.