Michigan Application For Authorization By Self-Insured Employer or Group Fund For Servicing Agent DEG User Account (fill-in form) is a form used by employers or group funds in Michigan to authorize a third-party servicing agent to access and use the DEG user account. The form is used by employers and group funds to provide authorization for a servicing agent to access and manage the DEG user account. The form requires the employer or group fund to provide information about the servicing agent, including their name, address, phone number, and email address. It also requires the employer or group fund to provide a description of the services the servicing agent will provide. There are two types of Michigan Application For Authorization By Self-Insured Employer or Group Fund For Servicing Agent DEG User Account (fill-in form): one for employers and one for group funds.

Michigan Application For Authorization By Self-Insured Employer or Group Fund For Servicing Agent DEG User Account (fill-in form)

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Michigan Application For Authorization By Self-Insured Employer Or Group Fund For Servicing Agent DEG User Account (fill-in Form)?

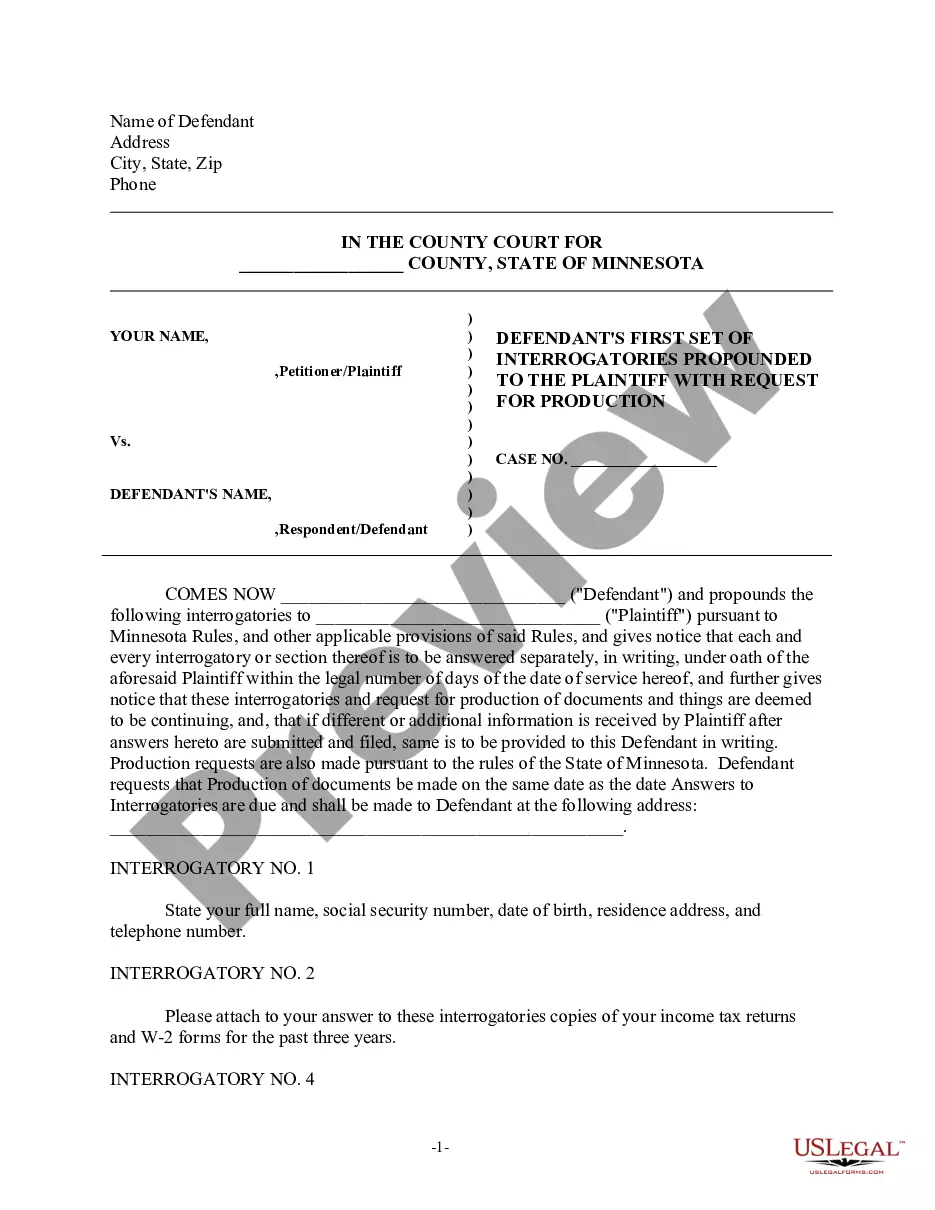

Filling out official documents can be quite a hassle if you lack accessible fillable templates. With the US Legal Forms online repository of formal paperwork, you can trust the forms you acquire, as all of them comply with federal and state regulations and have been reviewed by our specialists.

Therefore, if you need to obtain the Michigan Application For Authorization By Self-Insured Employer or Group Fund For Servicing Agent DEG User Account (fillable form), our service is the ideal source to download it.

Make sure to review the content of the form you wish to use and ensure it meets your requirements and complies with your state law regulations. Looking at your document preview and reading through its overall description will assist you in doing just that.

- Acquiring your Michigan Application For Authorization By Self-Insured Employer or Group Fund For Servicing Agent DEG User Account (fillable form) from our collection is as easy as pie.

- Previously approved users with an active subscription simply need to Log In and click the Download button after finding the suitable template.

- If necessary, users can access the same document from the My documents section of their profile.

- However, even if you are a newcomer to our service, signing up with a valid subscription will only take a few moments. Here’s a quick guide for you.

Form popularity

FAQ

Michigan Form 163 is used for reporting information to the Michigan Unemployment Insurance Agency regarding a self-insured employer or group fund. This form plays a crucial role in the application process for the Michigan Application For Authorization By Self-Insured Employer or Group Fund For Servicing Agent DEG User Account (fill-in form). By accurately completing Form 163, you provide necessary details that facilitate your compliance with Michigan’s unemployment insurance laws. You can find this form on the official Michigan government website or through platforms like uslegalforms, which offer streamlined solutions for form completion.

The employer account number for Michigan unemployment insurance is a unique identifier assigned to each employer by the Michigan Unemployment Insurance Agency. This number is essential for managing your unemployment insurance contributions and claims. To apply for the Michigan Application For Authorization By Self-Insured Employer or Group Fund For Servicing Agent DEG User Account (fill-in form), you will need this account number to ensure proper processing. If you do not have an account number, you can contact the Michigan Unemployment Insurance Agency for assistance.

The Michigan Workers' Disability Compensation Act (Act) established protections for workers who get sick or injured from the work they do. It makes benefits available to most workers regardless of who is at fault for the injury or illness.

Sole proprietors only require a workers' compensation policy when they have 1 full time or 3 part-time employees. The owner of a sole proprietor is not considered an employee of the business.

The law requires that every employer subject to the Act must provide some way of assuring that it can pay benefits to its workers should they become injured. Most employers in Michigan provide this security by purchasing an insurance policy from a private insurance company.

File an exclusion form with the Insurance Compliance Division of the Agency. This division can be reached at 517-284-8922. It is a form provided by the Insurance Compliance Division (WC-337) which is completed by the employer and filed with the Agency.

Any business with one or more employees is required to carry workers' compensation insurance in Michigan. This policy provides medical benefits for work-related injuries.

Be aware that there are exemptions to the state law, such as: Agricultural employers, unless they have three or more employees working more than 35 hours a week for 13 weeks. Domestic workers, like housekeepers. Partners and officers of a partnership and corporation.