Michigan Provisions Which May Be Added to a Division Or Transfer Order

Description

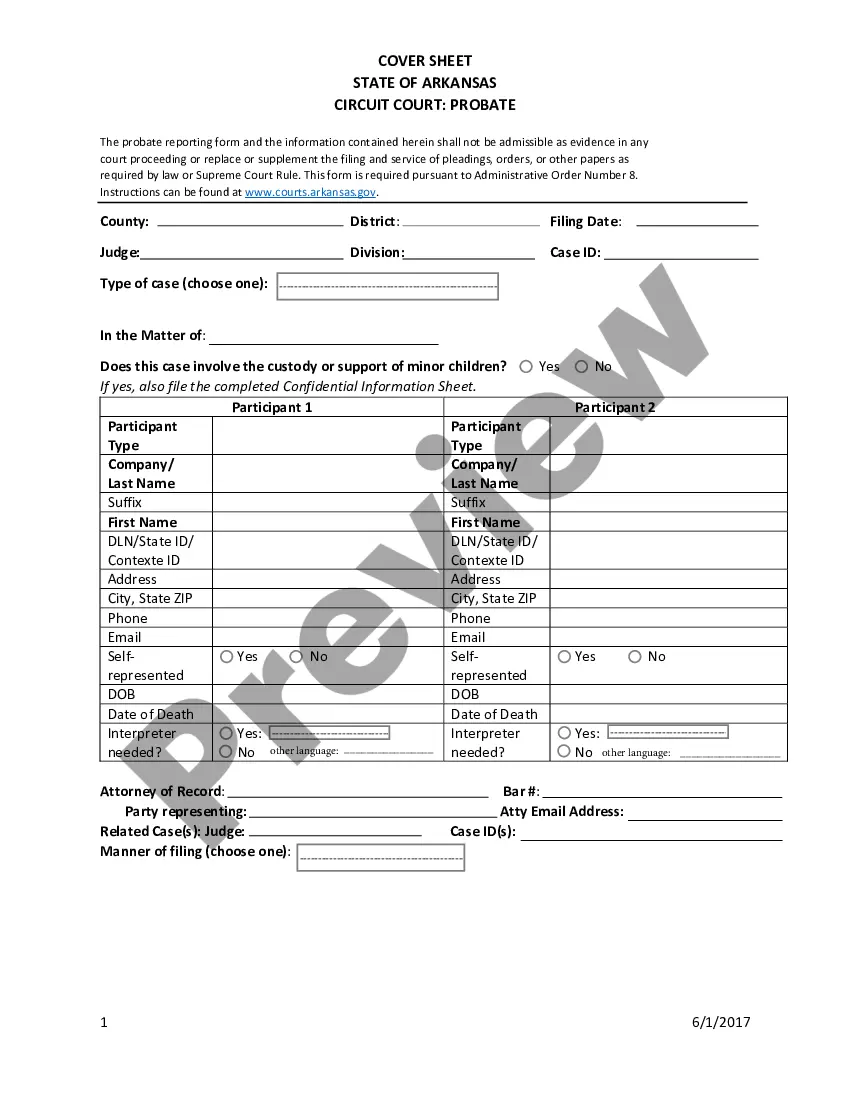

How to fill out Provisions Which May Be Added To A Division Or Transfer Order?

US Legal Forms - one of several greatest libraries of authorized forms in the USA - gives a variety of authorized document layouts you can acquire or print out. Making use of the internet site, you can find 1000s of forms for enterprise and person reasons, sorted by groups, claims, or keywords and phrases.You can get the latest types of forms such as the Michigan Provisions Which May Be Added to a Division Or Transfer Order within minutes.

If you already possess a membership, log in and acquire Michigan Provisions Which May Be Added to a Division Or Transfer Order from your US Legal Forms local library. The Obtain option will appear on every kind you view. You gain access to all formerly downloaded forms within the My Forms tab of your profile.

If you want to use US Legal Forms the very first time, listed here are straightforward recommendations to get you started:

- Ensure you have selected the best kind for your personal metropolis/county. Select the Preview option to examine the form`s content material. Read the kind description to ensure that you have chosen the right kind.

- In case the kind does not match your needs, make use of the Research industry on top of the screen to find the one which does.

- Should you be pleased with the shape, validate your selection by visiting the Acquire now option. Then, opt for the pricing prepare you like and supply your references to register to have an profile.

- Approach the transaction. Make use of your credit card or PayPal profile to complete the transaction.

- Pick the formatting and acquire the shape in your system.

- Make modifications. Load, change and print out and indicator the downloaded Michigan Provisions Which May Be Added to a Division Or Transfer Order.

Each design you included with your money does not have an expiration particular date which is your own property for a long time. So, if you would like acquire or print out one more version, just go to the My Forms segment and click about the kind you require.

Obtain access to the Michigan Provisions Which May Be Added to a Division Or Transfer Order with US Legal Forms, probably the most considerable local library of authorized document layouts. Use 1000s of specialist and status-particular layouts that satisfy your organization or person requires and needs.

Form popularity

FAQ

Sign and date the quitclaim deed in a notary's presence, then file it with the County Register of Deeds Office in the property's county, not the county where you live. Once the deed is filed and recorded, the transfer is deemed legal.

There are different options to have property transferred to another person. Simply adding someone's name to a property through the use of a quit claim deed or a similar document gives you the ability to gift real estate while you are still alive.

3.402. Rule 3.402 - Partition Procedure (A) Determination of Parties' Interests. In ordering partition the court shall determine the rights and interests of the parties in the premises, and describe parts or shares that are to remain undivided for owners whose interests are unknown or not ascertained.

Affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of the transfer. The information on this form is NOT CONFIDENTIAL.

How Much Are Transfer Taxes in Michigan? The state transfer tax rate in Michigan is $3.75 for every $500 of property value, or 0.75% of the transferred property's value. In addition to the state tax, each individual county levies an additional transfer tax of $0.55 per $500.

There will be a $30 recording fee. If you prepare a quitclaim deed using the Do-It-Yourself Quitclaim Deed (after Divorce) tool, detailed instructions on what to do next will print out along with the deed.

Sign and date the quitclaim deed in a notary's presence, then file it with the County Register of Deeds Office in the property's county, not the county where you live. Once the deed is filed and recorded, the transfer is deemed legal.

Use Form FOC 25 for the order transferring the case. The court may order that any past-due fees and costs be paid to the transferring FOC office at the time of transfer (MCR 3.212(C)(2)). FOC may decide to waive the fees or ask the court to order that the fees be paid to the receiving county's FOC.