Michigan Direction For Payment of Royalty to Trustee by Royalty Owners

Description

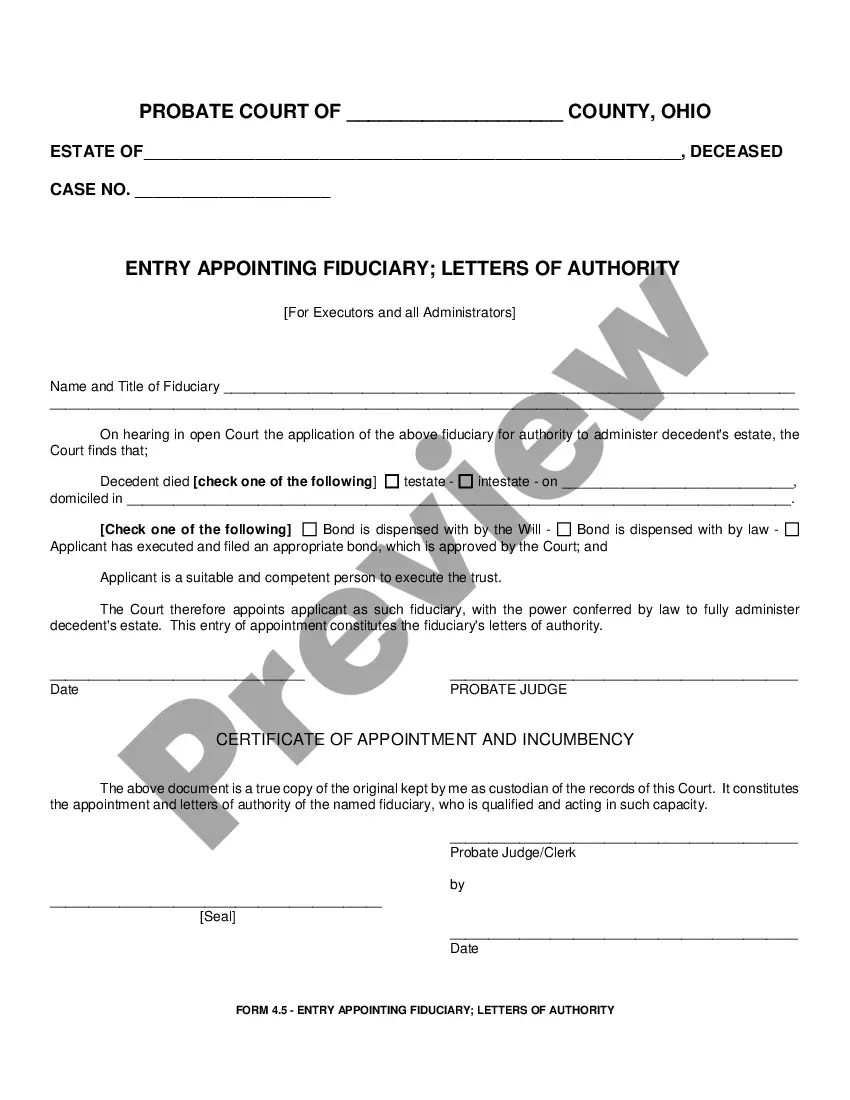

How to fill out Direction For Payment Of Royalty To Trustee By Royalty Owners?

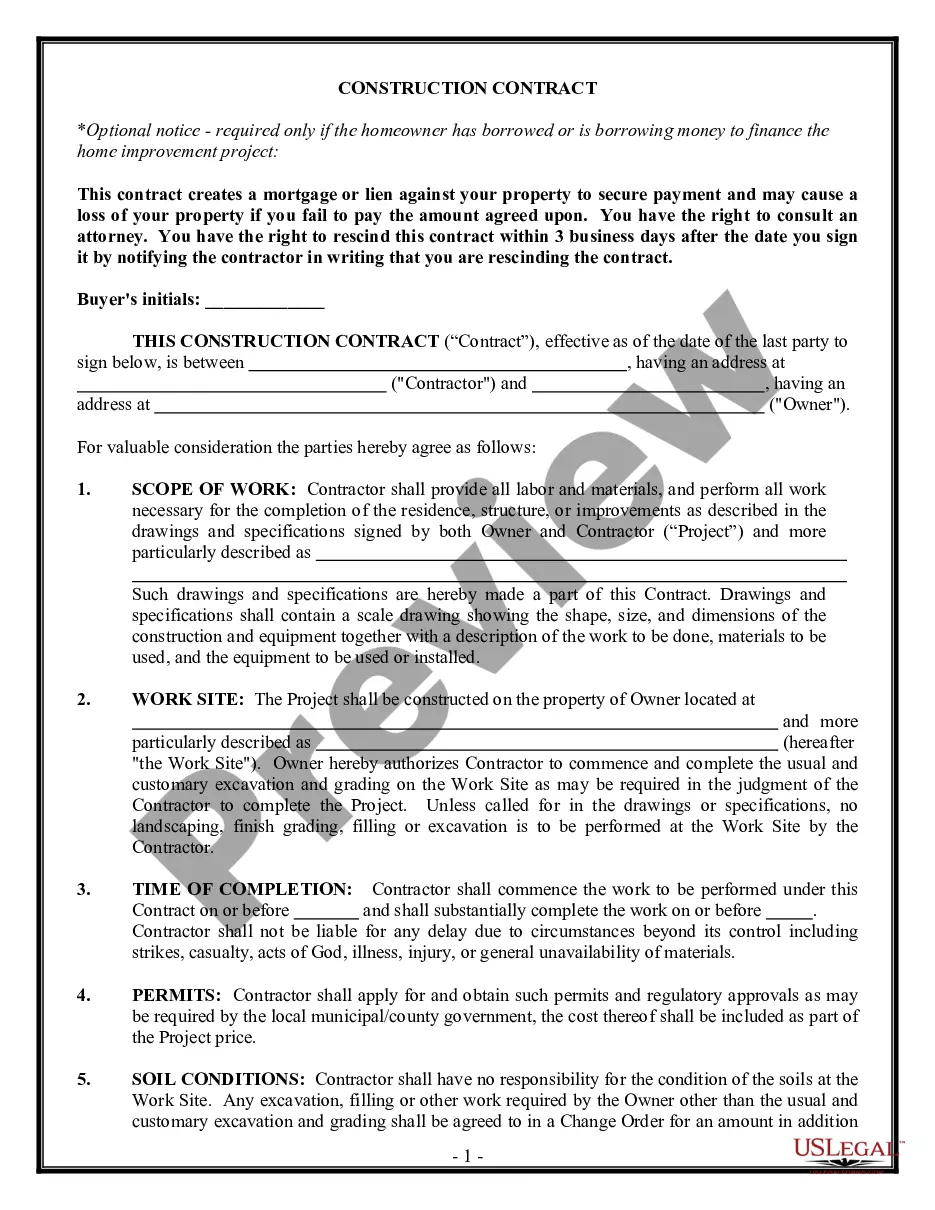

Finding the right authorized record format could be a struggle. Obviously, there are a lot of themes accessible on the Internet, but how do you obtain the authorized type you will need? Use the US Legal Forms web site. The service provides thousands of themes, like the Michigan Direction For Payment of Royalty to Trustee by Royalty Owners, that you can use for company and private demands. All of the types are examined by pros and meet federal and state requirements.

In case you are currently signed up, log in for your account and then click the Obtain button to get the Michigan Direction For Payment of Royalty to Trustee by Royalty Owners. Make use of account to search from the authorized types you possess bought previously. Proceed to the My Forms tab of your account and acquire yet another duplicate from the record you will need.

In case you are a whole new end user of US Legal Forms, listed below are straightforward recommendations that you should follow:

- First, be sure you have chosen the correct type for your personal city/state. You may examine the form using the Preview button and study the form explanation to ensure it is the best for you.

- In case the type is not going to meet your preferences, take advantage of the Seach area to obtain the proper type.

- When you are sure that the form would work, select the Purchase now button to get the type.

- Choose the pricing strategy you desire and enter in the needed information and facts. Make your account and purchase the transaction using your PayPal account or charge card.

- Select the data file structure and acquire the authorized record format for your device.

- Comprehensive, change and print and signal the obtained Michigan Direction For Payment of Royalty to Trustee by Royalty Owners.

US Legal Forms may be the largest collection of authorized types for which you can find numerous record themes. Use the service to acquire skillfully-created documents that follow status requirements.

Form popularity

FAQ

You must file a Michigan Fiduciary Income Tax Return (Form MI-1041) and pay the tax due if you are the fiduciary for an estate or trust that was required to file a U.S. Form 1041 or 990-T or that had income taxable to Michigan that was not taxable on the U.S. Form 1041.

If all trustees are California residents, then the entirety of the trust's income is taxable in California.

Residency of the beneficiary. California, Georgia, Montana, North Carolina, North Dakota, and Tennessee tax a trust if it has one or more resident beneficiaries. Generally, only income attributable to the resident beneficiary is taxed by the state.

Hear this out loud PauseResident estates and trusts are subject to the individual income tax. ( Sec. 206.51(6), M.C.L. )

Nonresidents and part-year residents must pay income tax to Michigan on all income earned in Michigan or attributable to Michigan. The following definitions may help determine what income is attributable to Michigan (1) Allocate: To assign or distribute to one state.