This form provides boilerplate contract clauses that outline the obligations of nondisclosure and the restrictions that apply to public announcements regarding the existence or terms of the contract agreement. Several different language options representing various levels of restriction are included to suit individual needs and circumstances.

Michigan Announcement Provisions in the Transactional Context

Description

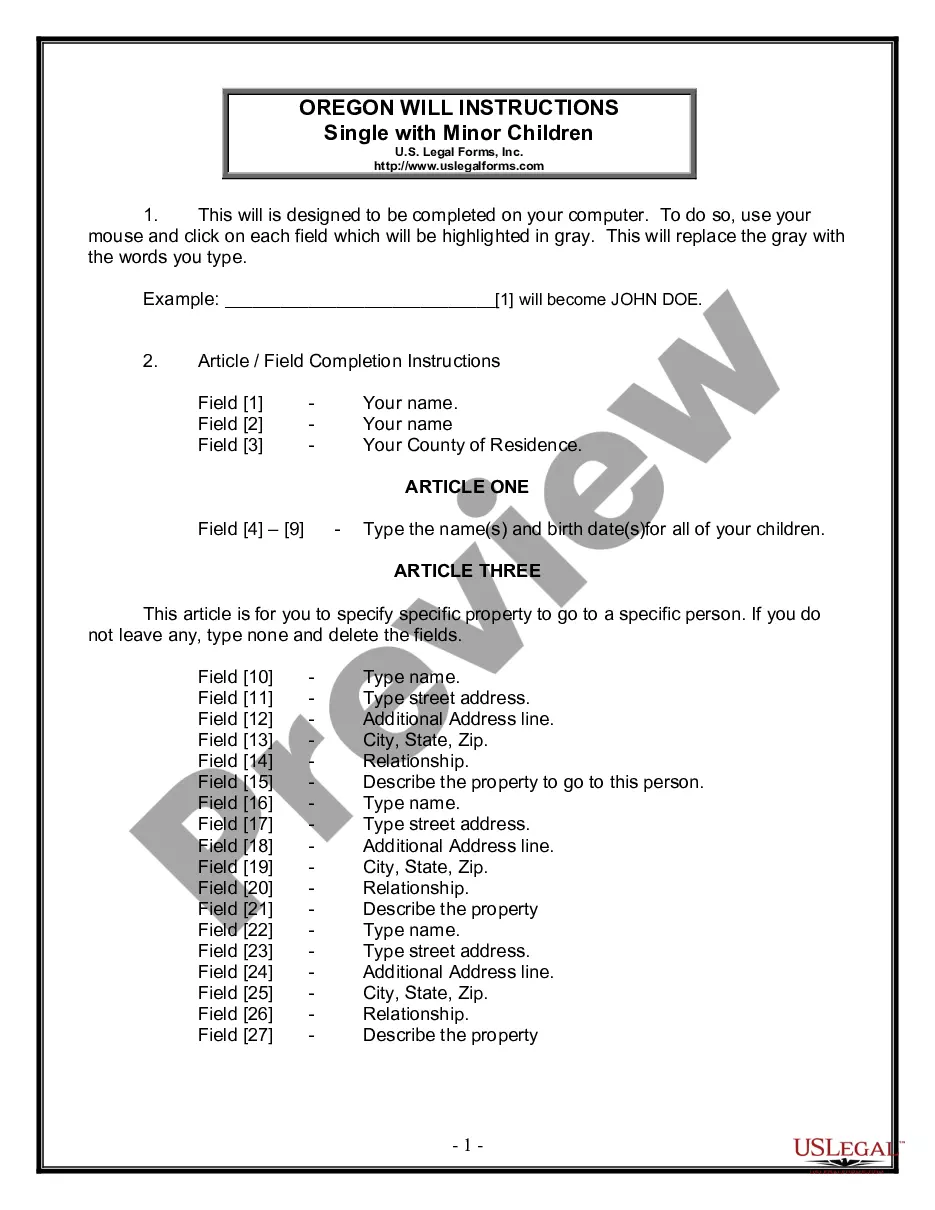

How to fill out Announcement Provisions In The Transactional Context?

It is possible to spend hours on-line looking for the legal document format that suits the state and federal demands you require. US Legal Forms offers a huge number of legal types that are analyzed by experts. You can actually download or produce the Michigan Announcement Provisions in the Transactional Context from the services.

If you currently have a US Legal Forms bank account, it is possible to log in and then click the Obtain key. Following that, it is possible to full, change, produce, or signal the Michigan Announcement Provisions in the Transactional Context. Every legal document format you purchase is yours forever. To obtain one more copy of the acquired form, proceed to the My Forms tab and then click the related key.

If you are using the US Legal Forms site for the first time, keep to the straightforward guidelines under:

- Initially, make certain you have selected the proper document format for that state/town of your choosing. Read the form description to make sure you have picked the appropriate form. If accessible, make use of the Review key to appear with the document format also.

- If you wish to find one more version of your form, make use of the Look for industry to discover the format that suits you and demands.

- When you have discovered the format you want, simply click Acquire now to proceed.

- Find the costs program you want, type in your qualifications, and register for your account on US Legal Forms.

- Total the deal. You can use your Visa or Mastercard or PayPal bank account to cover the legal form.

- Find the formatting of your document and download it to your product.

- Make modifications to your document if required. It is possible to full, change and signal and produce Michigan Announcement Provisions in the Transactional Context.

Obtain and produce a huge number of document templates while using US Legal Forms site, that offers the most important selection of legal types. Use skilled and express-certain templates to take on your small business or individual requirements.