Michigan Assignment of Member Interest in Limited Liability Company - LLC

Description

How to fill out Assignment Of Member Interest In Limited Liability Company - LLC?

US Legal Forms - one of many largest libraries of authorized kinds in the USA - delivers a wide range of authorized papers layouts you are able to obtain or printing. While using site, you can find a huge number of kinds for company and person reasons, categorized by classes, claims, or keywords.You will find the most up-to-date variations of kinds like the Michigan Assignment of Member Interest in Limited Liability Company - LLC within minutes.

If you have a monthly subscription, log in and obtain Michigan Assignment of Member Interest in Limited Liability Company - LLC in the US Legal Forms catalogue. The Download switch can look on every type you view. You gain access to all earlier delivered electronically kinds inside the My Forms tab of your accounts.

If you would like use US Legal Forms for the first time, listed here are simple directions to help you get started off:

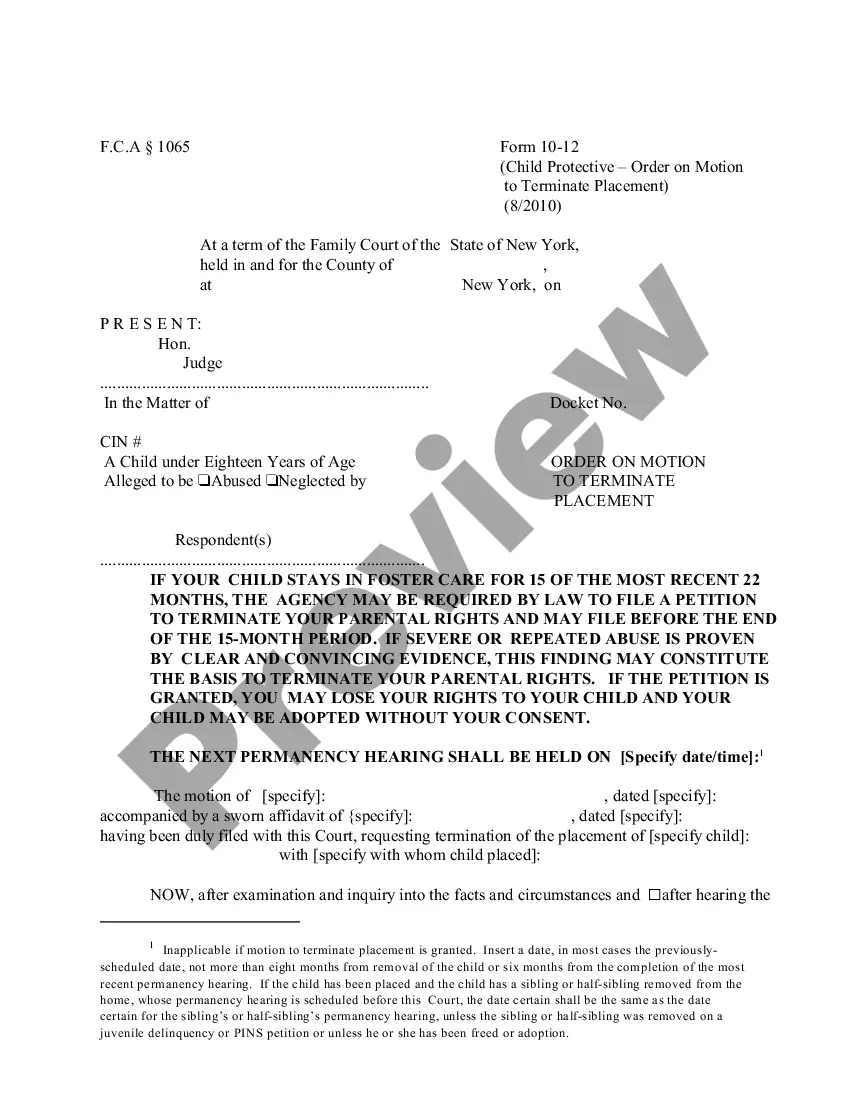

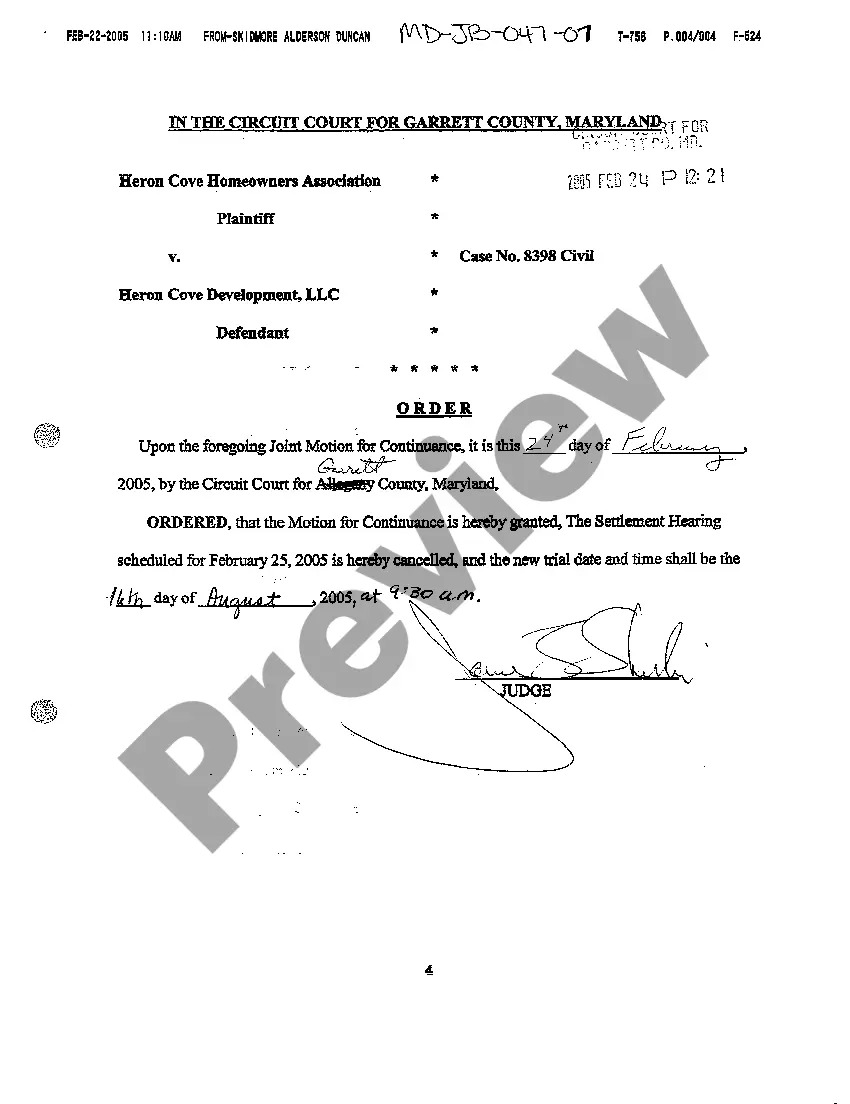

- Be sure to have picked out the proper type for the town/county. Select the Review switch to review the form`s articles. See the type information to actually have selected the right type.

- In case the type does not match your requirements, make use of the Research field at the top of the display screen to find the one that does.

- If you are happy with the shape, confirm your decision by clicking on the Acquire now switch. Then, choose the prices program you favor and provide your qualifications to sign up for an accounts.

- Method the deal. Use your Visa or Mastercard or PayPal accounts to accomplish the deal.

- Choose the format and obtain the shape in your gadget.

- Make changes. Load, revise and printing and indicator the delivered electronically Michigan Assignment of Member Interest in Limited Liability Company - LLC.

Every web template you included in your bank account does not have an expiry day and is also your own forever. So, in order to obtain or printing yet another duplicate, just check out the My Forms area and click on the type you will need.

Get access to the Michigan Assignment of Member Interest in Limited Liability Company - LLC with US Legal Forms, by far the most comprehensive catalogue of authorized papers layouts. Use a huge number of specialist and condition-particular layouts that meet your business or person requires and requirements.

Form popularity

FAQ

The term member refers to the individual(s) or entity(ies) holding a membership interest in a limited liability company. The members are the owners of an LLC, like shareholders are the owners of a corporation. Members do not own the LLC's property.

An assignment and assumption of membership interests used when a member of a limited liability company (LLC) wants to transfer its membership interest in the LLC to another entity. This Standard Document has integrated notes with important explanations and drafting and negotiating tips.

When a taxpayer sells an LLC interest, the taxpayer will usually have a capital gain or loss on the sale of the interest. However, capital gain or loss treatment does not apply to the sale of every LLC interest.

In LLCs, however, this does not apply. Since LLCs are more like partnerships, you cannot force partnerships between people without their agreement. You can only transfer an LLC's ownership interests if all the other LLC owners agree, and even then, only if the state law allows for it.

A membership interest purchase agreement, sometimes called a MIPA, is a contract between a seller and a buyer to transfer the ownership of an LLC.

An LLC owner (called a member) can transfer an ownership interest (called a membership interest) by complying with the transfer provisions within the LLC's operating agreement and state law. An assignment is one of the key documents a member must prepare to officially transfer a membership interest to a transferee.

After the terms of sale are negotiated, a written membership interest sales agreement can be created to record the transaction. This agreement should detail the new member's ownership percentage, the amount of the buy-in, and require that the new member agree to be bound by the existing Operating Agreement of the LLC.

form agreement for the redemption of a minority membership interest in a limited liability company (LLC). This Standard Document assumes that the redeeming member is selling its entire membership interest back to the LLC at the closing of the redemption.