Michigan Self-Employed Tennis Professional Services Contract

Description

How to fill out Self-Employed Tennis Professional Services Contract?

If you wish to acquire, obtain, or print lawful document templates, utilize US Legal Forms, the finest assortment of legal forms accessible online.

Employ the site’s straightforward and user-friendly search feature to find the documents you need. Various templates for business and personal purposes are categorized by groups and states, or keywords.

Utilize US Legal Forms to access the Michigan Self-Employed Tennis Professional Services Contract in just a few clicks.

Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the payment.

Step 6. Select the format of your legal form and download it to your device. Step 7. Complete, edit, and print or sign the Michigan Self-Employed Tennis Professional Services Contract. Every legal document template you purchase is yours indefinitely. You have access to every form you downloaded with your account. Go to the My documents section and select a form to print or download again. Be proactive and download and print the Michigan Self-Employed Tennis Professional Services Contract with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms member, sign in to your account and click on the Download button to retrieve the Michigan Self-Employed Tennis Professional Services Contract.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the steps below.

- Step 1. Ensure you have selected the form for the correct city/region.

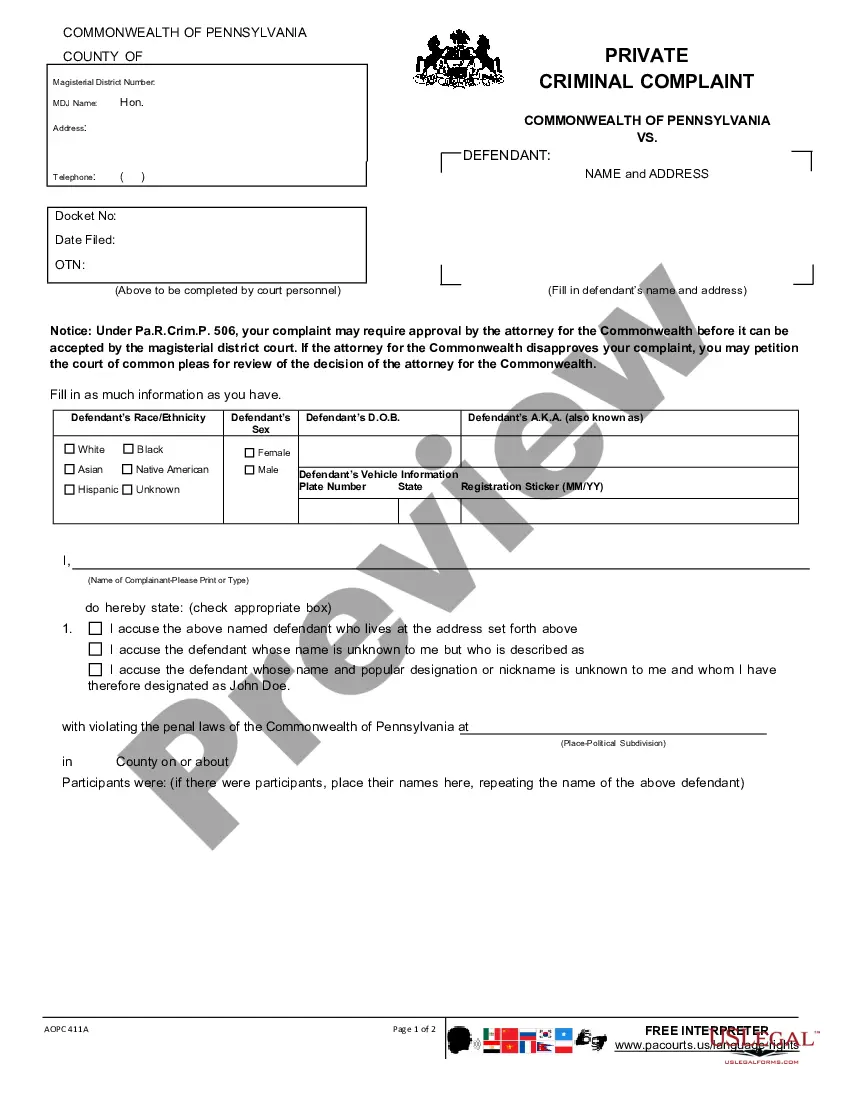

- Step 2. Use the Preview option to review the form’s details. Always remember to read the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find alternative versions of your legal form design.

- Step 4. Once you have found the form you need, click the Get now button. Choose your preferred payment plan and enter your information to register for the account.

Form popularity

FAQ

An independent contractor agreement in Michigan is a legal document that outlines the working relationship between a contractor and a client. This agreement typically includes payment terms, responsibilities, and timelines. By creating a Michigan Self-Employed Tennis Professional Services Contract, you can ensure that your rights are protected while adhering to state laws.

The new federal rule emphasizes the importance of correctly classifying workers as either independent contractors or employees. This classification affects tax obligations and benefits. For independent contractors in Michigan, using a Michigan Self-Employed Tennis Professional Services Contract can help clarify your status and comply with federal guidelines.

Yes, having a contract as an independent contractor is highly recommended. A solid agreement protects your rights and clarifies the terms of your engagement with clients. By utilizing a Michigan Self-Employed Tennis Professional Services Contract, you can ensure that all parties are on the same page, preventing disputes down the line.

Yes, you can sue an unlicensed contractor in Michigan; however, it may complicate your case. The lack of a license may affect the contractor's ability to defend themselves in court. To protect yourself, consider using a Michigan Self-Employed Tennis Professional Services Contract, which provides legal backing for the services rendered.

An independent contractor must earn at least $600 in a calendar year from a single client to receive a 1099 form. This form is essential for reporting income to the IRS. By utilizing a Michigan Self-Employed Tennis Professional Services Contract, you can accurately document earnings and ensure proper tax compliance.

In Michigan, independent contractors must meet specific legal requirements to operate legally. This includes obtaining any necessary licenses, adhering to tax obligations, and ensuring compliance with local regulations. Using a Michigan Self-Employed Tennis Professional Services Contract can help you navigate these requirements effectively, protecting your business interests.

An independent contractor agreement outlines the terms of the working relationship between a contractor and a client. This contract defines responsibilities, payment terms, and other critical aspects of the engagement. For those using a Michigan Self-Employed Tennis Professional Services Contract, this clarity helps ensure both parties understand their obligations, fostering a smoother collaboration.

The 23-year-old tennis billionaire is believed to be Emma Raducanu, who gained fame after her stunning victory at the 2021 US Open. Her success on the court, combined with lucrative endorsement deals, has propelled her financial status. If you aspire to achieve similar success, consider using a Michigan Self-Employed Tennis Professional Services Contract to establish your business framework. This contract can help you manage your finances and professional relationships effectively.

The income of tennis professionals varies widely based on experience, skill level, and location. On average, self-employed tennis pros in Michigan can earn between $30,000 and $70,000 annually. However, many factors, such as the number of clients and lesson frequency, can impact earnings significantly. Utilizing a Michigan Self-Employed Tennis Professional Services Contract can help you set clear terms and expectations, ensuring you maximize your income potential.

Michigan does not require an operating agreement for Limited Liability Companies (LLCs) or PLLCs, but it is highly recommended. An operating agreement outlines the management structure and operational guidelines for your business. For your Michigan Self-Employed Tennis Professional Services Contract, having an operating agreement can clarify roles and responsibilities, ultimately strengthening your business framework.