Michigan Grant Writer Agreement - Self-Employed Independent Contractor

Description

How to fill out Grant Writer Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal forms in the United States - offers a variety of legal document templates that you can download or print. By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can obtain the latest versions of forms such as the Michigan Grant Writer Agreement - Self-Employed Independent Contractor within seconds. If you already possess a monthly subscription, Log In and download the Michigan Grant Writer Agreement - Self-Employed Independent Contractor from your US Legal Forms library. The Download button will appear on every form you examine. You have access to all previously downloaded forms from the My documents section of your account.

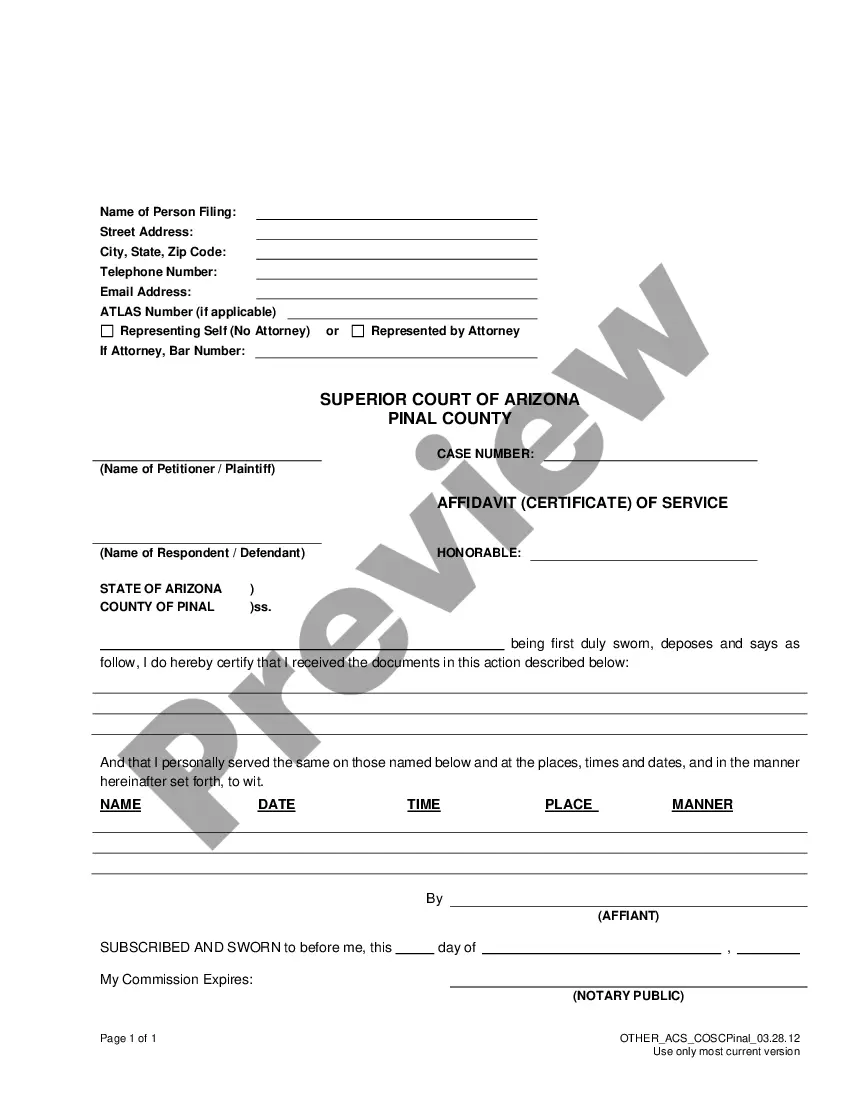

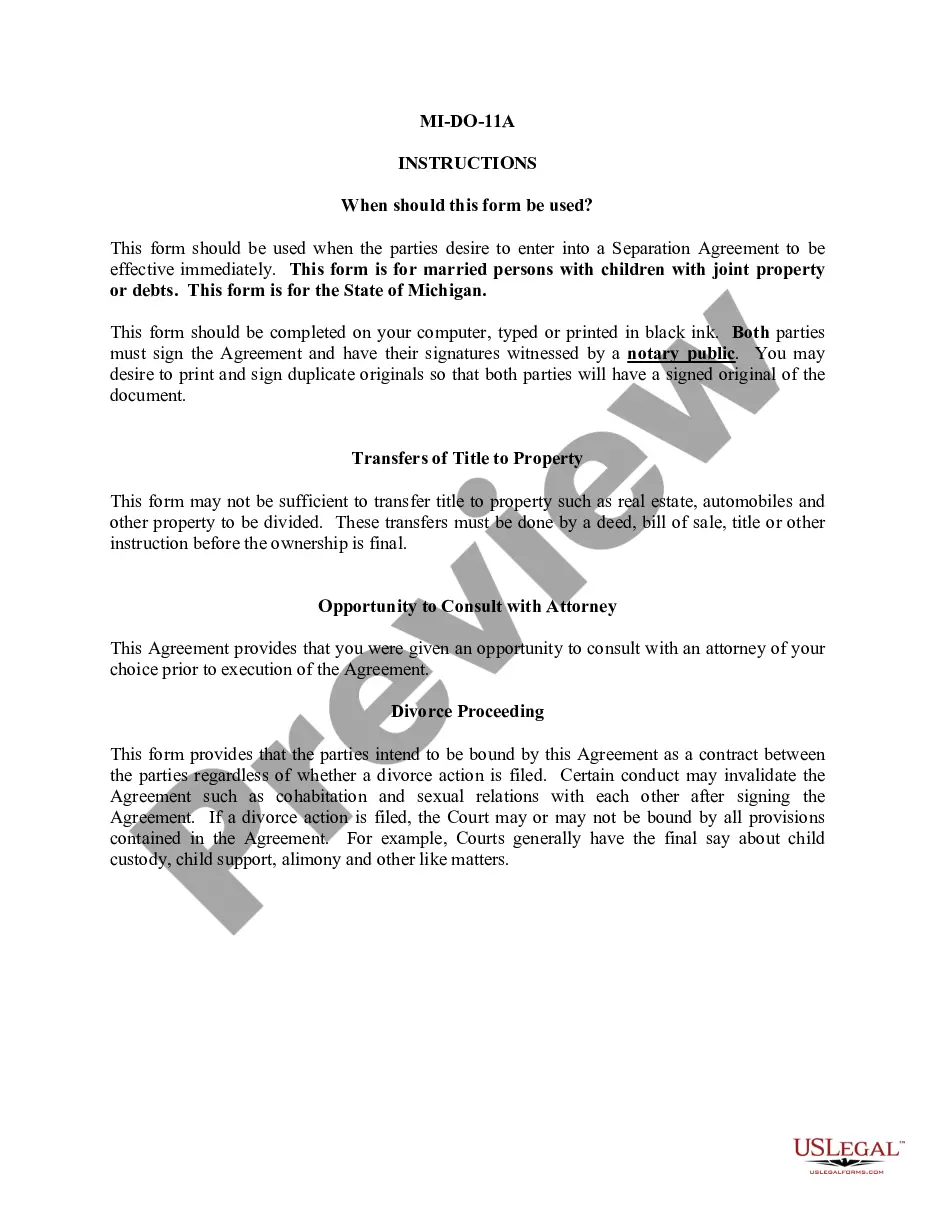

If you are using US Legal Forms for the first time, here are straightforward instructions to get you started: Ensure you have selected the correct form for your region/state. Click the Review button to inspect the form's content. Check the form summary to confirm that you have selected the right form. If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does. If you are satisfied with the form, confirm your choice by clicking the Get now button. Then, choose the payment plan you prefer and provide your information to create an account. Process the payment. Use your credit card or PayPal account to complete the transaction. Select the format and download the form onto your device. Make modifications. Fill out, edit, and print and sign the downloaded Michigan Grant Writer Agreement - Self-Employed Independent Contractor.

- Every template you add to your account has no expiration date and is yours indefinitely.

- So, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need.

- Access the Michigan Grant Writer Agreement - Self-Employed Independent Contractor with US Legal Forms, one of the most extensive collections of legal document templates.

- Utilize numerous professional and state-specific templates that meet your business or personal requirements and specifications.

Form popularity

FAQ

Yes, an independent contractor is considered self-employed. This classification means they run their own business and are responsible for their taxes and benefits. When you enter into a Michigan Grant Writer Agreement - Self-Employed Independent Contractor, you establish a business relationship that solidifies your status as self-employed. This distinction is important, as it affects how you manage your finances and obligations, making it essential to understand all aspects of self-employment.

Yes, a freelance writer typically qualifies as an independent contractor. They operate their own business, manage their workload, and have the freedom to choose their clients. When engaging in projects, such as those outlined in a Michigan Grant Writer Agreement - Self-Employed Independent Contractor, they maintain a level of independence that characterizes independent contractors. This classification allows freelance writers to enjoy certain benefits, such as flexible schedules and the ability to work on multiple projects simultaneously.

The new federal rule for independent contractors focuses on clarifying the criteria that determine whether a worker is classified as an independent contractor or an employee. This rule aims to provide more consistency in how independent contractors, including those working under a Michigan Grant Writer Agreement - Self-Employed Independent Contractor, are treated. It emphasizes the importance of the relationship between the worker and the employer, specifically looking at control and independence in the work performed. Understanding this rule is crucial for both workers and businesses to ensure proper compliance and classification.

The 5 R's of grant writing are research, relationships, relevance, resilience, and reporting. First, you need to research potential funders that align with your project. Building relationships with these funders is essential for successful applications. Then, ensure that your proposal is relevant to their priorities, demonstrate resilience in the face of rejection, and always report back on outcomes. Utilizing a Michigan Grant Writer Agreement can help streamline your processes and enhance your professionalism in grant writing.

Freelance grant writing involves creating proposals for organizations seeking funding. As a self-employed independent contractor, you will identify potential grant opportunities, develop compelling narratives, and ensure compliance with funder requirements. With a Michigan Grant Writer Agreement, you can formalize your services and establish clear expectations with clients. This structured approach enables you to build a successful freelance career in grant writing.

Yes, grant writing can certainly be a side hustle. Many individuals pursue grant writing as a self-employed independent contractor, allowing them to balance their primary job with this rewarding opportunity. With the right skills and a Michigan Grant Writer Agreement, you can attract clients and manage your time effectively. This flexibility makes it an ideal option for those looking to supplement their income.

In Michigan, an independent contractor agreement defines the working terms between a contractor and a client, adhering to state laws. It serves to clarify expectations, payment schedules, and project deliverables. If you are entering into a Michigan Grant Writer Agreement - Self-Employed Independent Contractor, using a platform like uslegalforms can simplify the process and ensure compliance with local regulations.

A basic independent contractor agreement outlines the terms of the working relationship between the contractor and the client. It typically includes payment details, project scope, deadlines, and confidentiality clauses. For those entering a Michigan Grant Writer Agreement - Self-Employed Independent Contractor, having a clear and concise agreement is essential for a successful collaboration.

Filling out an independent contractor agreement involves several key steps. Start by clearly stating the scope of work, payment terms, and duration of the agreement. Ensure you include relevant details specific to your Michigan Grant Writer Agreement - Self-Employed Independent Contractor, which can help protect both parties involved.

An independent contractor must earn at least $600 in a calendar year from a single client to receive a 1099 form. This form reports the income you earned as a self-employed individual, which is essential for tax purposes. If you work under a Michigan Grant Writer Agreement - Self-Employed Independent Contractor, keep track of your earnings to ensure you receive the necessary documents.