Michigan Instructions for Completing IRS Form 4506-EZ

Description

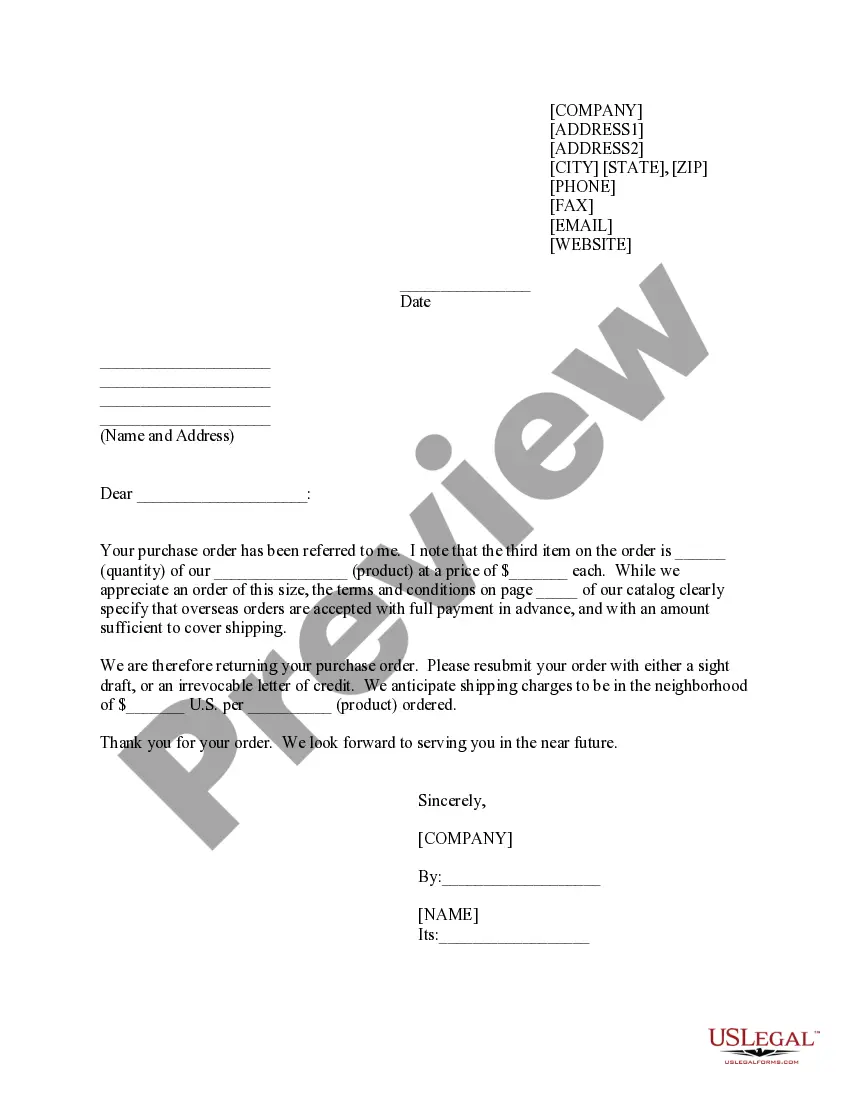

How to fill out Instructions For Completing IRS Form 4506-EZ?

Are you inside a place in which you need to have papers for either company or person uses almost every time? There are plenty of authorized papers web templates available online, but locating kinds you can rely on isn`t straightforward. US Legal Forms offers a huge number of develop web templates, just like the Michigan Instructions for Completing IRS Form 4506-EZ, that happen to be written to fulfill federal and state needs.

If you are already acquainted with US Legal Forms web site and also have your account, just log in. Following that, you may acquire the Michigan Instructions for Completing IRS Form 4506-EZ template.

Should you not have an accounts and want to start using US Legal Forms, adopt these measures:

- Find the develop you need and make sure it is to the correct metropolis/area.

- Utilize the Preview button to check the shape.

- See the description to ensure that you have selected the correct develop.

- When the develop isn`t what you are searching for, use the Research industry to get the develop that meets your needs and needs.

- Once you obtain the correct develop, simply click Get now.

- Choose the pricing prepare you want, fill out the specified information to make your bank account, and pay for the order using your PayPal or credit card.

- Decide on a convenient document format and acquire your version.

Discover all of the papers web templates you have purchased in the My Forms menus. You can aquire a extra version of Michigan Instructions for Completing IRS Form 4506-EZ any time, if possible. Just go through the needed develop to acquire or print the papers template.

Use US Legal Forms, the most extensive variety of authorized forms, to conserve time and avoid blunders. The assistance offers expertly produced authorized papers web templates which can be used for a variety of uses. Create your account on US Legal Forms and begin generating your life a little easier.

Form popularity

FAQ

Purpose of form. Use Form 4506-C to request tax return information through an authorized IVES participant. You will designate an IVES participant to receive the information on line 5a. Note: If you are unsure of which type of transcript you need, check with the party requesting your tax information.

Paper Request Form ? IRS Form 4506-T Complete lines 1 ? 4, following the instructions on page 2 of the form. Line 3: enter the non-filer's street address and zip or postal code. ... Line 5 provides non-filers with the option to have their IRS Verification of Non-filing Letter mailed directly to a third party by the IRS.

Fill out the type of tax information, tax form number, the years or periods, and the specific matter of the tax information you are authorizing in form 8821. You may enter multiple years or a series of periods such as ?2015 thru 2017,? but you may not make blanket statements such as ?all years.?

Use Form 4506-T to request tax return information. Taxpayers using a tax year beginning in one calendar year and ending in the following year (fiscal tax year) must file Form 4506-T to request a return transcript.

Paper 4506-T Instructions Fill out lines 1-4, if applicable. List your BYU ID number on line 5. Check box 7 (for Verification of Non-filing). On line 9 enter 12/31/__ for the tax year you are requesting. ... Sign the document. Mail to the appropriate address on page 2 (Chart for all other transcripts).

How to Fill-out IRS Form 4506-T Online | PDFRun - YouTube YouTube Start of suggested clip End of suggested clip To fill out form 4506 t click on the fill. Online. Button this will redirect you to pdf runs onlineMoreTo fill out form 4506 t click on the fill. Online. Button this will redirect you to pdf runs online editor to start enter your full legal name as it appears on your tax. Return. If it's a joint return

1. Complete the form. Line 1a: Enter your name as it's shown on your tax returns. Line 1b: Enter your Social Security number. Line 2a: Enter your spouse's name if you filed a joint return. Line 2b: Enter your spouse's Social Security number, if you filed a joint return. Line 3: Enter your current address.

Due to the Social Security Number no longer being visible, the IRS has created an entry for a Customer File Number. This is an optional entry that can be used by third parties to match a transcript to a taxpayer. The Customer File Number will be located on line 5b of the Transcript Request Form.