This form is an Application for Certificate of Discharge of IRS Lien. Use to obtain certificate of release when lien has been removed or satisfied. Check for compliance with your specific circumstances.

Michigan Application for Certificate of Discharge of IRS Lien

Description

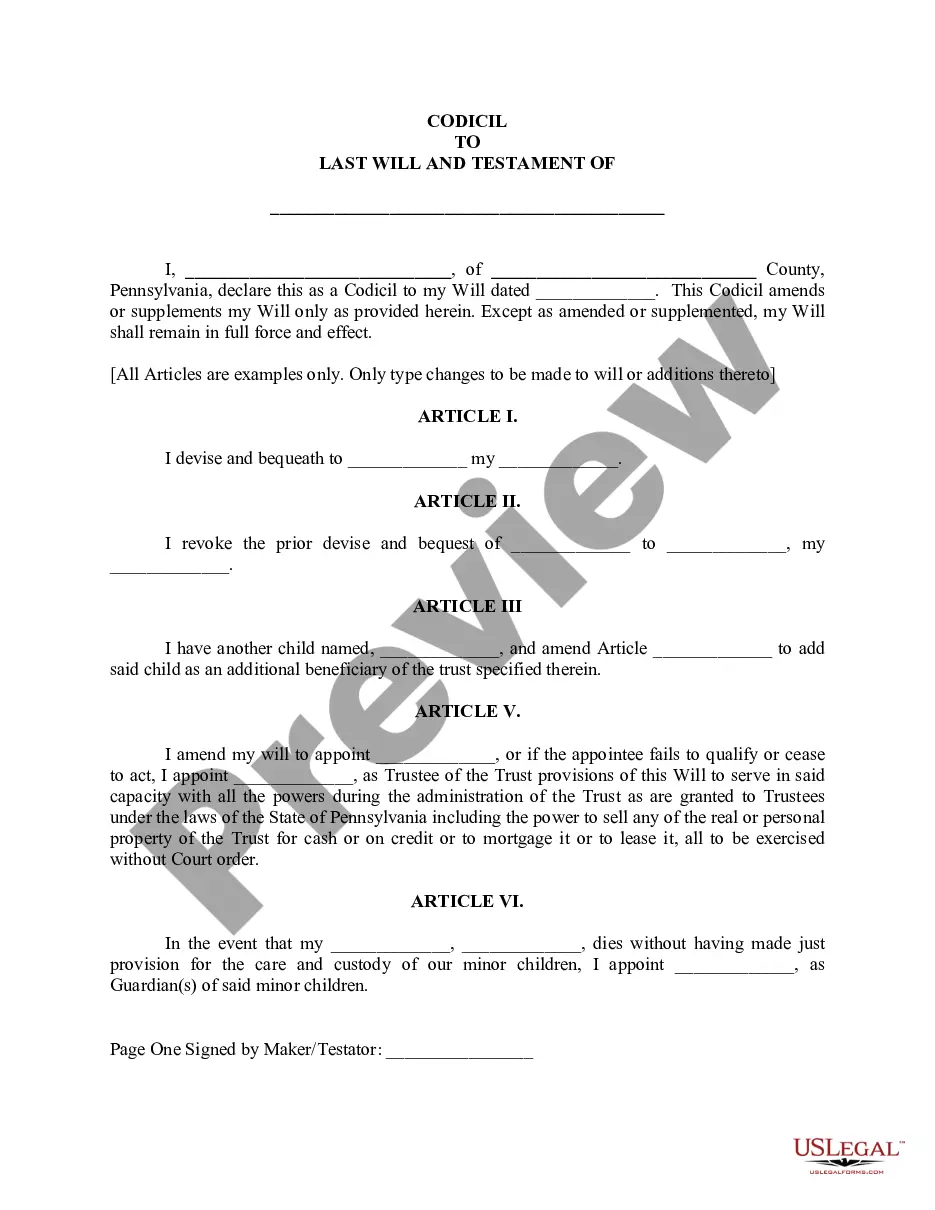

How to fill out Application For Certificate Of Discharge Of IRS Lien?

Discovering the right legitimate papers format can be quite a battle. Naturally, there are a variety of themes available on the Internet, but how do you find the legitimate form you want? Utilize the US Legal Forms web site. The assistance offers a large number of themes, like the Michigan Application for Certificate of Discharge of IRS Lien, which you can use for enterprise and private requirements. Every one of the forms are examined by experts and meet up with federal and state demands.

In case you are presently listed, log in for your profile and then click the Down load switch to have the Michigan Application for Certificate of Discharge of IRS Lien. Make use of profile to check from the legitimate forms you might have purchased earlier. Proceed to the My Forms tab of the profile and have one more duplicate of your papers you want.

In case you are a fresh user of US Legal Forms, allow me to share basic instructions that you should follow:

- Initially, make sure you have chosen the appropriate form for the town/region. It is possible to look over the form utilizing the Preview switch and look at the form outline to make sure this is the right one for you.

- If the form will not meet up with your requirements, utilize the Seach field to find the proper form.

- When you are certain the form is suitable, click the Acquire now switch to have the form.

- Choose the prices prepare you want and type in the essential info. Design your profile and purchase an order using your PayPal profile or charge card.

- Pick the document file format and download the legitimate papers format for your product.

- Full, edit and produce and signal the attained Michigan Application for Certificate of Discharge of IRS Lien.

US Legal Forms will be the biggest catalogue of legitimate forms that you can discover numerous papers themes. Utilize the company to download appropriately-manufactured papers that follow status demands.

Form popularity

FAQ

The IRS form used for applying for a certificate of discharge of property from a federal tax lien is Form 14135. This form enables you to request the discharge of a lien on your property after fulfilling your tax obligations. For Michigan residents, the Michigan Application for Certificate of Discharge of IRS Lien can help you navigate this process more smoothly.

To request a certificate of release of federal tax lien, you need to fill out IRS Form 668(Z), which is specifically designed for this purpose. Submitting this form allows you to apply for the release of the lien once your tax obligations are satisfied. If you are in Michigan, utilize the Michigan Application for Certificate of Discharge of IRS Lien for an easier experience.

You can obtain a lien release form directly from the IRS website or through authorized tax professionals. The form you need is typically Form 12277, which is used to request a withdrawal of a federal tax lien. If you're in Michigan, consider using the Michigan Application for Certificate of Discharge of IRS Lien to make your process simpler and more efficient.

To request a lien discharge from the IRS, you first need to fill out the IRS Form 14135, also known as the Application for Certificate of Discharge of Property from Federal Tax Lien. Ensure that you provide accurate information about your tax liability and the property involved. Once completed, submit the form to the IRS office that issued the lien. Using the Michigan Application for Certificate of Discharge of IRS Lien can streamline this process.

If you've paid your tax debt or fully paid your accepted Offer in Compromise and, if applicable, the outstanding amount of any related collateral agreement, and the lien was released, you can ask the IRS in writing to withdraw the lien.

To request IRS consider discharge, complete Form 14135, Application for Certificate of Discharge of Property from Federal Tax Lien. See Publication 783, Instructions on how to apply for a Certificate of Discharge from Federal Tax Lien, for more information on how to request discharge.

There are no tax liens in Michigan. Michigan is a tax deed state, and I'll explain what that means. When the owners don't pay their property tax in Michigan, the state doesn't put up with that at all. If people don't make property tax payments, they're going to lose their property.

Generally, a Notice of Federal Tax Lien is active for ten years and thirty days from the date the tax liability is assessed. (See ?Self-Releasing Liens? section on page 4 of this publication.)

Paying your tax debt - in full - is the best way to get rid of a federal tax lien. The IRS releases your lien within 30 days after you have paid your tax debt. When conditions are in the best interest of both the government and the taxpayer, other options for reducing the impact of a lien exist.

The removal of a lien on a motor vehicle or real property after the claim has been satisfied is referred to as a ?discharge of lien?.