Michigan Term Sheet - Six Month Promissory Note

Description

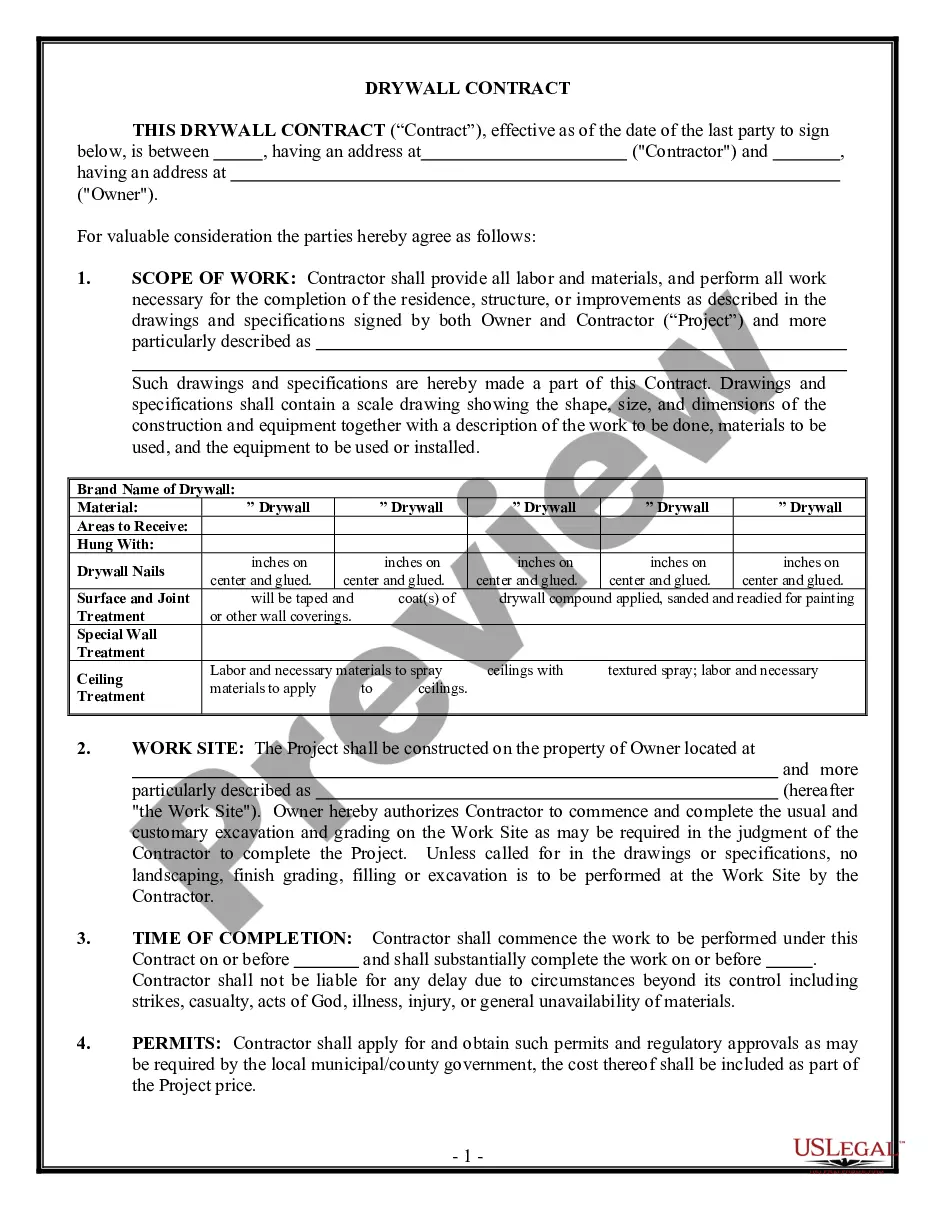

How to fill out Term Sheet - Six Month Promissory Note?

Have you been in a situation in which you will need paperwork for either organization or individual reasons virtually every time? There are a lot of authorized papers web templates available online, but finding versions you can depend on isn`t easy. US Legal Forms offers a huge number of form web templates, much like the Michigan Term Sheet - Six Month Promissory Note, that are written to satisfy federal and state needs.

If you are presently familiar with US Legal Forms web site and get your account, simply log in. After that, it is possible to obtain the Michigan Term Sheet - Six Month Promissory Note format.

Unless you have an profile and need to begin to use US Legal Forms, adopt these measures:

- Get the form you require and ensure it is for the right metropolis/area.

- Utilize the Preview key to check the shape.

- See the explanation to ensure that you have selected the appropriate form.

- When the form isn`t what you`re trying to find, make use of the Look for area to discover the form that suits you and needs.

- When you obtain the right form, click on Get now.

- Pick the costs program you would like, fill out the desired details to make your money, and pay money for your order with your PayPal or Visa or Mastercard.

- Pick a convenient paper structure and obtain your backup.

Find all the papers web templates you have purchased in the My Forms menu. You can obtain a additional backup of Michigan Term Sheet - Six Month Promissory Note any time, if needed. Just click the required form to obtain or printing the papers format.

Use US Legal Forms, one of the most considerable assortment of authorized forms, to save lots of time and stay away from errors. The assistance offers professionally produced authorized papers web templates which can be used for a range of reasons. Produce your account on US Legal Forms and commence producing your life easier.

Form popularity

FAQ

A promissory note is an important legal document that outlines the terms of a loan or debt agreement between two parties. A bit like an IOU, it serves as evidence of the borrower's promise to repay the principal amount. It also protects the lender's rights. Try our template.

Although it is legally enforceable, a promissory note is less formal than a loan agreement and is suitable where smaller sums of money are involved. However, its terms - which can include a specific date of repayment, interest rate and repayment schedule - are more certain than those of an IOU.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Detailed Information ? The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

What is an example of a promissory note? Another example of a promissory note is a personal loan promissory note. This type of note is typically used when one individual wants to borrow money from another individual, such as a friend or family member.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

No. Promissory notes do not need to be notarized. The borrower only needs to sign the document to make it legally enforceable. A witness may be helpful if one party contests the note, but a notary is not necessary.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.