Michigan Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property

Description

How to fill out Renunciation And Disclaimer Of Right To Inheritance Or To Inherit Property From Deceased - Specific Property?

US Legal Forms - among the largest libraries of authorized varieties in the USA - provides a wide range of authorized document web templates you are able to obtain or printing. While using internet site, you will get a huge number of varieties for business and individual functions, categorized by categories, claims, or key phrases.You can find the latest models of varieties such as the Michigan Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property in seconds.

If you already have a registration, log in and obtain Michigan Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property through the US Legal Forms library. The Acquire button can look on each kind you view. You have access to all in the past acquired varieties from the My Forms tab of the profile.

If you want to use US Legal Forms the first time, allow me to share basic instructions to help you began:

- Be sure to have chosen the correct kind to your area/region. Click on the Preview button to check the form`s information. Look at the kind description to ensure that you have selected the correct kind.

- In case the kind does not match your requirements, take advantage of the Search area on top of the monitor to obtain the one who does.

- If you are content with the form, confirm your decision by visiting the Get now button. Then, opt for the costs strategy you like and give your qualifications to register for the profile.

- Method the financial transaction. Make use of credit card or PayPal profile to accomplish the financial transaction.

- Pick the format and obtain the form on your product.

- Make modifications. Load, edit and printing and signal the acquired Michigan Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property.

Every single web template you put into your account lacks an expiration time and is the one you have forever. So, if you want to obtain or printing another duplicate, just go to the My Forms area and click on the kind you require.

Obtain access to the Michigan Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property with US Legal Forms, one of the most extensive library of authorized document web templates. Use a huge number of specialist and express-particular web templates that satisfy your business or individual requires and requirements.

Form popularity

FAQ

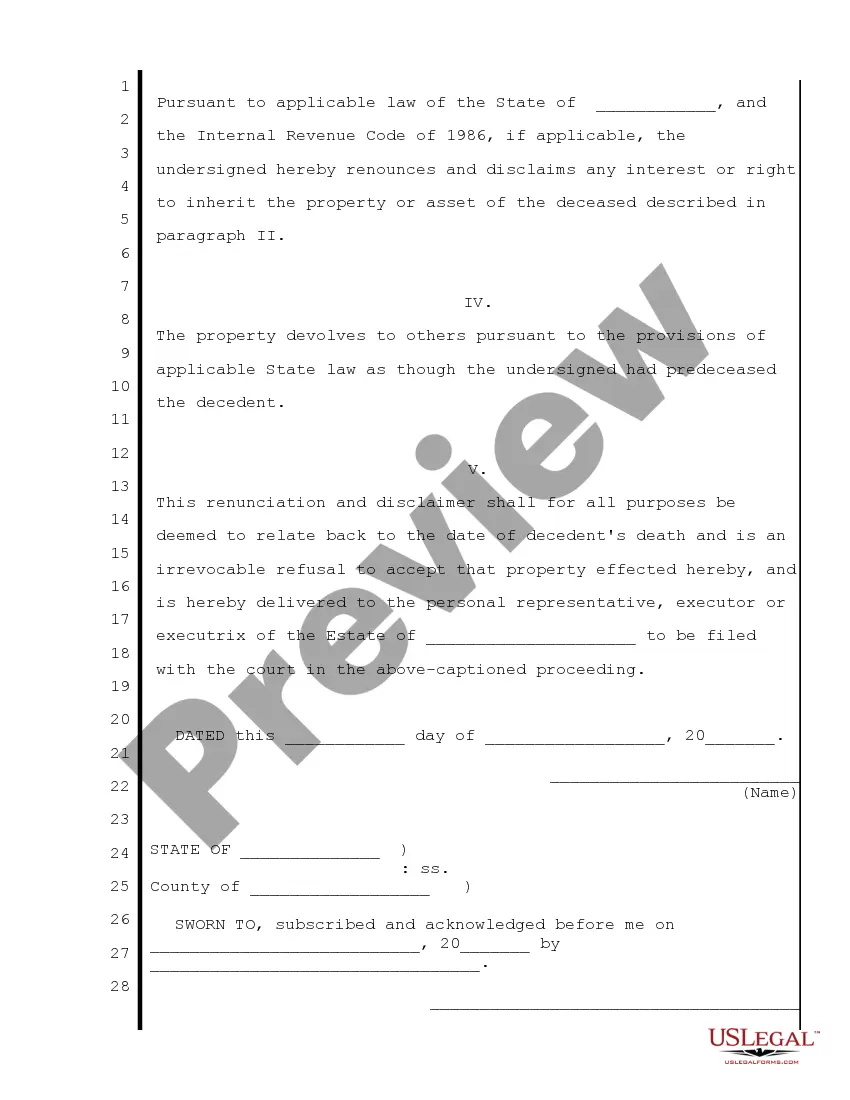

In order to disclaim an inheritance, you will need to write a Disclaimer, which states that you are disclaiming your inheritance in writing. Within your Disclaimer, you will need to explain what is being disclaimed, whether it is only part of your inheritance or all of it, as well as sign the document to make it legal.

If you refuse to accept an inheritance, you will not be responsible for inheritance taxes, but you'll have no say in who receives the assets in your place. The bequest passes either to the contingent beneficiary listed in the will or, if that person died without a will, ing to your state's laws of intestacy.

A beneficiary can disclaim part of or all of his or her interest in property under Michigan law. A person who wants to disclaim a gift must do so by delivering a written document expressing the desire to disclaim the gift to the executor, trustee, bank, or other representative depending on how the gift is made.

Renunciation of inheritance means that an heir renounces his/her right to inherit any of legacy when the heir does not want to inherit the legacy of the ancestor (a deceased person).

You make your disclaimer in writing. Your inheritance disclaimer specifically says that you refuse to accept the assets in question and that this refusal is irrevocable, meaning it can't be changed. You disclaim the assets within nine months of the death of the person you inherited them from.

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor, ...

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor, ...