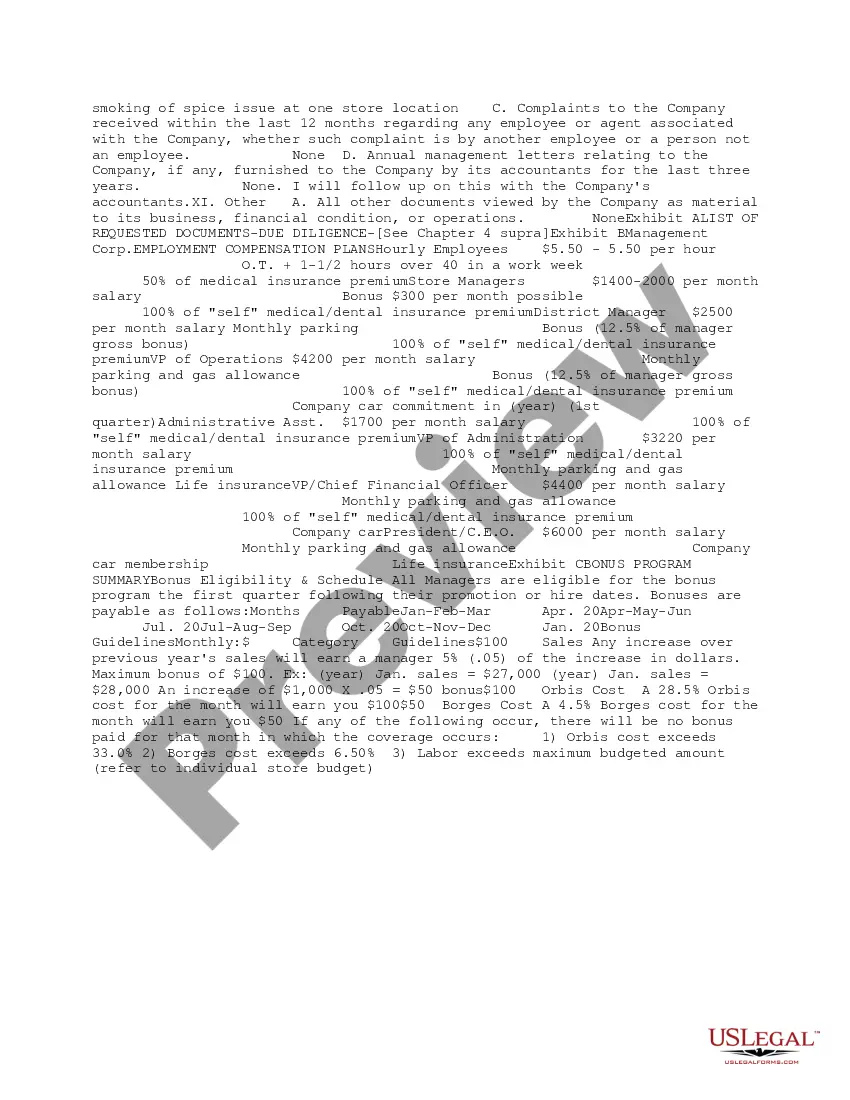

This due diligence form is a memorandum that summarizes the review of documents and the formation produced by a company in response to a list of requested materials.

Michigan Summary Initial Review of Response to Due Diligence Request

Description

How to fill out Summary Initial Review Of Response To Due Diligence Request?

Are you currently in a situation where you frequently require documents for either business or personal purposes every single day.

There are numerous authentic document templates accessible online, but finding ones you can rely on is challenging.

US Legal Forms offers a vast array of form templates, such as the Michigan Summary Initial Review of Response to Due Diligence Request, designed to comply with both federal and state regulations.

Once you find the right form, click Acquire now.

Select the pricing plan you prefer, complete the necessary information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After logging in, you can download the Michigan Summary Initial Review of Response to Due Diligence Request template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Search for the form you need and ensure it pertains to your specific city/state.

- Utilize the Preview button to review the form.

- Check the description to confirm that you have selected the correct form.

- If the form does not match your requirements, use the Search field to find the form that meets your needs.

Form popularity

FAQ

In Michigan, the statute of limitations for most consumer debts is six years. After this period, creditors typically cannot initiate legal action to collect the debt, rendering it uncollectible. If you are navigating issues related to a Michigan Summary Initial Review of Response to Due Diligence Request, knowing the limitations on debt collection can play a vital role in crafting your legal strategy and protecting your rights.

The 7 day rule for orders in Michigan mandates that any order or judgment issued by a court must be confirmed and placed on the record within seven days. This rule is designed to promote efficiency and clarity in legal proceedings. For those working through a Michigan Summary Initial Review of Response to Due Diligence Request, being aware of this timeline can help ensure that necessary documents are submitted promptly and that your legal standing is protected.

A motion for rehearing in Michigan is a formal request to the court to reconsider a decision based on new evidence or a perceived error in legal judgment. This motion is typically filed after a ruling that one party disagrees with, seeking a fresh assessment of the case's merits. If your matter involves a Michigan Summary Initial Review of Response to Due Diligence Request, understanding how to effectively present such a motion could be critical in achieving your desired outcome.

The 7 day order rule in Michigan requires that all court orders must be signed and provided to the parties involved within seven days of a hearing. This rule ensures that litigants receive timely updates and can respond appropriately. For anyone involved in a legal process, understanding this rule is crucial, especially when addressing matters like a Michigan Summary Initial Review of Response to Due Diligence Request. By adhering to this timeframe, you can maintain the momentum of your case.

The 4 P's of due diligence are People, Product, Process, and Projections. Each element provides insights into different aspects of a business or proposal, helping to evaluate overall viability. Incorporating a Michigan Summary Initial Review of Response to Due Diligence Request can enhance your understanding of these areas, ensuring a thorough analysis.

Handling due diligence effectively involves a systematic approach, starting with gathering all relevant information and documents. Organizing your findings into categories can help you identify patterns and potential concerns. Furthermore, seeking assistance from services like a Michigan Summary Initial Review of Response to Due Diligence Request can make the process smoother and more efficient.

To back out during due diligence, carefully review your contractual obligations and identify any clauses that allow for withdrawal. Communicate your concerns clearly to the other party, citing specific findings that led to your decision. Utilizing the Michigan Summary Initial Review of Response to Due Diligence Request can provide solid evidence to support your choice.

A red flag during due diligence indicates potential issues that may jeopardize the success of the deal. These could include discrepancies in financial records, unresolved legal matters, or inconsistencies in the contract terms. Identifying these red flags early through a Michigan Summary Initial Review of Response to Due Diligence Request can protect your interests.

The due diligence process for a proposal review typically includes an assessment of financial documents, an evaluation of the project risks, and validation of legal compliance. This helps you to ensure that all aspects of the proposal are legitimate and feasible. A Michigan Summary Initial Review of Response to Due Diligence Request can streamline this process, providing key insights that may influence your decision.

A variety of professionals can issue a due diligence report, including attorneys, accountants, and financial analysts. These experts evaluate relevant information and articulate their findings clearly to stakeholders. If you are looking for support, a Michigan Summary Initial Review of Response to Due Diligence Request can be invaluable in guiding the report preparation, ensuring thoroughness and accuracy in the final document.