This checklist is an outline of all matters considered and reviewed in by the due diligence team in the acquisition of a company.

Michigan Checklist Due Diligence for Acquisition of a Company

Description

How to fill out Checklist Due Diligence For Acquisition Of A Company?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates that you can download or create.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can obtain the latest forms such as the Michigan Checklist Due Diligence for Acquisition of a Company within moments.

If the form does not meet your criteria, use the Search feature at the top of the screen to find one that does.

Once you are satisfied with the form, confirm your choice by clicking on the Get now button. Next, choose your preferred pricing plan and provide your details to register for an account.

- If you already have an account, Log In and retrieve the Michigan Checklist Due Diligence for Acquisition of a Company from your US Legal Forms library.

- The Download option will appear on every form that you view.

- You can find all previously downloaded forms in the My documents section of your account.

- If you are planning to use US Legal Forms for the first time, here are straightforward instructions to get you started.

- Ensure that you have selected the appropriate form for your city/state.

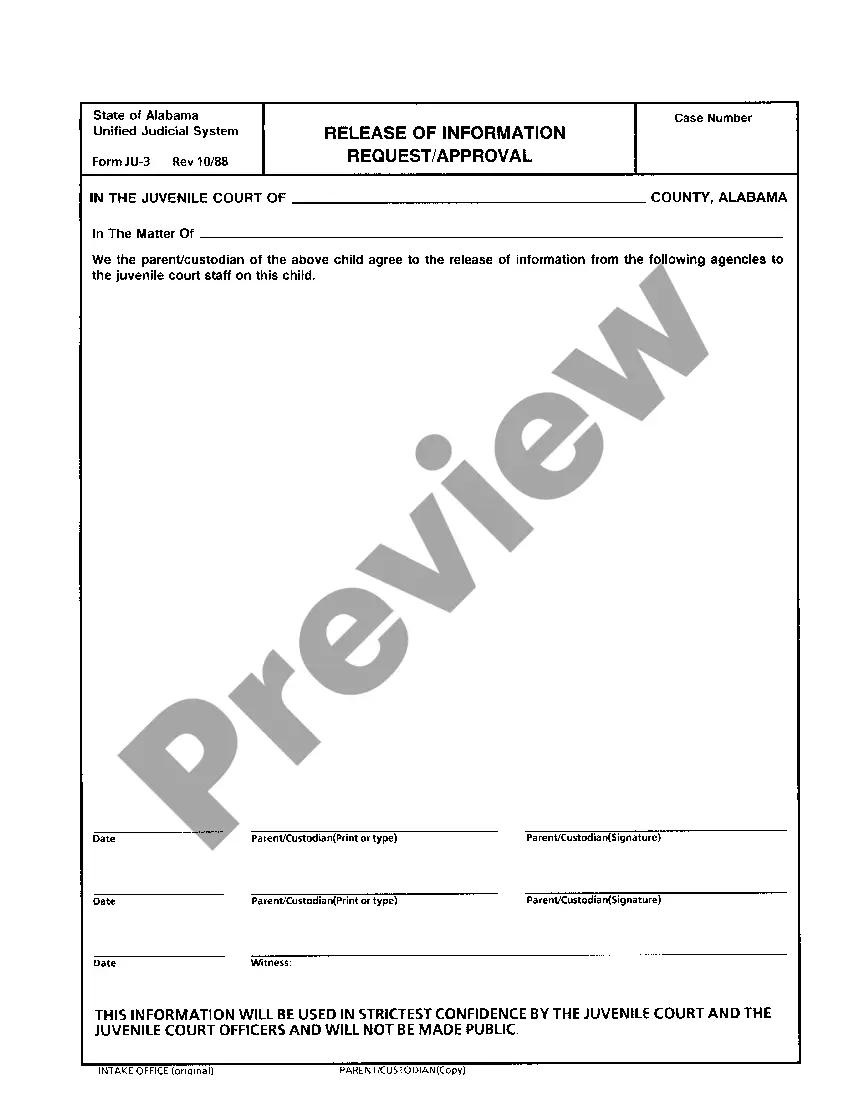

- Choose the Preview option to review the content of the form.

Form popularity

FAQ

A due diligence checklist is a comprehensive list that outlines all the information and documents needed during the due diligence process. It includes categories such as financial data, legal documentation, and operational insights. By applying a Michigan Checklist Due Diligence for Acquisition of a Company, you can ensure that your due diligence process is thorough and organized, reducing the chances of overlooking crucial details.

Conducting due diligence when buying a business involves a comprehensive examination of the target company's financial records, legal documents, and operational processes. Start by gathering essential information and utilizing a Michigan Checklist Due Diligence for Acquisition of a Company to guide your assessment. This thorough approach will help you make informed decisions and identify potential risks.

To obtain a due diligence report, you can engage a professional firm or consultants who specialize in this area. Ensure you communicate your needs clearly and provide relevant information about the target company. Using a Michigan Checklist Due Diligence for Acquisition of a Company can help streamline your request and ensure you receive a thorough analysis.

Due diligence reports can be issued by various parties, including independent consulting firms, accountants, and legal advisors. These professionals possess the expertise needed to conduct thorough investigations and provide actionable insights. Leveraging a Michigan Checklist Due Diligence for Acquisition of a Company will enhance the credibility and reliability of the report you receive.

An acquisition checklist is a detailed list of items and tasks required to successfully complete the acquisition of a company. It serves as a roadmap, guiding buyers through the complex stages of the acquisition process. A Michigan Checklist Due Diligence for Acquisition of a Company can be an invaluable tool, ensuring that all necessary steps are taken and key documents are gathered.

In most cases, a due diligence report is prepared by a team of professionals, including financial analysts, legal experts, and industry specialists. This team examines various aspects of the target company to ensure a comprehensive analysis. Utilizing a Michigan Checklist Due Diligence for Acquisition of a Company can help streamline this process and ensure that nothing essential is overlooked.

The due diligence process in acquisitions involves a thorough investigation of a target company before finalizing a deal. This process typically includes reviewing financial records, legal documents, operational practices, and any existing liabilities. By utilizing the Michigan Checklist Due Diligence for Acquisition of a Company, you can ensure that you cover all critical areas to protect your investment. This comprehensive checklist is designed to help potential buyers identify risks and opportunities, making informed decisions easier.

The 3 P's of due diligence are People, Processes, and Policies. These components focus on the human aspect of the business, the methods by which it operates, and the rules governing its operations. For a thorough approach, use the Michigan Checklist Due Diligence for Acquisition of a Company to evaluate these critical areas and uncover potential risks.

A comprehensive due diligence checklist should include financial statements, tax records, contracts, regulatory compliance documents, and HR policies. Additionally, consider including a section for operational procedures and risks. Incorporating the Michigan Checklist Due Diligence for Acquisition of a Company ensures that you cover all necessary bases.

The 4 P's of due diligence include People, Product, Process, and Property. Each of these elements plays a critical role in understanding the overall value and risks associated with the company. Keeping the Michigan Checklist Due Diligence for Acquisition of a Company in mind can help you examine each of these domains effectively.