Arizona Agreement and Plan of Conversion -

Description

How to fill out Agreement And Plan Of Conversion -?

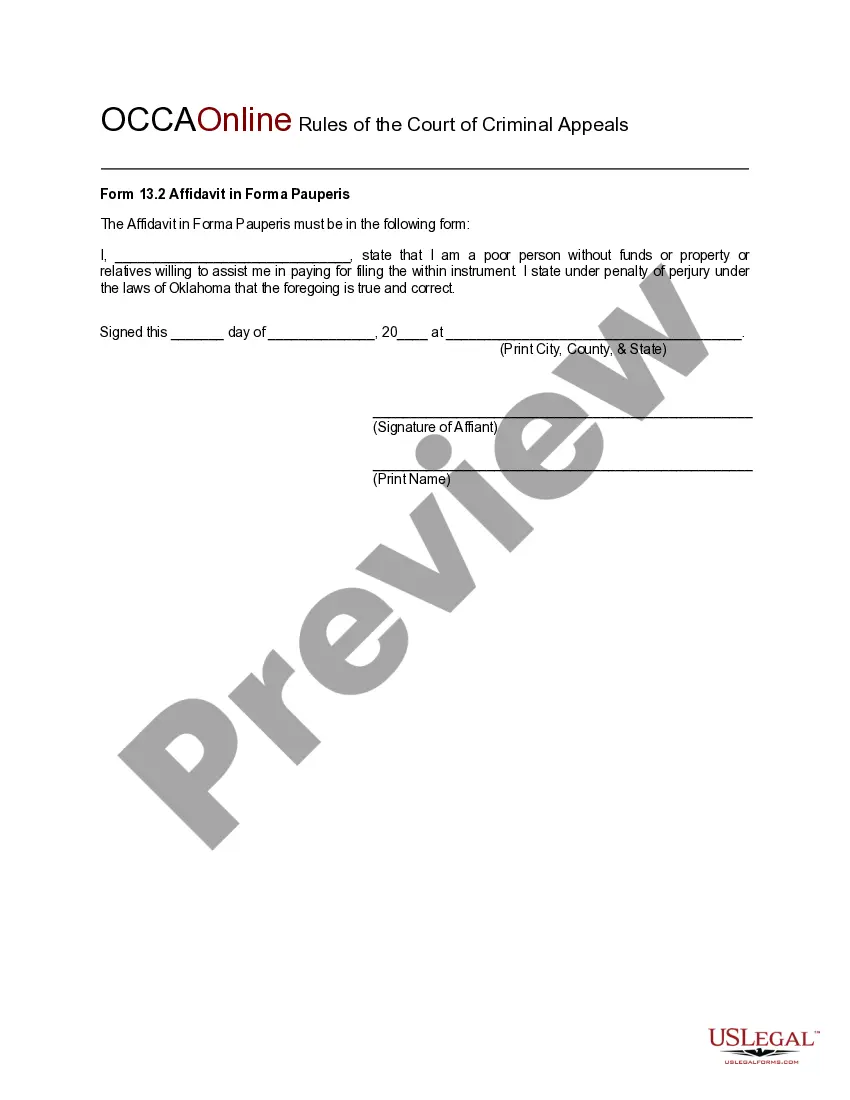

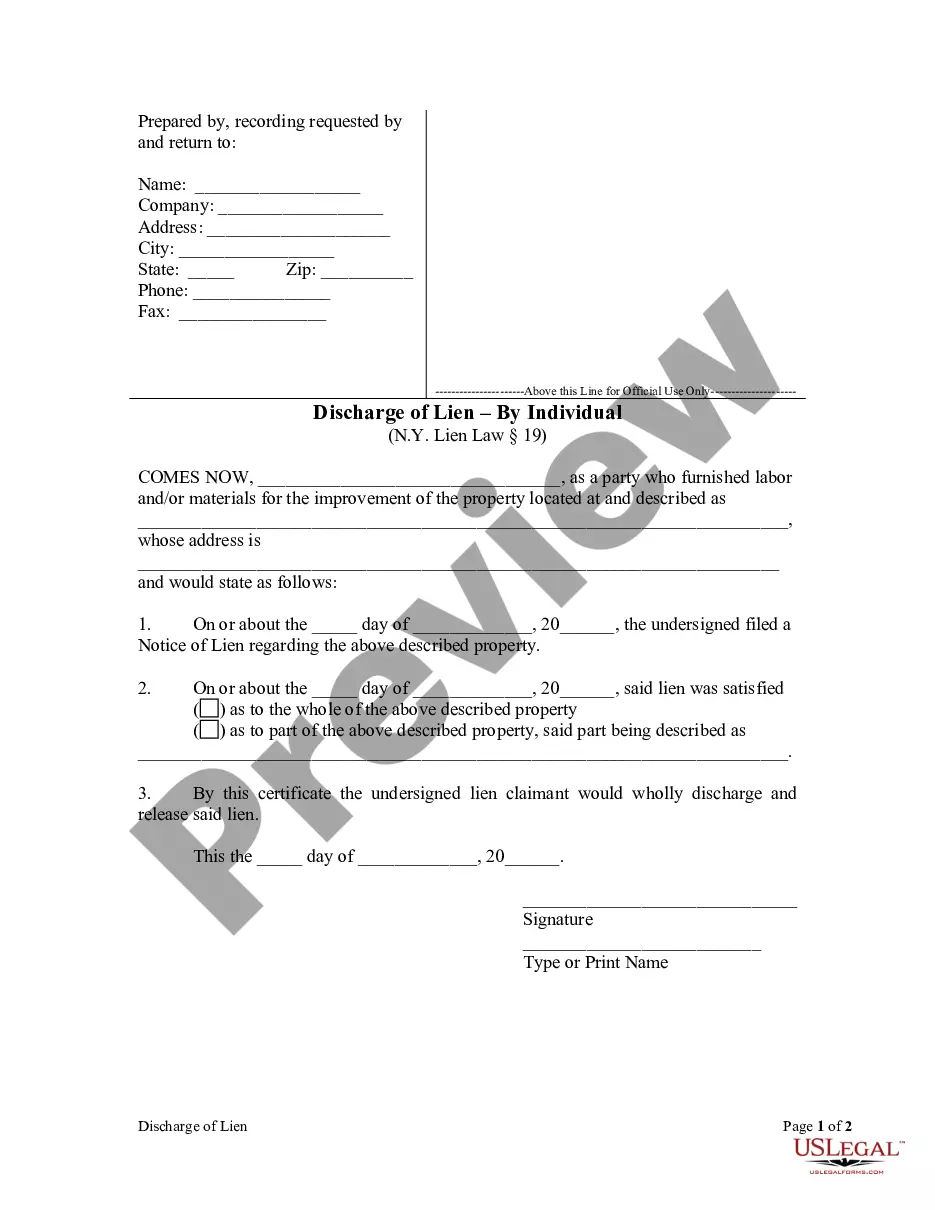

It is possible to commit hours on the web trying to find the authorized papers design that suits the state and federal specifications you require. US Legal Forms provides a large number of authorized types that are evaluated by professionals. You can actually acquire or printing the Arizona Agreement and Plan of Conversion - from the support.

If you already have a US Legal Forms bank account, you can log in and then click the Acquire option. Following that, you can complete, revise, printing, or indication the Arizona Agreement and Plan of Conversion -. Every authorized papers design you purchase is yours forever. To acquire another duplicate of the acquired develop, visit the My Forms tab and then click the related option.

Should you use the US Legal Forms website the very first time, keep to the simple instructions beneath:

- Initially, ensure that you have chosen the correct papers design for the area/metropolis of your choice. Look at the develop information to make sure you have selected the correct develop. If available, make use of the Review option to look with the papers design also.

- If you wish to discover another edition in the develop, make use of the Look for discipline to find the design that meets your needs and specifications.

- Upon having identified the design you desire, simply click Purchase now to continue.

- Pick the pricing prepare you desire, type in your references, and register for a merchant account on US Legal Forms.

- Comprehensive the purchase. You can use your credit card or PayPal bank account to fund the authorized develop.

- Pick the file format in the papers and acquire it in your product.

- Make alterations in your papers if possible. It is possible to complete, revise and indication and printing Arizona Agreement and Plan of Conversion -.

Acquire and printing a large number of papers templates utilizing the US Legal Forms Internet site, that provides the most important collection of authorized types. Use expert and status-particular templates to tackle your company or specific requirements.

Form popularity

FAQ

§§ 29-3102 and 29- 3105 through 29-3107. An operating agreement is not required by statute. If there is not operating agreement, then the LLC statutes will govern how the LLC conducts its affairs. Your needs may not be addressed by those statutory provisions, and, therefore, you might want an operating agreement.

File Articles of Organization ? Conversion (Form LLC-1A (PDF)) online at bizfileOnline.sos.ca.gov, by mail, or in person. The filing fee is $150 if a California Corp is involved; and $70 for all others.

You do not have to convert your LLC into a corporation. Instead, the LLC simply makes an election with the IRS to have the LLC taxed as an S corporation by having all members of the LLC sign an IRS Form 2553 and then file the signed Form 2553 with the IRS. See the Instructions to IRS Form 2553.

You can submit the documents necessary to convert your LLC to an S-Corp for tax purposes along with your tax return. In some situations, your election to be taxed as an S-Corp might not be effective until the following tax year, so the rest of your tax return should reflect this fact if it applies.

The Arizona Entity Restructuring Act Under the Act, entity conversion can to be done through a much more streamlined process called ?statutory conversion.?

Arizona allows only corporations (for-profit and non-prosit) to domesticate in the state. The procedure of domesticating your corporation in Arizona involves these steps: Step 1: Your corporation doesn't need to be qualified as foreign entity in Arizona, but if it is then its A.C.C.

You do not have to convert your LLC into a corporation. Instead, the LLC simply makes an election with the IRS to have the LLC taxed as an S corporation by having all members of the LLC sign an IRS Form 2553 and then file the signed Form 2553 with the IRS.

member LLC can be taxed as an S Corporation if it meets the IRS's eligibility criteria. In fact, both singlemember and multimember Limited Liability Companies can elect to be treated by the IRS as either an S Corporation or a C Corporation if they meet the requirements.