Michigan Plan of complete liquidation and dissolution

Description

How to fill out Plan Of Complete Liquidation And Dissolution?

US Legal Forms - one of many most significant libraries of lawful varieties in the United States - provides a variety of lawful document layouts you are able to obtain or print. Utilizing the site, you will get a large number of varieties for organization and specific purposes, categorized by classes, states, or key phrases.You will discover the most recent versions of varieties just like the Michigan Plan of complete liquidation and dissolution within minutes.

If you currently have a membership, log in and obtain Michigan Plan of complete liquidation and dissolution through the US Legal Forms local library. The Obtain key will show up on each type you view. You have accessibility to all earlier saved varieties within the My Forms tab of the account.

In order to use US Legal Forms initially, allow me to share simple guidelines to get you started:

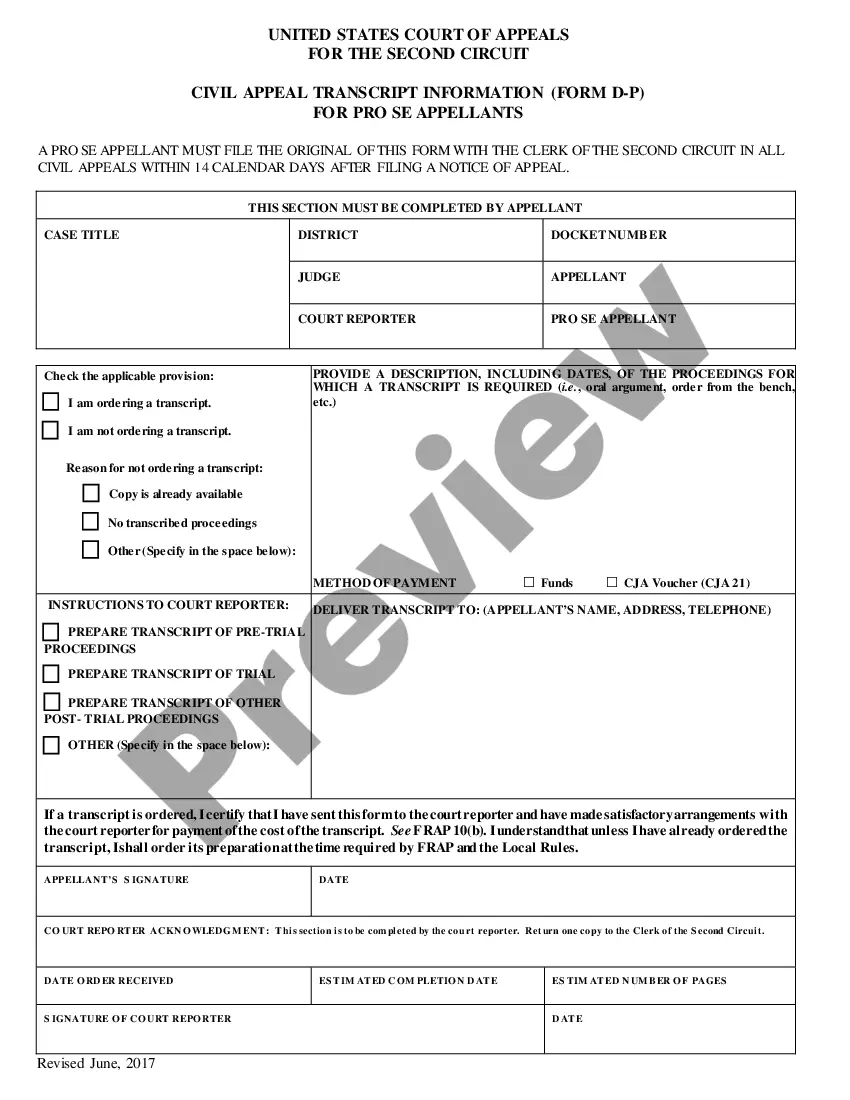

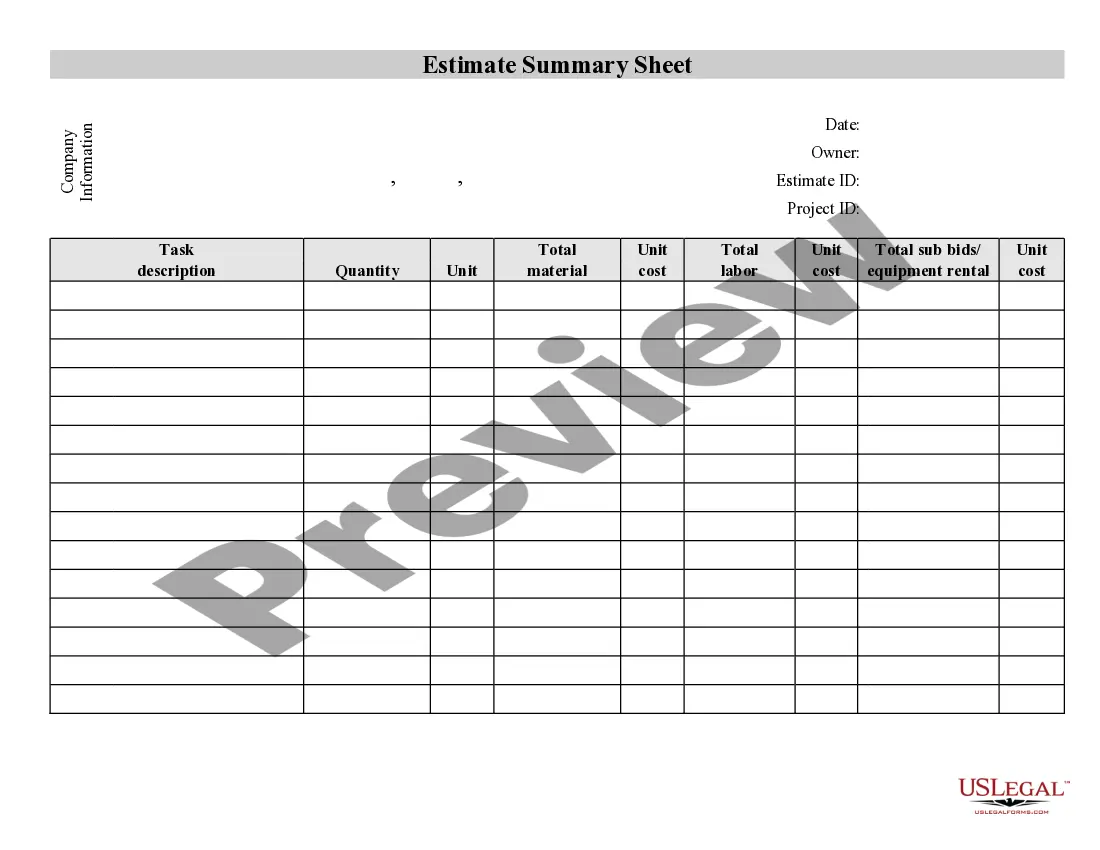

- Be sure you have picked the right type for your city/area. Select the Preview key to check the form`s information. Browse the type outline to ensure that you have selected the appropriate type.

- In case the type doesn`t match your specifications, take advantage of the Lookup area at the top of the screen to get the one who does.

- If you are happy with the form, verify your selection by visiting the Acquire now key. Then, choose the rates program you want and give your credentials to register for the account.

- Procedure the transaction. Use your credit card or PayPal account to accomplish the transaction.

- Select the format and obtain the form in your system.

- Make alterations. Load, revise and print and sign the saved Michigan Plan of complete liquidation and dissolution.

Every single template you put into your money does not have an expiration date and is yours eternally. So, if you would like obtain or print yet another version, just go to the My Forms segment and click on on the type you will need.

Obtain access to the Michigan Plan of complete liquidation and dissolution with US Legal Forms, the most considerable local library of lawful document layouts. Use a large number of specialist and express-distinct layouts that meet up with your organization or specific requirements and specifications.

Form popularity

FAQ

Michigan Certificates of Dissolution are processed by LARA in 3-5 days. If you need your documents processed more quickly, fill out the Expedited Service Request form for each document. It usually takes about 6 weeks to get a Tax Clearance Certificate.

Termination of Business. . Any sale, lease or exchange of all, or substantially all, of the Company's assets or business or any dissolution, liquidation or winding up of the Company.

Simply put, a dissolved company is a business entity that is no longer registered with Companies House. Dissolution can occur for various reasons. This could be bankruptcy, failure to file required documents or a decision by the owners to close the business.

Although some people confuse dissolution and termination, dissolution does not terminate an LLC's existence. What it does is change the purpose of its existence. Instead of conducting whatever business it conducted before, a dissolved LLC exists solely for the purpose of winding up and liquidating.

A member of an LLC can be removed only through a written notice of withdrawal. An LLC only negates the need for a notice of withdrawal with an operating agreement or organization articles describing how members can vote others out.

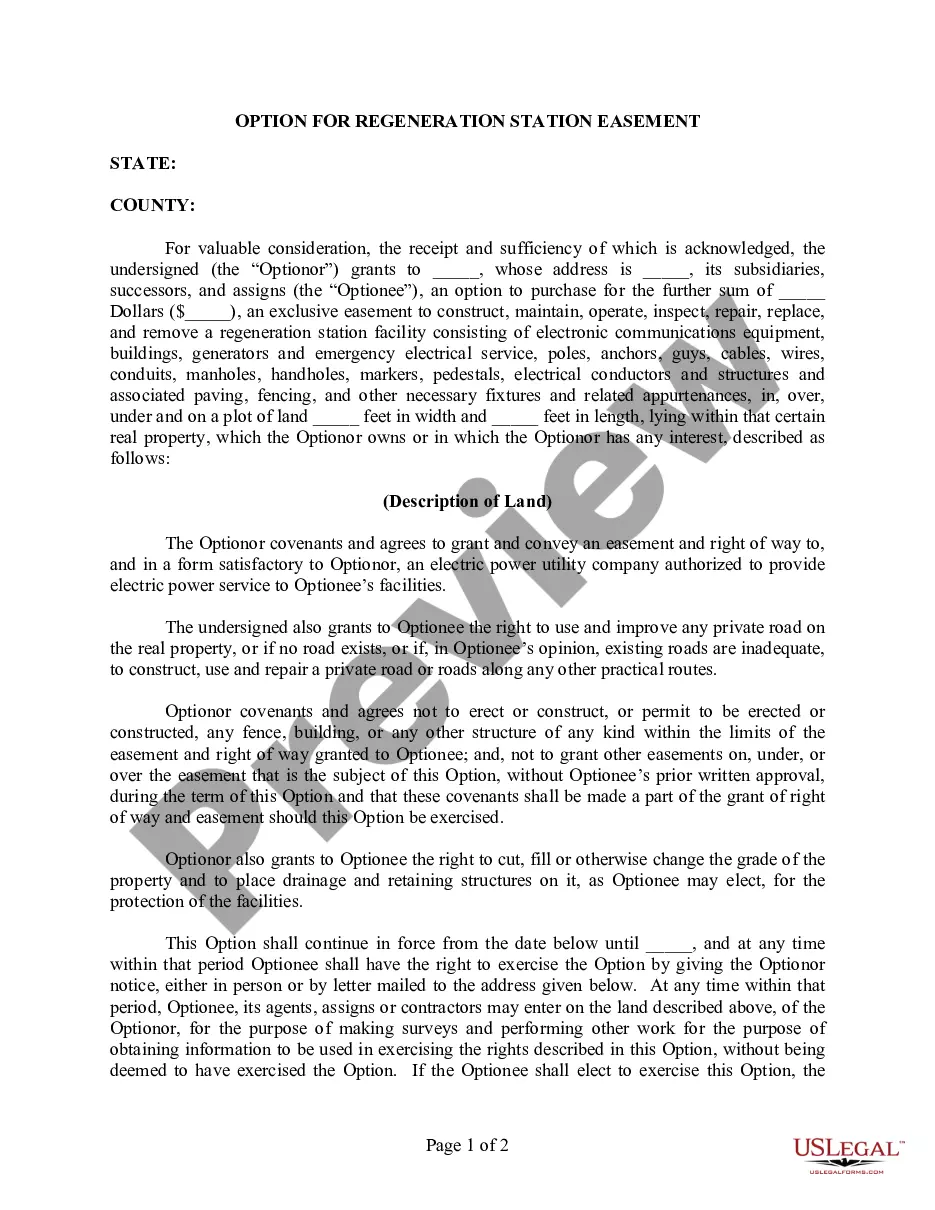

A plan of dissolution is a written description of how an entity intends to dissolve, or officially and formally close the business. A plan of dissolution will include a description of how any remaining assets and liabilities will be distributed.

Authorizing Dissolution Michigan's Nonprofit Corporation Act ("NCA") provides for voluntary dissolution through either: a vote of the members or shareholders entitled to vote on dissolution; or. if there are no such members or shareholders, a vote of the directors.

CLOSE LLC. The main difference between a regular LLC and a Close LLC is the restriction on the selling of a member's shares. A member must offer to sell his/her shares to the other member(s) of the Close LLC before they can be sold to anyone else. Also, all members must approve of the sale of shares.