Michigan Incentive and Nonqualified Share Option Plan

Description

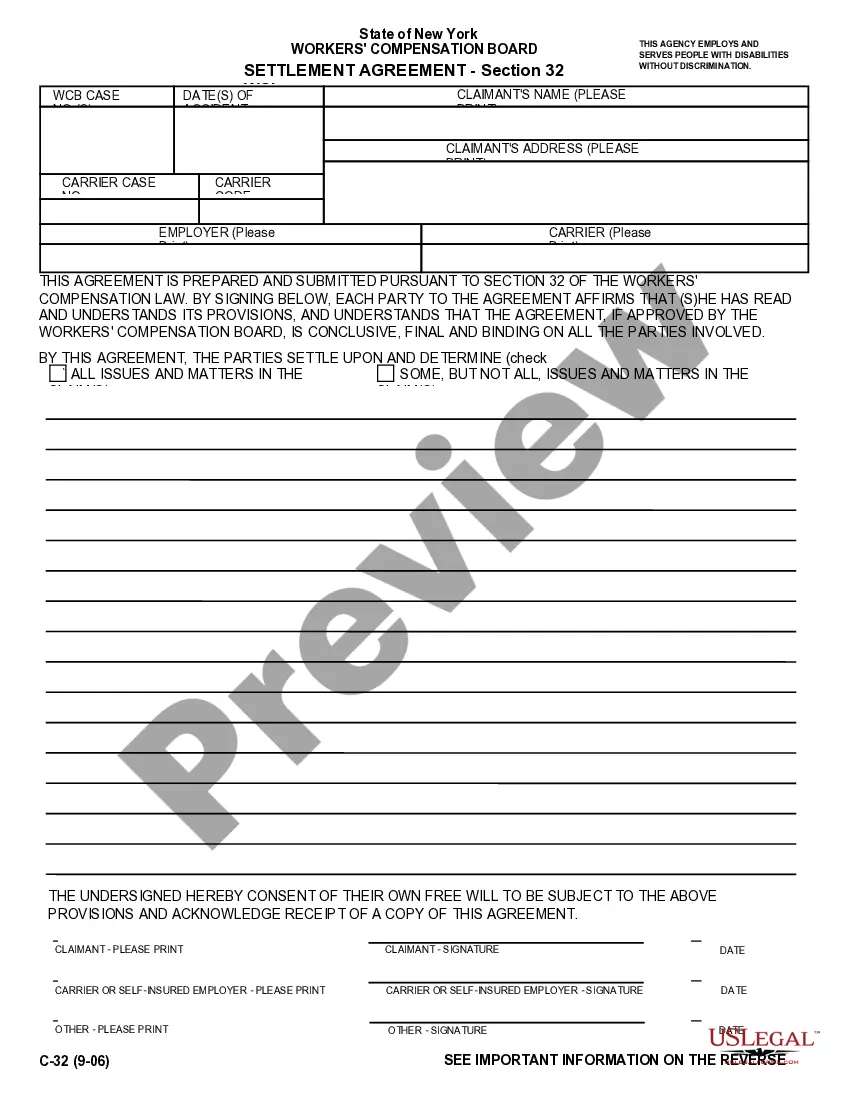

How to fill out Incentive And Nonqualified Share Option Plan?

Are you presently in a place that you need files for either company or individual uses virtually every working day? There are a lot of legitimate record templates available online, but finding types you can rely on isn`t simple. US Legal Forms provides a large number of type templates, such as the Michigan Incentive and Nonqualified Share Option Plan, that happen to be composed to satisfy state and federal demands.

When you are presently knowledgeable about US Legal Forms site and have your account, simply log in. Following that, you can obtain the Michigan Incentive and Nonqualified Share Option Plan format.

If you do not offer an bank account and would like to begin using US Legal Forms, follow these steps:

- Get the type you need and make sure it is for your right area/region.

- Use the Review key to check the form.

- Read the explanation to actually have selected the correct type.

- In the event the type isn`t what you are looking for, take advantage of the Search industry to discover the type that meets your needs and demands.

- Once you discover the right type, just click Get now.

- Pick the rates plan you need, fill in the specified information to produce your bank account, and pay for the order with your PayPal or bank card.

- Pick a hassle-free paper formatting and obtain your copy.

Discover each of the record templates you may have purchased in the My Forms food list. You can get a additional copy of Michigan Incentive and Nonqualified Share Option Plan at any time, if needed. Just click the necessary type to obtain or print out the record format.

Use US Legal Forms, one of the most considerable assortment of legitimate kinds, to save lots of some time and stay away from mistakes. The assistance provides skillfully produced legitimate record templates that you can use for an array of uses. Create your account on US Legal Forms and begin producing your life easier.

Form popularity

FAQ

NSOs vs. RSUs NSOs give you the option to buy stock, but you might decide to never exercise them if the company's valuation falls below your strike price. In comparison, restricted stock units (RSUs) are actual shares that you acquire as they vest. You don't have to pay to exercise RSUs; you simply receive the shares.

Taxation. The main difference between ISOs and NQOs is the way that they are taxed. NSOs are generally taxed as a part of regular compensation under the ordinary federal income tax rate. Qualifying dispositions of ISOs are taxed as capital gains at a generally lower rate.

Nonqualified: Employees generally don't owe tax when these options are granted. When exercising, tax is paid on the difference between the exercise price and the stock's market value. They may be transferable. Qualified or Incentive: For employees, these options may qualify for special tax treatment on gains.

NQOs are unrestricted. As such, they can be offered to anyone. That means that you can extend them to not just standard employees, but also directors, contractors, vendors, and even other third parties. ISOs, on the other hand, can only be issued to standard employees.

What Is a Non-Qualified Stock Option (NSO)? A non-qualified stock option (NSO) is a type of employee stock option wherein you pay ordinary income tax on the difference between the grant price and the price at which you exercise the option.

Taxation on nonqualified stock options As mentioned above, NSOs are generally subject to higher taxes than ISOs because they are taxed on two separate occasions ? upon option exercise and when company shares are sold ? and also because income tax rates are generally higher than long-term capital gains tax rates.

If you sell right away at the current FMV of the stock, you will not have any capital gain and will only have to pay ordinary income tax on the spread. If you sell your stock within a year of when you exercised your options, you'll pay short-term capital gains tax on any increase in value since the exercise date.

ISOs have more favorable tax treatment than non-qualified stock options (NSOs) in part because they require the holder to hold the stock for a longer time period. This is true of regular stock shares as well.