Michigan Terms of Class One Preferred Stock

Description

How to fill out Terms Of Class One Preferred Stock?

US Legal Forms - one of many biggest libraries of lawful kinds in the States - provides a variety of lawful papers layouts you can obtain or printing. While using site, you can get a large number of kinds for organization and specific uses, categorized by classes, states, or search phrases.You will discover the newest types of kinds just like the Michigan Terms of Class One Preferred Stock within minutes.

If you currently have a membership, log in and obtain Michigan Terms of Class One Preferred Stock from the US Legal Forms collection. The Acquire option will appear on every type you see. You have accessibility to all previously downloaded kinds within the My Forms tab of the account.

If you would like use US Legal Forms for the first time, listed here are straightforward guidelines to help you get began:

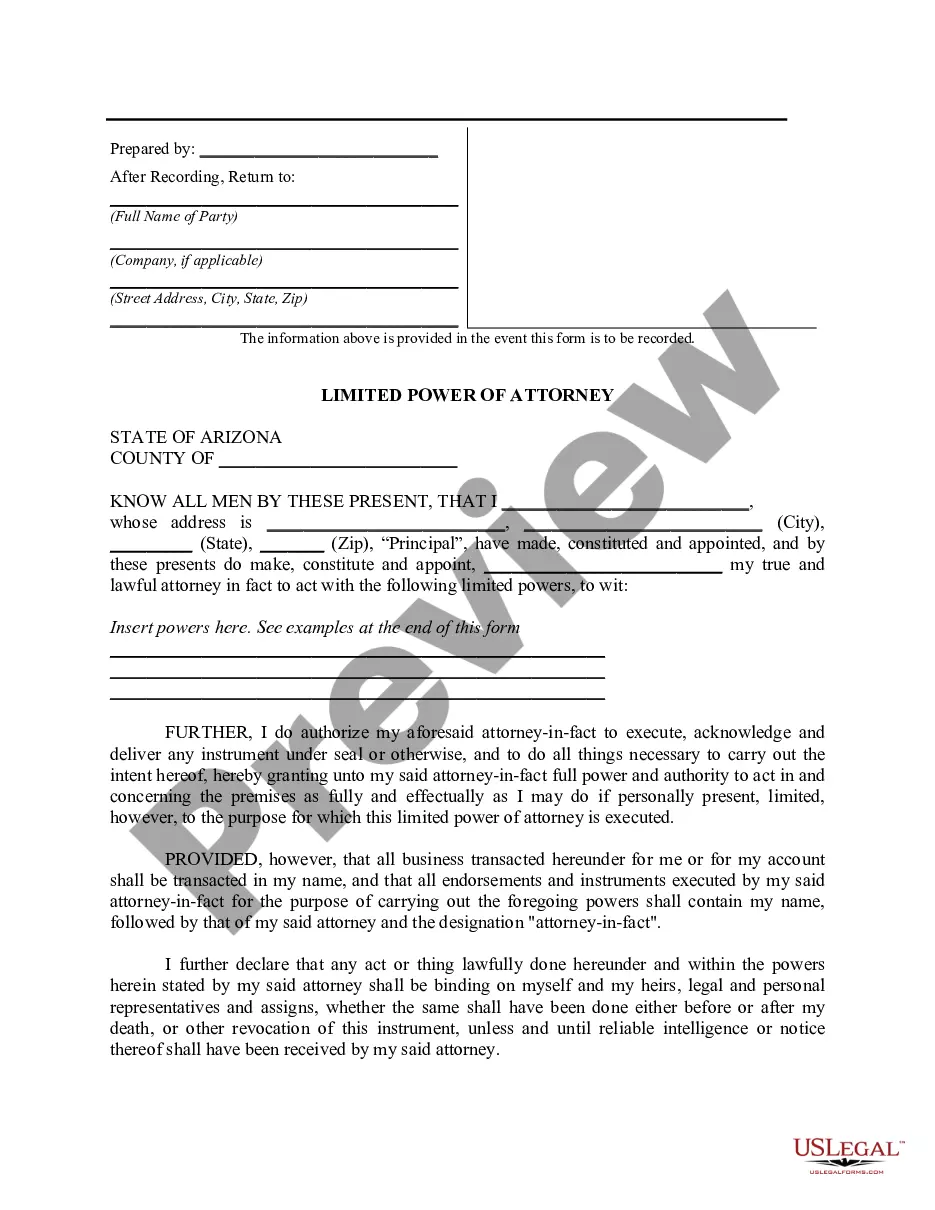

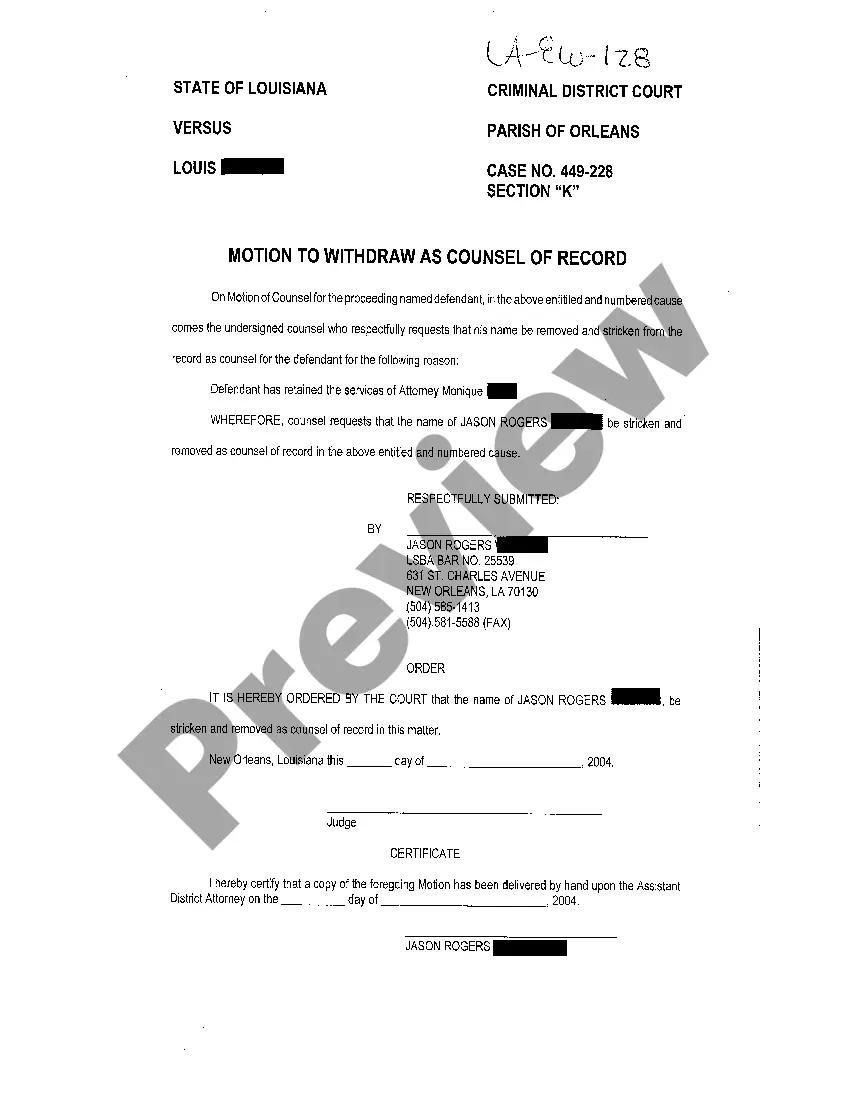

- Be sure you have picked out the proper type for your metropolis/area. Select the Review option to review the form`s content. See the type description to ensure that you have chosen the right type.

- When the type does not match your demands, make use of the Look for industry near the top of the display to obtain the one who does.

- If you are pleased with the form, confirm your decision by visiting the Buy now option. Then, choose the rates strategy you prefer and offer your credentials to sign up on an account.

- Process the deal. Make use of your credit card or PayPal account to finish the deal.

- Select the format and obtain the form on the device.

- Make changes. Load, edit and printing and signal the downloaded Michigan Terms of Class One Preferred Stock.

Each and every format you included with your account lacks an expiration particular date and is the one you have permanently. So, if you would like obtain or printing yet another backup, just visit the My Forms portion and click on on the type you want.

Obtain access to the Michigan Terms of Class One Preferred Stock with US Legal Forms, probably the most comprehensive collection of lawful papers layouts. Use a large number of expert and express-particular layouts that fulfill your small business or specific requirements and demands.

Form popularity

FAQ

Corporate bylaws are required in Michigan. ing to MI Comp L § 450.1231, ?the initial bylaws of a corporation shall be adopted? at the first organizational meeting following incorporation. In other words, bylaws are legally necessary to form a corporation in Michigan.

Sec. 531. (1) The officers of a corporation shall consist of a president, secretary, treasurer, and, if desired, a chairman of the board, 1 or more vice-presidents, and such other officers as may be prescribed by the bylaws or determined by the board.

The bylaws of a company are the internal rules that govern how a business is run. They're set out in a formal written document adopted by a corporation's board of directors and summarize important procedures related to decision-making and voting.

AN ACT to provide for the organization and regulation of corporations; to prescribe their duties, rights, powers, immunities and liabilities; to provide for the authorization of foreign corporations within this state; to prescribe the functions of the administrator of this act; to prescribe penalties for violations of ...

Corporate bylaws are guidelines for the way you'll structure and run your corporation. Bylaws are required in most states. Even when they're not required, bylaws are useful because they avoid uncertainty and ensure you're complying with legal formalities.