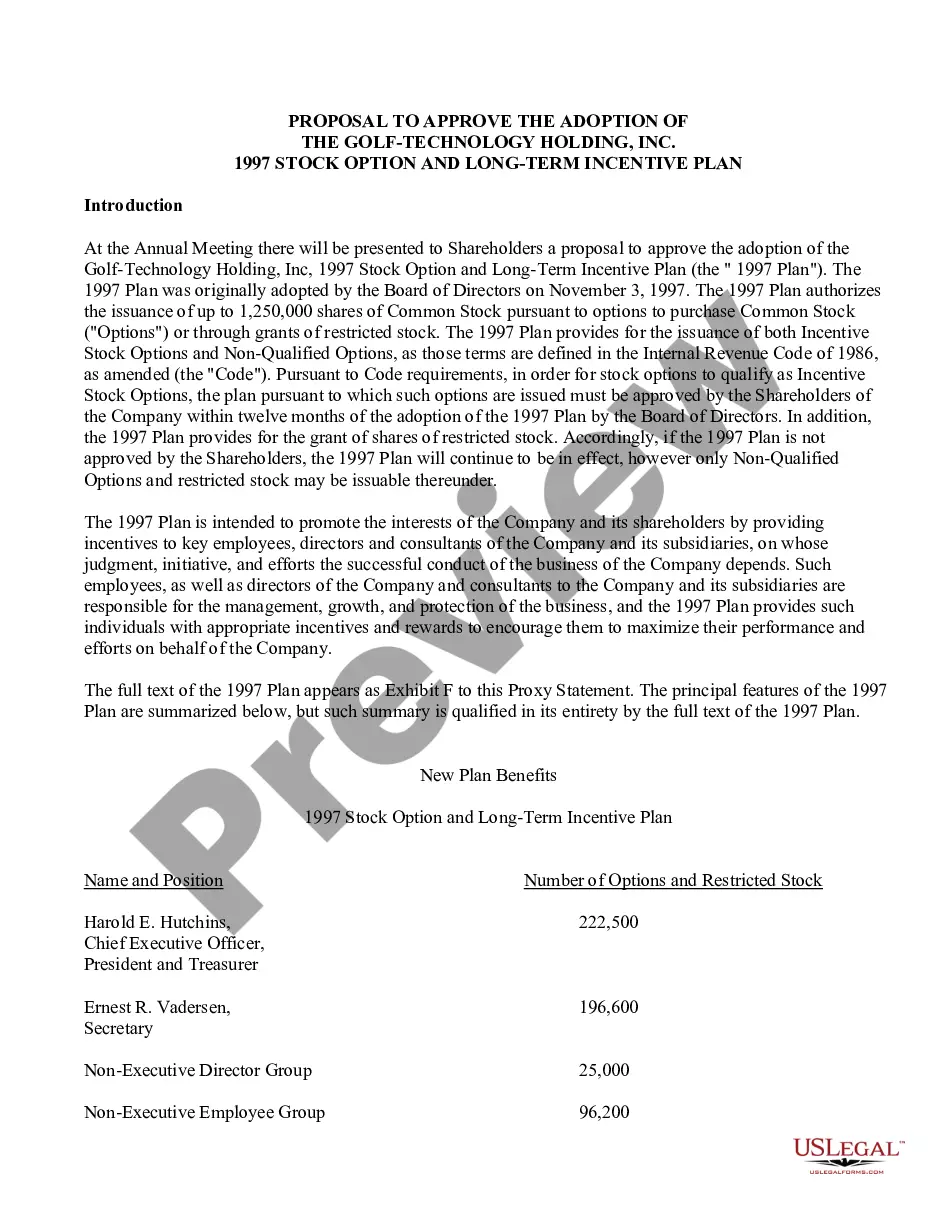

Michigan Stock Option and Long Term Incentive Plan of Golf Technology Holding, Inc.

Description

How to fill out Stock Option And Long Term Incentive Plan Of Golf Technology Holding, Inc.?

If you wish to full, download, or print authorized file themes, use US Legal Forms, the biggest variety of authorized varieties, which can be found online. Take advantage of the site`s simple and hassle-free lookup to get the documents you need. Various themes for business and specific uses are categorized by classes and suggests, or keywords and phrases. Use US Legal Forms to get the Michigan Stock Option and Long Term Incentive Plan of Golf Technology Holding, Inc. in just a handful of mouse clicks.

In case you are already a US Legal Forms consumer, log in for your account and click on the Obtain key to obtain the Michigan Stock Option and Long Term Incentive Plan of Golf Technology Holding, Inc.. You can also accessibility varieties you formerly saved within the My Forms tab of your account.

If you work with US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Make sure you have selected the shape to the proper town/country.

- Step 2. Make use of the Review option to look through the form`s content material. Never neglect to learn the explanation.

- Step 3. In case you are unhappy with all the kind, take advantage of the Look for discipline at the top of the screen to locate other variations in the authorized kind format.

- Step 4. Once you have located the shape you need, click on the Purchase now key. Pick the costs program you favor and include your credentials to sign up for an account.

- Step 5. Approach the purchase. You may use your charge card or PayPal account to accomplish the purchase.

- Step 6. Select the structure in the authorized kind and download it on the device.

- Step 7. Full, modify and print or indication the Michigan Stock Option and Long Term Incentive Plan of Golf Technology Holding, Inc..

Every authorized file format you purchase is your own permanently. You have acces to each kind you saved inside your acccount. Select the My Forms segment and pick a kind to print or download again.

Be competitive and download, and print the Michigan Stock Option and Long Term Incentive Plan of Golf Technology Holding, Inc. with US Legal Forms. There are millions of professional and express-distinct varieties you can utilize for your business or specific requirements.

Form popularity

FAQ

Understanding LTIPs and vesting As mentioned above, vesting is the waiting period before receiving 100% of the LTI ownership. For example, if your vesting period is three years, the incentives will be fully available to you (i.e. you can sell and/or exercise them) once the 3-year period has passed.

An example of a long-term incentive could be a cash plan, equity plan or share plan. A long-term incentive plan can typically run between three years and five years before the full benefit of the incentive is received by the employee.

In general, a cash incentive program is an employee reward system that pays out a sum of money to employees for achieving particular goals or milestones.

Cash-based LTIPs offer executives a guaranteed cash reward when certain performance targets are met, while equity-based LTIPs offer stock options or restricted stock units (RSUs) that align executives' interests with those of the company and its shareholders.

An LTIP works by rewarding employees (usually senior employees) with cash or shares of company stock for meeting specific goals. The goals are usually long-term, running for 3-5 years to stimulate ongoing progress rather than a-few-months objectives.

A long term incentive plan (LTIP) is a deferred compensation strategy that helps employers retain valued talent by rewarding employees for meeting specific performance goals.