Michigan Incentive Stock Plan of Chaparral Resources, Inc.

Description

How to fill out Incentive Stock Plan Of Chaparral Resources, Inc.?

You can commit hrs on the Internet searching for the legal record template that meets the federal and state demands you will need. US Legal Forms offers a large number of legal types which are reviewed by specialists. You can easily download or printing the Michigan Incentive Stock Plan of Chaparral Resources, Inc. from our assistance.

If you have a US Legal Forms account, you are able to log in and click on the Acquire switch. After that, you are able to complete, revise, printing, or signal the Michigan Incentive Stock Plan of Chaparral Resources, Inc.. Every legal record template you purchase is yours permanently. To get another backup for any acquired form, check out the My Forms tab and click on the corresponding switch.

If you use the US Legal Forms site for the first time, keep to the simple instructions listed below:

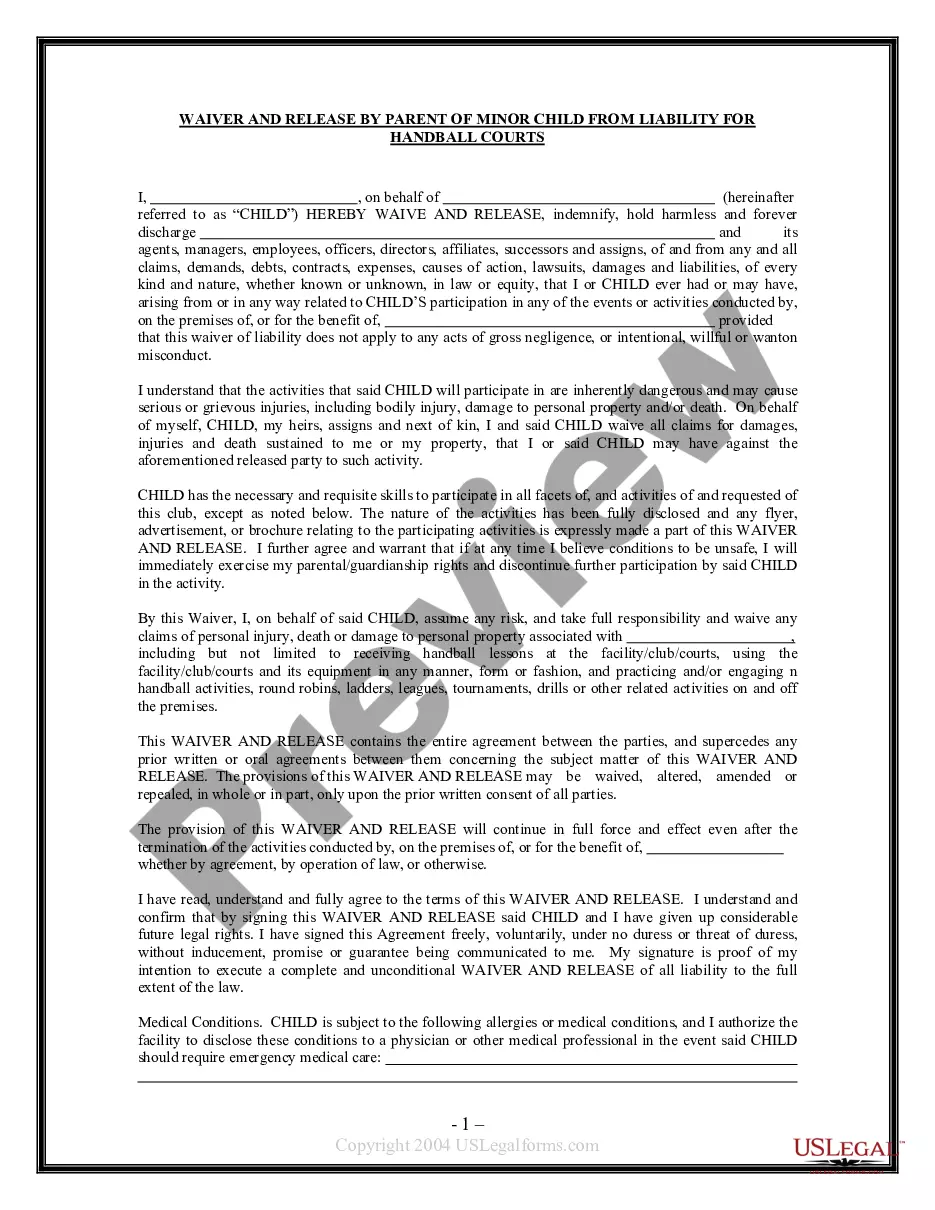

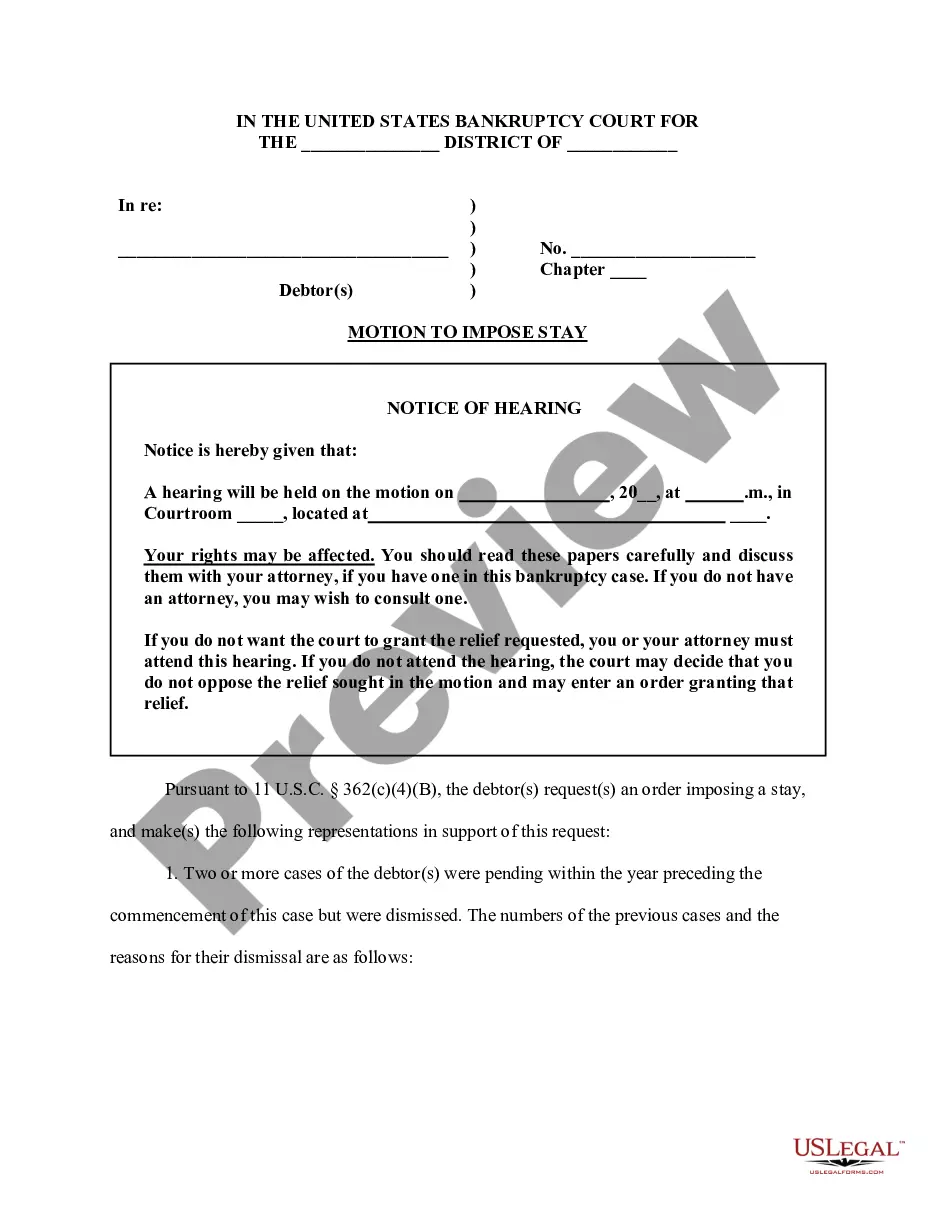

- Initially, ensure that you have chosen the best record template to the state/area of your liking. Read the form explanation to make sure you have chosen the appropriate form. If available, take advantage of the Preview switch to look with the record template at the same time.

- If you want to locate another version from the form, take advantage of the Search area to discover the template that suits you and demands.

- After you have identified the template you desire, click Buy now to carry on.

- Find the rates strategy you desire, enter your qualifications, and register for a free account on US Legal Forms.

- Complete the deal. You can use your bank card or PayPal account to fund the legal form.

- Find the format from the record and download it to your product.

- Make alterations to your record if possible. You can complete, revise and signal and printing Michigan Incentive Stock Plan of Chaparral Resources, Inc..

Acquire and printing a large number of record web templates using the US Legal Forms Internet site, that provides the most important selection of legal types. Use skilled and status-certain web templates to tackle your business or specific requires.

Form popularity

FAQ

They provide employees the right, but not the obligation, to purchase shares of their employer's stock at a certain price for a certain period of time. Options are usually granted at the current market price of the stock and last for up to 10 years.

The benefit of incentive stock options Over time, you can make a significant amount of money on your shares. You not only owe a portion of the business, but you also benefit from the company's growth. Companies offering ISOs can also increase employee motivation .

Incentive stock options (ISOs) are popular measures of employee compensation received as rights to company stock. These are a particular type of employee stock purchase plan intended to retain key employees or managers. ISOs often have more favorable tax treatment than other types of employee stock purchase plan.

Benefits of offering stock options to employees Employees who own shares of stock have an additional financial incentive for performing well at work beyond their regular salary. They want to help the company grow so the stock price will go up and they can make a significant profit on their initial employment package.

A stock bonus plan is a defined-contribution profit sharing plan, to which employers contribute company stock. These are considered to be qualified retirement plans, and as such, they're governed by the Employee Retirement Income Security Act (ERISA).

An equity incentive program offers an employee shares of the company they work for. Shares can be awarded through stock options, stocks, warrants, or bonds. Stock options are the most common and recognizable form of employee equity.