Michigan Statement of Current Monthly Income and Means Test Calculation for Use in Chapter 7 - Post 2005

Description

How to fill out Statement Of Current Monthly Income And Means Test Calculation For Use In Chapter 7 - Post 2005?

Have you been within a place where you require documents for both organization or specific purposes virtually every working day? There are plenty of legal file layouts accessible on the Internet, but discovering types you can rely on isn`t effortless. US Legal Forms offers a huge number of type layouts, like the Michigan Statement of Current Monthly Income and Means Test Calculation for Use in Chapter 7 - Post 2005, which are created in order to meet state and federal specifications.

When you are previously acquainted with US Legal Forms internet site and possess a free account, basically log in. Afterward, it is possible to acquire the Michigan Statement of Current Monthly Income and Means Test Calculation for Use in Chapter 7 - Post 2005 format.

Should you not have an account and wish to begin using US Legal Forms, abide by these steps:

- Find the type you need and make sure it is for that correct city/region.

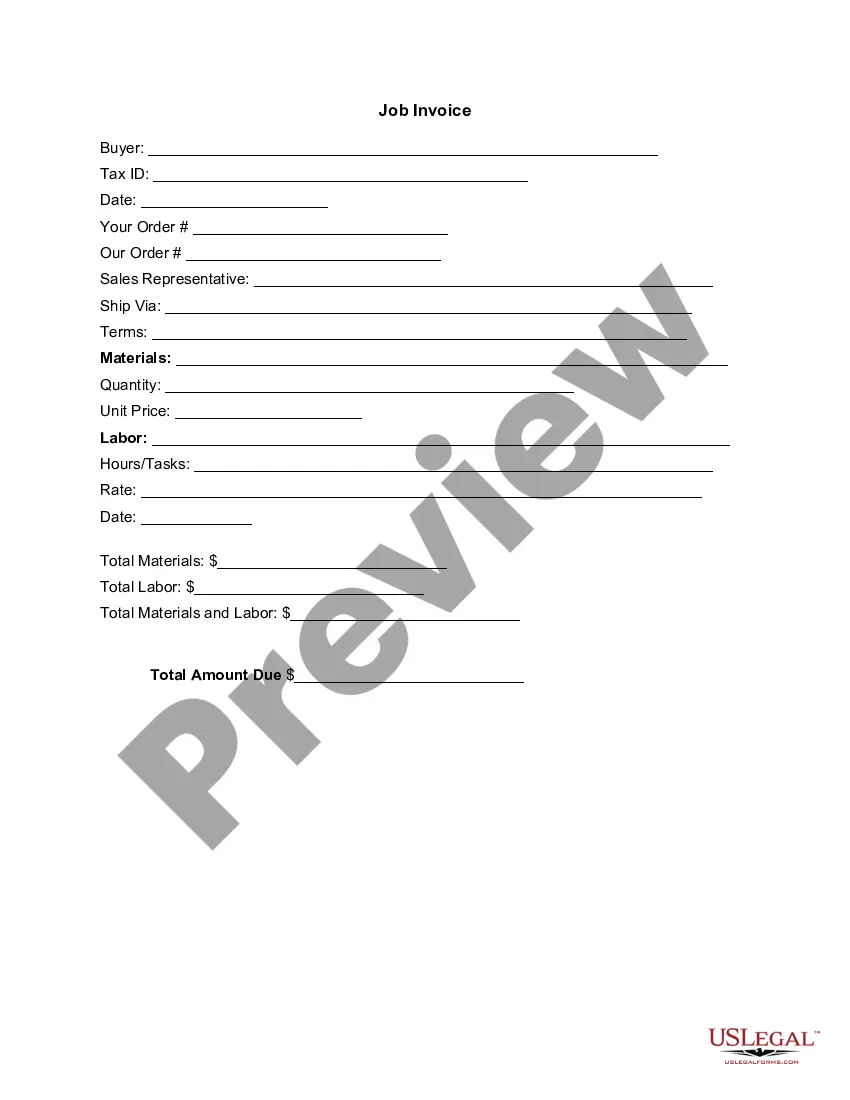

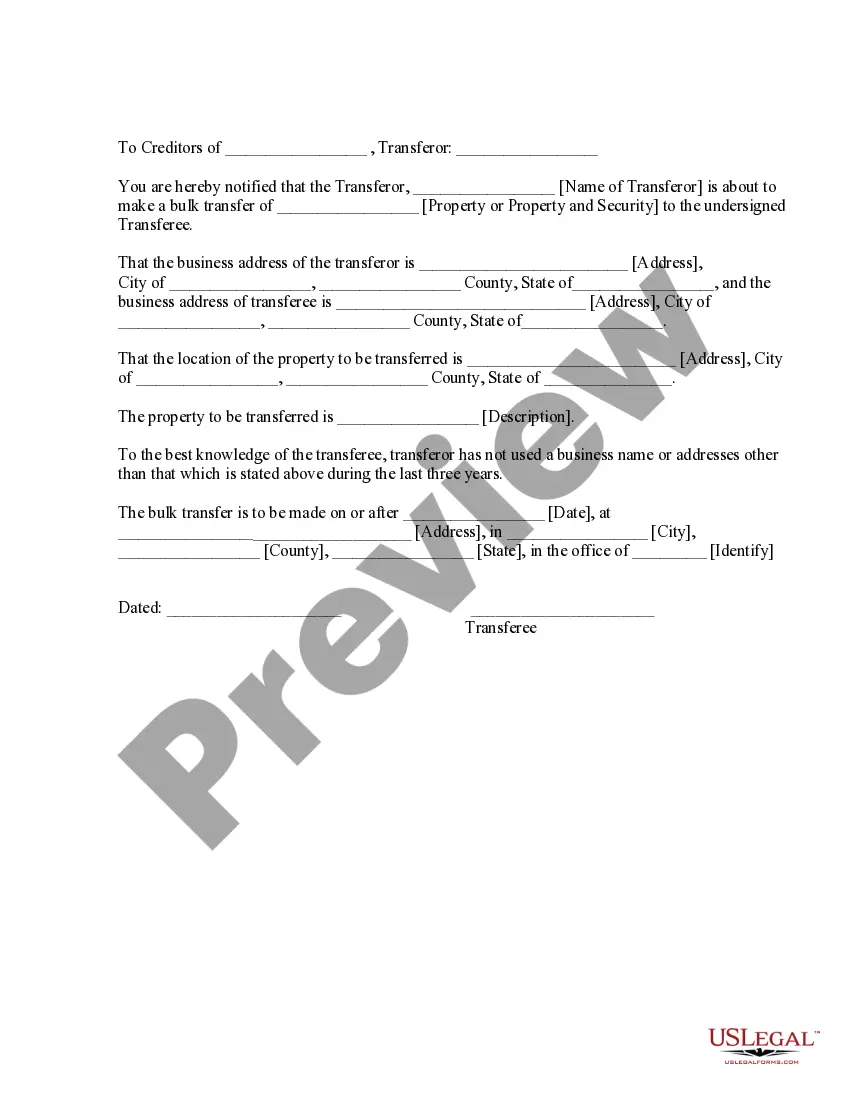

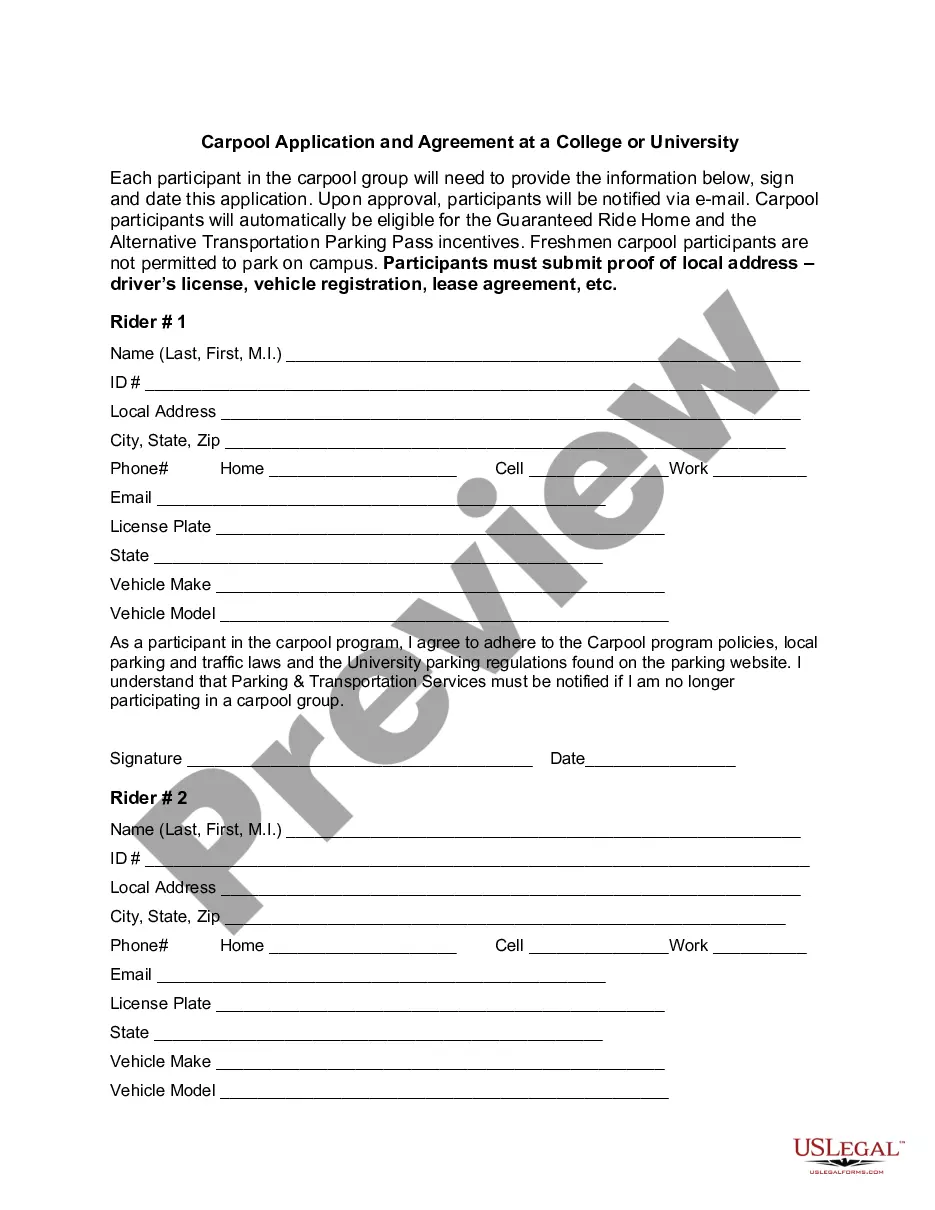

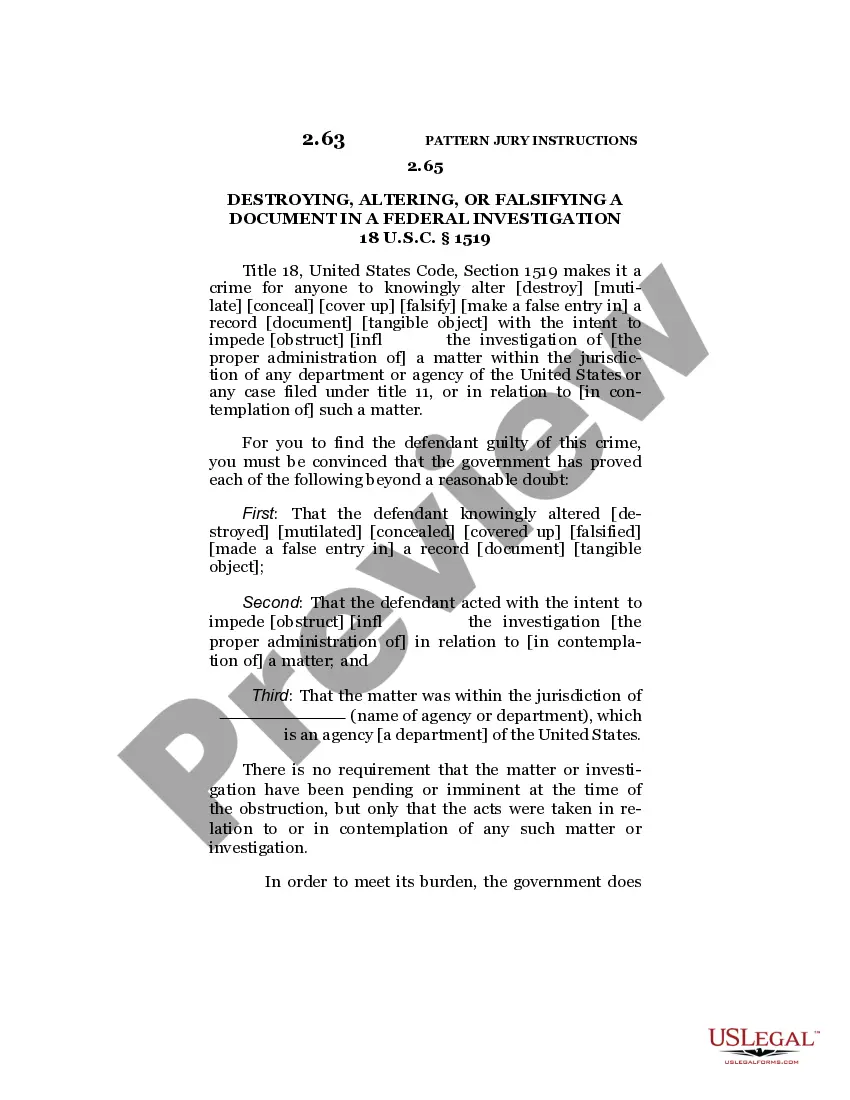

- Take advantage of the Preview switch to check the form.

- Look at the explanation to ensure that you have chosen the appropriate type.

- When the type isn`t what you are seeking, utilize the Search industry to get the type that suits you and specifications.

- Whenever you obtain the correct type, simply click Acquire now.

- Pick the rates prepare you would like, submit the required information to create your account, and pay money for your order utilizing your PayPal or bank card.

- Select a handy paper formatting and acquire your duplicate.

Find all the file layouts you may have bought in the My Forms menu. You can get a extra duplicate of Michigan Statement of Current Monthly Income and Means Test Calculation for Use in Chapter 7 - Post 2005 whenever, if possible. Just click on the needed type to acquire or print out the file format.

Use US Legal Forms, by far the most comprehensive selection of legal kinds, to conserve efforts and prevent blunders. The assistance offers skillfully produced legal file layouts that you can use for a selection of purposes. Generate a free account on US Legal Forms and initiate generating your daily life a little easier.

Form popularity

FAQ

To calculate your six-month average gross income, you first need to add up your wages, salaries, and tips for the past six months. Then, divide that number by six to get your average monthly income. If you receive any income from sources other than employment, you'll need to factor that in as well.

The U.S. bankruptcy code doesn't specify a minimum dollar amount someone must owe to make them eligible for a qualified filing. In short, any debt is enough debt. More important than the size of your debt is the size of your income. How much money you earn affects whether you qualify for Chapter 7.

Domestic support obligations, such as alimony or child support, and other court-ordered payments, including arrearage balances, can be deducted on the means test. The larger the arrearage balance, the more significant the benefit. Child care.

The first considers whether the filer's income is below the Chapter 7 income limit, which is the median in the state where the petition is filed. If income is less than the median for the prior six months and there is no reason to assume it will soon increase, the test is passed, and the Chapter 7 filing can proceed.

If a filer qualifies for an exception to the means test, they will file Form 122A-1Supp. You can earn a high income and still pass the means test if you have substantial expenses like a hefty mortgage, multiple car payments, taxes, childcare, health care, or care of an elderly or disabled person.

It does this by deducting specific monthly expenses from your "current monthly income" (your average income over the six calendar months before you file for bankruptcy) to arrive at your monthly "disposable income." The higher your disposable income, the more likely you won't be allowed to use Chapter 7 bankruptcy.

Form 122A-1: Chapter 7 Statement of Your Current Monthly Income. Form 122A-1 focuses on your marital and filing status, as well as your monthly income as compared to your state's median income.

The means test is calculated by comparing the debtor's average income for the past six months (current monthly income), annualized, to the median income for households of the same size in the debtor's state of residence.