Michigan Expense Reimbursement Request

Description

How to fill out Expense Reimbursement Request?

Are you presently in a situation where you need documents for potential business or personal purposes nearly every day.

There are numerous legal document templates accessible online, but finding forms you can trust is not easy.

US Legal Forms provides a wide variety of form templates, including the Michigan Expense Reimbursement Request, which can be tailored to meet federal and state regulations.

When you find the correct form, click Get now.

Choose the pricing plan you prefer, fill in the necessary information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Michigan Expense Reimbursement Request template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it corresponds to the correct state/region.

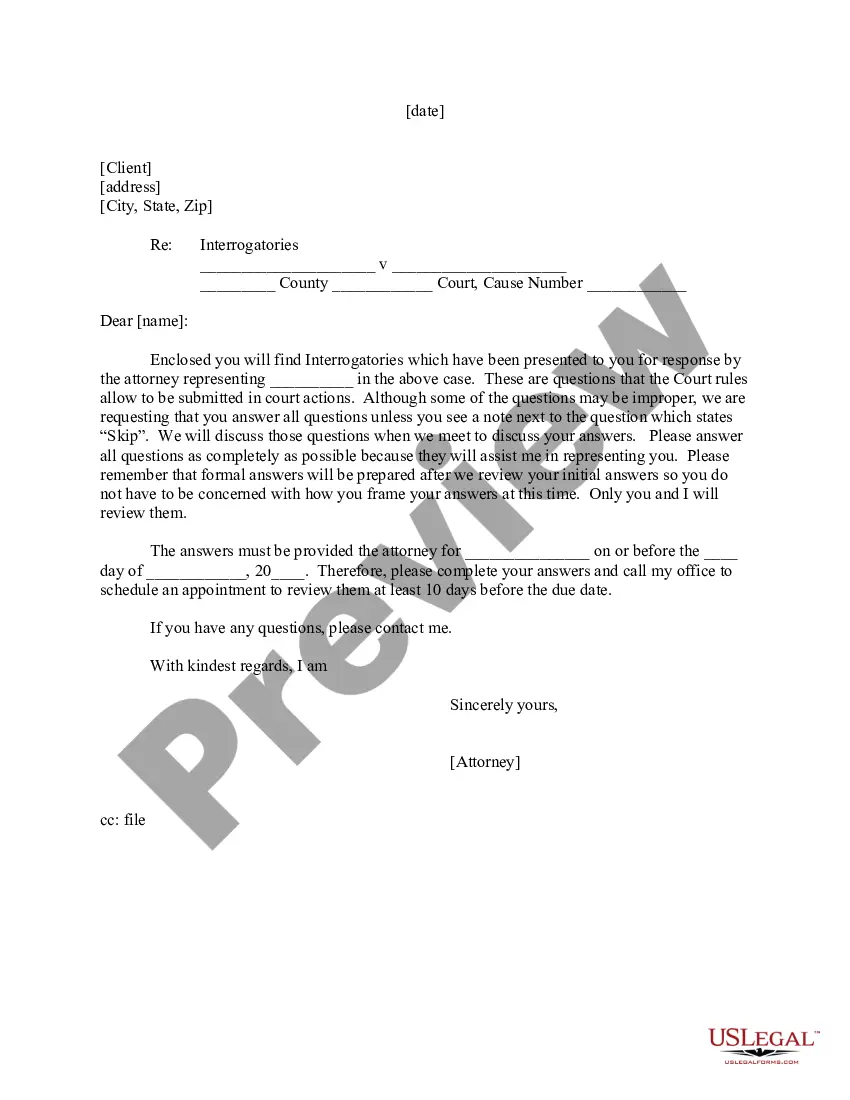

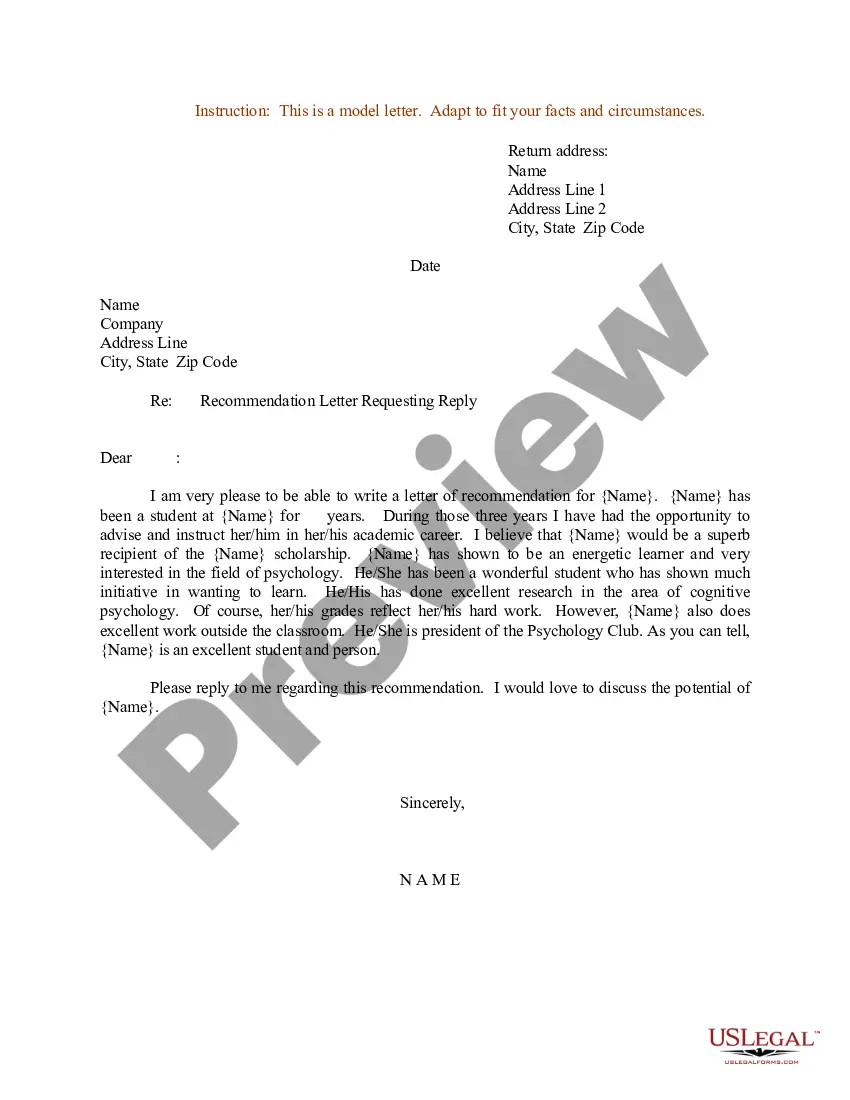

- Utilize the Review button to examine the form.

- Check the description to confirm you have selected the right form.

- If the form is not what you're looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

What is an expense reimbursement? An expense reimbursement is the payment made from your business to an employee for business-related expenses they have incurred personally. The reimbursement amount should exactly match the amount of the expense.

Add the expense and reimbursement to your accounting records. You may choose to add the reimbursement as a short-term loan so that it disappears from your books after the client pays it. Another option is to list your original payment under expenses and the repayment from the client under revenue or income.

Business expense reimbursements include out-of-pocket expenses, such as those for travel and food. Per diem rates are daily rates paid to employees as reimbursement for business trips. Tax refunds are a form of reimbursement from the government to taxpayers.

What Expenses Should a Business Cover?Business-related travel. Airfare, train, and/or other transportation expenses should be reimbursed to employees.Meals. Employees should also be reimbursed for meals as part of travel or business-related activities.Smartphones.Accommodations for travel.Training.

bystep guide to employee expense reimbursementForm a policy for the expense reimbursement process.Determine what expenses employees can claim.Create a system for collecting employee expense claims.Verify the legitimacy of expenses.Pay reimbursements within a specified timeframe.

That typically means 5-20 days after the expenses were approved they would hit your account. Certainly make sure the expenses were approved by your manager (or whomever signs off) before calling out the payroll group. A company should never try to make money off the float of reimbursements to employees.

What Is Expense Reimbursement? The expense reimbursement process allows employers to pay back employees who have spent their own money for business-related expenses. When employees receive an expense reimbursement, typically they won't be required to report such payments as wages or income.

This deduction excludes from the employee's taxable income provided that the expenses are legitimate business expenses and the reimbursements comply with IRS rules. The best way to reimburse employees for expenses can be accomplished by using either the per diem method or an accountable plan.

The cost of work-related travel, including transportation, lodging, meals, and entertainment that meet the criteria outlined in IRS Publication 463, Travel, Entertainment, Gift, and Car Expenses, are generally reimbursable expenses.

How to create an expense reimbursement plan for your businessCreate an expense management policy.Make sure it's accountable.Determine which expenses are reimbursable.Specify needed documentation.Provide submission deadlines.Determine the mode of reimbursement.