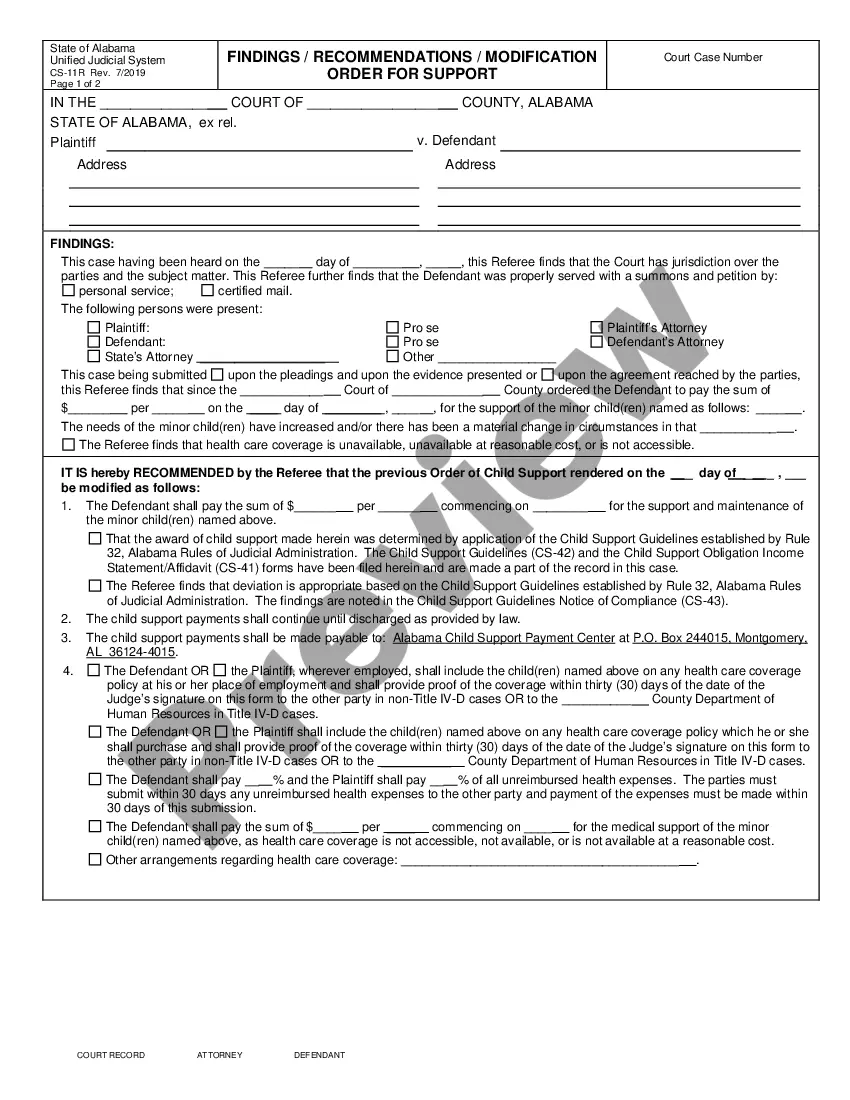

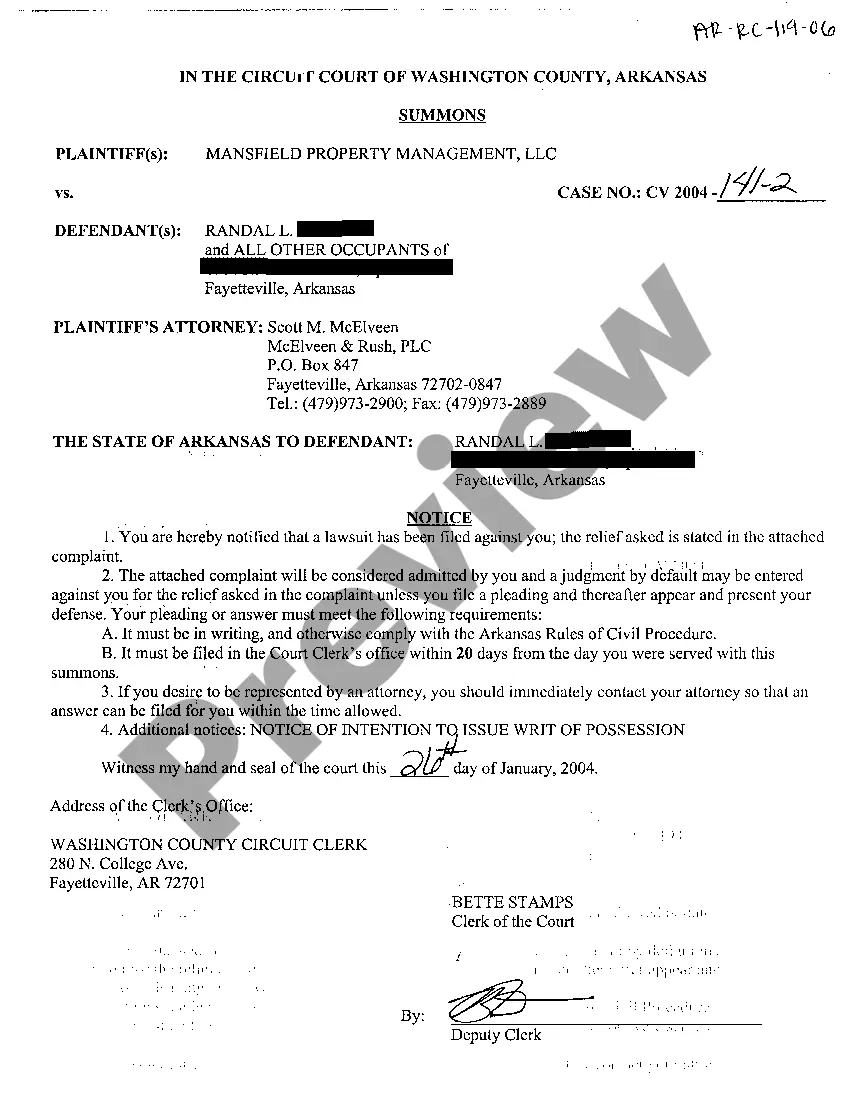

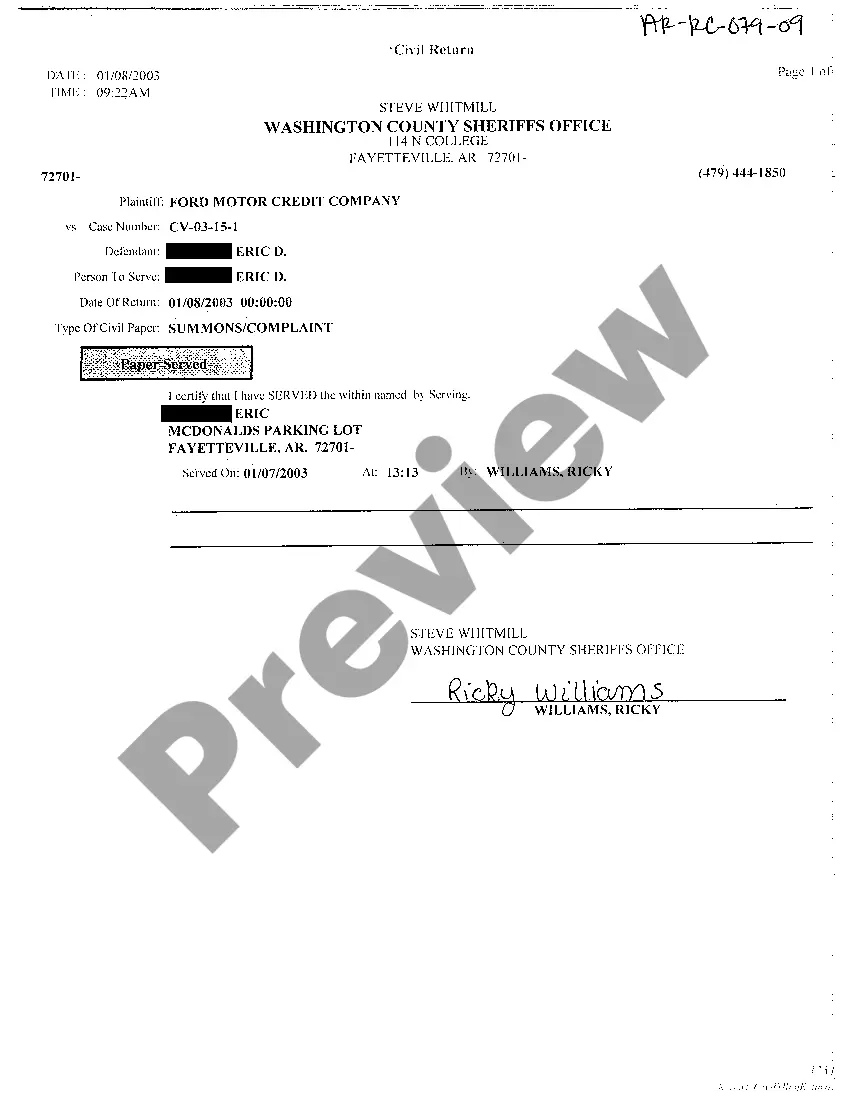

Michigan Flood Insurance Authorization

Description

How to fill out Flood Insurance Authorization?

Are you in a position that you need papers for sometimes organization or personal uses nearly every day? There are plenty of lawful record templates available online, but finding versions you can depend on is not straightforward. US Legal Forms provides a huge number of kind templates, such as the Michigan Flood Insurance Authorization, which can be created to fulfill state and federal specifications.

In case you are previously knowledgeable about US Legal Forms site and also have an account, just log in. After that, it is possible to acquire the Michigan Flood Insurance Authorization web template.

Unless you have an accounts and need to begin using US Legal Forms, abide by these steps:

- Discover the kind you will need and ensure it is for the correct city/county.

- Utilize the Review key to analyze the shape.

- Look at the outline to actually have selected the right kind.

- When the kind is not what you are searching for, utilize the Research field to get the kind that suits you and specifications.

- If you discover the correct kind, click on Buy now.

- Choose the rates strategy you need, complete the required information and facts to generate your bank account, and pay money for your order with your PayPal or bank card.

- Pick a convenient data file file format and acquire your backup.

Get every one of the record templates you might have bought in the My Forms menus. You can get a additional backup of Michigan Flood Insurance Authorization whenever, if needed. Just select the needed kind to acquire or printing the record web template.

Use US Legal Forms, by far the most considerable variety of lawful forms, to conserve time as well as avoid errors. The support provides professionally created lawful record templates that can be used for a range of uses. Produce an account on US Legal Forms and start producing your way of life a little easier.

Form popularity

FAQ

To determine if your community is in the NFIP and if a Flood Insurance Rate Map (FIRM) exists for your community, contact the Federal Emergency Management Agency (FEMA) toll free at 877-336-2627 or view the community status book on the FEMA Web site at: .

Flood insurance covers losses directly caused by flooding. In simple terms, a flood is an excess of water on land that is normally dry, affecting two or more acres of land or two or more properties. For example, damage caused by a sewer backup is covered if the backup is a direct result of flooding.

Typically, there's a 30-day waiting period from date of purchase until your flood insurance policy goes into effect.

Floods can cause power, water, and gas outages; disrupt transportation routes and commercial supplies; pollute drinking water systems; damage homes, buildings, and roads; and cause severe environmental problems including landslides and mudslides.

To purchase flood insurance, call your insurance company or insurance agent, the same person who sells your home or auto insurance. If you need help finding a provider go to FloodSmart.gov/flood-insurance-provider or call the NFIP at 877-336-2627.

A: The NFIP is a federal government program administered by the Federal Emergency Management Agency (FEMA). Private flood insurance, on the other hand, is written by private insurance carriers who are free to offer as much coverage as they want.

Contact your insurance company or agent as soon as possible. ITEMIZING YOUR POSSESSIONS. It's a good idea to be prepared in advance, if possible. ... AFTER THE FLOOD. Clean-up should begin as soon as the flood waters recede. ... WORKING WITH AN ADJUSTER. ... OBTAIN A REPAIR OR REPLACEMENT ESTIMATE. ... TAKE CHARGE OF YOUR CLAIM.

Flood insurance in Michigan costs an average of $1,047 per year, around $280 higher than the national average of $767. The flood risk of a Michigan area impacts policy costs.