Michigan Resolution of Meeting of LLC Members to Accept Resignation of Manager of the Company and Appoint a New Manager

Description

How to fill out Resolution Of Meeting Of LLC Members To Accept Resignation Of Manager Of The Company And Appoint A New Manager?

It is feasible to spend hours online searching for the legal document template that meets your state and federal requirements.

US Legal Forms provides thousands of legal forms that are assessed by experts.

You can easily obtain or print the Michigan Resolution of Meeting of LLC Members to Accept Resignation of Manager of the Company and Appoint a New Manager with my assistance.

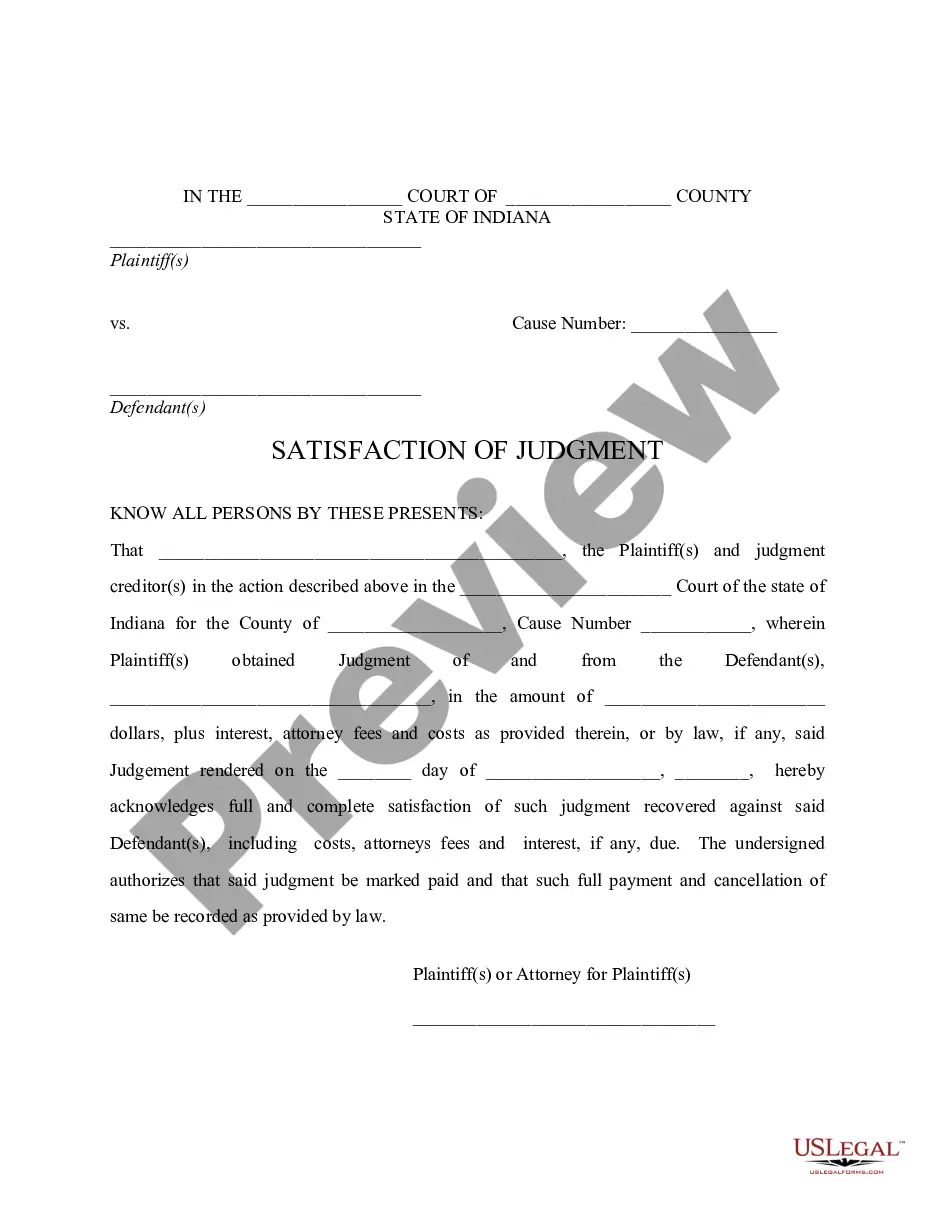

If available, use the Preview option to view the document template as well.

- If you already have a US Legal Forms account, you may Log In and click the Download button.

- Subsequently, you may complete, modify, print, or sign the Michigan Resolution of Meeting of LLC Members to Accept Resignation of Manager of the Company and Appoint a New Manager.

- Every legal document template you purchase is your property indefinitely.

- To obtain an additional copy of any purchased form, go to the My documents tab and click the relevant option.

- If you are visiting the US Legal Forms website for the first time, follow the simple steps below.

- First, ensure that you have selected the correct document template for the area/city of your choice.

- Read the form description to confirm you have chosen the correct form.

Form popularity

FAQ

An LLC is manager-managed when designated managers handle its operations instead of all members. This structure allows members to participate in high-level decisions while managers execute the daily tasks. Understanding when to transition to a manager-managed structure can lead to smoother operations, especially with resolutions like the Michigan Resolution of Meeting of LLC Members to Accept Resignation of Manager of the Company and Appoint a New Manager.

An LLC does not have to make resolutions, but there are times it could be useful: An LLC member makes a decision regarding the business's organization. A member must establish their authority to open a bank account for the LLC. Members must prove their authority to sign a loan on the LLC's behalf.

The main reason people form LLCs is to avoid personal liability for the debts of a business they own or are involved in. By forming an LLC, only the LLC is liable for the debts and liabilities incurred by the businessnot the owners or managers.

A member of a member-managed LLC or a manager of a manager-managed LLC is liable to the LLC for any damages the LLC incurs because of such conduct. this duty is a limited duty of care because it does not include ordinary negligence.

This is one of the benefits of having an LLC because it allows a Manager to run the business without fear of personal liability. But, a Manager may be held personally liable for criminal action and intentional actions that are outside the scope of its authority.

An LLC Corporate Resolution Form is a document that describes the management and decision-making processes of the LLC. While LLCs are generally not required to draft a resolution form, it is highly beneficial and important for all businesses to draft corporate resolutions.

Notwithstanding any restriction upon the right of a member to withdraw, resign, or retire, a member may withdraw from a limited liability company at any time by giving written notice to the other members.

LLC members and managers are generally not liable for the LLC's debts and other liabilities. However, California Corporations Code Section 17703.04 establishes specific instances in which members or managers may be held personally liable for company debts and other liabilities.

Managers of LLCs are not personally liable for the debts, obligations, and liabilities of the LLC they manage. A tortfeasor is a person who intentionally or unintentionally (negligently) causes injury or death to another person.

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...