Michigan Letter Requesting Transfer of Property to Trust

Description

How to fill out Letter Requesting Transfer Of Property To Trust?

Finding the correct legal document template can be a challenge. Of course, numerous templates are accessible online, but how can you obtain the legal form you need? Utilize the US Legal Forms website.

The platform offers an extensive selection of templates, including the Michigan Letter Requesting Transfer of Property to Trust, which is suitable for both business and personal uses. All templates are reviewed by professionals and adhere to state and federal regulations.

If you are already registered, Log In to your account and click the Download button to acquire the Michigan Letter Requesting Transfer of Property to Trust. Use your account to search through the legal forms you have previously purchased. Navigate to the My documents section of your account and download an additional copy of the document you need.

Choose the file format and download the legal document template to your device. Complete, modify, print, and sign the acquired Michigan Letter Requesting Transfer of Property to Trust. US Legal Forms is the largest library of legal templates, offering a variety of document layouts. Utilize the service to download professionally crafted documents that comply with state requirements.

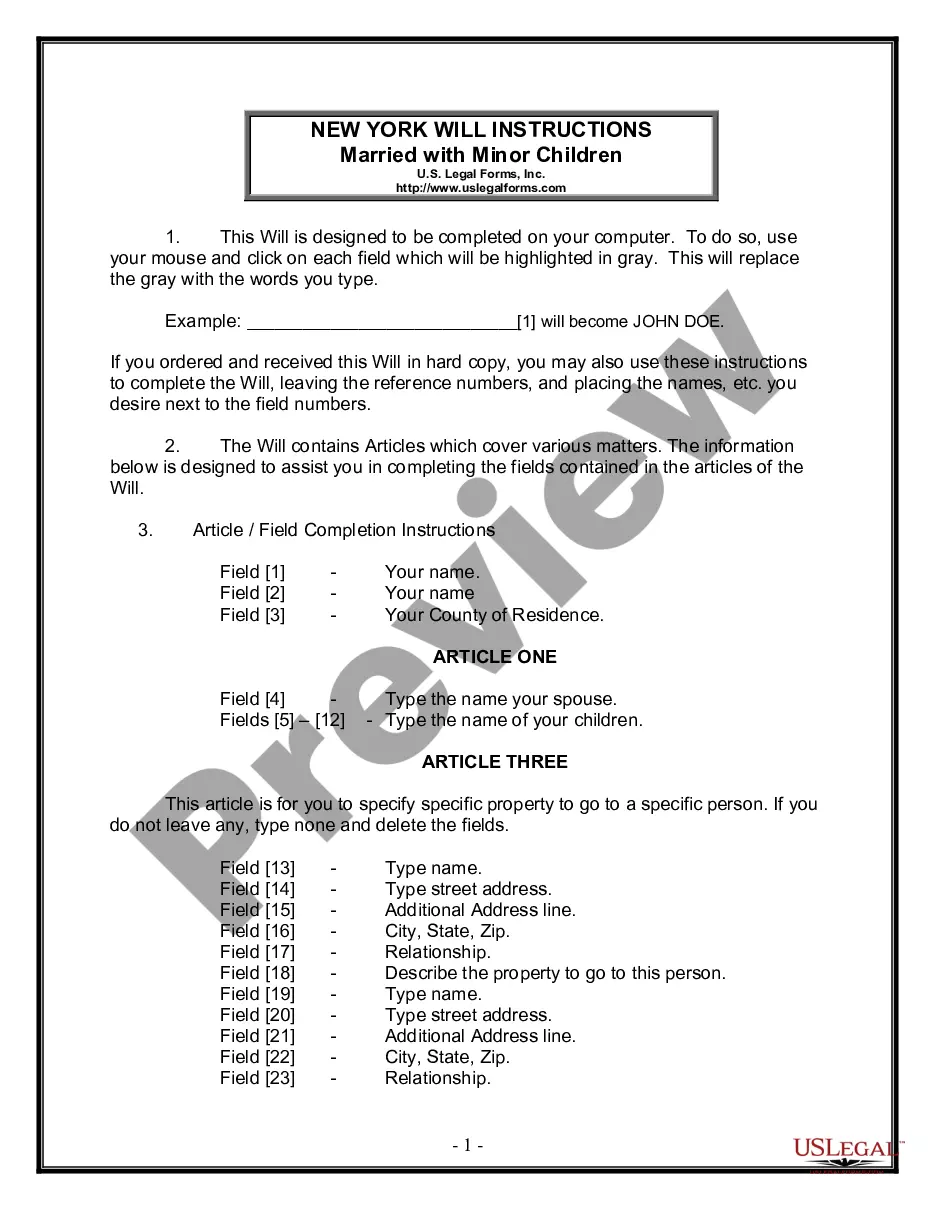

- First, ensure you have selected the correct form for your city/county.

- You can view the form using the Preview button and read the form description to verify it is the right one for you.

- If the form does not meet your requirements, use the Search field to find the appropriate form.

- Once you are certain the form is correct, click on the Buy now button to obtain the form.

- Select the pricing plan you desire and enter the required information.

- Create your account and complete the transaction using your PayPal account or credit card.

Form popularity

FAQ

Fill out and file a probate petition with the Michigan probate court in your area. If the deceased left property in her will, the probate court will use a fiduciary deed signed by the executor of the estate to transfer the property to the beneficiary.

In accordance with Michigan State Law, a Property Transfer Affidavit must be filed with the local assessor's office whenever real estate or some types of personal property transfer ownership (a transfer of ownership is generally defined as: a conveyance of title to, or present interest in, a property, including

How to Transfer Michigan Real EstateFind the most recent deed to the property. It is helpful to begin by locating the most recent deed to the property (the deed that transferred the property to the current grantor).Create the new deed.Sign and notarize the deed.File the deed in the county land records.

Michigan law requires that a Property Transfer Tax Affidavit (PTA) be filed with the local assessor (city or township) upon the transfer of ownership of real property. As used in the statute transfer of ownership means the conveyance of title 2026

Here are eight steps on how to transfer property title to an LLC:Contact Your Lender.Form an LLC.Obtain a Tax ID Number and Open an LLC Bank Account.Obtain a Form for a Deed.Fill out the Warranty or Quitclaim Deed Form.Sign the Deed to Transfer Property to the LLC.Record the Deed.Change Your Lease.

In accordance with Michigan State Law, a Property Transfer Affidavit must be filed with the local assessor's office whenever real estate or some types of personal property transfer ownership (a transfer of ownership is generally defined as: a conveyance of title to, or present interest in, a property, including

5 Ways to Transfer Property in IndiaSale Deed. The most common way of property transfer is through a sale deed.Gift Deed. Another popular way of transferring property ownership is by 'gifting' the property using a gift deed.Relinquishment Deed.Will.Partition Deed.

Filing is mandatory. Affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of the transfer. The information on this form is NOT CONFIDENTIAL.

With that in mind, here are five steps to help smoothly transfer property to a family member.Step 1 Organize the required documents.Step 2 Find the value.Step 3 Stay current with all payments.Step 4 Make it legal.Step 5 Pay the right donor's taxes.

How to Transfer Michigan Real EstateFind the most recent deed to the property. It is helpful to begin by locating the most recent deed to the property (the deed that transferred the property to the current grantor).Create the new deed.Sign and notarize the deed.File the deed in the county land records.