Michigan Agreement to Furnish and Install Equipment

Description

How to fill out Agreement To Furnish And Install Equipment?

US Legal Forms – one of the largest collections of legal templates in the United States – provides a broad selection of legal document categories available for download or printing.

By utilizing the website, you can access thousands of templates for business and personal applications, organized by categories, states, or keywords. You can find the latest versions of documents such as the Michigan Agreement to Provide and Install Equipment within moments.

If you have an account, Log In and download the Michigan Agreement to Provide and Install Equipment from the US Legal Forms library. The Download button will appear on every template you view.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the document onto your device. Modify. Fill out, alter, print, and sign the downloaded Michigan Agreement to Provide and Install Equipment. Every template you add to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the document you need. Access the Michigan Agreement to Provide and Install Equipment with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- If you are using US Legal Forms for the first time, here are simple instructions to help you start.

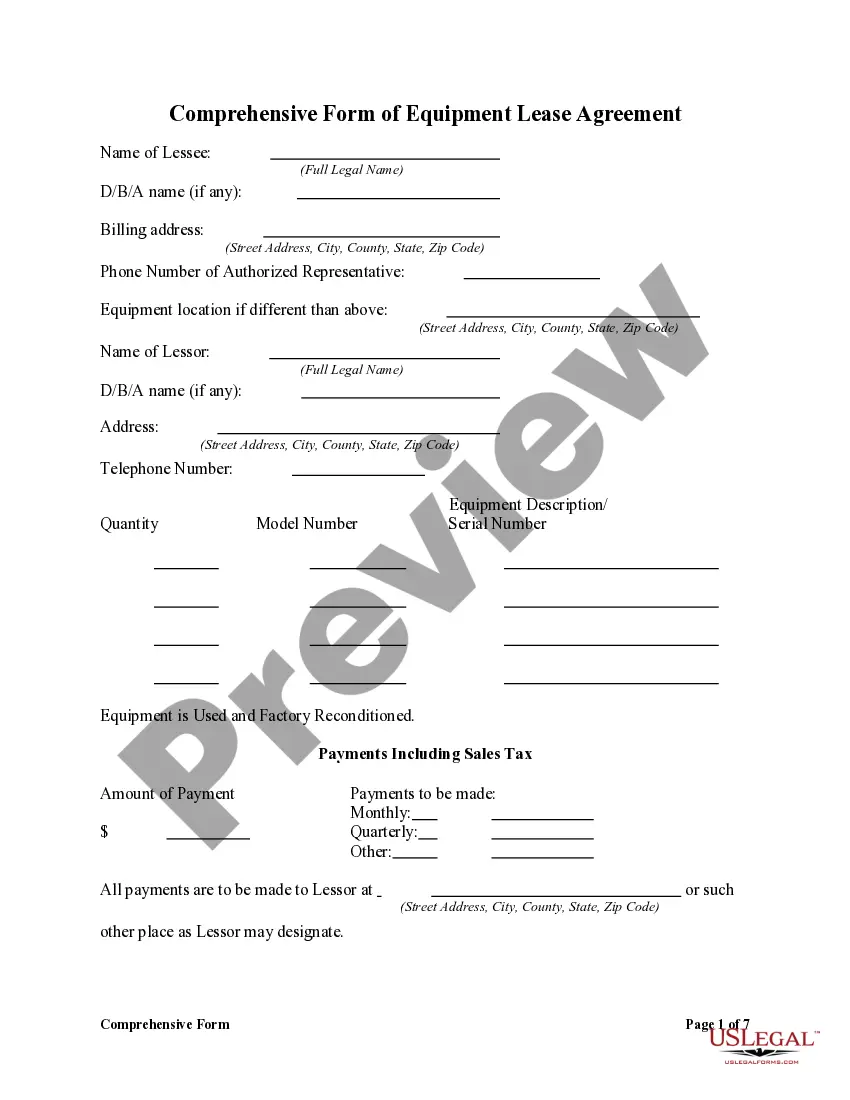

- Ensure you have selected the correct template for your city/state. Click on the Preview button to examine the document's content.

- Review the template details to confirm that you have chosen the appropriate document.

- If the document does not meet your requirements, use the Search field at the top of the screen to find one that fits.

- Once you are satisfied with the document, confirm your choice by clicking the Download now button.

- Then, select the pricing plan you prefer and provide your details to create an account.

Form popularity

FAQ

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

Every Michigan employer who is required to withhold federal income tax under the Internal Revenue Code must be registered for and withhold Michigan income tax. What is Michigan's 2021 payroll withholding tax rate? The tax rate for 2021 is 4.25%.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

The agreement should contain several sections of clauses defining the scope, terms, and conditions of the project, including what work will be done, the project schedule, payment terms, legal requirements, how disputes will be resolved, and more.

Who will pay for the repair and damages of the Contractor? 4. What if the Contractor fails to repair and pay claims? The Owner may repair the same and pay the claims, and deduct the entire cost of such repairs and claims from the payments due the Contractor.

Groceries, prescription medicine, and gasoline are all tax-exempt. Some services in Michigan are subject to sales tax.

A contractor incurs sales and use tax responsibilities as a consumer in the business of constructing, altering, repairing, or improving real estate for others. A. A contractor is required to pay sales or use tax on all items used to provide his or her service, including equipment, supplies, and materials.

In Michigan, sales tax applies to delivery and installation charges applied before the transfer of ownership occurs. When delivery and installation occurs after ownership has transferred to the buyer, delivery and installation charges are exempt.

5 Key Elements Every Construction Contract Should Contain1) The project's scope.2) The cost and payment terms.3) The project's time frame.4) Protection against lien law.5) Dispute resolution clauses.

In the state of Michigan, services are not generally considered to be taxable.