West Virginia Notice of Default on Promissory Note Installment

Description

How to fill out Notice Of Default On Promissory Note Installment?

Are you currently in a location where you require documents for either business or personal reasons almost every day.

There are many legal document templates obtainable on the web, but finding trustworthy ones isn’t simple.

US Legal Forms provides thousands of template forms, such as the West Virginia Notice of Default on Promissory Note Installment, which can be designed to meet state and federal requirements.

When you locate the appropriate form, click Buy now.

Choose the pricing plan that suits you, provide the necessary information to set up your account, and complete the purchase using your PayPal or credit card. Select a convenient document format and download your copy. You can find all the document templates you have purchased in the My documents section. You can always obtain another copy of the West Virginia Notice of Default on Promissory Note Installment if needed. Click on the required form to download or print the template. Use US Legal Forms, the most extensive selection of legal documents, to save time and avoid mistakes. This service offers expertly crafted legal document templates for various purposes. Create your account on US Legal Forms and begin simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the West Virginia Notice of Default on Promissory Note Installment template.

- If you don’t have an account and want to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct state/region.

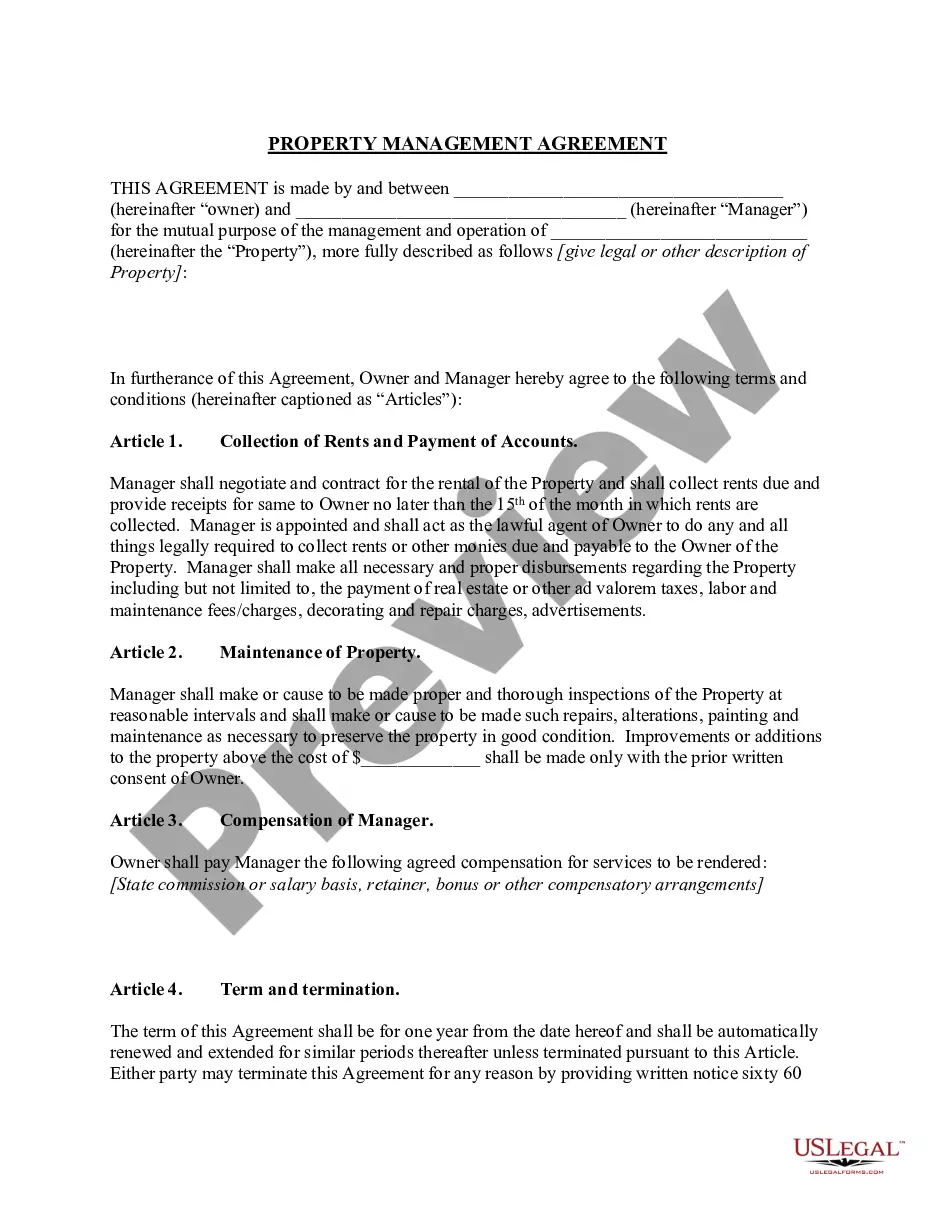

- Utilize the Preview option to examine the form.

- Read the description to confirm you have selected the right form.

- If the form isn’t what you are looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

When writing a default notice, be direct and factual. Start by specifying the borrower's name and the details of the West Virginia Notice of Default on Promissory Note Installment. Clearly outline what the default entails, cite the relevant contractual provisions, and state the consequences of failing to address the issue promptly.

To send a notice of default, you should consider delivery methods that ensure the recipient receives the document, such as certified mail or personal delivery. It is important to keep a copy for your records. Include clear identification of the notice as a West Virginia Notice of Default on Promissory Note Installment, and ensure it meets any legal requirements for official notices.

Writing a notice of default letter involves outlining the specifics of the debt, including dates and amounts owed. Begin with a straightforward opening that states it is a notice of default for the West Virginia Notice of Default on Promissory Note Installment. Include information on how to rectify the situation, and be sure to give a reasonable time frame for payment or response.

To write a letter for a defaulter, start by clearly stating the purpose of your communication. Clearly identify the individual or entity in default, specify the amount owed, and cite the terms of the West Virginia Notice of Default on Promissory Note Installment. It is important to maintain a professional tone, offer a repayment plan if applicable, and conclude with a call to action.

In West Virginia, the statute of limitations for enforcing a promissory note is generally five years. This time frame starts from the date of default on the payment. Being aware of this limit is vital when responding to a West Virginia Notice of Default on Promissory Note Installment to prevent losing your rights.

If you default on a promissory note, the lender may initiate collection procedures, which can include pursuing legal action. Following a West Virginia Notice of Default on Promissory Note Installment, the lender might seek to reclaim the owed amount through court. Understanding your rights and options in this situation is essential.

To collect on a default promissory note, start by sending a formal notice to the borrower about the default status. If this does not resolve the issue, consider legal actions, such as filing a claim in court. Utilizing services like USLegalForms can guide you through the collection process and help you understand a West Virginia Notice of Default on Promissory Note Installment.

Receiving a notice of default indicates that the borrower has failed to meet their repayment obligations. This notice serves as a warning that legal action may follow if the situation is not addressed. If you find yourself in this position, it is crucial to review the terms of your promissory note, consider potential remedies, and respond accordingly to prevent further complications. Utilizing tools like uslegalforms can help you navigate this process effectively.

If someone defaults on a promissory note, the lender may face uncertainty about recovering the owed funds. The borrower may miss payments, leading to financial difficulties for both parties. In many cases, the lender will issue a West Virginia Notice of Default on Promissory Note Installment to formally acknowledge the situation, which might prompt the borrower to rectify the issue or prepare for potential legal proceedings.

Remedies for default on a promissory note include negotiating a new payment plan, seeking a judgment in court, or repossessing collateral if applicable. The first approach often involves open communication with the borrower to find an amicable solution. However, if these efforts fail, issuing a West Virginia Notice of Default on Promissory Note Installment can help solidify your position in any legal claims you may pursue.